Dropbox: Fiscal 1Q21 Financial Results

Dropbox: Fiscal 1Q21 Financial Results

Sales up 12% and net 21% Y/Y

This is a Press Release edited by StorageNewsletter.com on May 12, 2021 at 2:32 pm| (in $ million) | 1Q20 | 1Q21 | Growth |

| Revenue |

455.0 | 511.6 | 12% |

| Net income (loss) | 39.3 | 47.6 | 21% |

Dropbox, Inc. announced financial results for its first quarter ended March 31, 2021.

“We kicked off the year with a profitable Q1, along with strong revenue growth and free cash flow,” said co-founder and CEO Drew Houston. “We welcomed DocSend to the team, saw great momentum with HelloSign, and continued to make meaningful progress vs. our 2021 priorities. In this new era of distributed work, we have a big opportunity to deliver more value to our customers and shareholders, and I’m excited for what’s ahead.“

1FQ21 results

- Total revenue was $511.6 million, an increase of 12% from 1FQ20. On a constant currency basis, Y/Y growth would have been 11%.

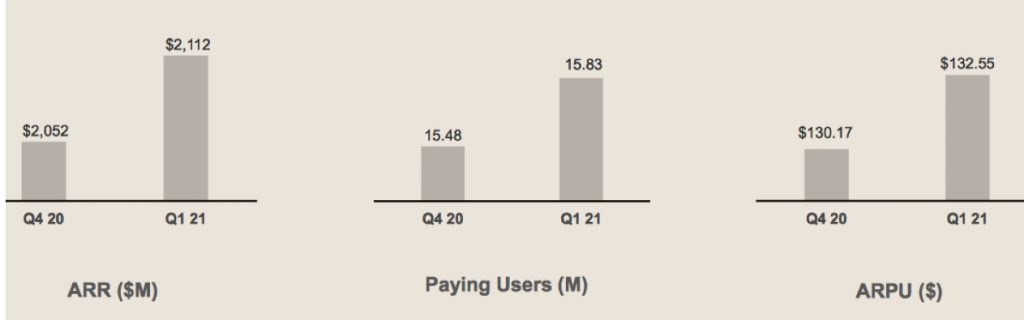

- Total ARR ended at $2.112 billion, an increase of 13% from 1FQ20. On a constant currency basis, Total ARR grew $60.5 million quarter-over-quarter, and Y/Y growth would have been 12%.

- Paying users ended at 15.83 million, as compared to 14.59 million for 1FQ20. Average revenue per paying user was $132.55, as compared to $126.30 for 1FQ20

- GAAP gross margin was 78.6%, as compared to 77.3% in 1FQ20. Non-GAAP gross margin was 80.2%, as compared to 78.3% in 1FQ20.

- GAAP operating margin was 8.3%, as compared to 5.9% in 1FQ20. Non-GAAP operating margin was 29.1%, as compared to 16.1% in 1FQ20.

- GAAP net income was $47.6 million, as compared to $39.3 million in 1FQ20. Non-GAAP net income was $141.8 million, as compared to $69.8 million in 1FQ20.

- Net cash provided by operating activities was $115.7 million, as compared to $53.3 million in 1FQ20. Free cash flow was $108.8 million, as compared to $25.5 million in 1FQ20.

- GAAP basic and diluted net income per share attributable to common stockholders was $0.12, as compared to $0.09 in 1FQ20. Non-GAAP diluted net income per share attributable to common stockholders was $0.35, as compared to $0.17 in 1FQ20.

- Cash, cash equivalents and short-term investments ended at $1.916 billion.

During the quarter, the company completed an offering for $1.389 billion of zero-coupon convertible senior notes, which included the exercise of the over-allotment options. This consisted of $695.8 million of convertible senior notes that mature in 2026 and $693.3 million of convertible senior notes that mature in 2028. After deducting the net costs of related hedge and warrant transactions and certain offering expenses, total net proceeds from the offering were $1.305 billion.

DocSend acquisition

Dropbox completed the acquisition of DocSend, Inc., which enables companies to share business-critical documents with ease and get real-time actionable feedback, on March 22, 2021 for approximately $165 million, consisting primarily of cash payments, subject to customary purchase price adjustments. Of the approximately $165 million of consideration, $30.7 million is subject to ongoing employee service. The combination of Dropbox, HelloSign, and DocSend will help customers across industries manage end-to-end document workflows-from closing deals to onboarding teams-giving them more control over their business results.

Comments

Global revenue for the quarter increased to 12% Y/Y and 1% Q/Q to $512 million, beating the high end of firm's guidance with not usual profitability.

CFO Tim Regan stated: "The core tenets of our financial plan are as follows: doubling free cash flow to $1 billion annually by 2024, investing for continued revenue growth, driving annual improvements in operating margins targeting 28% to 30%, allocating capital to organic initiatives and acquisitions that align with our strategic and financial objectives, and returning capital to our shareholders by allocating some significant portion of our annual free cash flow to share repurchases with the goal of reducing our share count."

1FQ21 financial highlights

The company exited the quarter with 15.83 million paying users, and added approximately 350,000 net new paying users in 1FQ21, driven in part by positive momentum in adoption of the Family plan. Average revenue per paying user was $132.55 in during this quarter.

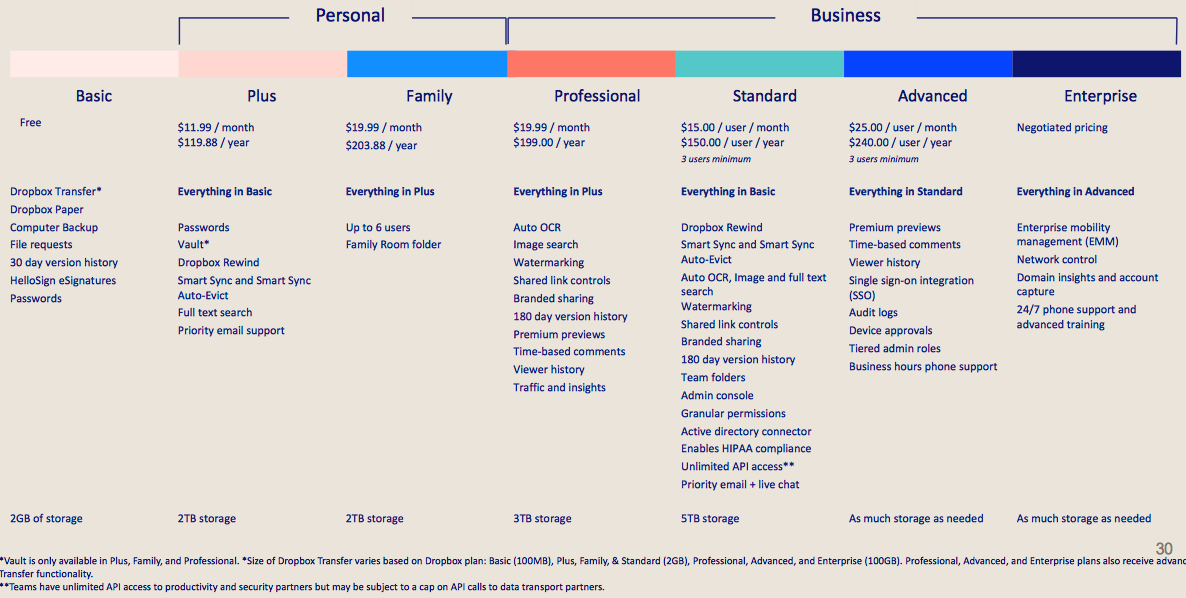

Subscriptions plans

Click to enlarge

1FQ21 R&D expense was $131 million or 26% of revenue, which decreased compared to 31% of revenue in 1FQ20. Sales and marketing expense was $88 million or 17% of revenue, which decreased compared to 21% of revenue in 1FQ20.

On total sales, $266.9 million came from USA, $244.7 million from international.

For 2FQ21, revenue is expected to be in the range of $522 million to $525 million or +2% to 3%.

For FY21, Dropbox is raising revenue guidance range, which was previously $2.095 billion to $2.115 billion to $2.118 billion to $2.130 billion or yearly around 11%.

| Fiscal period |

Revenue in $ million |

Y/Y growth | Net loss in $ million |

| 2015 | 603.8 | NA | (352.9) |

| 2016 | 844.8 | 40% | (210.2) |

| 2017 | 1,107 | 13% | (111.7) |

| 2018 | 1,392 | 26% | (484.9) |

| 2019 |

1,661 | 19% | (52.7) |

| 2020 |

1,914 | 15% | (256.3) |

| 1Q21 |

511.6 | 12% | 47.6 |

| 2Q21 (estim.) |

522-525 | 2-3% | NA |

| 2021 (estim.) |

2,095-2,115 | 11% | NA |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter