All M&As in 2015

Only 51 but huge ones (Dell/EMC, WD/SanDisk, Carlyle/Veritas)

By Jean Jacques Maleval | January 4, 2016 at 2:59 pmSince 1998 we analyze the merger and acquisition trends in the worldwide storage industry, which has allowed us the proper perspective from which to gauge the evolution over time.

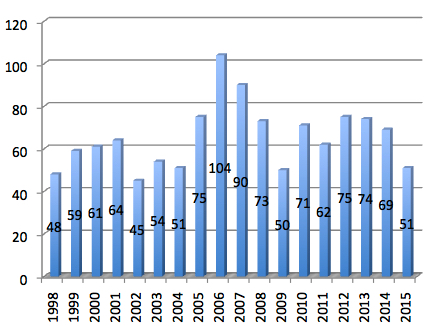

NUMBER OF ACQUISITIONS SINCE 1998 IN WW STORAGE INDUSTRY

| Year | ≠ |

| 1998 | 48 |

| 1999 | 59 |

| 2000 | 61 |

| 2001 | 64 |

| 2002 | 45 |

| 2003 | 54 |

| 2004 | 51 |

| 2005 | 75 |

| 2006 | 104 |

| 2007 | 90 |

| 2008 | 73 |

| 2009 | 50 |

| 2010 | 71 |

| 2011 | 62 |

| 2012 | 75 |

| 2013 | 74 |

| 2014 | 69 |

| 2015 | 51 |

| TOTAL | 1,176 |

| Acquisitions/year | 65 |

(Source: StorageNewsletter.com)

In 2006, there was a record of 104 M&As. Since 2012, the number of deals decreased yearly to reach 51 in 2015 compared to 69 the former year, and 65 being the average per year since 1998.

And into these 51 M&As in 2015 are included ten by only J2 Global getting small online backup companies. The price of only 15 deals was revealed by the buyers, meaning that it was relatively low for the 36 other ones with an amount not impacting seriously their financial results.

ALL M&As IN 2015 WITH KNOWN PRICE

| Buyer | Bought | Price in $ million |

| Dell | EMC | 67,000 |

| Western Digital | SanDisk | 19,000 |

| The Carlyle Group and GIC | Veritas (Symantec) | 8,000 |

| Microsemi | PMC-Sierra | 2,300 |

| EMC | Virtustream | 1,200 |

| NetApp | SolidFire | 870 |

| Seagate | Dot Hill Systems | 696 |

| Avago Technologies | Emulex | 606 |

| TDK | Hutchinson Technology | 133 |

| Silicon Motion Technology | Shannon Systems | 57.5 |

| Technicolor | Cinram Group (assets) | 40 |

| Carbonite | Evault (Seagate) | 14 |

| Blancco Technology Group | Tabernus | 12 |

| Imation | Connected Data (substantially all equity) | 7.5 |

| Sphere 3D | Imation RDX business | 6 |

(Source: StorageNewsletter.com)

What’s impressive in 2015 is the number of deals surpassing $1 billion, a total of 5 vs. 2 last year. And there was even the highest acquisition in the history of the storage industry, at $67 billion (EMC by Dell) – even if both of them are not in storage only – and the second one ($19 billion by WD to acquired SanDisk), this latter becoming the biggest M&A in storage only.

MORE THAN $1 BILLION M&As IN HISTORY OF STORAGE INDUSTRY

(five in 2015)

2015: EMC by Dell, $67,000 million

2001: Compaq by HP, $25,000 million

2015: SanDisk by Western Digital, $19,000 million

2005: Veritas by Symantec, $11,000 million

2011: Autonomy by HP, $10,300 million

1998: Digital Equipment by Compaq, $9,600 million

2015: Veritas (Symantec) by The Carlyle Group and GIC, $8,000 million

2009: Sun by Oracle, $7,400 million

2013: LSI by Avago technologies, $6.600 million

2011: Hitachi GST by WD, $4,300 million

2005: StorageTek by Sun, $4,100 million

2000: Sterling Software by CA, $4,000 million

2000: Seagate by Suez Acquisition, $4,000 million

2006: Agere by LSI, $4,000 million

2014: Riverbed by Thoma Bravo, $3,600 million

2008: Foundry Networks by Brocade, $2,600 million

2012: Elpida by Micron Technology, $2,500 million

2012: Quest Software by Dell, $2,400 million

2010: 3par by HP, $2,350 million

2015: PMC-Sierra by Microsemi, $2,300 million

2010: Isilon by EMC, $2,250 million

2009: Data Domain by EMC, $2,200 million

2006: RSA by EMC, $2,100 million

2002: IBM HDD by Hitachi, $2,050 million

2000: Cobalt Networks by Sun, $2,000 million

2004: Kroll by Marsh & McLennan Companies, $1,900 million

2006: Maxtor by Seagate, $1,900 million

2000: Ancor Communications by QLogic, $1,700 million

1998: Seagate Software by Veritas, $1,600 million

2006: FileNet by IBM, $1,600 million

2006: msystems by SanDisk, $1,500 million

2007: EqualLogic by Dell, $1,400 million

2011: Samsung HDD by Seagate, $1,375 million

2000: Quantum HDD by Maxtor, $1,300 million

2003: Legato by EMC, $1,300 million

2010: Numonyx by Micron, $1,270 million

1996: Cheyenne by CA, $1,200 million

2010: Division 5 Technology by Max Stiegemeier (GCF), $1,200 million

2015: Virtustream by EMC, $1,200 million

1999: Data General by EMC, $1,100 million

2014: Fusion-io by SanDisk, $1,100 million

1995: Conner Peripherals by Seagate, $1,040 million

(Source: StorageNewsletter.com)

In conclusion, there was not an intense activity in 2015 in number of deals but some of them represented enormous sum.

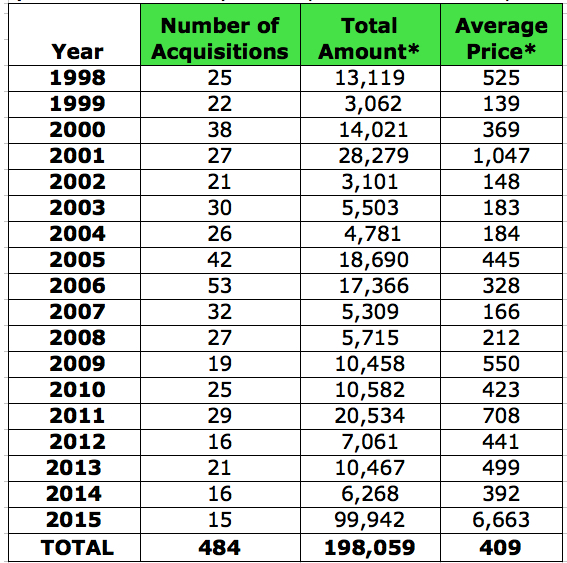

For the 15 operations with price being known, average is incredible, $6.7 billion. Since 1998 the former record was only $1.0 billion. Last year total was $6.3 billion for an average of $392 million per deal.

Consequently, the average price per M&A since 1998 has increased from $393 million to $409 million.

We are not far to reach $200 billion spent in M&As once more since 1998.

EMC was historically is the most voracious in the industry with 81 acquisitions since 1994, but was much quieter these past years. It acquired a record 23 companies in 2006 and 2007 only, just one in 2011, three in 2012 and 2013, five in 2014 and three in 2015 (CloudLink Technologies, Virtustream and Graphite Systems).

With these 81 deals, EMC is largely in front of Seagate (including Seagate Software) with a total of 31 acquisitions, Iron Mountain 29, Veritas added to Symantec 25, IBM, WD, LSI with Avago 20, J2 Global 19, Dell 18, Xyratex (acquired by Seagate), HP and NetApp 16.

TOTAL AMOUNT OF ACQUISITIONS SINCE 1998

(here we include only the acquisitions when the price is known)

* in $ million

(Source: StorageNewsletter.com)

The consolidation in the industry will continue because some publicly-traded companies are in bad shape and there are too many storage start-ups trying to survive with only two goals: to be acquired or die.

Furthermore a trend is not going to stop: storage giants invent about nothing in new killing storage technologies and prefer to get them by acquiring start-ups. It’s less expansive than investing in their own R&D.

We will probably continue to see several M&As in the most demanding storage sectors: cloud market, software, systems, and SSD where there are too many companies, but also in the channel for consolidation.

WHO BOUGHT WHOM IN 2015

| MO. | BUYER | ACQUISITION | PRICE IN $ MILLION | ACTIVITY OF ACQUIRED COMPANY |

| 7 | Autotask | Soonr | NA | Enterprise secure file sharing and collaboration services |

| 2 | Avago Technologies | Emulex | 606 | Network connectivity, monitoring and management |

| 9 | Avnet | Orchestra Service | NA | German IT distributor of storage solutions and services around EMC |

| 9 | Barracuda Networks | Intronis | NA | Data protection solutions to MSPs |

| 9 | Blancco Technology Group | Tabernus | 12 | Data erasure software and hardware used to remove data from HDDs |

| 9 | Carbonite | Rebit (IP) | NA | Backup and recovery software |

| 12 | Carbonite | Evault (Seagate) | 14 | BC and DR solutions designed for SMBs |

| 1 | Citrix | Sanbolic | NA | Workload-oriented storage virtualization |

| 7 | Claranet | Techgate | NA | UK BC and DR specialist |

| 9 | DataLocker | BlockMaster | NA | USB security solutions provider |

| 10 | Dell | EMC | 67,000 | WW leader of storage industry |

| 4 | EMC | CloudLink Technologies | NA | Canadian company in end-to-end data encryption for hybrid cloud |

| 5 | EMC | Virtustream | 1200 | Cloud software and services |

| 9 | EMC (DSSD) | Graphite Systems | NA | High performance flash array |

| 2 | Hitachi Data Systems | Pentaho | NA | Big data integration and business analytics |

| 2 | Hitachi Data Systems | oXya | NA | French SAP technical services and hosting solution |

| 3 | Hitachi GST | Amplidata | NA | Software-defined storage for high capacity scale out storage |

| 10 | IBM | Cleversafe | NA | Object-based storage software and appliances |

| 10 | Imation | Connected Data(substantially all equity) | 7.5 | Private cloud sync and share line of appliances alternative to Dropbox |

| NA | j2 Global | LiveVault | NA | Online backup in USA |

| NA | J2 Global | SugarSync | NA | Online backup in USA |

| NA | J2 Global | Dobson | NA | Online backup in USA |

| NA | J2 Global | Opin | NA | Online backup in Iceland |

| NA | J2 Global | Omnis | NA | Online backup in Iceland |

| NA | J2 Global | BackupSystems | NA | Online backup in Denmark |

| NA | J2 Global | iDrift | NA | Online backup in Norway |

| NA | J2 Global | Online Backup Vault | NA | Online backup in USA |

| NA | J2 Global | DSA Technologies | NA | Online backup in USA |

| NA | J2 Global | Comtech | NA | Online backup in Norway |

| 10 | Micron | Tidal Systems | NA | Stealthy start-up in SSD controllers |

| 12 | Microsemi | PMC-Sierra | 2,300 | Semiconductor and software solutions in storage, optical and mobile networks |

| 10 | Neosem | Flexstar Technology | NA | SSD testing system |

| 1 | NetApp | HvNAS | NA | Small Australian independent developer of SMB 3/2 for Linux |

| 12 | NetApp | SolidFire | 870 | All-flash system |

| 8 | NetJapan | Muntor | NA | Swiss distributor becoming European HQs |

| 1 | NextGgen Storage | SanDisk assets (part of Fusion-io) | NA | Hybrid flash/HDD appliances |

| 1 | Novachips | HyperLink NAND (HLNAND) | NA | Flash memory technology from Conversant Intellectual Property Management, formerly Mosaid Technologies. |

| 9 | Redstor | Attix5 | NA | Secure data protection, recovery and storage, specialising in virtualization and cloud-based solutions |

| 8 | Seagate | Dot Hill Systems | 696 | Storage subsystems |

| 4 | Silicon Motion Technology | Shannon Systems | 57.5 | Enterprise PCIe SSD and array solutions |

| 7 | Skyview Capital | EMC Syncplicity | NA | Enterprise file sync and share business |

| 5 | Sony | Optical Archive | NA | Facebook spinoff in cold storage on Blu-ray discs |

| 8 | Sphere 3D | Imation RDX business | 6 | Removable disk drive subsystems |

| 2 | StreamNation | Picturelife | NA | Video and audio online storage |

| 8 | Strencom | Storage Online | NA | Disaster-recovery services in Ireland |

| 11 | TDK | Hutchinson Technology | 133 | HDD suspension assemblies |

| 11 | Technicolor | Cinram Group (assets) | 40 | North American optical disc manufacturing and distribution |

| 8 | The Carlyle Group and GIC | Veritas (Symantec) | 8,000 | Storage software |

| 5 | Unknown investment group | Drobo | NA | Arrays for businesses and professionals |

| 9 | Vinci Energies | APX Intégration | NA | French integrator |

| 10 | Western Digital | SanDisk | 19,000 | Flash products |

(Source: StorageNewsletter.com)

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter