Dropbox: Fiscal 4Q21 Financial Results

Dropbox: Fiscal 4Q21 Financial Results

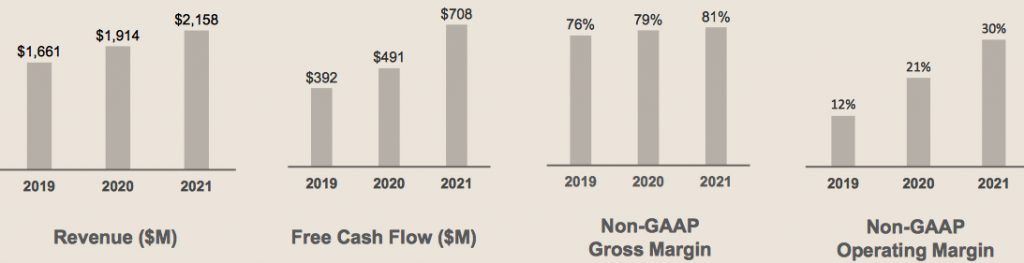

Sales up 12%, first profitable fiscal year since 2015

This is a Press Release edited by StorageNewsletter.com on February 21, 2022 at 2:02 pm| (in $ million) | 4Q20 | 4Q21 | FY20 | FY21 |

| Revenue | 504.1 | 565.5 | 1,914 | 2,158 |

| Growth | 12% | 13% | ||

| Net income (loss) | (345.8) | 124.6 | (256.3) | 335.8 |

Dropbox, Inc., announced financial results for its fourth quarter ended December 31, 2021.

“2021 was a strong year for Dropbox. I’m proud of the progress our team made on evolving our core offerings and expanding our product portfolio to align to our customers’ growing needs, all during our first year as a Virtual First company,” said Dropbox co-founder and CEO. “We improved our non-GAAP operating margin by nearly 9 points, grew free cash flow by over 40% Y/Y, and delivered our first full year of GAAP profitability. Looking ahead to 2022, I’m excited about the opportunity we have to help our customers organize their digital lives and deliver value to our shareholders.”

4FQ21 Results

• Total revenue was $565.5 million, an increase of 12.2% from 4FQ20. On a constant currency basis, Y/Y growth would have been 10.8%.

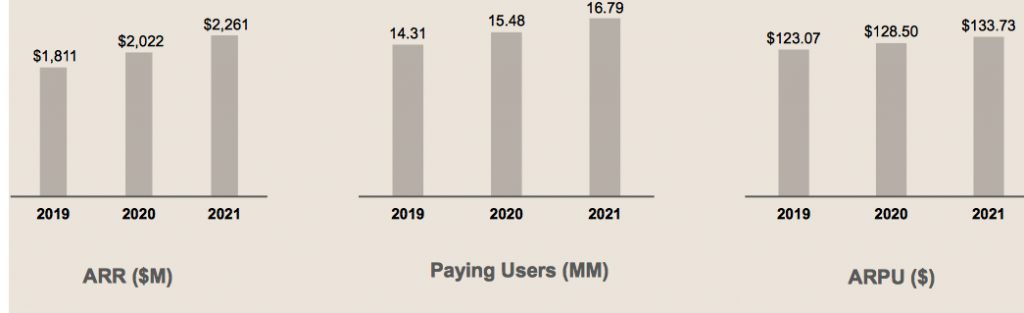

• Total ARR ended at $2.261 billion, an increase of $43.1 million Q/Q and an increase of 11.8% Y/Y. On a constant currency basis, Y/Y growth would have been 10.2%.

• Paying users ended at 16.79 million, as compared to 15.48 million for the same period last year. Average revenue per paying user was $134.78, as compared to $130.17 for 4FQ20.

• GAAP gross margin was 79.5%, as compared to 79.0% in 4FQ20. Non-GAAP gross margin was 80.9%, as compared to 80.1% in 4FQ20.

• GAAP operating margin was 12.4%, as compared to (68.8%) in 4FQ20. Non-GAAP operating margin was 29.7%, as compared to 25.3% in 4FQ20.

• GAAP net income (loss) was $124.6 million, as compared to ($345.8) million in 4FQ20 due to significant impairment charges of $398.2 million in 4FQ20 as a result of the company’s decision to shift to a Virtual First work model, as well as an income tax benefit from the release of a valuation allowance of $38.1 million on the company’s Irish deferred tax assets in 4FQ21. Non-GAAP net income was $159.9 million, as compared to $117.9 million in 4FQ20.

• Net cash provided by operating activities was $162.7 million, including the cash paid for the company’s real estate lease termination of $32.0 million, as compared to $170.7 million in 4FQ20. Free cash flow was $161.4 million, as compared to $158.4 million in 4FQ20.

• GAAP diluted net income (loss) per share attributable to common stockholders was $0.32, as compared to ($0.84) in 4FQ20 due to significant impairment charges of $398.2 million in 4FQ20 as a result of the company’s decision to shift to a Virtual First work model, as well as an income tax benefit from the release of a valuation allowance of $38.1 million on the company’s Irish deferred tax assets in 4FQ21. Non-GAAP diluted net income per share attributable to common stockholders was $0.41, as compared to $0.28 in 4FQ20.

• Cash, cash equivalents and short-term investments ended at $1.718 billion.

FY21 Results

• Total revenue was $2.158 billion, an increase of 12.7% Y/Y. On a constant currency basis, Y/Y growth would have been 11.1%.

• Average revenue per paying user was $133.73, as compared to $128.50 in FY20.

• GAAP gross margin was 79.4%, as compared to 78.3% in FY20. Non-GAAP gross margin was 80.8%, as compared to 79.4% in FY20.

• GAAP operating margin was 12.7%, as compared to (14.5%) in FY20. Non-GAAP operating margin was 30.0%, as compared to 21.4% in FY20.

• GAAP net income (loss) was $335.8 million, as compared to ($256.3) million in FY20 due to significant impairment charges of $398.2 million in 4FQ20 as a result of the company’s decision to shift to a Virtual First work model, as well as an income tax benefit from the release of a valuation allowance of $38.1 million on the company’s Irish deferred tax assets in 4FQ21. Non-GAAP net income was $609.3 million, as compared to $391.1 million in FY20.

• Net cash provided by operating activities was $729.8 million, including the cash paid for the company’s real estate lease termination of $32.0 million, as compared to $570.8 million in FY20. Free cash flow was $707.7 million as compared to $490.7 million in FY20.

• GAAP diluted net income (loss) per share attributable to common stockholders was $0.85, as compared to ($0.62) in FY20 due to significant impairment charges of $398.2 million in 4FQ20 as a result of the company’s decision to shift to a Virtual First work model, as well as an income tax benefit from the release of a valuation allowance of $38.1 million on the company’s Irish deferred tax assets in the fourth quarter of 2021. Non-GAAP diluted net income per share attributable to common stockholders was $1.54, as compared to $0.93 in FY20.

Share Repurchase Authorization

On February 11, 2022, the board of directors authorized Dropbox to repurchase an additional $1.2 billion of its Class A common stock. The repurchase is expected to be executed, subject to general business and market conditions and other investment opportunities, through open market purchases or privately negotiated transactions, including through Rule 10b5-1 plans.

Comments

Total revenue for 4FQ21 increased 12.2% Y/Y to $565.5 million, beating guidance range of $556 million to $559 million.

For FY21, it was $2,158 million, up 13% Y/Y, also above guidance ($2,148 to $2,151 million).

Growing revenue was driven by strength in higher ASP offerings, such as professional SKU, teams plans and DocSend.

4FQ21 R&D expense was $148 million or 26% of revenue, which is slightly increased as a percent of revenue compared to 4FQ20. Sales and marketing expense was $99 million or 17% of revenue, which decreased compared to 20% of revenue in 4FQ20.

In 4FQ21, the company added $16 million to its finance leases for data center equipment

In 2021, it saw the number of PDF files shared on Dropbox grow by 40%, and the number of videos shared grew by 25%.

For FY22, it expects revenue to be in the range of $2.320 billion to $2.330 billion or up around 8%, and gross margin to be approximately 81%.

| Fiscal period |

Revenue in $ million |

Y/Y growth | Net loss in $ million |

| 2015 | 603.8 | NA | (352.9) |

| 2016 | 844.8 | 40% | (210.2) |

| 2017 | 1,107 | 13% | (111.7) |

| 2018 | 1,392 | 26% | (484.9) |

| 2019 |

1,661 | 19% | (52.7) |

| 2020 |

1,914 | 15% | (256.3) |

| 1Q21 |

511.6 | 12% | 47.6 |

| 2Q21 |

530.6 | 14% | 88.0 |

| 3Q21 |

550.2 | 13% | 75.6 |

| 4Q21 |

565.5 |

12% | 124.6 |

| FY21 |

2,158 | 13% | 335.8 |

| FY22 (estim.) |

2.320-2,330 |

8% |

NA |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter