Seagate: Fiscal 1Q22 Financial Results

Seagate: Fiscal 1Q22 Financial Results

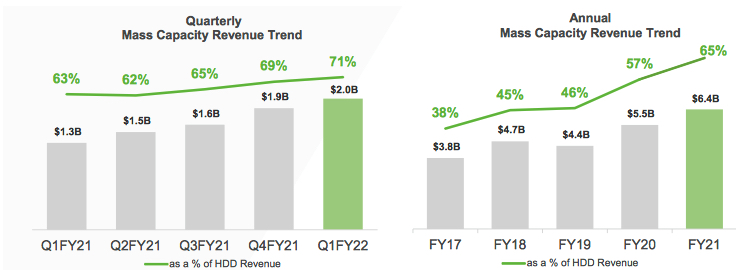

Outstanding period as mass capacity HDD sales exceeds $2 billion for first time

This is a Press Release edited by StorageNewsletter.com on October 25, 2021 at 1:02 pm| (in $ million) | 1Q21 | 1Q22 | Growth |

| Revenue |

2,314 | 3,115 | 35% |

| Net income (loss) | 223 | 526 |

Seagate Technology Holdings plc reported financial results for its fiscal first quarter ended October 1, 2021.

“Seagate had an exceptional start to the fiscal year with solid revenue growth, significant profit expansion and higher free cash flow gen in the September quarter. Mass capacity revenue topped the $2 billion mark for the first time, led by ongoing demand from cloud data center customers and strength in the video and image applications markets. Our results demonstrate consistent execution, a sustained healthy demand environment and positive structural change in storage industry dynamics. Collectively these factors led to achieving margin levels consistent with our long-term targets and support our increased revenue growth outlook for fiscal 2022,” said Dave Mosley, CEO. “Long-term, secular demand for mass capacity storage underpins our multi-year financial growth targets. Seagate’s innovative technology roadmap and operational agility position the company well to capture these growing opportunities and continue generating robust free cash flow to deliver value for customers and shareholders.“

The company generated $496 million in cash flow from operations and $379 million in free cash flow during 2FQ22. It maintained a healthy balance sheet, and during 1FQ22 it paid cash dividends of $153 million and repurchased 4.9 million ordinary shares for $425 million. Cash and cash equivalents totaled $991 million. There were 225 million ordinary shares issued and outstanding as of the end of the quarter.

Quarterly cash dividend

The board of directors declared a quarterly cash dividend of per share, which will be payable on January 5, 2022 to shareholders of record as of the close of business on.

2FQ22 guidance:

• Revenue of $3.1 billion, plus or min $150 million

• Non-GAAP diluted EPS of $2.35, plus or min $0.15

Guidance regarding non-GAAP diluted EPS excludes known charges related to amortization of acquired intangible assets of $0.02 per share and estimated share-based compensation expenses of $0.17 per share.

Comments

3.1 billion revenue for the most recent quarter is conform to guidance, and is up 35% Y/Y and 3% Q/Q above a strong June quarter.

Following this announcement, shares were up 3.3% in the pre-market trading on October 22. In the past year, shares of the company have returned 62.1% vs. the industry's decline of 12.5%.

Mass capacity HDD sales exceeds $2 billion for first time, representing 71% of global revenue and 83% of exabyte shipments, supported by growth across each of the underlying end markets, which include nearline, VIA and mass product. These sales were up 8% sequentially, and up 51% Y/Y.

The cloud is a strongest contributor to the mass capacity markets and firm's revenue growth.

HDD capacity shipment increased 4% sequentially to 159EB, up 39% relative to the prior year period.

Seagate started to see moderation in legacy annual revenue decline following pandemic disruption. Furthermore, demand for mission critical drives partially offsets decline in consumer drives following a strong June quarter.

Nearline shipments were up 5% Q/Q and 65% Y/Y affecting demand for high-capacity units. The company saw strong growth for dual actuator drives, and ongoing market momentum for its common platform products, spending 16 through 20TB drive. Robust demand in the VIA market led to sequential revenue growth that was above the average for the mass capacity markets and then the firm expects solid demand to continue in the December report.

The legacy market made up the remaining 29% of the HDD revenue, holding relatively stable at $831 million down 3% sequentially, and up 5% Y/Y.

Improving enterprise demand, boosted sales for mission-critical drive, partially offsetting decline in consumer life.

CEO Dave Mosley said: "Without a question, the HDD industry has being driven by long-term secular demand for mass capacity storage. A market that we expect to more than double by calendar 2026 to $26 billion. (...) We have been able to seamlessly transition from 16 to 18TB drive and are now operating multiple varieties of 20TB drive to meet the breadth of customer demand. We began ramping 20TB products in the September quarter and I'm thrilled with the strong customer interest. I'm equally excited by customer reception for our MACH.2 dual actuator drives, which are now shipping at large scale. I'm also confident in achieving 30TB capacities and beyond. (...) Our mass capacity innovation roadmap puts Seagate in an excellent position to thrive in this environment and continue to deliver revenue growth beyond FY22 in line with our long-term target of 3% to 6%. "

CFO Gianluca Romano added: "Based on our current outlook, we expect mass capacity exabyte shipment will remain strong in the December quarter."

After this excellent quarter, Seagate expects flat revenue for next one.

HDDs from 2FQ15 to 1FQ22

| Fiscal period | HDD ASP | Exabytes shipped |

Average GB/drive |

| 2Q15 | $61 | 61.3 | 1,077 |

| 3Q15 | $62 | 55.2 | 1,102 |

| 4Q15 | $60 | 52.0 | 1,148 |

| 1Q16 | $58 | 55.6 | 1,176 |

| 2Q16 | $59 | 60.6 | 1,320 |

| 3Q16 | $60 | 55.6 | 1,417 |

| 4Q16 | $67 | 61.7 | 1,674 |

| 1Q17 | $67 | 66.7 | 1,716 |

| 2Q17 | $66 | 68.2 | 1,709 |

| 3Q17 | $67 | 65.5 | 1,800 |

| 4Q17 | $64 | 62.2 | 1,800 |

| 1Q18 | $64 | 70.3 | 1,900 |

| 2Q18 | $68 | 87.5 | 2,200 |

| 3Q18 | $70.5 | 87.4 | 2,400 |

| 4Q18 |

$72 | 92.9 | 2,500 |

| 1Q19 | $70 | 98.8 | 2,500 |

| 2Q19 |

$68 | 87.4 | 2,400 |

| 3Q19 |

$72 | 76.7 | 2,400 |

| 4Q19 | $79.7 | 84.5 | 2,700 |

| 1Q20 |

$81 | 98.3 | 2,900 |

| 2Q20 |

$77 | 106.9 | 3,300 |

| 3F20 | $86 | 120.2 | 4,100 |

| 4F20 |

$89 | 117.0 | 4,500 |

| 1F21 |

$82 | 114.0 | 4,400 |

| 2F21 |

$81 | 129.2 | 4,300 |

| 3F21 | $91 | 139.6 | 5,100 |

| 4F21 | $97 | 152.3 | 5,400 |

| 1F22 |

NA |

159 | 5,700 |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter