NetApp: Fiscal 2Q22 Financial Results

NetApp: Fiscal 2Q22 Financial Results

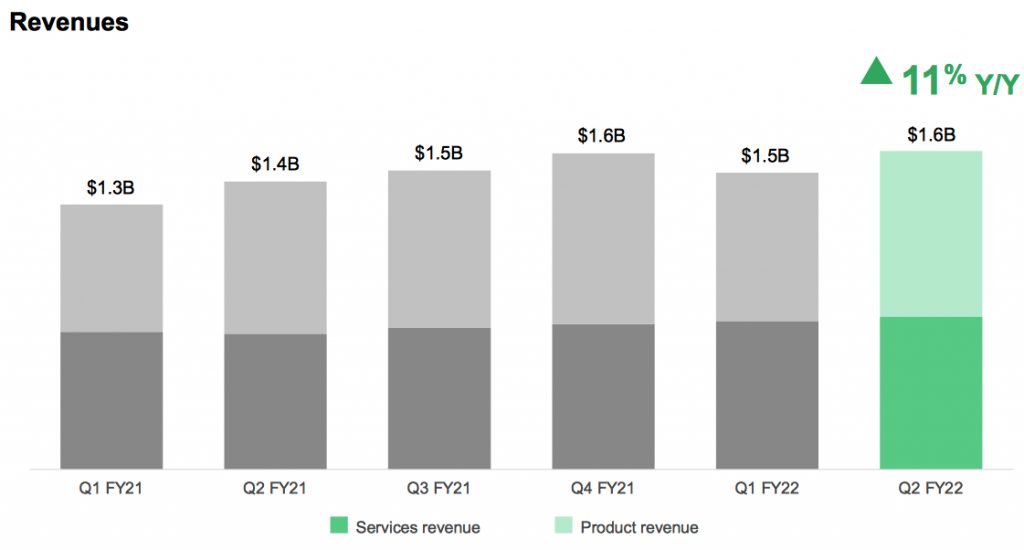

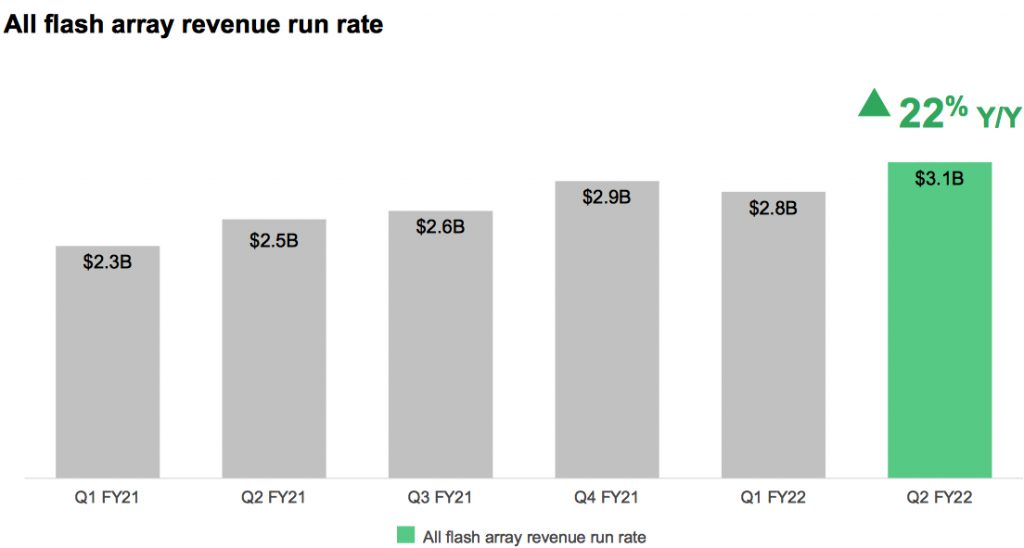

Sales up 11% Y/Y, AFA annualized net revenue run rate up 22% to $3.1 billion

This is a Press Release edited by StorageNewsletter.com on December 2, 2021 at 2:02 pm| (in $ million) | 2Q21 | 2Q22 | 6 mo. 21 |

6 mo. 22 |

| Revenue | 1,416 | 1,566 | 2,719 | 3,024 |

| Growth | 11% | 11% | ||

| Net income (loss) | 236 | 292 | 373 | 494 |

NetApp, Inc. reported financial results for the second quarter of fiscal year 2022, which ended on October 29, 2021.

“We delivered another strong quarter, with results all at the high end or above our guidance. Our performance reflects a strong demand environment, a clear vision, and exceptional execution by the NetApp team and gives the confidence to raise our full year guidance for revenue, EPS and public cloud ARR,” said George Kurian. “We are gaining share in the key markets of all-flash and object storage, while rapidly scaling our public cloud business. Our industry-leading innovation and unique and deep cloud partnerships position us well to capitalize on significant opportunity ahead.”

2FQ22 financial results

• Net revenues: $1.57 billion, compared to $1.42 billion in 2FQ21

-

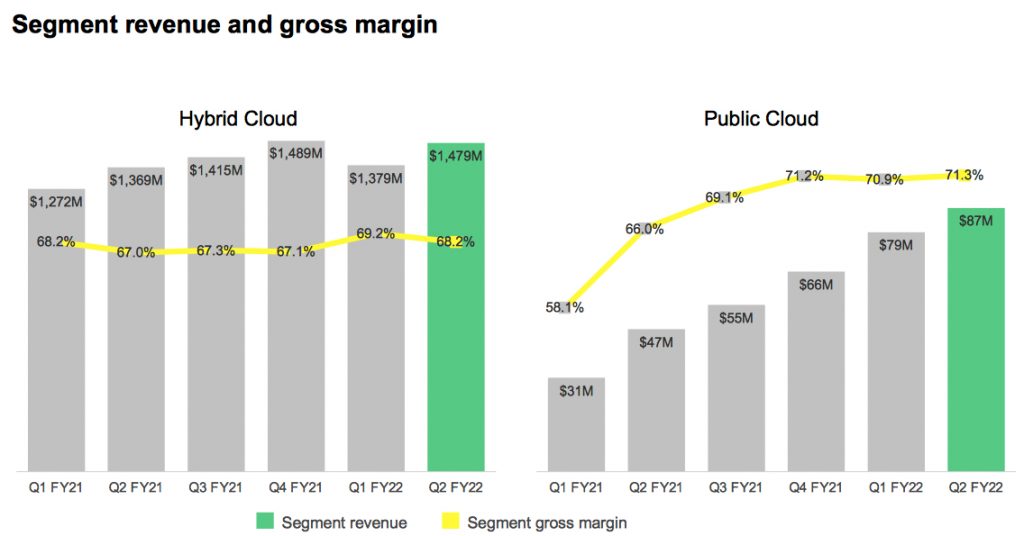

- Hybrid cloud segment revenue: $1.48 billion, compared to $1.37 billion in 2FQ21

- Public cloud segment revenue: $87 million, compared to $47 million in 2FQ21

• Net income: GAAP net income of $224 million, compared to $137 million in 2FQ21; non-GAAP net income of $292 million, compared to $236 million in 2FQ21

• Earnings per share: GAAP net income per share5 of $0.98, compared to $0.61 in 2FQ21; non-GAAP net income per share of $1.28, compared to $1.05 in 2FQ21

• Cash, cash equivalents and investments: $4.55 billion at the end of 2FQ22

• Cash provided by operations: $298 million, compared to $161 million in 2FQ21

• Share repurchase and dividends: Returned $237 million to shareholders through share repurchases and cash dividends

3FQ22 outlook

Net revenues in the range of $1.525 billion to $1.675 billion

FY22 outlook

Net revenues to grow in the range of 9% to 10%

Comments

Quarterly revenue of $1,566 million is on top of what was expected at the end of the former quarter ($1.49 billion to $1.59 billion).

Gross margin, operating margin and EPS all also came in above the high-end of guidance. Operating margin of 24% is an all-time company high.

Product revenue grew yearly 9%, the third consecutive quarter of Y/Y growth, reaching $814 million.

Software product revenue of $475 million increased Y/Y, driven by the continued mix shift towards all-flash portfolio.

Public cloud

Public revenue grew triple digits again this quarter, up 155% from 2Q21 and 85% year-over-year at $85 million, driven by Azure NetApp Files, Cloud Insights, and Spot by NetApp.

Public cloud ARR exited 2FQ21 at $388 million, up 80% Y/Y and 15% Q/Q. The growing scale of public cloud platform continues to positively impact the overall growth profile of NetApp, delivering 3 of the 11 points in revenue growth.

Recurring support and public cloud revenue of $677 million was up 13% Y/Y, constituting 43% of total revenue. When combined, software product revenue, recurring support and public cloud revenue totaled $1.2 billion and increased 13% Y/Y, representing 74% of total revenue, up from 72% in 2FQ21. The company ended the quarter with $3.9 billion in deferred revenue, an increase of 6% Y/Y

Hybrid cloud

Growth in hybrid cloud segment was driven by strength in object storage for the growing unstructured data and analytics use cases, and firm's AFA portfolio. 2FQ22 AFA business reached a record high annualized run rate of $3.1 billion, an increase of 22% Y/Y. AFAs now compose 30% of firm's installed base systems.

Note that AFA pure player Pure Storage, for its most recent quarter, recorded revenue of $497 million up 23% Q/Q. Other big competitors Dell and IBM didn't reveal their figure for this fast growing business

Total hybrid cloud segment revenue of $1.48 billion was up 8% year-over-year. Within hybrid cloud, NetApp delivered product revenue growth for the third consecutive quarter and expect this momentum to continue throughout FY22.

Total 2FQ21 recurring support revenue of $590 million increased 7% year-over-year.

This quarter marks the 15th consecutive quarter of Y/Y deferred revenue growth.

Total gross margin was 68%, reflecting the value of software portfolio and public cloud platform.

During 2FQ22, the company advanced its cloud agenda, and remained confident in its ability to achieve its goal of reaching $1 billion ARR in FY25.

For FY22, it continues to forecast total gross margin to be 68%. However, the current supply chain challenges with temporarily higher freight and expedite charges, will pressure product margins in the next two quarters. The firm now anticipates product margins to be 54% for the full year.

It is reaffirming its full-year operating margin guidance of 23% to 24%.

It is raising the guidance on its organic public cloud ARR, with a new range of $475 million to $500 million.

In total, new guidance for exit FY22 public cloud ARR is $510 million to $540 million, which at the midpoint, implies a 74% increase Y/Y.

Sales are expected to increase 4% to 14% Y/Y next quarter, and to surpass $6 billion in FY22, a sum never reached since FY19.

At the end of the former quarter, the company was expected FY22 revenue to grow in the range of 8% to 9%. These figures have been augmented to 9% to 10%.

NetApp's financial results since FY2016

| Fiscal Period | Revenue | Y/Y Growth | Net income (loss) |

| FY16 | 5,546 | -9% | 229 |

| FY17 | 5,519 | -0% | 509 |

| FY18 | 5,911 | 7% | 75 |

| FY19 |

6,146 | 4% |

1,169 |

| 1Q20 |

1,236 | -16% | 103 |

| 2Q20 |

1,371 | -10% | 243 |

| 3Q20 |

1,404 | -10% | 277 |

| 4Q20 |

1,401 | -12% | 196 |

| FY20 |

5,412 | -12% |

819 |

| 1Q21 |

1,303 | 5% | 77 |

| 2Q21 |

1,416 | 3% | 137 |

| 3Q21 |

1,470 | 5% | 182 |

| 4Q21 |

1,555 | 11% | 344 |

| FY21 | 5,744 | 6% | 730 |

| 1Q22 |

1,458 | 12% | 202 |

| 2Q22 |

1,566 | 11% | |

| 3Q22* |

1,525-1,675 | 4%-14% | NA |

| FY22* | 6,261-6,318 | 9%-10% | NA |

Revenue and net income (loss) in $ million

* Outlook

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter