Micron: Fiscal 3Q20 Financial Results

Will continue to be ≠1 WW storage company instead FY revenue to decrease yearly around 7%.

This is a Press Release edited by StorageNewsletter.com on July 1, 2020 at 3:02 pm| (in $ million) | 3Q19 | 3Q20 | 9 mo. 19 | 9 mo. 20 |

| Revenue | 4,788 | 5,438 | 18,536 | 15,379 |

| Growth | 14% | -15% | ||

| Net income (loss) | 851 | 805 | 5,752 | 1,720 |

Micron Technology, Inc. announced results for its third quarter of fiscal 2020, which ended May 28, 2020.

3Q20 highlights

• Revenue of $5.44 billion vers$4.80 billion for the prior quarter and $4.79 billion for 3Q19

• GAAP net income of $803 million, or $0.71 per diluted share

• Non-GAAP net income of $941 million, or $0.82 per diluted share

• Operating cash flow of $2.02 billion vs. $2.00 billion 2Q20 and $2.71 billion for 3Q19

“Micron’s exceptional execution in the fiscal third quarter drove strong sequential revenue and EPS growth, despite challenges in the macro environment,” said president and CEO Sanjay Mehrotra. “We are ramping the industry’s most advanced DRAM technology into production and have delivered more than 75% of our NAND volume as high-value solutions, supported by record SSD revenue in the quarter. Our portfolio momentum positions us exceedingly well to leverage the long-term growth across our end markets.“

Business outlook for 4FQ20

Revenue between $5.75 billion and $6.25 billion

Comments

The 40-year old company records solid quarter with revenue up 13% Q/Q and up 14% Y/Y, even if he pandemic has impacted the cyclical recovery in DRAM and NAND, causing stronger demand in some segments and weaker demand in others. Furthermore, the recent restrictions on Huawei are also impacting firm's opportunity in the near term.

The company ended the quarter with total cash of $9.3 billion and total debt of $6.7 billion.

For current FY20, global sales will reach around $21.7 billion compared to $23.4 billion in FY19, or -7%. It was -30% from FY18 to FY19. Despite this decreases, Micron continues to be the top storage firm in term or revenue, beating SK Hynix, Dell, WD, Seagate and Kingston this year.

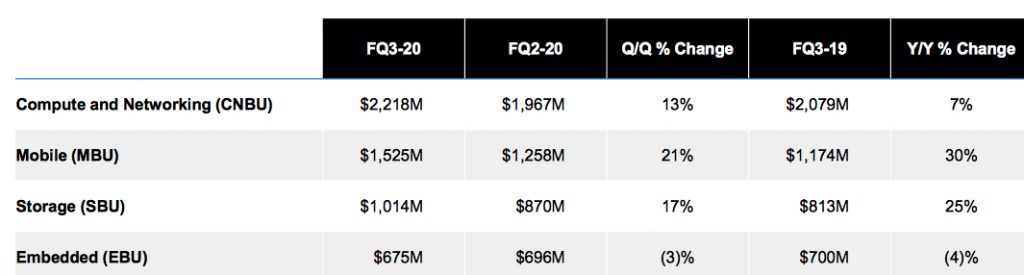

Revenue by business unit

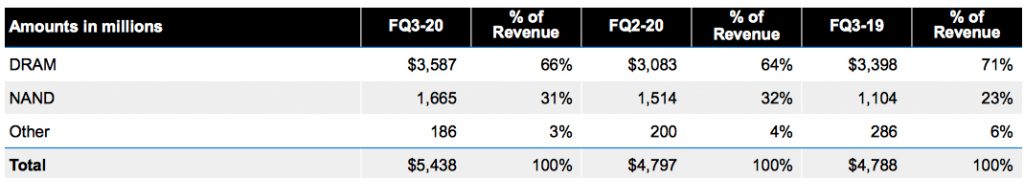

Revenue by technology

Operations update

- Most of fab and assembly sites operated at full production throughout the quarter

- Singapore and Taiwan assembly and test facilities achieving record production

- Covid-19's impact to production early in FQ20 was limited to back-end assembly and test sites in Muar and Penang, Malaysia, and the quickly offset this impact with production adjustments at other facilities

- All production facilities are operating normally at this time

- The firm is taking a conservative, phased and site-specific approach to returning its team members on-site, prioritizing its manufacturing workforce and engineering teams

NAND

- 31% of total revenue in 3FQ20, up 10% Q/Q and up 50% Y/Y

- Bit shipments up lower-single-digit percent range Q/Q

- ASPs up upper-single-digit percent range Q/Q

SSDs

- Record quarterly revenue with cloud SSD doubling Q/Q and client NVMe SSD growth

- Customer qualifications progressing for next-gen products for both NVMe and SATA markets

- Announced a TLC client SSD and its first QLC client SSD, both using next-gen 96-layer technology

NAND roadmap

- 128-layer first-gen RG node in volume production in 3FQ20 and recently began customer shipments; good progress on second-gen RG and on track for meaningful RG NAND output by the end of CY20

- QLC bits now represent more than 10% of Micron's NAND production, contributing to NAND cost improvements

- NAND high-value solutions now make up over 75% of quarterly NAND bits, on target to increase this to 80% for FY21

Long term outlook

- DRAM industry bit demand CAGR in the mid to high teens

- NAND industry bit demand CAGR in the 30% range

- Long term Micron supply growth in line with industry demand growth CAGR

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter