NetApp: Fiscal 4Q22 Financial Results

NetApp: Fiscal 4Q22 Financial Results

Historical record for quarter and FY22 but bad outlook for next 3-month period

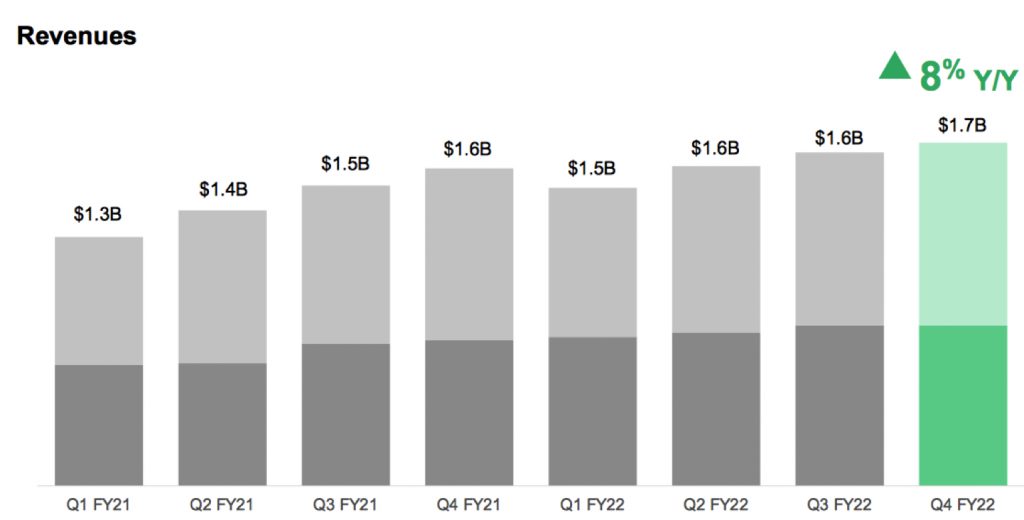

This is a Press Release edited by StorageNewsletter.com on June 3, 2022 at 2:42 pm| (in $ million) | 4Q21 | 4Q22 | FY22 | FY21 |

| Revenue | 1,555 | 1,680 | 5,744 | 6,318 |

| Growth | 8% | 10% | ||

| Net income (loss) | 334 | 259 | 730 | 937 |

NetApp, Inc. reported financial results for the fourth quarter and fiscal year 2022, which ended on April 29, 2022.

“Our solid fourth quarter results cap off a strong year. We made sustained progress vs. our strategic goals: gaining share in enterprise storage, expanding our public cloud business, and, most notably, delivering record levels of gross margin dollars, operating income, and earnings per share,” said George Kurian, CEO. “The strong fundamentals of our business, including our alignment to customer priorities, strong balance sheet, and prudent operational management put NetApp in a position of strength as we scale our Public Cloud services while continuing to drive growth in our Hybrid Cloud solutions.”

4FQ22 financial results

• Net revenues: $1.68 billion, compared to $1.56 billion in 4FQ21

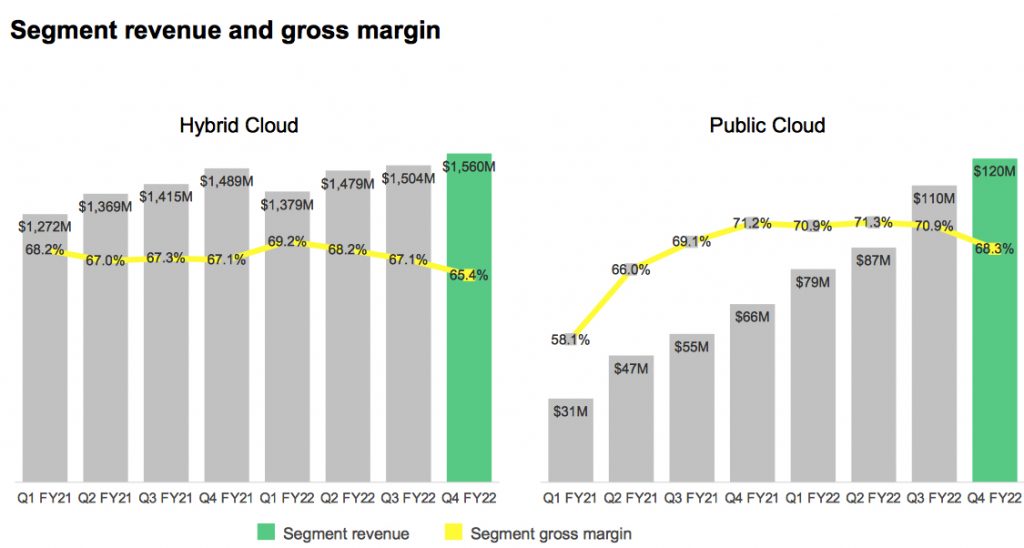

• Hybrid Cloud segment revenue: $1.56 billion, compared to $1.49 billion in 4FQ21

• Public Cloud segment revenue: $120 million, compared to $66 million in 4FQ21

• Net income: GAAP net income of $259 million, compared to $334 million in 4FQ21; non-GAAP net income4 of $324 million, compared to $268 million in 4FQ21

• Earnings per share: GAAP net income per share of $1.14 compared to $1.46 in 4FQ21; non-GAAP net income per share of $1.42, compared to $1.17 in 4FQ21

• Cash, cash equivalents and investments: $4.13 billion at the end of 4FQ22

• Cash provided by operations: $411 million, compared to $559 million in 4FQ21

• Share repurchase and dividends: Returned $361 million to shareholders through share repurchases and cash dividends

FY22 financial results

• Net revenues: $6.32 billion, compared to $5.74 billion in FY21

• Hybrid Cloud segment revenue: $5.92 billion, compared to $5.55 billion in FY21

• Public Cloud segment revenue: $396 million, compared to $199 million in FY21

• Net income: GAAP net income of $937 million, compared to $730 million in FY21; non-GAAP net income of $1.21 billion, compared to $917 million in fiscal year 2021

• Earnings per share: GAAP net income per share of $4.09 compared to $3.23 in FY21

• Cash provided by operations: $1.21 billion compared to $1.33 billion in FY21

• Share repurchase and dividends: Returned $1.05 billion to shareholders through share repurchases and cash dividends

1FQ23 financial outlook

Net revenues in the range of $1.475 billion to $1.625 billion

FY23 financial outlook

- Net revenues to grow in the range of 6% to 8%

- Public Cloud ARR in the range of $780 million to $820 million

Comments

For 4FQ22, the company formerly expected sales between $1,635 and $1,735 million or up 5% to 12%, being a record since at least 1FQ20. Final result is $1,680 million at low end of guidance.

FY22 ended with record revenue of $6,318 million, up 10% Y/Y.

The company delivered billings of $6.74 billion.

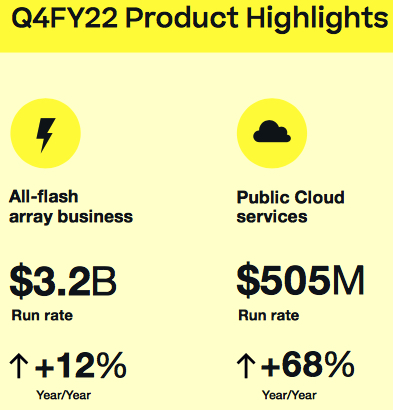

Public Cloud ARR of $505 million grew 68% Y/Y, driven by strength in Cloud Storage, led by Azure NetApp Files. The 4FQ22 dollar-based net revenue retention rate remains strong at 159%. The firm finished FY22 with $505 million in Public Cloud ARR, with Public Cloud revenue growing 99% for FY22. It balanced strong growth in its key strategic areas with another year of disciplined investment - delivering record operating margin of 23.7% (up more than 3 points from last year), with all-time high EPS of $5.28, up 30% Y/Y. Public Cloud ARR exited 4FQ22 at $505 million, up 68% Y/Y. Public Cloud revenue recognized in the quarter was $120 million, up 82% Y/Y and 9% Q/Q. NetApp ended 4FQ22 with a record $4.2 billion in deferred revenue, an increase of 6% Y/Y. This quarter marks the 17th consecutive quarter of Y/Y deferred revenue growth.

Demand for cloud storage solutions was strong in 4FQ22. The company also saw a healthy number of new customer additions across both cloud storage and cloud operations services in the quarter. Unfortunately, these tailwinds were not enough to offset the lower-than-expected growth created by higher churn, lower expansion rates, and sales force turnover in cloud operations portfolio.

The firm understand the root causes of these temporary headwinds, and, in FY23, its focus will be on returning these services to the growth trajectory saw in the first three quarters of the year.

Overall, FY22 was a good year for cloud business, doubling Public Cloud segment revenue from $199 million in FY21 to $396 million in FY22, expanding its cloud partnerships and routes to market, and introducing new, organic innovations.

Demand for our Hybrid Cloud solutions remains high. Despite supply constraints that impeded firm's ability to meet all customer demand, NetApp grew product revenue 6% in 4FQ22 and 10% in FY22. Hybrid Cloud segment revenue of $1.56 billion was up 5% Y/Y. Within Hybrid Cloud, product revenue grew for the 5th consecutive quarter and the company expects this momentum to continue into FY23. Product revenue of $894 million increased 6% Y/Y. Software product revenue of $530 million increased yearly 10%, driven by the on-going mix shift towards all-flash portfolio. Total 4FQ22 recurring support revenue of $590 million increased 2% Y/Y, highlighting the health of installed base.

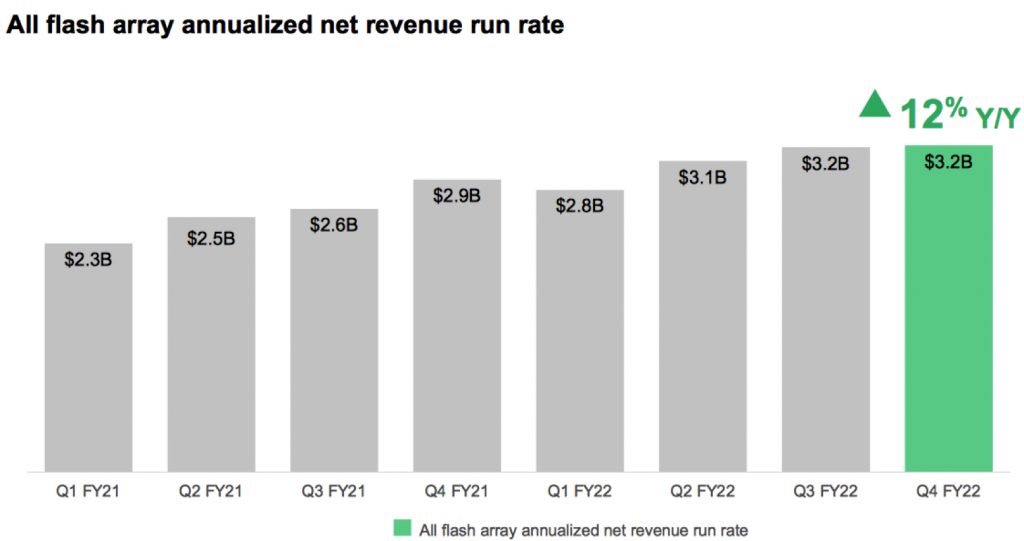

Within hybrid cloud segment, all-flash revenue grew 20% and object storage revenue 49%. All flash array annualized revenue run rate is up 12% Y/Y to $3.2 billion. Thanks to strong unit growth in FAS hybrid arrays, all flash penetration remained flat at 31% of installed systems.

Bad outlook is expected next quarter: $1,475 to 1,625 million, or 1% to 11% Y/Y and -3% to -4% Q/Q.

Net revenues is supposed to grow in the range of 6% to 8% (10% was announced last quarter).

The company plans to slow the pace of acquisitions and reprioritize its use of cash in FY23 to favor shareholder returns.

In FY23, revenue is expected to grow 6 to 8% Y/Y, which includes a 2% point headwind from Fx. The firm anticipates sustained demand for and continued share gain momentum in both all-flash and object storage solutions, which it expects to drive product revenue growth in the mid-single digits. It will also continue to grow and invest in its Public Cloud business. It expects to exit FY23 with Public Cloud ARR of $780 to $820 million, which includes approximately $40 million from recently closed acquisition of Instaclustr. At the ARR mid-point, it expects Public Cloud segment to drive 4 points of total company revenue growth in FY23. It remains confident in its ability to deliver $2 billion in Public Cloud ARR exiting FY26.

In FY23, gross margin is expected in the range between 66% and 67%, as elevated component costs and logistical expenses from supply constraints continue to weigh on product margins.

Operating margin is anticipated to be between 23% and 24% for the full year as NetApp continue to invest in its growth initiatives, while maintaining a disciplined approach to spending. Commitment is to again grow revenue faster than operating expenses in FY23.

NetApp's financial results since FY2016

| Fiscal Period | Revenue | Y/Y Growth | Net income (loss) |

| FY16 | 5,546 | -9% | 229 |

| FY17 | 5,519 | -0% | 509 |

| FY18 | 5,911 | 7% | 75 |

| FY19 |

6,146 | 4% |

1,169 |

| 1Q20 |

1,236 | -16% | 103 |

| 2Q20 |

1,371 | -10% | 243 |

| 3Q20 |

1,404 | -10% | 277 |

| 4Q20 |

1,401 | -12% | 196 |

| FY20 |

5,412 | -12% |

819 |

| 1Q21 |

1,303 | 5% | 77 |

| 2Q21 |

1,416 | 3% | 137 |

| 3Q21 |

1,470 | 5% | 182 |

| 4Q21 |

1,555 | 11% | 344 |

| FY21 | 5,744 | 6% | 730 |

| 1Q22 |

1,458 | 12% | 202 |

| 2Q22 |

1,566 | 11% | 292 |

| 3Q22 |

1,614 | 10% | 252 |

| 4Q22 | 1,680 | 8% | 259 |

| FY22 | 6,318 | 10% | 937 |

| 1Q23* |

1,475-1,625 |

1%-11% | NA |

| FY23* |

6,697-6,823 |

6%-8% | NA |

Revenue and net income (loss) in $ million

* Outlook

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter