NetApp: Fiscal 3Q22 Financial Results

NetApp: Fiscal 3Q22 Financial Results

Y/Y sales up 10% to $1.61 billion, never ending net income, good outlook

This is a Press Release edited by StorageNewsletter.com on February 24, 2022 at 2:02 pm| (in $ million) | 3Q21 | 3Q22 | 9 mo. 21 | 9 mo. 22 |

| Revenue | 1,470 | 1,614 | 4,189 | 4,638 |

| Growth | 10% | 11% | ||

| Net income (loss) | 182 | 252 | 396 | 678 |

NetApp, Inc. reported financial results for the third quarter of fiscal year 2022, which ended on January 28, 2022.

“Q3 results and positive growth outlook are powered by the alignment of our differentiated technology portfolio with customer priorities for cloud and digital transformation. We have a unique position in solving organizations’ most significant challenges in hybrid, multi-cloud IT,” said George Kurian, CEO. “Our focused execution and effective management of temporary supply chain headwinds enable us to capture our expanding opportunity while investing for continued growth and delivering operating leverage.”

3FQ22 financial results

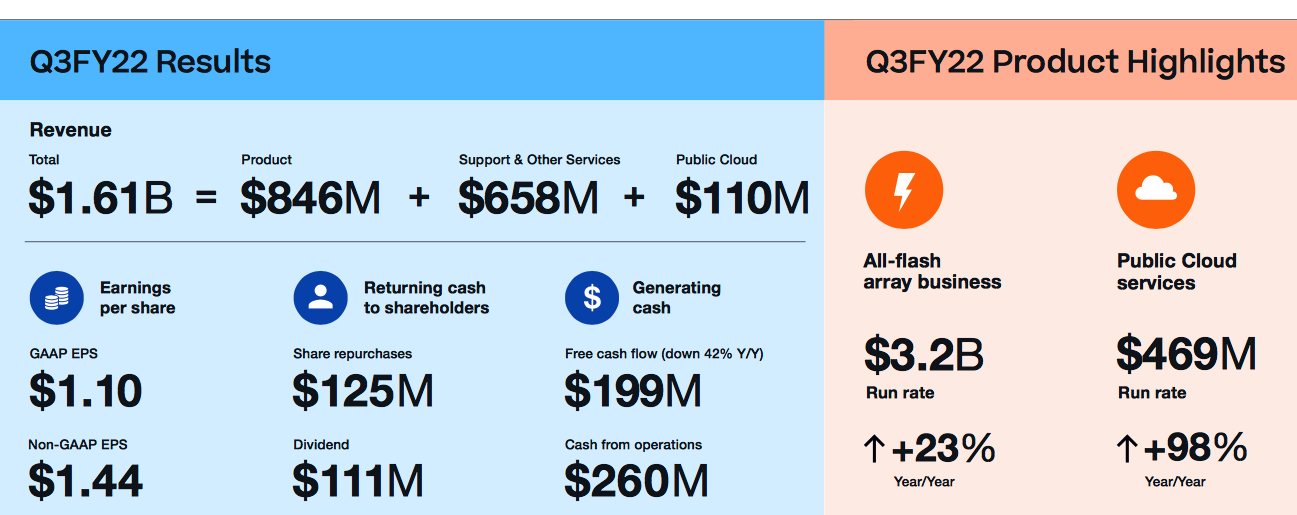

- Net revenues: $1.61 billion, compared to $1.47 billion in 3FQ21

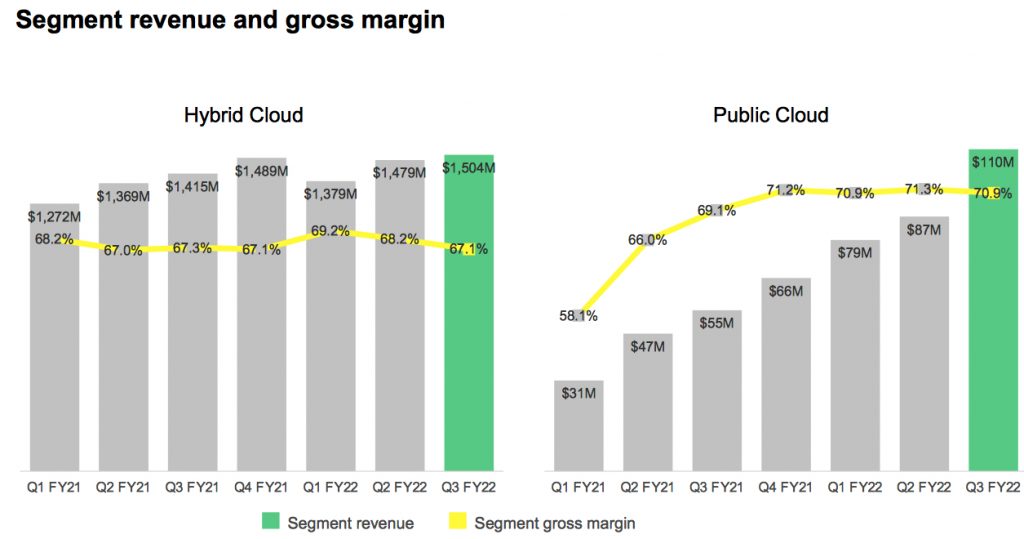

- Hybrid Cloud segment revenue: $1.50 billion, compared to $1.42 billion in the third quarter of fiscal year 2021

- Public Cloud segment revenue: $110 million, compared to $55 million in 3FQ21

- Net income: GAAP net income of $252 million, compared to $182 million in 3FQ21; non-GAAP net income of $330 million, compared to $250 million in 3FQ21

- Earnings per share: GAAP net income per share of $1.10, compared to $0.80 in 3FQ21; non-GAAP net income per share of $1.44, compared to $1.10 in 3FQ21

- Cash, cash equivalents and investments: $4.20 billion at the end of 3FQ22

- Cash provided by operations: $260 million, compared to $373 million in 3FQ21

- Share repurchase and dividends: Returned $236 million to shareholders through share repurchases and cash dividends

4FQ22 outlook

Net revenues are expected to be in the range of $1.635 billion to $1.735 billion

FY22 financial outlook

- Net revenues are expected to grow by ~10%

- Public Cloud ARR is expected to exit the fiscal year in the range of $525 million to $545 million

Dividend

The next cash dividend of $0.50 per share is to be paid on April 27, 2022, to shareholders of record as of the close of business on April 8, 2022.

Comments

During the former quarter, the company expected sales to increase 4% to 14% Y/Y. Finally, it's 10% at 1,614 million.

3FQ22 recorded an all-time company highs in gross profit dollars, operating

income and EPS.

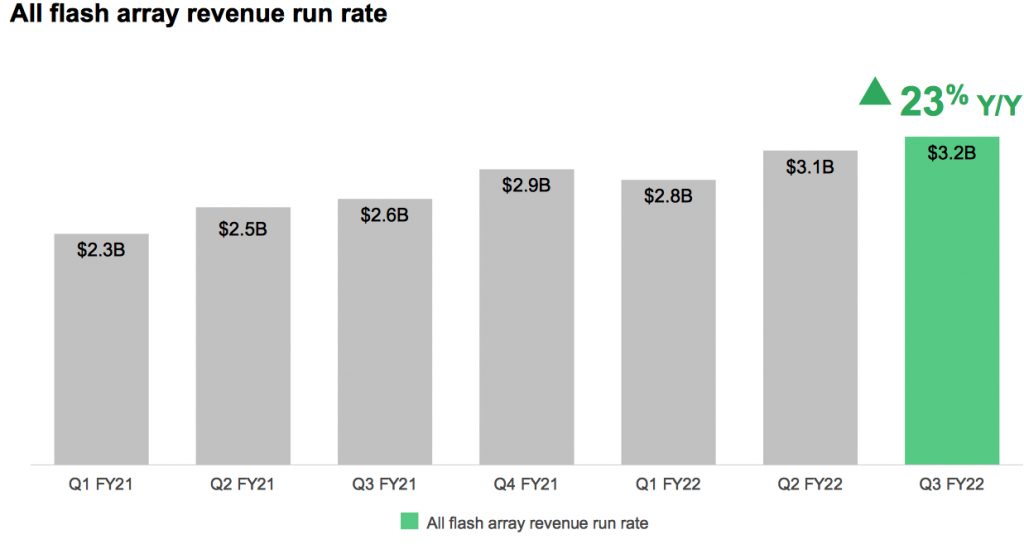

Growth in hybrid cloud segment was driven by continued strength in object storage and AFAs.

AFA business hit another milestone in 3FQ22, with a record high annualized run rate of $3.2 billion, an increase of 23% Y/Y. AFA penetration of installed base ticked up another point to 31% of installed base systems.

Public Cloud ARR grew to $469 million, an increase of 98% Y/Y and 21% Q/Q, including the benefit from the Cloud Checkr acquisition which closed early in 3FQ22. Public cloud dollar-based net revenue retention rate remains healthy at 169%, as customers increase their usage of public cloud services and adopt new products. The expanded market reach from cloud partners and the broadening participation of field sales organization has delivered excellent performance in public cloud segment this year, which puts the company ahead of its plan to achieve $1 billion in ARR in FY25.

Hybrid cloud segment revenue of $1.5 billion was up 6% Y/Y.

Within this business, NetApp delivered product revenue growth for the 4th consecutive quarter and expects this momentum to continue into 4FQ22 and throughout FY23. Product revenue of $846 million increased 9% Y/Y. Software product revenue of $507 million increased 18% Y/Y, driven by the on-going mix shift towards all-flash portfolio.

Total 3FQ22 recurring support revenue of $586 million increased 3% Y/Y.

When combined, software product revenue, recurring support and public cloud revenue totaled $1.2 billion, another company high, and increased 14% Y/Y, representing 75% of total revenue, up from 72% in 3FQ21.

The vendor ended 3FQ22 with $4 billion in deferred revenue, an increase of 4% Y/Y and the 16th consecutive quarter of yearly deferred revenue growth.

For 4FQ22, the company expects sales between $1,635 and $1,735 million or up 5% to 12%, being a record since at least 1FQ20.

At the end of the former quarter, the company was expected FY22 revenue to grow in the range of 9% to 10%. This time it's around 10% or $6,318 million, that will be an historical record.

NetApp's financial results since FY2016

| Fiscal Period | Revenue | Y/Y Growth | Net income (loss) |

| FY16 | 5,546 | -9% | 229 |

| FY17 | 5,519 | -0% | 509 |

| FY18 | 5,911 | 7% | 75 |

| FY19 |

6,146 | 4% |

1,169 |

| 1Q20 |

1,236 | -16% | 103 |

| 2Q20 |

1,371 | -10% | 243 |

| 3Q20 |

1,404 | -10% | 277 |

| 4Q20 |

1,401 | -12% | 196 |

| FY20 |

5,412 | -12% |

819 |

| 1Q21 |

1,303 | 5% | 77 |

| 2Q21 |

1,416 | 3% | 137 |

| 3Q21 |

1,470 | 5% | 182 |

| 4Q21 |

1,555 | 11% | 344 |

| FY21 | 5,744 | 6% | 730 |

| 1Q22 |

1,458 | 12% | 202 |

| 2Q22 |

1,566 | 11% | 292 |

| 3Q22 |

1,614 | 10% | 252 |

| 4Q22* | 1,635-1,735 | 5%-12% | NA |

| FY22* | 6,318 | 10% | NA |

Revenue and net income (loss) in $ million

* Outlook

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter