All M&As in 2021

Only 35, lowest figure since 1998

By Jean Jacques Maleval | January 5, 2022 at 2:02 pmSince decades, we analyze the merger and acquisition trends in the WW storage industry, which has allowed us the proper perspective from which to gauge the evolution over time.

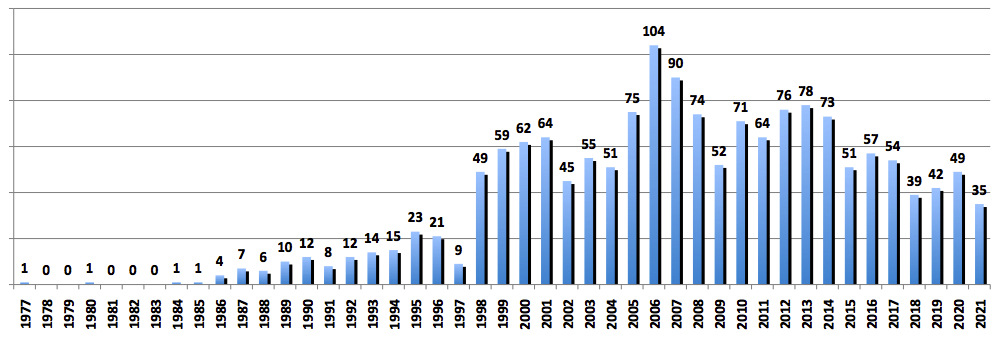

NUMBER OF ACQUISITIONS SINCE 1977 IN WW STORAGE INDUSTRY

(Total 1,614 or 37/year)

(Source: StorageNewsletter.com)

We count 35 M&As in 2021, the lower figure since 1998 and less than in 2020 (49). In 2006, there was a record of 104, and total of 1,614 since 1977 or 37 one average per year.

Why this low figure? The consolidation in the mature storage industry is slowing. Furthermore, there are few start-ups with revolutionary technologies that could interested potential buyers. Some interesting start-ups could be acquired but they apparently are asking for price too high and prefer to remain private or waiting for an IPO.

And into these 48 M&As in 2020, the price of only 5 deals were revealed by the buyers, meaning that it was relatively low for the 43 other ones with an amount not impacting seriously their financial results.

ALL M&As IN 2021 WITH KNOWN PRICE

| Mo. | Buyer | Bought | Price in $million |

| 6 | Clayton, Dubilier & Rice and KKR | Cloudera | 5,300 |

| 11 | Clearlake Capital | Quest Software | 5,400 |

| 4 | Gigas | Valoradata | 2.75 |

| 7 | HPE | Zerto | 374 |

| 12 | Primera | Mimecast | 5,800 |

| 10 | Proact IT |

ahd | 30.4 |

| 7 | Quantum | Pivot 3 (assets) | 8.9 |

(Source: StorageNewsletter.com)

Three deals surpasses $5 billion in 2021 (see above) compared to 2 in 2020. The highest acquisition in the history of the storage industry, at $63 billion, was the merger in 2015 of EMC and Dell – even if both of them were not in storage only. Biggest deal last year was at $9 billion, Intel NAND memory business (but Optane) by SK hynix.

MORE THAN $1 BILLION M&As IN HISTORY OF STORAGE INDUSTRY

(3 in 2021)

2015: EMC by Dell, $63,000 million

2018: Red Hat by IBM, $34,000

2001: Compaq by HP, $25,000 million

2018: CA Technologies by Broadcom, $18,900 million

2017: Toshiba NAND business by Bain Capital (and partners), $18,000 million

2015: SanDisk by Western Digital, $16,000 million

2005: Veritas by Symantec, $11,000 million

2011: Autonomy by HP, $10,300 million

1998: Digital Equipment by Compaq, $9,600 million

2020: Intel (assets) by SK hynix, $9,000 million

2015: Veritas (Symantec) by The Carlyle Group and GIC, $7,400 million

2009: Sun by Oracle, $7,400 million

2019: Mellanox by Nvidia, $6.900 million

2013: LSI by Avago Technologies, $6.600 million

2017: Cavium by Marvell, $6,000 million

2016: Brocade by Broadcom, $5,900 million

2021: Mimecast by Primera, 5,800 million

2021: Quest Software by Clearlake Capital, 5,400 million

2021: Cloudera by Clayton, Dubilier & Rice and KKR, 5,300 million

2020: Veeam Software by Insight Partners, $5,000 million

2011: Hitachi GST by WD, $4,800 million

2005: StorageTek by Sun, $4,100 million

2000: Sterling Software by CA, $4,000 million

2000: Seagate by Suez Acquisition, $4,000 million

2006: Agere by LSI, $4,000 million

2014: Riverbed by Thoma Bravo, $3,500 million

2008: Foundry Networks by Brocade, $2,600 million

2012: Elpida by Micron Technology, $2,500 million

2012: Quest Software by Dell, $2,400 million

2010: 3par by HP, $2,350 million

2015: PMC-Sierra by Microsemi, $2,300 million

2010: Isilon by EMC, $2,250 million

2009: Data Domain by EMC, $2,200 million

2006: RSA by EMC, $2,100 million

2002: IBM HDD by Hitachi, $2,050 million

2000: Cobalt Networks by Sun, $2,000 million

2000: Seagate by Suez Acquisition, $2,000 million

2004: Kroll by Marsh & McLennan Companies, $1,900 million

2006: Maxtor by Seagate, $1,900 million

2000: Ancor Communications by QLogic, $1,700 million

2003: Documentum by EMC, $1,700 million

2016: Dell EMC Enterprise Content Division by OpenText, $1,620 million

1998: Seagate Software by Veritas, $1,600 million

2017: Barracuda Networks by Thoma Bravo, $1,600 million

2006: FileNet by IBM, $1,600 million

2007: Opsware by HP, $1,600 million

2006: msystems by SanDisk, $1,500 million

2018: IM Flash Technologies (JV With Intel), $1,500 million

2019: Carbonite by Opentext, $1,420 million

2007: EqualLogic by Dell, $1,400 million

2019: Cray by HPE, $1,400 million

2011: Samsung HDD by Seagate, $1,375 million

2000: Quantum HDD by Maxtor, $1,300 million

2003: Legato by EMC, $1,300 million

2015: Cleversafe by IBM, $1,300 million

2010: Numonyx by Micron, $1,270 million

1996: Cheyenne by CA, $1,200 million

2010: Division 5 Technology by Max Stiegemeier (GCF), $1,200 million

2015: Virtustream by EMC, $1,200 million

1999: Data General by EMC, $1,100 million

2014: Fusion-io by SanDisk, $1,100 million

2017: Nimble Storage by HPE, $1,090 million

1995: Conner Peripherals by Seagate, $1,040 million

2016: QLogic by Cavium, $1,000 million

(Source: StorageNewsletter.com)

In conclusion, there was not at all an intense activity in 2021 in number of deals and only 3 represented big sums.

In 2021, for the 7 operations with price being known, total is $16.915,65 billion. compared to $14.97 billion for 5 deals in 2020, $10.4 billion in 2019 and $21 billion in 2018, far from an historical record of $99.9 billion in 2016.,

Consequently, the average price per M&A since 1977 now reaches $696 million for a cumulative total of more than $426 billion spent following 616 deals when price has been revealed.

EMC was historically the most voracious in the storage industry with 82 acquisitions since 1993. It acquired a record of 23 companies in 2006 and 2007 only, just 1 in 2011, 3 in 2012 and 2013, 5 in 2014, 3 in 2015. On its side acquirer Dell got a total of 18 companies and also no one since 6 years.

With these 82 deals, EMC is largely in front of J2 Global with a total of 36 small acquisitions, Seagate (including Seagate Software) 31, Iron Mountain (in data storage only) 29, LSI with Avago and Broadcom 26, Adaptec with acquirers PMC Sierra and then Microsemi 26, Veritas added to Symantec 28, HP with HPE 25, WD 24, NetApp 24, IBM 22, Dell 18, and Xyratex (acquired by Seagate in 2013) 16 .

The consolidation in the industry will continue in 2021, but at a slow pace and since 2014, because some publicly-traded companies are in bad financial shape and even if many storage start-ups are trying to survive with only 2 possibilities: to be acquired or die.

Furthermore a trend is not going to stop: storage giants invent about nothing in new killing storage technologies and prefer to get them by acquiring start-ups. It’s less expansive than investing in their own R&D.

We will probably continue to see a few M&As in 2022 in the most demanding storage sectors: cloud, software, security, hyperconverged system, and SSD where there are too many companies, but also in the channel for expansion.

WHO BOUGHT WHOM IN 2021

| Mo. | Buyer | Acquired company | Price* | Comments |

| 3 | Acronis | Synapsys | NA | Software distributor in South Africa |

| 2 | Arcserve | StorageCraft | NA | Merger to create set of BC solutions from single vendor |

| 6 | Clayton, Dubilier & Rice and KKR | Cloudera | 5,300 | Acquirers being investor companies |

| 11 | Clearlake Capital | Quest Software | 5,400 | Solutions to protect and empower users and data, streamline IT operations and harden cybersecurity from inside out |

| 7 | ColoHouse | Lume Cloud | NA | Private cloud, cloud backup and recovery, and security |

| 2 | Data433 | ArcMail | NA | Enterprise information and email archiving |

| 5 | Databarracks | 4sl | NA | Enterprise data protection |

| 2 | DataCore Software | Caringo | NA | Object storage |

| 11 | DataCore Software | MayaData | NA | Cross-cloud control plane for data, based Kubernetes and OpenEBS |

| 4 | Gigas | Valoradata | 2.75 | Backup of servers and workstations, both in the cloud as well as for on-premise hybrid backup structures |

| 7 | Hewlett-Packard Enterprise | Zerto | 374 | Cloud data management and protection |

| 1 | Hornetsecurity | Altaro | NA | Backup solution provider |

| 9 | Jungle Disk | KeepItSafe | NA | Custom cloud backup and recovery solutions |

| 9 | Jungle Disk | LiveVault | NA | Cloud backup and disaster recovery services |

| 9 | Jungle Disk | OffsiteDataSync | NA | Secure cloud data protection solutions, including infrastructure, disaster recovery and backup |

| 6 | NetApp | Data Mechanics | NA | Big data processing and cloud analytics |

| 10 | NetApp | CloudCheckr | NA | Cloud optimization platform that provides cloud visibility and insights to lower costs, maintain security and compliance, and optimize cloud resources |

| 1 | OWC | LumaForge | NA | Shared storage Jellyfish solutions and technologies |

| 10 | PacketFabric | RStor | NA | Cloud-based provider of storage and data mobility solutions |

| 9 | Park Place Technologies | Congruity360 (assets) | NA | Hardware maintenance and data migration businesses |

| 12 | Primera | Mimecast | 5,800 | Email security and cyber resilience company |

| 10 | Proact IT | ahd | 30.4 | German IT provider of managed services, offering cloud solutions, consulting and services |

| 7 | Quantum | Pivot3 (assets) | 8.9 | Video surveillance |

| 8 | Quantum | EnCloudEn | NA | HCI software start-up in India |

| 11 | Recovery Point Systems | Geminare | NA | Global resiliency, application and data protection |

| 2 | Rewind | BackHub | NA | Backup-as-a-service software for GitHub repositories |

| 6 | SAP | ScaleMP | NA | Virtualization for high-end computing |

| 11 | ScalePad | Backup Radar | NA | Automation platform for backup monitoring, reporting, and compliance |

| 7 | Sewan | Ikoula | NA | French cloud and backup company |

| 3 | StorMagic | SoleraTec | NA | Video and digital asset management software company |

| 9 | Tuxera | HCC Embedded | NA | Hungarian developer of embedded file systems, flash management, and network data transfer software |

| 1 | Veritas | Hubstor | NA | SaaS cloud data platform that unifies backup and archive as a service |

| 7 | Virtuozzo | OnApp | NA | Software and services that enable hosts, MSPs and telecom providers to create and sell their own public, private and hybrid clouds |

| 10 | Virtuozzo | Jelastic | NA | Multi-cloud platform-as-a-service software |

| 2 | Zadara | NeoKarm | NA | Flexible multi-cloud hybrid platforms |

* In $ million

(Source: StorageNewsletter.com)

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter