Seagate: Fiscal 3Q22 Financial Results

Seagate: Fiscal 3Q22 Financial Results

Sales much lower than expected, down 10% Q/Q and up 3% Y/Y; shipments ceased into Russia and Belarus

This is a Press Release edited by StorageNewsletter.com on April 28, 2022 at 2:02 pm| (in $ million) | 3Q21 | 3Q22 | 9 mo. 21 | 9 mo. 22 |

| Revenue | 2,731 | 2,802 | 7,668 | 9,033 |

| Growth | 3% | 18% | ||

| Net income (loss) | 329 | 346 | 832 | 1,373 |

Seagate Technology Holdings plc reported financial results for its fiscal third quarter ended April 1, 2022.

“Seagate’s March quarter financial results were consistent with our revised outlook, with record nearline product revenue driven by cloud customers partially offsetting multiple macro related headwinds that impacted other end markets, particularly video and image applications, and pressured profitability,” said Dave Mosley, CEO. “Our focus is on mitigating these external challenges through ongoing expense discipline, new pricing strategies and operational efficiencies. We are also continuing to execute our strong product roadmap to address customer demand for cost-efficient, mass capacity solutions. In the March quarter, we began the volume ramp of our 20-plus terabyte products, which, combined with continued healthy cloud demand, support our outlook for double-digit FY revenue growth.“

The company generated $460 million in cash flow from operations and $363 million in free cash flow during 3FQ22. Its balance sheet remains healthy, and during the fiscal third quarter the company paid cash dividends of $154 million, repurchased 4.2 million ordinary shares for $417 million and repaid $220 million to retire the 2022 Senior Notes. Cash and cash equivalents totaled $1.1 billion. There were 216 million ordinary shares issued and outstanding as of the end of the quarter.

Quarterly Cash Dividend

The board of directors declared a quarterly cash dividend of $0.70 per share, which will be payable on July 7, 2022 to shareholders of record as of the close of business on June 24, 2022. The payment of any future quarterly dividends will be at the discretion of the board and will be dependent upon firm’s financial position, results of operations, available cash, cash flow, capital requirements and other factors deemed relevant by the board.

Business Outlook

The company is providing the following guidance for its 4FQ22:

• Revenue of $2.8 billion, plus or min $150 million

• Non-GAAP diluted EPS of $1.90, plus or min $0.20

Guidance regarding non-GAAP diluted EPS excludes known charges related to amortization of acquired intangible assets of $0.02 per share and estimated share-based compensation expenses of $0.18 per share.

Comments

Former quarter revenue was $3.1 billion, the highest figure over 6 years and expectations for this quarter were flat or decreasing revenue between $2.850 billion and $3.150 billion, or -10% to 1%.

The figure for 3FQ22 is finally $2.8 billion much lower than expected, down 10% Q/Q and up 3% Y/Y.

CEO commented: "We continue to see solid cloud demand, and that boosted revenue for our nearline products to a fifth consecutive quarterly record. The strong nearline performance was offset to a degree by demand disruptions in other end markets. These include non-HDD component shortages as well as new Covid lockdown measures that intensified toward the end of March, sharply impacting the video and image applications or via market. Rising inflationary pressures were an additional burden on profitability for the quarter as we continue to operate amid an unusual mix of external challenges."

The manufacturer is shipping 20TB+ products in high volume and expect unit shipments to more than triple quarter over quarter in 4FQ22 to well over 1 million units.

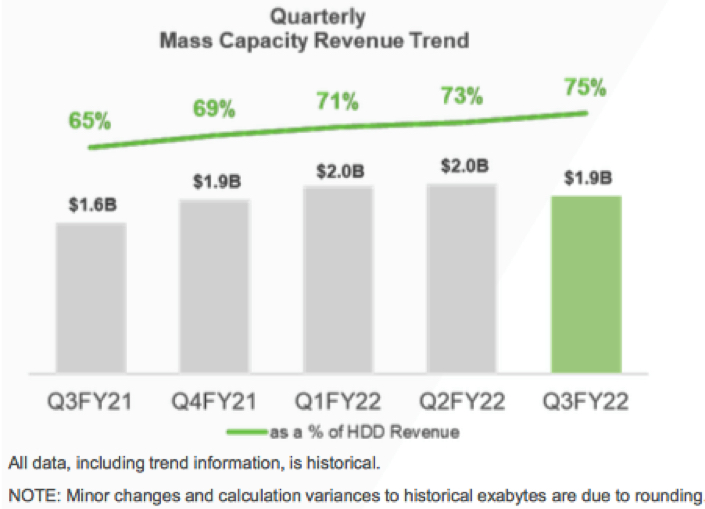

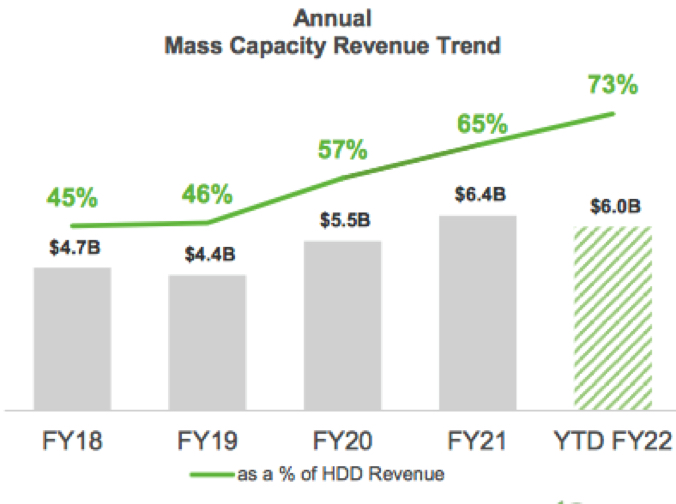

In the March quarter, mass capacity revenue increased 18% Y/Y and decreased 6% sequentially off a record December quarter.

Strong double-digit sequential growth in cloud nearline sales partially offset the impacts of demand constraints in the other mass capacity end markets. In the enterprise and OEM market, some customers continue to grapple with non-HDD supply shortages that have impacted their ability to get parts and address their own in demand. Covid lockdown measures are limiting near-term demand in the VIA markets. In the March quarter, new security surveillance and smart city infrastructure projects were delayed due in large part to physical installations being hindered.

The HDD business ship approximately 154EB, down 6% sequentially and up 10% Y/Y. Strong demand for high-capacity nearline drives boosted average capacity per total HDD to a record 6.7TB, up 10% Q/Q and 32% Y/Y. Demand for nearline product supported mass capacity revenue was $1.9 billion, down 6% Q/Q but up 18% compared with the prior-year period.

Shipment into the mass capacity market totaled 133EB, down 3% Q/Q and up 20% Y/Y. Nearline product segment continues to grow, with revenue outpacing the broader mass capacity business once again. In the March quarter, the company increased shipment to 117EB, up 6% Q/Q and 23% Y/Y, supported by the ongoing adoption of 18TB drives and initial volume shipments of new 20TB+ products.

Within the legacy markets, revenue came in at $642 million, down 17% Q/Q and 26% Y/Y. Quarter over quarter, the pace of decline was similar across each of the legacy end markets.

HDD gross margin was inside of firm's long-term target range of 30% to 33%, and the company expects its HDD and total company gross margin to trend higher in the next June quarter.

Seagate ceased shipments into Russia and Belarus at the onset of the invasion, which typically represents 1% to 2% points of revenue on a quarterly basis. It expects these impacts to persist at least through the fiscal year.

Flat sales of $2.8 billion, plus or min $150 million are expected for 4FQ22 (or -5% to +5%).

The company expects to be at or below the low end of its target range of 4% to 6% of revenue for FY22.

HDDs from 2FQ15 to 2FQ22

| Fiscal period | HDD ASP | Exabytes shipped |

Average GB/drive |

| 2Q15 | $61 | 61.3 | 1,077 |

| 3Q15 | $62 | 55.2 | 1,102 |

| 4Q15 | $60 | 52.0 | 1,148 |

| 1Q16 | $58 | 55.6 | 1,176 |

| 2Q16 | $59 | 60.6 | 1,320 |

| 3Q16 | $60 | 55.6 | 1,417 |

| 4Q16 | $67 | 61.7 | 1,674 |

| 1Q17 | $67 | 66.7 | 1,716 |

| 2Q17 | $66 | 68.2 | 1,709 |

| 3Q17 | $67 | 65.5 | 1,800 |

| 4Q17 | $64 | 62.2 | 1,800 |

| 1Q18 | $64 | 70.3 | 1,900 |

| 2Q18 | $68 | 87.5 | 2,200 |

| 3Q18 | $70.5 | 87.4 | 2,400 |

| 4Q18 |

$72 | 92.9 | 2,500 |

| 1Q19 | $70 | 98.8 | 2,500 |

| 2Q19 |

$68 | 87.4 | 2,400 |

| 3Q19 |

$72 | 76.7 | 2,400 |

| 4Q19 | $79.7 | 84.5 | 2,700 |

| 1Q20 |

$81 | 98.3 | 2,900 |

| 2Q20 |

$77 | 106.9 | 3,300 |

| 3F20 | $86 | 120.2 | 4,100 |

| 4F20 |

$89 | 117.0 | 4,500 |

| 1F21 |

$82 | 114.0 | 4,400 |

| 2F21 |

$81 | 129.2 | 4,300 |

| 3F21 | $91 | 139.6 | 5,100 |

| 4F21 | $97 | 152.3 | 5,400 |

| 1F22 |

$103 | 159 | 5,700 |

| 2F22 |

$106 | 163 | 6,100 |

| 3F22 |

NA |

154 |

6,700 |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter