Micron: Fiscal 2Q20 Financial Results

Covid-19 began to unfold halfway through quarter, 2 employees contaminated

This is a Press Release edited by StorageNewsletter.com on March 27, 2020 at 2:31 pm| (in $ million) | 2Q19 | 2Q20 | 6 mo. 19 | 6 mo. 20 |

| Revenue | 5,835 | 4,797 | 13,748 | 9,941 |

| Growth | -18% | -28% | ||

| Net income (loss) | 1,619 | 407 | 4,912 | 896 |

Micron Technology, Inc. announced results for its second quarter of fiscal 2020, which ended February 27, 2020.

2FQ20 highlights

• Revenue of $4.80 billion vs. $5.14 billion for 1FQ20 and $5.84 billion for 2FQ19

• GAAP net income of $405 million, or $0.36 per diluted share

• Non-GAAP net income of $517 million, or $0.45 per diluted share

• Operating cash flow of $2.00 billion vs. $2.01 billion for 1FQ20 and $3.44 billion for 2FQ19

“Micron delivered solid second quarter results and revenue at the high end of the guidance range, despite the unfolding COVID-19 pandemic,” said president and CEO Sanjay Mehrotra. “I am grateful to our team for the excellent business execution we have achieved during this unprecedented situation. Their resilience, together with Micron’s technology leadership, stronger product portfolio, and healthy balance sheet, give us confidence that we will emerge from this challenging time well-positioned to capture the robust long-term demand opportunities for memory and storage.”

Investments in capital expenditures, net were $1.94 billion for 2FQ20, which resulted in adjusted free cash flows of $63 million.

The firm repurchased approximately 785,000 shares of its common stock for $44 million during 2FQ20 and ended the quarter with cash, marketable investments, and restricted cash of $8.12 billion, for a net cash position of $2.70 billion.

Outlook for 3FQ20: Revenue between $4.6 billion and $5.2 billion

Comments

For the most recent quarter, global revenue was $4.8 billion at high end of guided range ($4.5 to $4.87 billion), outpacing the consensus mark of $4.6 billion, even "as the COVID began to unfold halfway through our quarter," noted the chip maker.

As of March 24, it had two employees who have tested positive for the coronavirus.

On March 16, the Malaysian government issued a Restriction of Movement Order, resulting in the closure of borders and most businesses in Malaysia. Subsequently, it added semiconductors to the list of essential services, and Micron was able to resume operations. Its assembly and test facilities in Muar and Penang, primarily used for packaging high-value NAND, were briefly shut down and have since been able to return to production on a limited basis.

In response to Covid-19, the company said:

- Ongoing communication with or suppliers to ensure continuity and identify supply gaps

- To increase or on-hand inventory of raw materials

- To increase multi-sourcing of parts to reduce supplier dependence risk

- To add assembly and test capacity in order to provide redundant manufacturing capability

Global sales are down 7% Q/Q and 18% Y/Y, with net income slightly increasing with profitability for the 13th consecutive quarter.

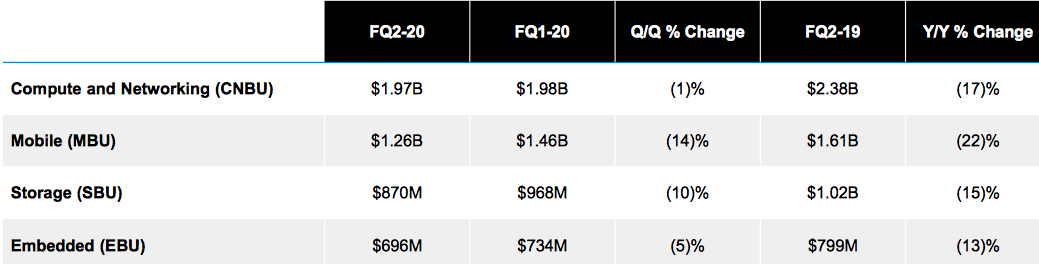

Revenue by business unit

Revenue for the storage business unit in 2FQ20 was $870 million, down 10% from 1FQ20 and down 15% Y/Y.

NAND

- It represents 32% of total revenue in 2FQ20: $1,514 million, up 6% Q/Q and up 9% Y/Y.

- Bit shipments down low-single-digit percent range Q/Q and up 20% Y/Y

- ASPs up upper-single-digit percent range Q/Q

- Beginning production is expected on 128-layer first-gen RG node in current quarter with revenue shipments in 4FQ20

- QLC SSD bit shipments rose by 60% Q/Q in 2FQ20, with a meaningful portion of consumer SSDs now shipping with QLC technology, expecting continued growth in 2H20

SSDs

- Revenue grew 20% sequentially, led by more than 50% growth in datacenter SSDs

- Record consumer SSD revenue assisted by growth of QLC NVMe consumer SSDs

- Strong sequential bit growth is expected in NVMe in 3FQ20 as continuing to the transition from SATA to NVMe

- Several customer qualifications achieved on 96-layer SATA datacenter SSD

Near-term Outlook

- Stronger demand from datacenter due to remote-work economy, increased gaming and e-commerce activity

- Datacenter demand in all regions looks strong and is leading to supply shortages

- Recent increase in demand for notebooks to support work-from-home and virtual learning

- Smartphone, consumer electronics and auto demand below prior expectations for 2FH20

- Moving supply from smartphone to datacenter markets, for both DRAM modules and SSDs

- NAND industry demand CAGR in the 30% range

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter