Micron: Fiscal 4Q20 Financial Results Results

Revenue up 24% Y/Y for quarter, -9% for FY, thanks to DRAM rather than NAND

This is a Press Release edited by StorageNewsletter.com on September 30, 2020 at 2:21 pm| (in $ million) | 4Q19 | 4Q20 | FY19 | FY20 |

| Revenue | 4,870 | 6,056 | 23,406 | 21,435 |

| Growth | 24% | -9% | ||

| Net income (loss) | 586 | 990 | 6,358 | 2,710 |

Micron Technology, Inc. announced results for its fourth quarter and fiscal 2020, which ended September 3, 2020.

4FQ20 highlights

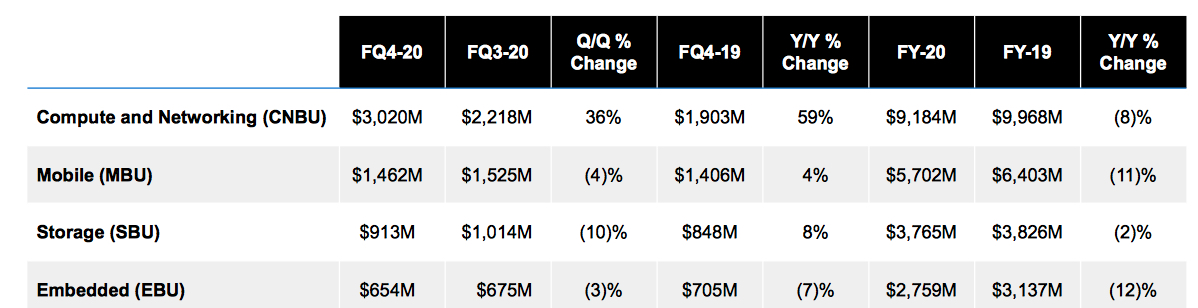

• Revenue of $6.06 billion vs. $5.44 billion for 3FQ20 and $4.87 billion for 4FQ19

• GAAP net income of $988 million, or $0.87 per diluted share

• Non-GAAP net income of $1.23 billion, or $1.08 per diluted share

• Operating cash flow of $2.27 billion versus $2.02 billion for 3FQ20 and $2.23 billion for 4FQ19

FY20 highlights

• Revenue of $21.44 billion versus $23.41 billion for FY19

• GAAP net income of $2.69 billion, or $2.37 per diluted share

• Non-GAAP net income of $3.24 billion, or $2.83 per diluted share

• Operating cash flow of $8.31 billion vs. $13.19 billion for FY19

“Micron delivered solid fiscal fourth quarter revenue and EPS resulting from strong DRAM sales in cloud, PC and gaming consoles and an extraordinary increase in QLC NAND shipments,” said president and CEO Sanjay Mehrotra. “We look forward to improving market conditions throughout calendar 2021, driven by 5G, cloud and automotive growth, and we are excited by the continued momentum in our product portfolio.“

Business Outlook for 1FQ21: Revenue of $5.2 billion ± $200 million

Comments

Revenue was 11% Q/Q and 14% Y/Y, -9% Y/Y for fiscal year for a solid quarter above the mid-point of guided range, driven by strength in DRAM shipments to cloud, PC and game console customers for FY20.

With FY20 sales of $21.4 billion, the company is ranking in the top of WW storage firms if you consider DRAM as a storage product (some people estimates the contrary as DRAM is non volatile and not able to keep data without power.)

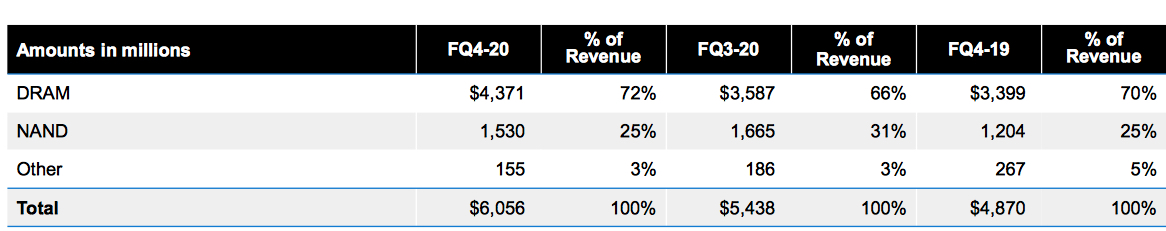

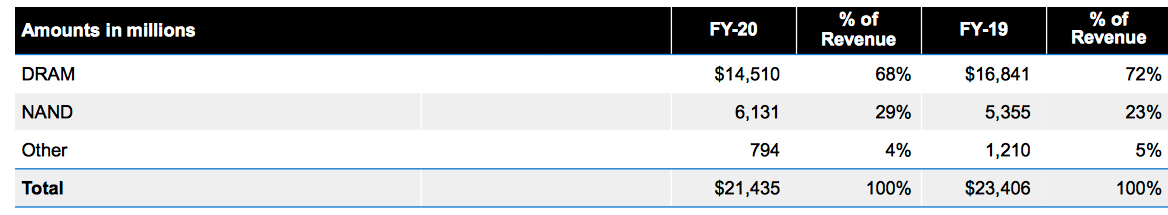

In fact, it records 72% of revenue from DRAM, 25% from NAND, 3% from other products (5G, and PC and graphics.)

Revenue by Technology

Revenue by business unit

Operations

. continued to operate or fabs at normal capacity in FY20

. achieved record production from assembly and test facilities in Xi'an, Taiwan and Singapore in FY20

. almost 3 quarters of team members back on-site including manufacturing operations which are running close to fully staffed levels

DRAM

. revenue up 22% Q/Q and 29% Y/Y

. bit shipments up mid-20% range Q/Q

. ASPs down lower-single-digit percent range Q/Q

. 68% of total revenue in FY20

. revenue down yearly 14% in FY20

. leads the industry in 1Z nm production mix, a significant contributor to 4FQ20 sales

. making progress on 1-alpha which remains on track for introduction in FY21

. announced GDDR6X, the fastest discrete graphics memory solution and the first to power system bandwidth up to 1TB/s

. remains on track to commence High Bandwidth Memory volume shipments by the end of CQ20

NAND/SSD

. 4FQ20 SSD revenue almost doubled Y/Y led by data center SSD sales

. client SSD average capacities grew almost 30% Q/Q, driven by QLC growth

. consumer SSD had another record quarter in volume shipped, with NVMe bits more than doubling Q/Q

. 25% of total revenue in 4FQ20

. revenue down 8% Q/Q and up 27% Y/Y

. bit shipments flat Q/Q

. ASPs down upper-single-digit percent range Q/Q

. 29% of total revenue in FY20

. revenue up 14% Y/Y in FY20

. 128L RG entered volume production in 3FQ20; began shipping RG- based consumer SSDs in 4FQ20

. making progress on 2nd gen RG node; expects to introduce into volume production during FY21

. QLC SSD bit mix more than doubled Q/Q, surpassing expectations

. NAND high-value solutions now make up around 80% of quarterly NAND bits, achieving goal set for FY-21

. expanded NVMe portfolio and continued SATA market leadership

Industry Outlook

- DRAM

- CY20 industry bit demand growth is to be in the mid-teens percentage with supply constraints for 8Gb-based DRAM products

- CY21 industry bit demand growth of approximately 20%

- long-term bi demand growth CAGR of mid-to-highteens

- NAND

- CY20 industry bit demand growth in the mid-20s, with supply and demand roughly balanced

- CY21 industry bit demand growth of arpoud 30%; risk of some excess supply unless industry Capex moderates

- long-term bit demand growth CAGR of approximately 30%

Despite halted shipments to Huawei on September 14, the company expects to offset impact by end of 2FQ21.

For next quarter, Micron expects revenue between -11% and -17%.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter