All M&As in 2017

About 50 since 3 years, with one at $18 billion

By Jean Jacques Maleval | January 8, 2018 at 2:40 pmSince 1998 we analyze the merger and acquisition trends in the worldwide storage industry, which has allowed us the proper perspective from which to gauge the evolution over time.

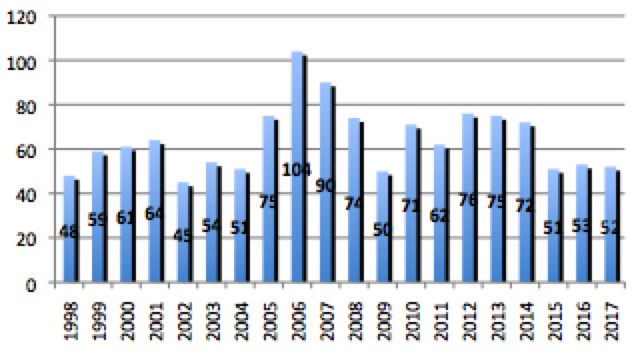

NUMBER OF ACQUISITIONS SINCE 1998

IN WW STORAGE INDUSTRY

| Year | ≠ |

| 1998 | 48 |

| 1999 | 59 |

| 2000 | 61 |

| 2001 | 64 |

| 2002 | 45 |

| 2003 | 54 |

| 2004 | 51 |

| 2005 | 75 |

| 2006 | 104 |

| 2007 | 90 |

| 2008 | 74 |

| 2009 | 50 |

| 2010 | 71 |

| 2011 | 62 |

| 2012 | 76 |

| 2013 | 75 |

| 2014 | 72 |

| 2015 | 51 |

| 2016 | 53 |

| 2017 | 52 |

| TOTAL | 1,287 |

| Acquisitions/year | 68 |

(Source: StorageNewsletter.com)

In 2006, there was a record of 104 M&As. Since 2012, this number decreased yearly with small growth in 2016 to reach 52 in 2017 compared to 53 the former year, and 68 being the average since 1998. The lowest figure was 45 in 2002. So now it is stabilized at around 50 per year since 3 years.

And into these 52 M&As in 2017 are included three (eleven last year) by only J2 Global getting small online backup companies and also surprising by NetApp with the reputation of not being voracious. The price of only 11 deals were revealed by the buyers, meaning that it was relatively low for the 41 other ones with an amount not impacting seriously their financial results.

ALL M&As IN 2017 WITH KNOWN PRICE

| Buyer | Bought | Price in $ million |

| Bain Capital and others | Toshiba Memory Corp. (Toshiba’s assets) | 18,000 |

| Marvell | Cavium | 6,000 |

| Thoma Bravo | Barracuda Networks | 1,600 |

| HPE | Nimble Storage | 1,090 |

| Veeco | Ultratech | 815 |

| HPE | SimpliVity | 650 |

| Cisco | Springpath | 320 |

| Carbonite | Double-Take Software (Vision Solutions) | 65 |

| Extreme Networks | Broadcom (assets) | 55 |

| Vecima Networks | Concurrent Computer (assets) | 29 |

| Proact IT | Teamix | 9.5 |

(Source: StorageNewsletter.com)

What’s relatively impressive in 2017 is the number of deals surpassing $1 billion, a total of 4 vs. 3 last year. The highest acquisition in the history of the storage industry, at $63 billion, was the merger in 2015 of EMC by Dell – even if both of them are not in storage only. But there was also an enormous deal last year (it will be completed in 2018): $18 billion by Bain Capital and a lot of partners to get Toshiba NAND chip manufacturing business. Another big one is Marvell getting Cavium for $6 billion. Two other acquisitions surpassing $1 billion: Barracuda Networks by Thoma Bravo and Nimble Storage by HPE (also acquiring SimpliVity for $650 million). There was only 2 deals in 2016 over $1 billion, highest one being Brocade by Broadcom for $5.9 billion.

MORE THAN $1 BILLION M&As IN HISTORY OF STORAGE INDUSTRY

(four in 2017)

2015: EMC by Dell, $63,000 million

2001: Compaq by HP, $25,000 million

2017: Toshiba NAND business by Bain Capital (and partners), $18,000 million

2015: SanDisk by Western Digital, $16,000 million

2005: Veritas by Symantec, $11,000 million

2011: Autonomy by HP, $10,300 million

1998: Digital Equipment by Compaq, $9,600 million

2015: Veritas (Symantec) by The Carlyle Group and GIC, $7,400 million

2009: Sun by Oracle, $7,400 million

2013: LSI by Avago Technologies, $6.600 million

2017: Cavium by Marvell, $6,000 million

2016: Brocade by Broadcom, $5,900 million

2011: Hitachi GST by WD, $4,800 million

2005: StorageTek by Sun, $4,100 million

2000: Sterling Software by CA, $4,000 million

2000: Seagate by Suez Acquisition, $4,000 million

2006: Agere by LSI, $4,000 million

2014: Riverbed by Thoma Bravo, $3,500 million

2008: Foundry Networks by Brocade, $2,600 million

2012: Elpida by Micron Technology, $2,500 million

2012: Quest Software by Dell, $2,400 million

2010: 3par by HP, $2,350 million

2015: PMC-Sierra by Microsemi, $2,300 million

2010: Isilon by EMC, $2,250 million

2009: Data Domain by EMC, $2,200 million

2006: RSA by EMC, $2,100 million

2002: IBM HDD by Hitachi, $2,050 million

2000: Cobalt Networks by Sun, $2,000 million

2004: Kroll by Marsh & McLennan Companies, $1,900 million

2006: Maxtor by Seagate, $1,900 million

2000: Ancor Communications by QLogic, $1,700 million

2003: Documentum by EMC, $1,700

2016: Dell EMC Enterprise Content Division by OpenText, $1,620

1998: Seagate Software by Veritas, $1,600 million

2017: Barracuda Networks by Thoma Bravo, $1,600 million

2006: FileNet by IBM, $1,600 million

2006: msystems by SanDisk, $1,500 million

2007: EqualLogic by Dell, $1,400 million

2011: Samsung HDD by Seagate, $1,375 million

2000: Quantum HDD by Maxtor, $1,300 million

2003: Legato by EMC, $1,300 million

2010: Numonyx by Micron, $1,270 million

1996: Cheyenne by CA, $1,200 million

2010: Division 5 Technology by Max Stiegemeier (GCF), $1,200 million

2015: Virtustream by EMC, $1,200 million

1999: Data General by EMC, $1,100 million

2014: Fusion-io by SanDisk, $1,100 million

2017: Nimble Storage by HPE, $1,090 million

1995: Conner Peripherals by Seagate, $1,040 million

2016: QLogic by Cavium, $1,000

(Source: StorageNewsletter.com)

In conclusion, there was not an intense activity in 2017 in number of deals but some of them represented huge sum. Why so few? Some interesting start-ups could be acquired but they apparently are asking for price too high and prefer to wait for eventually an IPO.

For the 11 operations with price being known in 2017, total is $29 billion and average per deal is $2,603 million, figures much higher than in 2016 ($10.6 billion and $754 million) but far from an historical record of $92.3 billion and $6.156 million respectively in 2016.

Consequently, the average price per M&A since 1998 now reaches $596 million for a cumulative total of more than $300 billion spent following 533 deals when price has been revealed and 1,335 all included from 1984.

EMC was historically the most voracious in the industry with 81 acquisitions since 1994. It acquired a record of 23 companies in 2006 and 2007 only, just one in 2011, three in 2012 and 2013, five in 2014, three in 2015 but no one since last two years. On its side acquirer Dell got a total of 18 companies and also no one since two years.

With these 81 deals, EMC is largely in front of Seagate (including Seagate Software) with a total of 31 acquisitions, J2 Global 34, Iron Mountain (in data storage only) 29, LSI with Avago and Broadcom 26, Veritas added to Symantec 25, IBM 21, WD 21, Dell 18, Xyratex (acquired by Seagate) 16, HP with HPE 19, and NetApp 19.

TOTAL AMOUNT OF ACQUISITIONS SINCE 1998

(here we include only the acquisitions when price is known)

| Year | Number of acquisitions | Total amount* | Average price* |

| 1998 | 25 | 13,119 | 525 |

| 1999 | 22 | 3,062 | 139 |

| 2000 | 38 | 14,021 | 329 |

| 2001 | 27 | 28,279 | 1,047 |

| 2002 | 21 | 3,101 | 148 |

| 2003 | 30 | 5,503 | 183 |

| 2004 | 26 | 4,781 | 184 |

| 2005 | 42 | 18,690 | 445 |

| 2006 | 53 | 17,366 | 328 |

| 2007 | 34 | 7,123 | 210 |

| 2008 | 28 | 5,726 | 205 |

| 2009 | 19 | 10,431 | 549 |

| 2010 | 25 | 10,582 | 423 |

| 2011 | 29 | 20,544 | 708 |

| 2012 | 16 | 7,061 | 441 |

| 2013 | 21 | 10,470 | 499 |

| 2014 | 17 | 6,173 | 363 |

| 2015 | 15 | 92,342 | 6,156 |

| 2016 | 14 | 10,554 | 754 |

| 2017 | 11 | 28,663 | 2,603 |

| TOTAL | 533 | 317,572 | 596 |

* in $ million

(Source: StorageNewsletter.com)

The consolidation in the industry will continue in 2018, but at a slow pace, because some publicly-traded companies are in bad shape and even if many storage start-ups are trying to survive with only two possibilities: to be acquired or die.

Furthermore a trend is not going to stop: storage giants invent about nothing in new killing storage technologies and prefer to get them by acquiring start-ups. It’s less expansive than investing in their own R&D.

We will probably continue to see several M&As in the most demanding storage sectors: cloud, software, hyperconverged system and SSD where there are too many companies, but also in the channel for consolidation. The year 2008 already began with the acquisition of start-up Avere Systems by Microsoft.

WHO BOUGHT WHOM IN 2017

| Mo. | BUYER | ACQUISITION | PRICE* | ACTIVITY OF ACQUIRED COMPANY |

| 1 | 1847 Partners | Cinram (European operations & business) | NA | Optical disc manufacturing and supply chain solutions |

| 4 | AntemetA | C-Storage | NA | Data protection |

| 4 | Arcserve | FastArchiver | NA | Email archiving |

| 7 | Arcserve | Zetta | NA | Enterprise-cloud disaster recovery |

| 2 | Axway | Syncplicity | NA | Secure collaboration and file sharing |

| 12 | Bain Capital and others | Toshiba Memory Corp. (Toshiba’s assets) | 18,000 | Others are Apple, Dell, Kingston, Seagate, SK Hynix, Hoya, and eventually Network Corporation, Development Bank of Japan; NAND chips |

| 11 | Barracuda Networks | Sonian | NA | Cloud archiving, compliance and analytics |

| 8 | Bet365 | Basho Technologies (IP assets) | NA | NoSQL database technology |

| 3 | Betsol | Rebit software from Carbonite | NA | Backup solutions |

| 2 | Carbonite | Double-Take Software (Vision Solutions) | 65 | HA software for SMBs |

| 8 | Carbonite | Datacastle | NA | Enterprise mobility endpoint backup, recovery and analytics solutions |

| 8 | Cisco | Springpath | 320 | Hyperconvergence software |

| 9 | Cloudera | Fast Forward Labs | NA | Machine learning and applied AI |

| 7 | Cray | Seagate ClusterStor Business | NA | Storage for HPC |

| 2 | Data Blue | LPS Integration | NA | VAR in cloud infrastructure, networking, security and storage architecture |

| 2 | Datto | Open Mesh | NA | Cloud-managed WiFi networks and SD-LAN |

| 7 | eFolder | Axcient | NA | Merger; cloud-based DR and data protection platform |

| 1 | Endless Fund IV | MTI Europe | NA | Integrator in UK, Germany and France |

| 7 | Evernex | TTS France | NA | Tape drives and libraries repair |

| 3 | Extreme Networks | Broadcom (assets) | 55 | Brocade data center networking business |

| 1 | Hewlett Packard Enterprise | SimpliVity | 650 | Software for hyperconverged infrastructure |

| 3 | Hewlett-Packard Enterprise | Nimble Storage | 1,090 | Hybrid and all-flash systems |

| 7 | Hive-IO | Atlantis Computing (assets) | NA | Software-defined storage and VDI |

| 7 | HyTrust | DataGravity | NA | Data-aware storage platform that tracks data access and analyzes data |

| 10 | IDdriven | Iosafe | NA | Disaster proof storage |

| 4 | Insight Venture Partners | Spanning Cloud Apps | NA | Acquired from Dell EMC; in SaaS data protection |

| 1 | j2 Global | Abaxio | NA | Cloud backup in USA |

| 7 | j2 Global | CloudRecover Cloud | NA | Backup in Australia |

| 10 | j2 Global | backupsonline | NA | Cloud backup in Netherlands |

| 9 | Longsys | Lexar (brand of Micron) | NA | Consumer flash storage |

| 11 | LTL Group | Dataram | NA | Memory products |

| 11 | Marvell | Cavium | 6,000 | Multi-core processing, networking communications, storage connectivity and security solutions |

| 5 | NetApp | Plexistor | NA | Software that turns off-the-shelf servers into high-performance converged infrastructure offerings with persistent memory technologies |

| 5 | NetApp | Immersive Partner Solutions | NA | Cloud-based converged infrastructure monitoring and compliance |

| 8 | NetApp | GreenQloud | NA | Iceland software company in Qstack hybrid cloud management software |

| 1 | NXSN Acquisition | Nexsan (Imation) | NA | Disk arrays, NXSN Acquisition is affiliate of Spear Point Capital Management |

| 8 | Park Place Technologies | Allen Myland | NA | Pennsylvania-based storage maintenance firm |

| 6 | Park Place Technologies | Performance Data (Asia assets) | NA | Hardware maintenance and systems integration services |

| 1 | Proact IT | Teamix | 9.5 | Provider of technology and services in Germany |

| 1 | Procurri | Congruity | NA | Provider of enterprise storage support for EMC, NetApp, HDS, Brocade and VMware |

| 4 | Quantum Partners (Soros) | Violin Memory | NA | All-flash arrays |

| 9 | Rackspace | Datapipe | NA | Managed public cloud services |

| 6 | Reactive Group | Arraid | NA | Replacement storage solutions for ageing disk, tape and floppy drives and revamping products using SSD |

| 8 | Red Hat | Permabit (assets) | NA | De-dupe and compression technology |

| 1 | Sphere 3D | HVE and sister company Unified ConneXion | NA | Converged and hyperconverged infrastructure and IT services |

| 1 | StorageCraft | Exablox | NA | Flash and HDD based scale-out NAS |

| 11 | Thoma Bravo | Barracuda Networks | 1,600 | Cloud-enabled security and data protection solutions |

| 10 | Vecima Networks | Concurrent Computer (assets) | 29 | Content delivery and storage |

| 2 | Veeco | Ultratech | 815 | Lithography, laser-processing and inspection systems |

| 10 | Vista Equity Partners | Datto | NA | BC solutions that secure business data; merged with Autotask |

| 8 | Western Digital | Upthere | NA | Home cloud backup |

| 8 | Western Digital | Tegile Systems | NA | Multi-protocol SSD/HDD array with de-dupe for primary storage |

* In $ million

(Source: StorageNewsletter.com)

Read also:

All M&As in 2016

Number of deals decreased to 47 compared to 51 in 2015, 65 being average per year since 1998

by Jean Jacques Maleval | 2017.01.04 | News

All M&As in 2015

Only 51 but huge ones (Dell/EMC, WD/SanDisk, Carlyle/Veritas)

by Jean Jacques Maleval | 2016.01.04 | News

All M&As in 2014

Top ones are …

by Jean Jacques Maleval | 2015.01.05 | News

All M&As (73) in 2013

Same number in 2012: top ones are …

by Jean Jacques Maleval | 2014.01.03 | News

All M&As (70) in 2012

70 compared to 61 in 2011: top ones are …

by Jean Jacques Maleval | 2013.01.15 | News

ANALYSIS: All Mergers and Acquisitions in 2011

The year of HDD consolidation

by Jean Jacques Maleval | 2012.01.03 | News

2010: The Year of Consolidation

57 M&As and big ones, vs. 47 in 2009

by Jean Jacques Maleval | 2011.01.01 | News

Only 43 M&As in 2009 in the WW Storage Industry

Vs. 69 in 2008, 84 in 2007 and 104 in 2006

by Jean Jacques Maleval | 2010.01.04 | News | [with our comments]

These figures in these former reports on M&As increased sometimes later as we discovered other acquisitions after these annual publications.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter