Phison: Fiscal 4Q21 Financial Results

Phison: Fiscal 4Q21 Financial Results

Y/Y revenue up 31% and 29% for FY21

This is a Press Release edited by StorageNewsletter.com on March 8, 2022 at 2:02 pmHighlights:

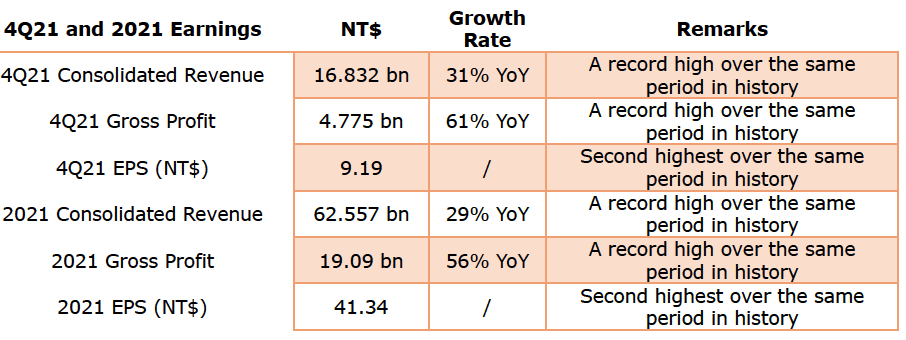

- 4Q21 consolidated revenue was NT$16.832 billion, up 31% Y/Y, while the annual revenue in 2021 reached NT$62.557 billion, a yearly increase of 29%, a record high for the same period.

- The ESP for the full year of 2021 is NT$41.34.

- The firm has gradually get rid of the business cycle of the NAND storage industry, and become a value-growing company worthy of long-term investment.

Phison Electronics Corp. announced its consolidated financial results for the fourth quarter of 2021 and revenue for February 2022.

4FQ21 consolidated revenue was NT$16.832 billion, up 31% Y/Y; the annual revenue in 2021 reached NT$62.557 billion, a yearly increase of 29%, a record high for the same period.

Gross profit in 4FQ21 reached NT$4.775 billion, an increase of 61% over 4FQ20; gross profit in 2021 also hit a record high of NT$19.09 billion, an increase of 56% over 4GQ20. In addition, the gross profit margin reached 28.37%, and the overall gross profit margin in 2021 reached 30.53%; net profit after tax and EPS in the fourth quarter also reached NT$1.81 billion and NT$9.19 respectively; the ESP for FY21 is NT$41.34.

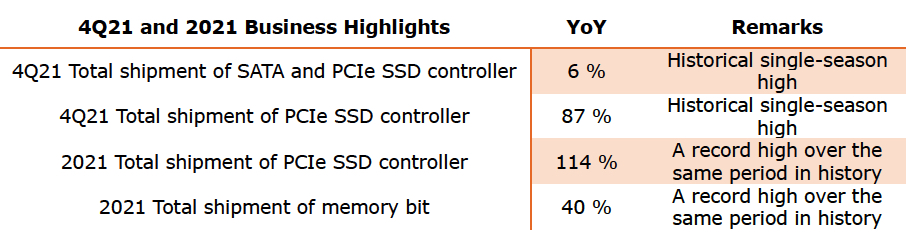

Compared with 4GQ20, the total shipments of SATA and PCIe controllers in the 4FQ21 increased by more than 6%, of which the total shipments of PCIe SSD controllers increased by nearly 87%. In terms of cumulative shipments in 2021, the total shipments of PCIe SSD controllers increased by 114%, and the total shipments of total bits increased by nearly 40%, setting a new record for the same period in history.

K.S.Pua, CEO, said that in 2021, non-consumer/retail overall revenue contribution exceeded 70%, and the revenue continued to grow, and the gross profit margin also met the long-term target range of 27%±3%. It represents the transformation of the company, and also shows that the foundation of revenue and profit is becoming more and more stable, gradually getting rid of the business cycle of the NAND storage industry, and becoming a value-growing company worthy of long-term investment.

The CEO went on to explain that the recent contamination of the NAND factory Kioxia and WD has affected the supply of the NAND storage industry. It is very likely that the global NAND storage products will be in shortage during the traditional peak season (2Q to 3Q), which will lead to a rise in market prices.

Furthermore, since Phison has had a better sense of the market’s supply and demand situation than its peers and made rolling adjustments to the inventory level according to customer needs, it has a relatively sufficient inventory level to meet the needs of global customers in this contamination incident.

In other words, what looks like good luck to the outside world is actually due to firm’s accumulated experience in market supply and demand for more than 20 years. In the face of future market changes, the company will continue to join hands with global customers to create common prosperity.

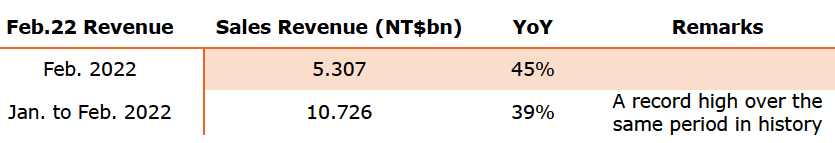

In addition, for the revenue in February 2022, the consolidated revenue was NT$5.307 billion, an increase of 45% over the same period last year; the cumulative revenue from 2022 to February reached NT$10.726 billion, an increase of 39% Y/Y compared with the same period last year, setting a new record for the same period in history.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter