Seagate: Fiscal 1Q23 Financial Results

Seagate: Fiscal 1Q23 Financial Results

Sales down 35% Y/Y, plan to lay off 3,000 employees or 8% of workforce

This is a Press Release edited by StorageNewsletter.com on October 27, 2022 at 2:02 pm| (in $ million) | 1Q22 | 1Q23 | Growth |

| Revenue |

3,115 | 2,035 | -35% |

| Net income (loss) | 526 | 29 |

Seagate Technology Holdings plc reported financial results for its fiscal first quarter ended September 30, 2022.

“Global economic uncertainties and broad-based customer inventory corrections worsened in the latter stages of the September quarter, and these dynamics are reflected in both near-term industry demand and Seagate’s financial performance. We have taken quick and decisive actions to respond to current market conditions and enhance long-term profitability, including adjusting our production output and annual capital expenditure plans, and announcing a restructuring plan that will deliver meaningful cost savings while maintaining investments in the mass capacity solutions driving our future growth,” said Dave Mosley, CEO. “We continue to meet our development milestones for the 30TB+ product family, which is based on industry leading HAMR technology. Our team is executing well on our innovation roadmap, and we are seeing strong engagement from cloud customers. Looking beyond the current macro uncertainties, we are confident in the secular demand for mass capacity storage driven by the underlying growth in data and believe Seagate is in a great position to capture growth opportunities over the long-term.”

During 1FQ23 the company generated $245 million in cash flow from operations and $112 million in free cash flow, paid cash dividends of $147 million and repurchased 5.4 million ordinary shares for $408 million. It raised $600 million in new capital through a new term loan facility, exiting 1FQ23 with cash and cash equivalents totaling $761 million. There were 206 million ordinary shares issued and outstanding as of the end of the quarter.

Quarterly Cash Dividend

The board of directors declared a quarterly cash dividend of $0.70 per share, which will be payable on January 5, 2023 to shareholders of record as of the close of business on December 21, 2022. The payment of any future quarterly dividends will be at the discretion of the board and will be dependent upon Seagate’s financial position, results of operations, available cash, cash flow, capital requirements and other factors deemed relevant by the board.

Restructuring Plan

On October 24, 2022, the board approved and committed to a restructuring plan to reduce its cost structure to better align the company’s operational needs to current economic conditions while continuing to support the long-term business strategy. The plan includes reducing its worldwide headcount by approximately 3,000 employees, or 8% of the global workforce, along with other cost saving measures.

The plan, which the company expects to be substantially completed by the end of 2FQ23, is expected to result in total pre-tax charges between $60 million and $70 million. The charges are expected to be primarily cash-based and consist of employee severance and other one-time termination benefits.

The company expects to realize run-rate savings of approximately $110 million on an annualized basis starting in 4FQ23.

Guidance for 2FQ23:

• Revenue of $1.85 billion, ±$150 million

• Non-GAAP diluted EPS of $0.15, ±$0.20

Guidance regarding non-GAAP diluted EPS excludes known pre-tax charges related to amortization of acquired intangible assets of $0.01 per share, estimated share-based compensation expenses of $0.18 per share, and restructuring costs of $0.29 to $0.34 per share.

Comments

It's rare for Seagate to record such an horrible financial quarter. Sales just above $2 billion - insite its revised quidance - are down 13% Q/Q and 35% Y/Y. It was $2.6 billion for 4FQ22, -13% Y/Y.

Shares fell more than 8% by early afternoon Wednesday.

The reason is clear: the WW HDD market is rapidly diminishing and the ≠1 manufacturer of these devices just follows this trend as the company get about all its revenue from this business.

The only positive sign: the firm continues to be profitable but with a mere $20 million net income and sharply down from $276 million the former 3-month period.

Even the average capacity per drive is slightly down at 7.5TB vs. 7.8TB in 4FQ22, for the first time since 2FQ21. And total exabytes shipped is down at 118.2TB, decreasing 24% Q/Q ad 26% Y/Y.

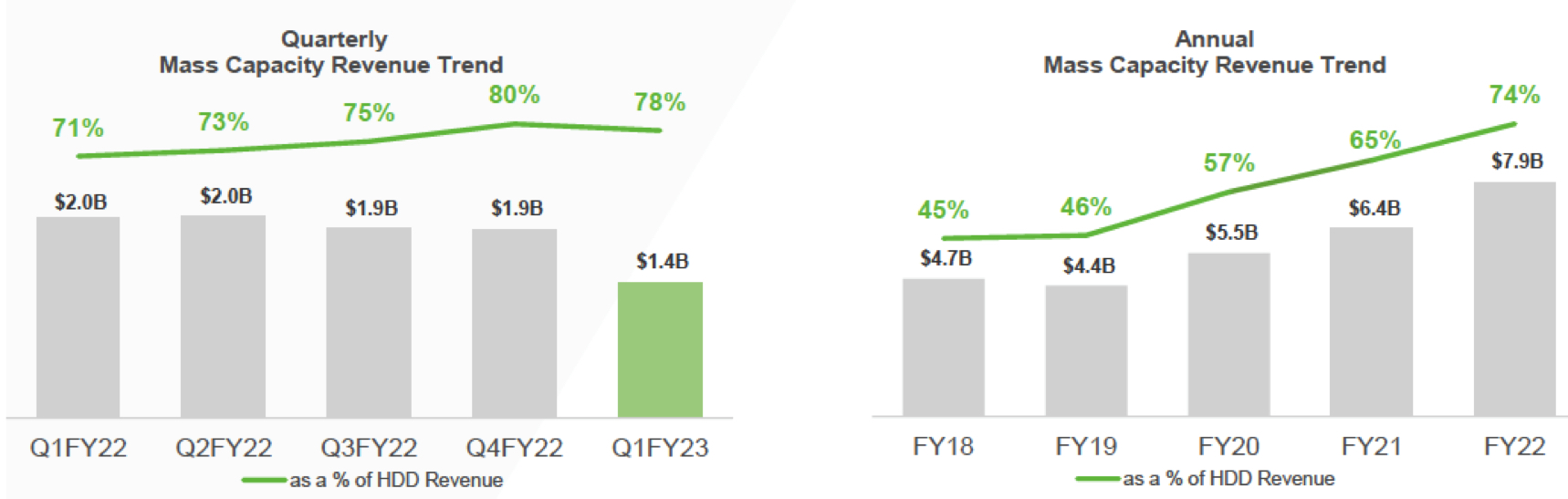

Mass storage capacity

• Mass capacity demand was impacted by Covid lockdowns and the related economic slowdown in China, broad-based customer inventory adjustments

• Nearline 20TB+ platform revenue/exabytes/units surpassed 18TB as expected

• VIA markets impacted by global economic slowdown, delaying project budgets and installation timelines; expect demand to resume as conditions improve

• Mass capacity HDDs down 25% Q/Q for a total of 104EB.

Mass capacity revenue trend

Legacy market

• Legacy revenue declined 11% Q/Q and 47% Y/Y in total capacity, as on-going inflationary pressures and dynamic Covid policies weighed on demand

• Mission critical down meaningfully quarter over quarter

• Consumer reflecting weakening global consumer spending

Next quarter, the vendor expects even lower revenue, $1.85 billion, plus or min$150 million or between -2% and -16%.

Accused of providing HDDs to Chinese Huawei

In a more recent SEC filing, the company revealed that the Commerce Department's Bureau of Industry and Security (BIS) had accused it of providing HDDs to a customer on the BIS Entity list, and therefore violating U.S. Export Administration Regulations. Seagate did not name the customer.

But Reuters, citing a source familiar, reported that the customer was Chinese telecommunications giant Huawei, which is currently under investigation by the U.S. government for an alleged conspiracy to steal trade secrets from U.S. technology firms. Huawei has been on the BIS Entity List since 2019 due to U.S. national security concerns.

The vendor said in the SEC document that it has responded to the U.S. government's claims and argues it "did not engage in probated conduct as alleged by BIS, because, among other reasons, Seagate's HDDs are not subject to the EAR."

The disclosure also stated that the HDDs sales that were flagged by the U.S. government occurred between August 2020 and September 2021. A source told Reuters that Seagate halted shipments to Huawei a year ago.

If the Commerce Department finds Seagate in violation of the export rules, the company could face civil penalties of up to $300,000 per violation or twice the value of the transaction, according to Reuters.

HDDs from 1FQ16 to 1FQ23

| Fiscal period | HDD ASP | Exabytes shipped |

Average GB/drive |

| 1Q16 | $58 | 55.6 | 1,176 |

| 2Q16 | $59 | 60.6 | 1,320 |

| 3Q16 | $60 | 55.6 | 1,417 |

| 4Q16 | $67 | 61.7 | 1,674 |

| 1Q17 | $67 | 66.7 | 1,716 |

| 2Q17 | $66 | 68.2 | 1,709 |

| 3Q17 | $67 | 65.5 | 1,800 |

| 4Q17 | $64 | 62.2 | 1,800 |

| 1Q18 | $64 | 70.3 | 1,900 |

| 2Q18 | $68 | 87.5 | 2,200 |

| 3Q18 | $70.5 | 87.4 | 2,400 |

| 4Q18 |

$72 | 92.9 | 2,500 |

| 1Q19 | $70 | 98.8 | 2,500 |

| 2Q19 |

$68 | 87.4 | 2,400 |

| 3Q19 |

$72 | 76.7 | 2,400 |

| 4Q19 | $79.7 | 84.5 | 2,700 |

| 1Q20 |

$81 | 98.3 | 2,900 |

| 2Q20 |

$77 | 106.9 | 3,300 |

| 3Q20 | $86 | 120.2 | 4,100 |

| 4Q20 |

$89 | 117.0 | 4,500 |

| 1Q21 |

$82 | 114.0 | 4,400 |

| 2Q21 |

$81 | 129.2 | 4,300 |

| 3Q21 | $91 | 139.6 | 5,100 |

| 4Q21 | $97 | 152.3 | 5,400 |

| 1Q22 |

$103 | 159.1 | 5,700 |

| 2Q22 |

$106 | 163.2 | 6,100 |

| 3Q22 |

NA | 154.2 | 6,700 |

| 4Q22 |

NA | 154.6 | 7,800 |

| 1Q23 |

NA |

118.2 |

7,500 |

FY ending in June

* in $million

| Period | Revenue* | Y/Y growth | Net income* |

| FY18 | 11,184 | 4% | 772 |

| FY19 | 10,390 | -7% | 2,012 |

| FY20 | 10,509 | 1% | 1,004 |

| FY21 | 10,681 | 2% | 1,314 |

| 1FQ22 | 3,115 | 35% | 526 |

| 2FQ22 | 3,116 | 19% | 501 |

| 3FQ22 | 2,802 | 3% | 346 |

| 4FQ22 | 2,628 | -13% | 276 |

| FY22 | 11,661 | 9% | 1,649 |

| 1FQ23 |

2,035 |

-35% |

29 |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter