Micron: Fiscal 1Q21 Financial Results

Micron: Fiscal 1Q21 Financial Results

27% of revenue for NAND at $1.6 billion, up 3% Q/Q and 11% Y/Y

This is a Press Release edited by StorageNewsletter.com on January 11, 2021 at 2:18 pm| (in $ million) | 1Q20 | 4Q20 |

1Q21 |

| Revenue | 5,144 | 6,056 | 5,773 |

| Y/Y growth | -35% | 24% |

12% |

| Net income (loss) | 508 | 990 | 803 |

Micron Technology, Inc. announced results for its 1FQ21, which ended December 3, 2020.

- Fiscal 1FQ21 highlights

• Revenue of $5.77 billion vs. $6.06 billion for the prior quarter and $5.14 billion for the same period last year

• GAAP net income of $803 million, or $0.71 per diluted share

• Non-GAAP net income of $897 million, or $0.78 per diluted share

• Operating cash flow of $1.97 billion vs. $2.27 billion for the prior quarter and $2.01 billion for the same period last year

“Micron delivered outstanding fiscal first quarter results, driven by focused execution and strong end-market demand,” said president and CEO Sanjay Mehrotra. “We are excited about the strengthening DRAM industry fundamentals. For the first time in our history, Micron is simultaneously leading on DRAM and NAND technologies, and we are in an excellent position to benefit from accelerating digital transformation of the global economy fueled by AI, 5G, cloud, and the intelligent edge.”

Guidance for 2FQ21: Revenue of $5.8 billion ± $200 million

Comments

Micron beat Wall Street's targets for this quarter and guided higher for the current period as the memory-chip market strengthened.

Sales have risen for 3 straight quarters since the company emerged from a cyclical downturn.

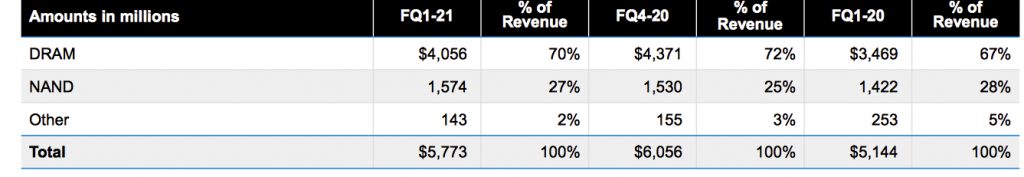

Revenue by technology

Performance by Technology

DRAM

- 70% of total revenue in 1FQ21 or $4.1 billion

- Revenue down 7% Q/Q DRAM and up 17% Y/Y

- Bit shipments down low-single-digit percent range Q/Q

- ASPs down mid-single-digit percent range Q/Q

NAND

- 27% of total revenue in 1FQ21 for NAND or $1.6 billion

- Revenue up 3% Q/Q and 11% Y/Y

- Bit shipments up high-teens percent range Q/Q

- ASPs down low-teens percent range Q/Q

Operations

- In early December, 2 separate events affected Taiwan DRAM operations: a power outage at Taoyuan facility on December 3, and a 6.7-magnitude earthquake off the northeast coast of Taiwan on December 10, felt at both Taoyuan and Taichung locations

- Investments made over the last few years in facilities, redundancy and cleanroom control substantially mitigated the impact of these 2 events

- These disruptions have, however, reduced our available 2FQ21 DRAM supply and negatively influenced costs in the short term

- The expected impact of these events is factored into firm's outlook

NAND

- Began volume production of 176- layer NAND

- It features 2X the power efficiency and write performance vs. 96-layer NAND, which is essential for addressing future high-end mobile applications

- Began shipping 176-layer consumer SSDs in 1FQ21 and

will introduce additional 176-layer products over the next several months - Broad portfolio of QLC SSDs across client, consumer, and data center markets; increased bit mix of QLC SSDs in 1FQ21

- In client SSD, NVMe represented over 90% of the client SSD bits, with nearly half of those NVMe SSD bits being QLC

NAND outlook

- CY21 bit supply growth expected to be below industry demand growth

- Long-term Micron bit supply growth CAGR in line with industry demand

- FY21 cost reductions expected to be in the low-to-mid-teens percentage range

- Calendar 2021 industry NAND bit demand growth is expected to be approximately 30%, with supply potentially higher.

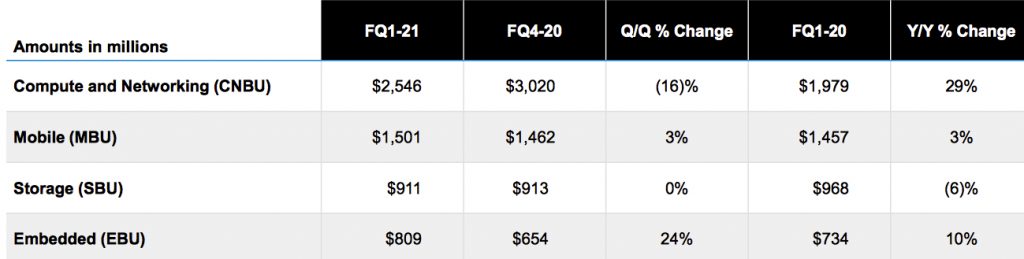

The company has 4 business units:

- Compute and networking at $2.5 billion down 16% Q/Q, up 29% Y/Y

- Mobile at $1.5 billion, up 3% Q/Q, up 3% Y/Y

- Storage at $911 million, roughly flat from the prior quarter, down 6% Y/Y

- Embedded at $809 million, up 24% Q/Q, up 10% Y/Y

Micron ended the quarter with total cash of $8.4 billion with total debt of $6.6 billion.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter