All M&As in 2019

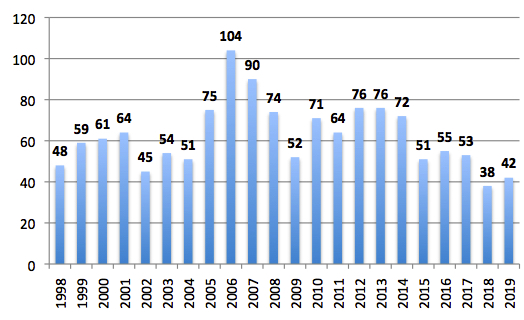

42, lowest figure since 1998 but in 2018 (38), compared to 104 in 2006 - with corrections

By Jean Jacques Maleval | January 2, 2020 at 2:19 pmCorrections (Editor): It’s better not to write such a long deep report with lot of figures after a hearty New Years. Fortunately, our readers found our errors. In this article we missed the acquisition of Carbonite, in data protection and end-point security, by Opentext for $1,420 million in November 2019, but we added it later one of the table below: MORE THAN $1 BILLION M&As IN HISTORY OF STORAGE INDUSTRY. Also we correct the price of Cray bought by HPE at $1,400 million and not $11,400 million. Not least is $6.190 billion rather than $61,900 million by Nvidia for Mellanox.

Since 1998 we analyze the merger and acquisition trends in the WW storage industry, which has allowed us the proper perspective from which to gauge the evolution over time.

NUMBER OF ACQUISITIONS SINCE 1998 IN WW STORAGE INDUSTRY

| Year | ≠ |

| 1998 | 48 |

| 1999 | 59 |

| 2000 | 61 |

| 2001 | 64 |

| 2002 | 45 |

| 2003 | 54 |

| 2004 | 51 |

| 2005 | 75 |

| 2006 | 104 |

| 2007 | 90 |

| 2008 | 74 |

| 2009 | 52 |

| 2010 | 71 |

| 2011 | 64 |

| 2012 | 76 |

| 2013 | 76 |

| 2014 | 72 |

| 2015 | 51 |

| 2016 | 55 |

| 2017 | 53 |

| 2018 | 38 |

| 2019 |

42 |

| TOTAL | 1,375 |

| Acquisitions/year | 65 |

(Source: StorageNewsletter.com)

We count only 42 M&As in 2019 but a little more than in 2018 (38). In 2006, there was a record of 104, and 65 being the average per year since 1998.

Why this low figure? The consolidation in the mature industry is slowing. Furthermore, there are few start-ups with revolutionary technologies that could interested potential buyers. Some interesting start-ups could be acquired but they apparently are asking for price too high and prefer to remain private or waiting for an IPO.

And into these 42 M&As in 2019 are included 3 small ones by J2 Global for small online backup companies. The price of only 8 deals were revealed by the buyers, meaning that it was relatively low for the 34 other ones with an amount not impacting seriously their financial results.

ALL M&As IN 2019 WITH KNOWN PRICE

| Buyer | Bought | Price in $ million |

| Nvidia | Mellanox | 6,190 |

| Opentext |

Carbonite | 1,420 |

| Hewlett-Packard Enterprise | Cray | 1,400 |

| Carbonite | Webroot | 618.5 |

| Commvault | Hedvig | 225 |

| Amazon | CloudEndure | 200 |

| Toshiba Memory | Lite-On SSD business | 165 |

| SMART Global Holdings | Artesyn | 80 |

| NetApp | Cognigo | 70 |

| Amazon | E8 Storage | 50-60 |

| AVERAGE |

1,042 |

(Source: StorageNewsletter.com)

Three deals surpasses $1 billion in 2019 with2 in 2018 compared to a total of 4 in 2017 and 3 in 2016. The highest acquisition in the history of the storage industry, at $63 billion, was the merger in 2015 of EMC by Dell – even if both of them were not in storage only. But there was also a huge deal last year currently to be done: $6.190 billion by Nvidia to get Mellanox, in front of $1.4 billion for the acquisition of Opentext by Nvidia, and Cray by HPE.

Another relatively big deal in 2019 was Carbonite getting Webroot for $618.5 million.

MORE THAN $1 BILLION M&As IN HISTORY OF STORAGE INDUSTRY

(3 in 2019)

2015: EMC by Dell, $63,000 million

2018: Red Hat by IBM, $34,000

2001: Compaq by HP, $25,000 million

2018: CA Technologies by Broadcom, $18,900 million

2017: Toshiba NAND business by Bain Capital (and partners), $18,000 million

2015: SanDisk by Western Digital, $16,000 million

2005: Veritas by Symantec, $11,000 million

2011: Autonomy by HP, $10,300 million

1998: Digital Equipment by Compaq, $9,600 million

2015: Veritas (Symantec) by The Carlyle Group and GIC, $7,400 million

2009: Sun by Oracle, $7,400 million

2013: LSI by Avago Technologies, $6.600 million

2019: Mellanox by Nvidia, $6.190 million

2017: Cavium by Marvell, $6,000 million

2016: Brocade by Broadcom, $5,900 million

2011: Hitachi GST by WD, $4,800 million

2005: StorageTek by Sun, $4,100 million

2000: Sterling Software by CA, $4,000 million

2000: Seagate by Suez Acquisition, $4,000 million

2006: Agere by LSI, $4,000 million

2014: Riverbed by Thoma Bravo, $3,500 million

2008: Foundry Networks by Brocade, $2,600 million

2012: Elpida by Micron Technology, $2,500 million

2012: Quest Software by Dell, $2,400 million

2010: 3par by HP, $2,350 million

2015: PMC-Sierra by Microsemi, $2,300 million

2010: Isilon by EMC, $2,250 million

2009: Data Domain by EMC, $2,200 million

2006: RSA by EMC, $2,100 million

2002: IBM HDD by Hitachi, $2,050 million

2000: Cobalt Networks by Sun, $2,000 million

2004: Kroll by Marsh & McLennan Companies, $1,900 million

2006: Maxtor by Seagate, $1,900 million

2000: Ancor Communications by QLogic, $1,700 million

2003: Documentum by EMC, $1,700

2016: Dell EMC Enterprise Content Division by OpenText, $1,620 million

1998: Seagate Software by Veritas, $1,600 million

2017: Barracuda Networks by Thoma Bravo, $1,600 million

2006: FileNet by IBM, $1,600 million

2006: msystems by SanDisk, $1,500 million

2019: Carbonite by Opentext, $1,420 million

2007: EqualLogic by Dell, $1,400 million

2019: Cray by HPE, $1,400 million

2011: Samsung HDD by Seagate, $1,375 million

2000: Quantum HDD by Maxtor, $1,300 million

2003: Legato by EMC, $1,300 million

2010: Numonyx by Micron, $1,270 million

1996: Cheyenne by CA, $1,200 million

2010: Division 5 Technology by Max Stiegemeier (GCF), $1,200 million

2015: Virtustream by EMC, $1,200 million

1999: Data General by EMC, $1,100 million

2014: Fusion-io by SanDisk, $1,100 million

2017: Nimble Storage by HPE, $1,090 million

1995: Conner Peripherals by Seagate, $1,040 million

2016: QLogic by Cavium, $1,000 million

(Source: StorageNewsletter.com)

In conclusion, there was not at all an intense activity in 2019 in number of deals but with only 3 represented big sums.

In 2019, for the 10 operations with price being known, total is $10.4 billion – compared to $21 billion in 2018, $29 billion in 2017- and average per deal is $1,000 million in 2016. It was $10.6 billion and $754 million in 2016, far from an historical record of $92.3 billion and $6.156 million respectively in 2016.

Consequently, the average price per M&A since 1984 now reaches $587 million for a cumulative total of more than $355 billion spent following 572 deals when price has been revealed (and 1,458 all included) from 1987.

EMC was historically the most voracious in the storage industry with 79 acquisitions since 1994. It acquired a record of 23 companies in 2006 and 2007 only, just 1 in 2011, 3 in 2012 and 2013, 5 in 2014, 3 in 2015 but no one since last 4 years. On its side acquirer Dell got a total of 18 companies and also no one since 3 years.

With these 79 deals, EMC is largely in front of J2 Global with a total of 37 small acquisitions, Seagate (including Seagate Software) 31, Iron Mountain (in data storage only) 29, LSI with Avago and Broadcom 27, Veritas added to Symantec 27, HP with HPE 22, IBM, WD and NetApp 21, Dell 18, and Xyratex (acquired by Seagate) 16 .

The consolidation in the industry will continue in 2019, but at a slow pace, because some publicly-traded companies are in bad shape and even if many storage start-ups are trying to survive with only two possibilities: to be acquired or die.

Furthermore a trend is not going to stop: storage giants invent about nothing in new killing storage technologies and prefer to get them by acquiring start-ups. It’s less expansive than investing in their own R&D.

We will probably continue to see several M&As in the most demanding storage sectors: cloud, software, hyperconverged system and SSD where there are too many companies, but also in the channel for expansion.

WHO BOUGHT WHOM IN 2019

| Month | Buyer | Bought | Price* | Comments |

| 12 | Acronis | 5nine | NA | Unified cloud management and security tools |

| 10 | Ahead | Data Blue | NA | Storage, backup and server virtualization and consolidation solutions to enterprise |

| 1 | Amazon | CloudEndure | 200 | BC software solutions for DR |

| 8 | Amazon | E8 Storage | 50-60 | Centralized NVMe enterprise all-flash solution |

| 6 | Atempo | Lima (assets) | NA | Synchronization engine |

| 6 | Boxx Technologies | Pacific Alliance Capital | NA | Vertically integrated provider of storage and protection systems |

| 2 | Carbonite | Webroot | 618.5 | Cybersecurity |

| 9 | Cloudera | Arcadia Data | NA | Cloud-native AI-powered business intelligence and real-time analytics |

| 5 | Cohesity | Imanis Data | NA | Enterprise backup and data management for distributed databases |

| 9 | Commvault | Hedvig | 225 | Software-defined storage |

| 12 | Compuware | INNOVATION Data Processing | NA | Enterprise data protection, business continuance and SRM solutions serving mainframe market |

| 11 | ConnectWise | Continuum | NA | Backup and DR to cloud services |

| 5 | DDN | Nexenta | NA | SDS |

| 9 | DDN | WD AFA and hybrid business | NA | AFA and hybrid business |

| 5 | DC BLOX | Ploid | NA | SaaS for independent research institutions, life sciences and genomic sequencing organizations |

| 6 | Druva | CloudLanes | NA | VTL in cloud |

| 5 | HPE | Cray | 1,400 | HPC compute and storage |

| 8 | HPE | MapR | NA | File system for unified analytics from edge to cloud |

| 3 | Huayun Data International | Maxta | NA | Software-defined storage platform |

| 7 | iVedha | Open Storage Solutions | NA | Data protection and BC solutions |

| 0 | J2 Global | Armada Cloud | NA | Enterprise cloud backup |

| 0 | J2 Global | SafeSend | NA | Online backup in Norway |

| 0 | J2 Global | OffSiteDataSync (assets) | NA | Cloud backup in USA |

| 7 | Microsoft | BlueTalon | NA | Unified Data Access Control solutions for data platforms |

| 1 | Mimecast | Simply Migrate | NA | Archive data migration technology |

| 5 | NetApp | Cognigo | 70 | Platform for data protection and adapting it to privacy regulations such as GDPR, using AI technology and natural language processing |

| 3 | Nvidia | Mellanox | 6,900 | IB and Ethernet connectivity, especially for HPC |

| 11 | Opentext |

Carbonite | Data protection and end-point security | |

| 1 | OWC | Akitio | NA | Two pioneers in PC and Mac storage and accessories |

| 3 | OWC | InXtron | NA | Fast Thunderbolt and USB external storage enclosures, in Taiwan |

| 4 | Pure Storage | Compuverde | NA | File software solutions for enterprises and cloud providers based in Sweden |

| 1 | Rambus | Diablo Technologies (assets) | NA | In hybrid DRAM and flash memory |

| 8 | Rambus | Northwest Logic | NA | In memory, PCIe and MIPI digital controllers |

| 7 | SMART Global Holdings | Artesyn | 80 | Embedded computing solutions based on open standards such as ATCA, VMEbus, PCIe and computer-on-module |

| 2 | Storagepipe | GridWay Computing | NA | Canadian MSP in backup and DR |

| 6 | StorCentric | Retrospect | NA | Backup software for Mac and Windows |

| 7 | StorCentric | Vexata | NA | AFAs |

| 8 | Toshiba Memory | Lite-On SSD business | 165 | SSDs |

| 6 | Tuxera | Datalight | NA | Embedded file systems, and flash management and acceleration software |

| 3 | Veritas Technologies | APTARE | NA | Analytics, reporting and protection of enterprise data |

| 3 | Vinpower | ACARD Technology | NA | SCSI IC design house in Taiwan |

| 8 | Virtual Instruments | Metricly | NA | SaaS-based cloud cost, optimization and monitoring service |

| 10 | Western Digital | Kazan Networks | NA | NVMe-oF ASIC and adapter products |

* In $ million

(Source: StorageNewsletter.com)

Read also:

All M&As in 2018

Only 36, lower figure in history of WW storage industry

by Jean Jacques Maleval | January 3, 2019 | News

All M&As in 2017

About 50, as last 3 years, with one at $18 billion

by Jean Jacques Maleval | 2018.01.08 | News

All M&As in 2016

Number of deals decreased to 47 compared to 51 in 2015, 65 being average per year since 1998

by Jean Jacques Maleval | 2017.01.04 | News

All M&As in 2015

Only 51 but huge ones (Dell/EMC, WD/SanDisk, Carlyle/Veritas)

by Jean Jacques Maleval | 2016.01.04 | News

All M&As in 2014

Top ones are …

by Jean Jacques Maleval | 2015.01.05 | News

All M&As (73) in 2013

Same number in 2012: top ones are …

by Jean Jacques Maleval | 2014.01.03 | News

All M&As (70) in 2012

70 compared to 61 in 2011: top ones are …

by Jean Jacques Maleval | 2013.01.15 | News

ANALYSIS: All Mergers and Acquisitions in 2011

The year of HDD consolidation

by Jean Jacques Maleval | 2012.01.03 | News

2010: The Year of Consolidation

57 M&As and big ones, vs. 47 in 2009

by Jean Jacques Maleval | 2011.01.01 | News

Only 43 M&As in 2009 in the WW Storage Industry

Vs. 69 in 2008, 84 in 2007 and 104 in 2006

by Jean Jacques Maleval | 2010.01.04 | News

These figures in these former reports on M&As increased sometimes later as we discovered other acquisitions after these annual publications.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter