Phison: Fiscal October 2021 Financial Results

Phison: Fiscal October 2021 Financial Results

Sales up 36% Y/Y at NT$6 billion

This is a Press Release edited by StorageNewsletter.com on November 9, 2021 at 2:01 pmPhison Electronics Corp. announced the consolidated financial results for 3FQ21 and October 2021 revenue.

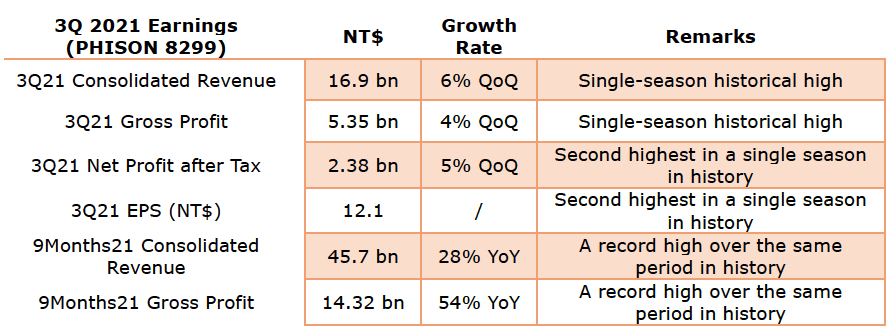

Consolidated revenue in 3FQ21 was NT$16.9 billion, an increase of 6% compared to 2FQ21; the cumulative annual revenue for 2021 to 3FQ21 reached NT$45.7 billion, a growth of 28% compared 3FQ20.

Gross profit in 3FQ21 reached NT$5.35 billion, an increase of nearly 4% over 2FQ21; the gross profit accumulated to 3FQ21 also reached a record high of NT$14.32 billion in the same period, a 54% increase 2FQ21. In addition, the overall gross profit margin in 3FQ21 reached 31.64%, and the net profit after tax and EPS in this quarter also reached NT$2.38 billion and NT$12.1.

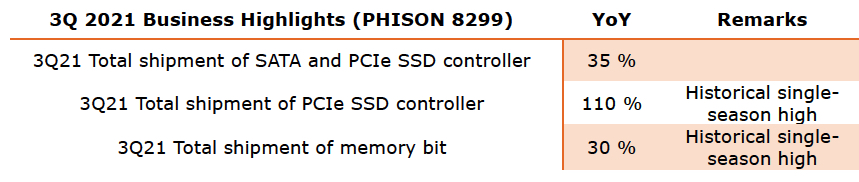

Compared with the same period last year, the total shipments of SATA and PCIe controllers in 3FQ21 grew by nearly 35%, of which the total shipments of PCIe SSD controllers grew by nearly 110%. In addition, the total number of memory bits shipments in 3FQ21 grew by nearly 30%, setting a new historical single-season high.

K.S. Pua, chairman and CEO, said that in 3FQ21, R&D expenses accounted for more than 80% of overall operating expenses, and R&D engineers have reached more than 2,000 (accounting for more than 70% of the total global employees). The main reason is that in addition to Phison’s continued R&D and investment of next-gen NAND controllers to maintain technology leadership, Phison is also actively deploying momentum for future operational growth, including PCIe 5.0 ReDriver IC, custom PCIe 5.0 SSD controller solution, edge computing storage solution, and automotive-grade UFS controller, etc., to grasp the growth trend and business opportunities of the future NAND storage market.

K.S. Pua went on to explain that the popularization of 5G wireless technology will drive the unlimited long-term growth momentum of the NAND industry; in other words, despite the murmur of weak demand in the retail market, Phison has transformed its deployment in the non-consumer high-end storage market. As a result, its revenue and profits continue to grow steadily, and are gradually unaffected by price fluctuations in the NAND market. In addition, in order to meet the needs of global customers, the firm has signed long-term supply agreement with fab partners to ensure stable supply in the future. Although there is still a large capacity gap between wafer supply and customer demand, it will continue to communicate with upstream and downstream suppliers and grow together with global customers.

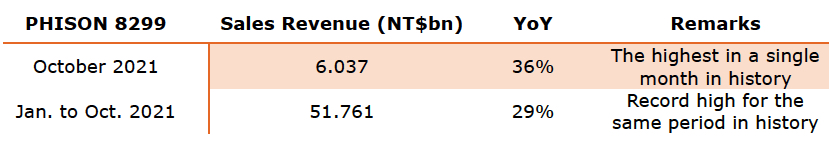

In addition, for the October revenue, consolidated revenue was NT$6.037 billion, a Y/Y increase of nearly 36%; the cumulative revenue of the year to October reached NT$51.761 billion, a growth of 29% compared to the same period last year, setting a new historical high for the same period.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter