Dropbox: Fiscal 1Q22 Financial Results

Dropbox: Fiscal 1Q22 Financial Results

Revenue up 10% Y/Y and net income increasing 67%

This is a Press Release edited by StorageNewsletter.com on May 10, 2022 at 2:02 pm| (in $ million) | 1Q21 | 1Q22 | Growth |

| Revenue |

511.6 | 562.4 | 10% |

| Net income (loss) | 47.6 | 79.7 |

“2022 is off to a strong start as we launched new functionality and features across Backup, Shop and document workflows with HelloSign, DocSend and PDF editing; all designed to help customers organize, secure, and do more with their digital content,” said co-founder and CEO Drew Houston. “I’m pleased with our team’s execution and performance in Q1, including strong profitability and improved user retention, reflecting our resilience in a challenging macro-environment. Looking ahead, I’m excited to build on this momentum as we continue to drive value for our customers and shareholders and work towards our vision of building one organized place for content and all the workflows around it.“

1FQ22 Results

• Total revenue was $562.4 million, an increase of 9.9% from 1FQ21. On a constant currency basis, Y/Y growth would have been 9.7%.

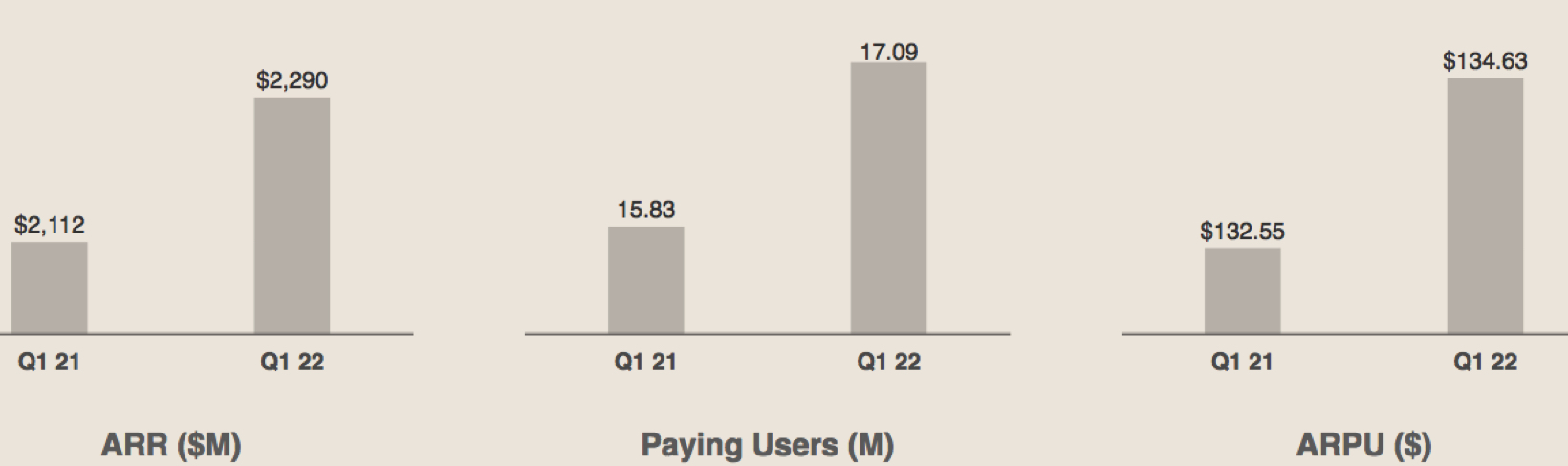

• Total ARR ended at $2.290 billion, an increase of 8.4% from the 1FQ21. On a constant currency basis, it grew $40 million Q/Q and Y/Y growth would have been 8.9%.

• Paying users ended at 17.09 million, as compared to 15.83 million for 1FQ21. Average revenue per paying user was $134.63, as compared to $132.55 for 1FQ21.

• GAAP gross margin was 79.9%, as compared to 78.6% for 1FQ21. Non-GAAP gross margin was 81.3%, as compared to 80.2% for 1FQ21.

• GAAP operating margin was 15.9%, as compared to 8.3% for 1FQ21. Non-GAAP operating margin was 30.3%, as compared to 29.1% for 1FQ21.

• GAAP net income was $79.7 million, as compared to $47.6 million for 1FQ21. Non-GAAP netincome was $141.5 million, as compared to $141.8 million for 1FQ21.

• Net cash provided by operating activities was $141.4 million, as compared to $115.7 million for 1FQ21. Free cash flow was $130.7 million, as compared to $108.8 million for 1FQ21.

• GAAP diluted net income per share attributable to common stockholders was $0.21, as compared to $0.12 for 1FQ21. Non-GAAP diluted net income per share attributable to common stockholders was $0.38, as compared to $0.35 for 1FQ21.

• Cash, cash equivalents and short-term investments ended at $1.496 billion.

Comments

Total revenue for the quarter increased 9.9% Y/Y to $562.4 million not far from top of guidance range of $557 million to $560 million, and slightly decreased Y/Y.

Net income for the quarter was $141 million vs. $124.6 million last quarter, as income tax expense increased due to the impact of R&D tax legislation newly effective in 2022.

Total ARR for the quarter grew 8.4% Y/Y for a total of $2.290 billion.

The company continuing to evolve its core FSS business to improve attention and drive monetization. Second, it's expanding into workflows beyond pass around documents with HelloFax and DocSend and rich media content to better serve creators and freelancers. Finally, it remains focused on operational excellence as it continues to balance growth and profitability. So it will start with its efforts around retention.

It exited 1FQ22 with 17.09 million paying users and added approximately 300,000 net new paying users Q/Q, driven in part by its family plan. Average revenue per paying user was $134.63 in 1FQ22.

First quarter sales and marketing expense was $88 million or 16% of revenue, which decreased, compared to 17% of revenue in 1FQ21.

The firm expects the impact from discontinuing new sales and financial sanctions in Russia to be in the high single-digit millions of dollars to revenue this year. Despite this, its outperformance in 1FQ22 and the trends it is seeing within the business give the company confidence that it can absorb the impact of Russia, while still maintaining its initial revenue guidance.

Last quarter Dropbox stated that it expects for FY22 revenue in the range of $2.320 billion to $2.330 billion or up around 8%, and gross margin to be approximately 81%.

| Fiscal period |

Revenue in $ million |

Y/Y growth | Net loss in $ million |

| 2015 | 603.8 | NA | (352.9) |

| 2016 | 844.8 | 40% | (210.2) |

| 2017 | 1,107 | 13% | (111.7) |

| 2018 | 1,392 | 26% | (484.9) |

| 2019 |

1,661 | 19% | (52.7) |

| 2020 |

1,914 | 15% | (256.3) |

| 1Q21 |

511.6 | 12% | 47.6 |

| 2Q21 |

530.6 | 14% | 88.0 |

| 3Q21 |

550.2 | 13% | 75.6 |

| 4Q21 |

565.5 |

12% | 124.6 |

| FY21 |

2,158 | 13% | 335.8 |

| 1Q22 |

562.4 | 10% | 79.7 |

| FY22 (estim.) |

2.320-2,330 |

8% |

NA |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter