NetApp: Fiscal 3Q21 Financial Results

NetApp: Fiscal 3Q21 Financial Results

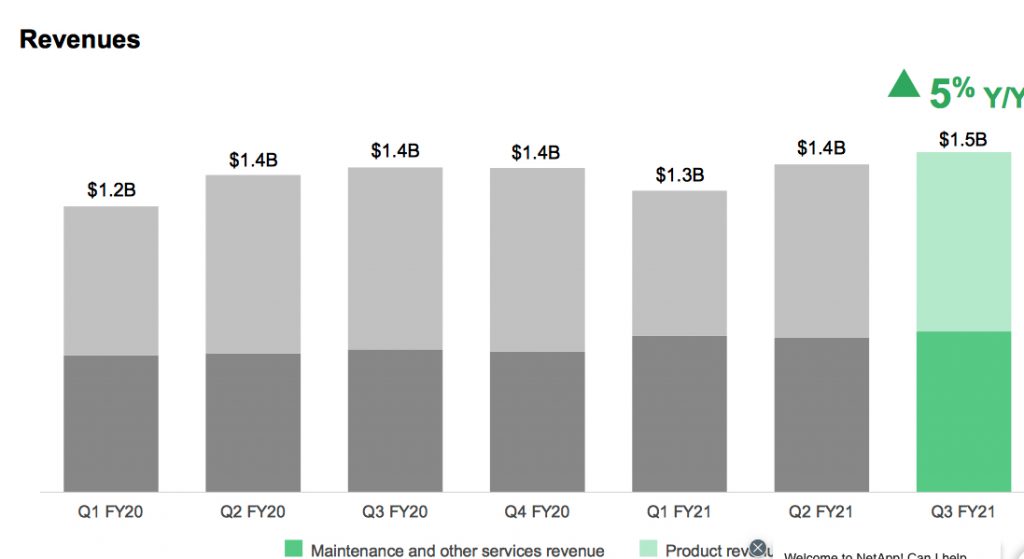

Revenue up 5% and profit 2%

This is a Press Release edited by StorageNewsletter.com on February 25, 2021 at 2:18 pm| (in $ million) | 3Q20 | 3Q21 | 9 mo. 20 | 9 mo. 21 |

| Revenue | 1,404 | 1,470 | 4,011 | 4,189 |

| Growth | 5% | 4% | ||

| Net income (loss) | 277 | 182 | 623 | 396 |

NetApp, Inc. reported financial results for the third quarter of fiscal year 2021, which ended on January 29, 2021.

“We delivered another strong quarter with revenues at the top of our guidance range and operating margin and EPS above the high end of our expectations. We have sharpened our execution and 3FQ21 marks our third consecutive quarter of revenue and billings growth,” said George Kurian, CEO. “Looking ahead, we are uniquely positioned to address customers’ requirements for digital transformations as they deploy workloads in the cloud, as well as maintain and modernize on premises. We are confident in the strength of our position as customers continue to turn to NetApp to help them solve the challenge of managing data in the hybrid cloud as the recovery unfolds.”

3FQ21 financial results

• Net Revenue: $1.47 billion, compared to $1.40 billion in 3FQ20

• Net Income: GAAP net income of $182 million, compared to GAAP net income of $277 million in 3FQ20; non-GAAP net income of $250 million, compared to non-GAAP net income of $265 million in the 3FQ20

• Earnings per Share: GAAP net income per share of $0.80 compared to GAAP net income per share of $1.21 in 3FQ20; non-GAAP net income per share of $1.10, compared to non-GAAP net income per share of $1.16 in 3FQ20

• Cash, Cash Equivalents and Investments: $3.89 billion at the end of 3FQ21

• Cash Provided by Operations: $373 million, compared to $420 million in 3FQ20

• Share Repurchase and Dividend: Returned $157 million to shareholders through share repurchases and cash dividends

4FQ21 outlook

Net revenues are expected to be in the range of $1.44 billion to $1.54 billion.

Comments

It's the third consecutive quarter of revenue, net income, and billings growth, with sales at the top of guidance range.

But stock dropped 8%, near 65.60, during after-hours trading on the stock market.

Q3 billings were $1.6 billion, up 6% Y/Y.

Product revenue of $775 million decreased yearly 2%.

When combined, software revenue, recurring maintenance and cloud revenue totaled $1.1 billion and increased 13% Y/Y, representing 72% of total revenue. The company ended 3FQ21 with $3.8 billion in deferred revenue, an increase of 7% Y/Y.

Software product revenue of $428 million was up 14% Y/Y, driven by the continued mix shift towards all-flash portfolio.

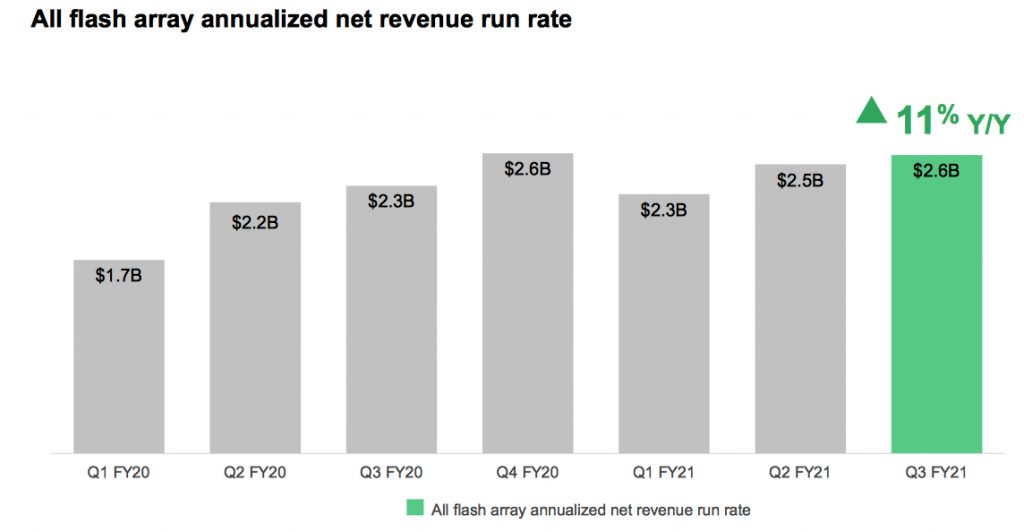

All-flash business grew 11% Y/Y at $652 million to an annualized net revenue (ARR) run rate of $2.6 billion. For the third consecutive quarter, the firm believes it outpaced the market, gaining share from competitors and converting its installed base from hybrid arrays to all-flash. At the end of the quarter, 27% of installed systems were all-flash, giving headroom for continued growth.

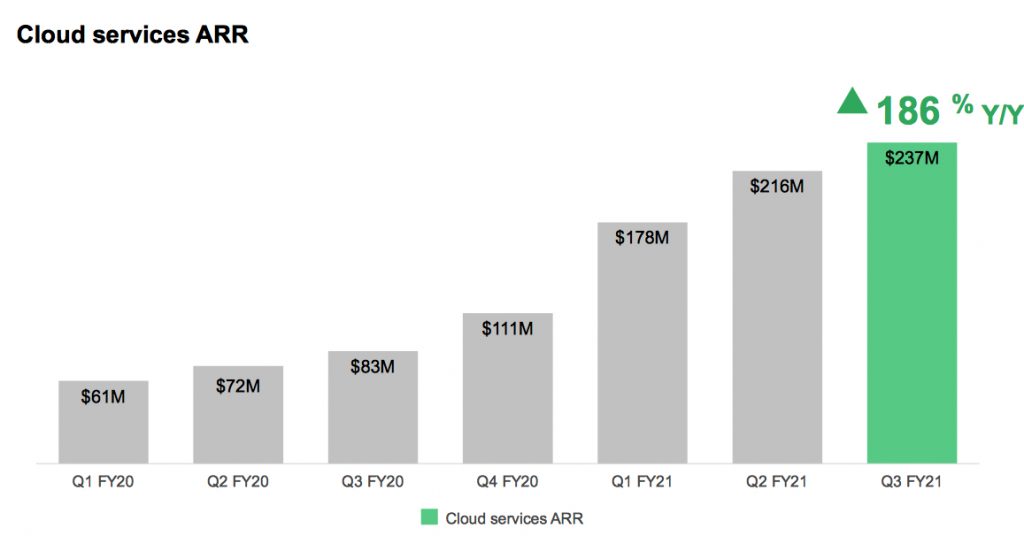

Public cloud services delivered $237 million in ARR, growing 186% Y/Y and 10% Q/Q. NetApp continues to see strong demand from customer cohorts with Q3 dollar-based net retention rate coming in at 227%. Given the strong sales pipeline heading into 4FQ21, it expects to exit FY with cloud ARR of $260 million to $290 million.

Geographically, it saw notable strength in Americas enterprise.

Net revenues are expected next quartert be between -2% and +5%.

NetApp's financial results since FY16

| Fiscal Period | Revenue | Y/Y Growth | Net income (loss) |

| FY16 | 5,546 | -9% | 229 |

| FY17 | 5,519 | -0% | 509 |

| 1Q18 | 1,325 | -11% | 136 |

| 2Q18 | 1,422 | 7% | 175 |

| 3Q18 | 1,523 | 7% | (506) |

| 4Q18 | 1,641 | 8% | 271 |

| FY18 | 5,911 | 7% | 75 |

| 1Q19 |

1,474 | 12% |

283 |

| 2Q19 |

1,517 | 7% |

241 |

| 3Q19 |

1,563 | 2% |

319 |

| 4Q19 |

1,592 | -3% |

296 |

| FY19 |

6,146 | 4% |

1,169 |

| 1Q20 |

1,236 | -16% | 103 |

| 2Q20 |

1,371 | -10% | 243 |

| 3Q20 |

1,404 | -10% | 277 |

| 4Q20 |

1,401 | -12% | 196 |

| FY20 |

5,412 | -12% |

819 |

| 1Q21 |

1,303 | 5% | 77 |

| 2Q21 |

1,416 | 3% | 137 |

| 3Q21 |

1,470 | 5% | 182 |

| 3Q21* |

1,440-1,540 | -2% - +5% | NA |

Revenue and net income (loss) in $ million

* Outlook

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter