Nutanix: Fiscal 3Q21 Financial Results

Nutanix: Fiscal 3Q21 Financial Results

Losses never ending but diminishing 2x Y/Y, surpassing $1 billion in revenue in 3 quarters

This is a Press Release edited by StorageNewsletter.com on May 28, 2021 at 2:32 pm| (in $ million) | 3Q20 | 3Q21 | 9 mo. 20 | 9 mo. 21 |

| Revenue | 318.3 | 344.5 | 979.8 | 1,004 |

| Growth | 8% | 2% | ||

| Net income (loss) | (240.7) | (123.6) | (687.5) | (676.1) |

Nutanix, Inc. announced financial results for its third quarter ended April 30, 2021.

“I am delighted with our strong quarterly results. For the third quarter in a row, we delivered outperformance across all guided metrics and demonstrated our ability to execute consistently,” said Rajiv Ramaswami, president and CEO. “We are also pleased with our progress on key priorities, including bolstering our ecosystem with our extended partnership with Lenovo, continued momentum with our core cloud software platform and an increased attach rate of our emerging products.“

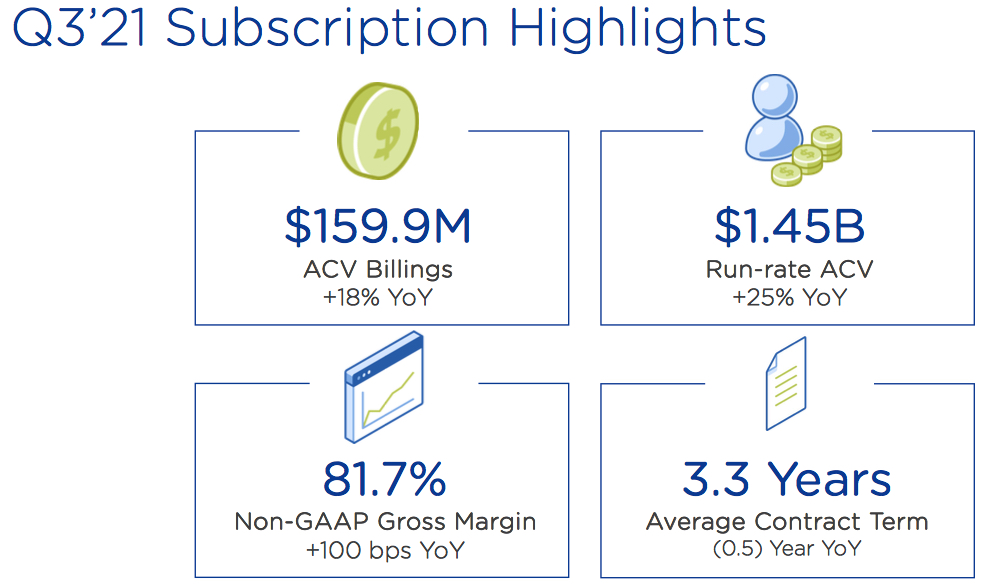

“We saw record ACV billings, with growth accelerating to 18% Y/Y, while our disciplined spending delivered operating expenses below our guidance,” said Duston Williams, CFO. “Our growing renewals pipeline will help to drive future top line growth, offer substantial sales and marketing efficiencies, and increase the predictability in our business.”

Fourth Quarter Fiscal 2021 Outlook

- ACV Billings: $170 – $175 million

- Non-GAAP Gross Margin: Approximately 81.5% to 82.0%

- Non-GAAP Operating Expenses: $380 – $385 million

- Weighted Average Shares Outstanding: Approximately 212 million

Comments

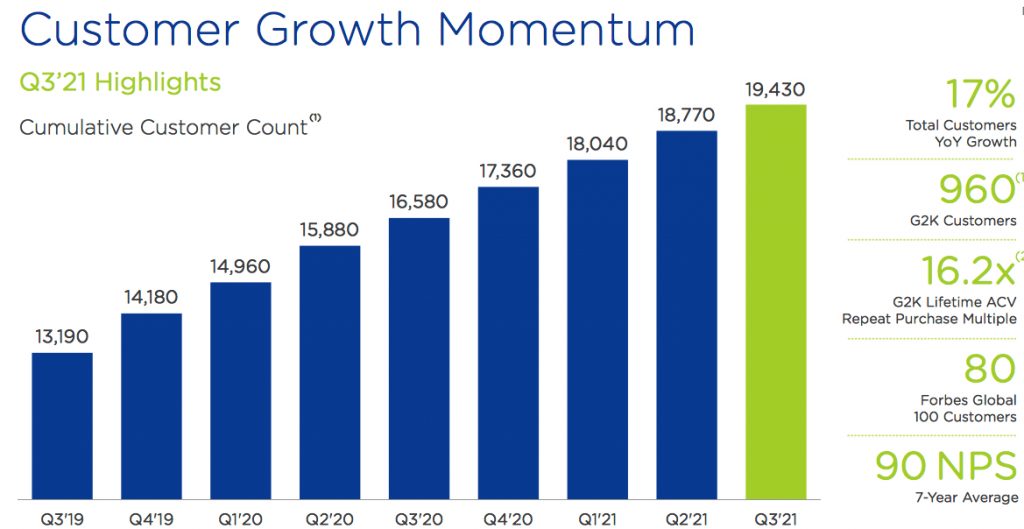

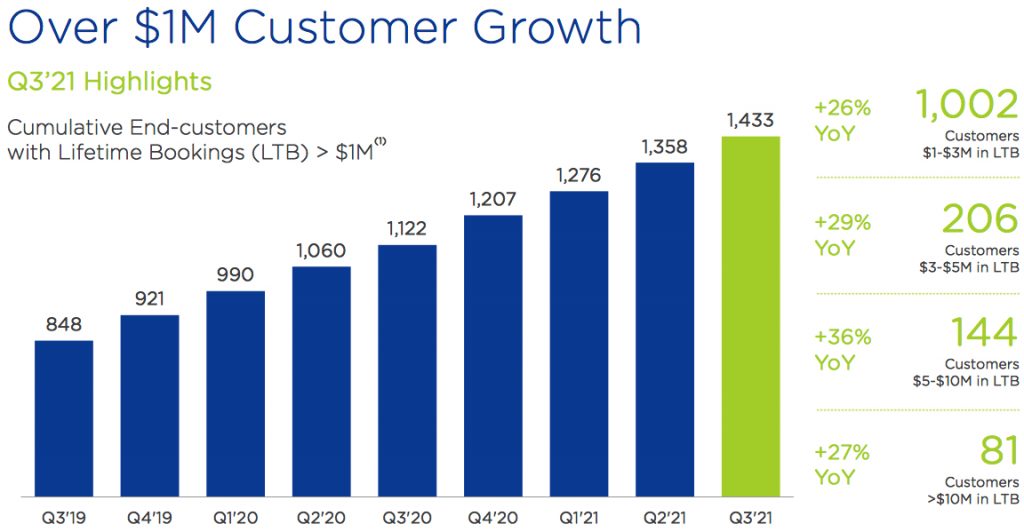

In this quarter, the company exceeded guidance metric and the expected benefits of its subscription transition and its ACV first focus continued to play out as planned.

Average contract term lengths compressed as expected, declining to 3.3 years vs. 3.4 years in 2FQ21.

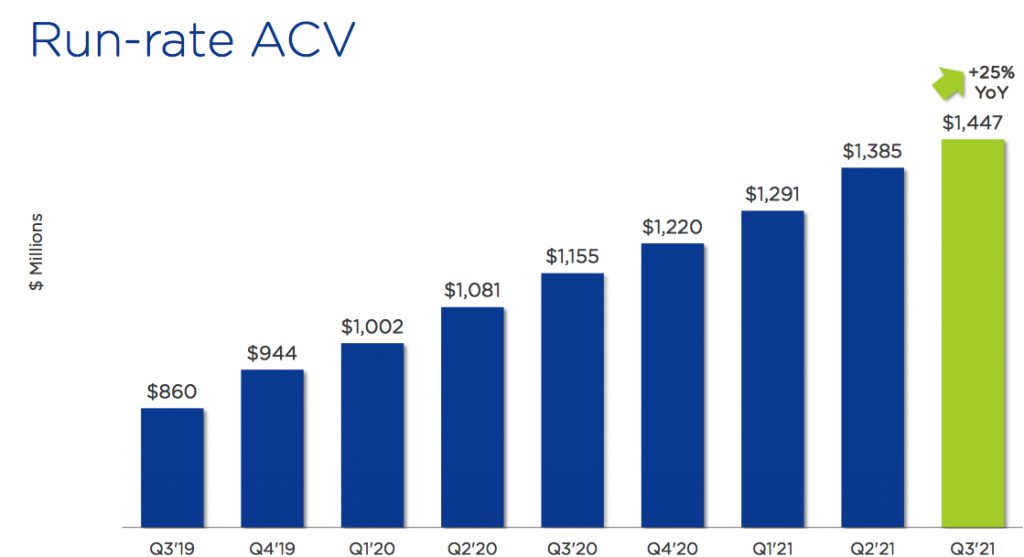

The firm had record ACV billings in 3FQ21. They were $160 million, reflecting 18% growth Y/Y, above guidance range of $150 million to $155 million. Run rate ACV as of the end of 3FQ21 was $1.45 billion, growing 25% Y/Y compared to guidance for growth in the mid 20% range. Revenue was $345 million, growing 8% from Q3 '20.

The firm recently decreased its global headcount by 2.5% from within the sales and marketing functions and expects these actions to yield approximately $50 million in annual savings.

Based on 4FQ21 ACV billings guidance, it expects ACV billings for FY21 to approximate $590 million to $95 million, up from $505 million in FY20 reflecting Y/Y growth of 17% to 18%.

As usual, no revenue guidance was revealed and profitability is far to be realized after years of continuing losses.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter