Nutanix: Fiscal 4Q20 Financial Results Results

Total of $2.6 billion loss since inception and never stopping

This is a Press Release edited by StorageNewsletter.com on September 1, 2020 at 2:14 pm| (in $ million) | 4Q19 | 4Q20 | FY19 | FY20 |

| Revenue | 299.9 | 327.9 | 1,236 | 1,308 |

| Growth | 9% | 6% | ||

| Net income (loss) | (194) | (185) | (621) | (873) |

Nutanix, Inc. announced financial results for its fourth quarter and fiscal year ended July 31, 2020.

4FQ20 Financial Highlights

• Revenue: $327.9 million, up 9% Y/Y from $299.9 million in 4FQ19

• Billings: $388.5 million, up 5% Y/Y from $371.7 million in 4FQ19

• Software and Support (TCV or Total Contract Value) Revenue: $326.5 million, up 14% Y/Y from $286.9 million in 4FQ19

• Software and Support (TCV) Billings: $387.1 million, up 8% Y/Y from $358.7 million in 4FQ19

• Annual Contract Value (ACV) Billings: $139.9 million, up 13% Y/Y from $123.6 million in 4FQ19

• Run-rate (Book of Business) (ACV): $1.22 billion, up 29% Y/Y from $944.4 million as of 4FQ19

• Gross Margin: GAAP gross margin of 79.6%, up from 77.0% in 4FQ19; Non-GAAP gross margin of 83.0%, up from 80.0% in 4FQ19

• Net Loss: GAAP net loss of $185.3 million, compared to a GAAP net loss of $194.3 million in 4FQ19 2019; Non-GAAP net loss of $79.0 million, compared to a non-GAAP net loss of $105.8 million in 4FQ19

• Net Loss Per Share: GAAP net loss per share of $0.93, compared to a GAAP net loss per share of $1.04 in 4FQ19; Non-GAAP net loss per share of $0.39, compared to a non-GAAP net loss per share of $0.57 in 4FQ19

• Cash and Short-term Investments: $719.8 million, down from $908.8 million in 4FQ19

• Deferred Revenue: $1.18 billion, up 30% from 4FQ19

• Operating Cash Flow: gen of $3.6 million, compared to use of $9.7 million in 4FQ19

• Free Cash Flow: Use of $13.8 million, compared to use of $33.3 million in 4FQ19

FY20 Financial Highlights

• Revenue: $1.31 billion, up 6% Y/Y from $1.24 billion in FY19

• Billings: $1.58 billion, up 4% Y/Y from $1.51 billion in FY19

• Software and Support (TCV) Revenue: $1.28 billion, up 14% Y/Y from $1.13 billion in FY19

• Software and Support (TCV) Billings: $1.56 billion up 10% Y/Y from $1.41 billion in FY19

• ACV Billings: $505.2 million, up 18% Y/Y from $428.6 million in FY19

• Run-rate (Book of Business) ACV: $1.22 billion, up 29% Y/Y from $944.4 million as of FY19

• Gross Margin: GAAP gross margin of 78.1%, up from 75.4% in FY199; Non-GAAP gross margin of 81.3%, up from 78.1% in FY19

• Net Loss: GAAP net loss of $872.9 million, compared to a GAAP net loss of $621.2 million in FY19; Non-GAAP net loss of $465.8 million, compared to a non-GAAP net loss of $272.9 million in FY19

• Net Loss Per Share: GAAP net loss per share of $4.48, compared to a GAAP net loss per share of $3.43 in FY19; Non-GAAP net loss per share of $2.39, compared to a non-GAAP net loss per share of $1.51 in FY19

• Operating Cash Flow: Use of $159.9 million, compared to gen of $42.2 million in FY19

• Free Cash Flow: Use of $249.4 million, compared to use of $76.3 million in FY19

“I am thrilled to report strong results to close the year, a performance all the more impressive given the uncertainty of the global market environment we are facing today,” said Dheeraj Pandey, chairman, co-founder and CEO. “We have demonstrated growth in the midst of a pandemic and have now generated $1.6 billion in annual billings. In addition, the $750 million investment from Bain Capital Private Equity validates the market opportunity in front of us and positions us well with enhanced financial flexibility and resources to further scale, gain share and remain at the forefront of innovation in our industry. The strategic value of IT is clear as customers increasingly value our software and solutions in a rapidly changing work environment. Our biggest product news of the quarter was launching our solution on bare metal with AWS, creating a new type of HCI: hybrid cloud infrastructure.”

“We entered the fourth quarter with a continued focus on managing expenses and cash usage, handily outperforming all key consensus metrics, while progressing on our business model transformation,” said Duston Williams, CFO. “We achieved these objectives, and in doing so, delivered all-time highs across a number of key financial and operating metrics, including ACV billings and gross margin. We also made significant progress on our transformation to a subscription-based business model, with 88% of billings for the quarter coming from subscription. With our shift to subscription nearly complete, the guidance metrics we provide will change accordingly to reflect our business growth, namely focusing on ACV.“

Recent company highlights

• Announces chairman and CEO Dheeraj Pandey’s Intent to Retire from the Nutanix Management Team: He plans to retire from the Nutanix management team upon the selection and appointment of next CEO. He will remain chairman and CEO while a formal search is conducted by the board of directors.

• Announces $750 Million Investment from Bain Capital Private Equity and New Board Members: Nutanix plans to use the investment to support the company’s growth initiatives. In connection with the investment, David Humphrey and Max de Groen, MDs of Bain Capital, will join the board of directors following and subject to the close of this transaction, which is expected to occur in late September. Separately, the company also added Virginia Gambale to its board of directors in June. She is an experienced board member, technology advisor and investor with experience in financial and business services.

• Expanded Customer Base: The firm ended 4FQ20 with 17,360 end-customers. Customer wins included the following Global 2000 companies: AIB Group, Cadence Design Systems, Dongfeng Renault, MayBank Singapore, QBE Insurance, and more.

• Launched Nutanix Hybrid Cloud Infrastructure on Amazon Web Services: The company released Clusters on AWS extending the simplicity and ease of use of its software to the public cloud, beginning with AWS. This solution delivers a single software stack across clouds, addressing key technical and operational challenges of the hybrid and multicloud era.

• Reached 88% of Billings from Subscription: Nutanix continued its transition to a subscription-based business model, with subscription billings up 29% Y/Y to $341 million, representing 88% of total billings, and subscription revenue up 46% Y/Y to $285 million, representing 87% of total revenue.

• Recognized as a Leader: It was named a Leader in The Forrester Wave: Hyperconverged Infrastructure, 3Q20 report, published by Forrester Research, Inc. It believes this is consistent with additional independent market research, all of which conclude that its software is a leader in the growing HCI market.

• Reached Customer Milestone for Nutanix Files: Nutanix Files, the company’s scale-out file storage solution, reached the milestone of 2,500 customers, including nearly 180 Global 2,000 companies. Nutanix Files, Objects and Volumes deliver the a software-defined, end-to-end storage solutions, delivered on a single platform, through a common management environment covering file, object and block storage needs.

• Strengthened Nutanix’s Desktop as a Service Solution: The company added several new capabilities to its Desktop as a Service (DaaS) solution, Xi Frame, including enhanced onboarding for on-premises desktop workloads on Nutanix AHV, expanded support for user profile management, the ability to convert Windows Apps into Progressive Web Apps (PWA), and increased regional support to 69 regions across Microsoft Azure, GCP and AWS.

• Delivered Solutions to Manage Cloud Infrastructure from Anywhere: It launched new solutions that allow IT teams to deploy, upgrade and troubleshoot their cloud infrastructure while working from anywhere. These solutions are delivered via Nutanix Foundation Central, Insights and Lifecycle Manager – all of which are available as part of Nutanix software at no additional cost to customers.

• Will Host Virtual .NEXT User Conference September 8-11: The company’s marquee user event has been reinvented to suit an online, interactive format for global participants. It will include keynotes participants have come to expect, as well as hands-on technology sessions and the ability for attendees to interact with each other and firm’s experts.

Comments

Revenue never stops to increase since the inception of the company in 2009. For the quarter, it reached $328 million, modestly up 3% Q/Q and 9% Y/Y. For FY20, the percentage is 6%, above $ billion since FY18.

But, up to now, Nutanix was unable to be profitable, totaling huge losses, $2.6 billion, since the beginning of its business.

Revenue and loss of Nutanix

(in $ million)

| FY ended in July |

Revenue | Loss |

| 2012 | 6.6 | 14.0 |

| 2013 | 30.5 | 44.7 |

| 2014 | 127.1 | 84.0 |

| 2015 | 241.4 | 126.1 |

| 2016 | 444.9 | 168.5 |

| 2017 | 845.9 | 379.6 |

| 2018 | 1155 | 297.2 |

| 2019 | 1136 | 621.2 |

| 2020 | 1308 | 872.9 |

| Total | 2608.2 |

($238 million IPO in 2016)

Following the announcement of these most recent financial results, shares were up 10%.

Big move was the successful transition from billings to subscriptions.

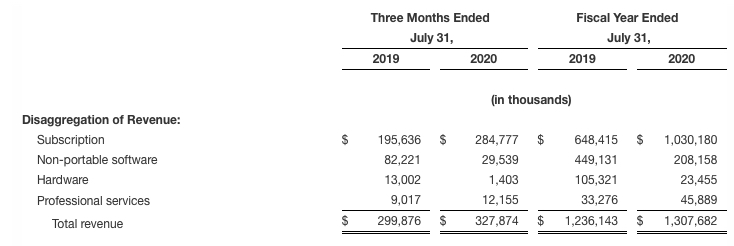

Disaggregation of revenue and billings

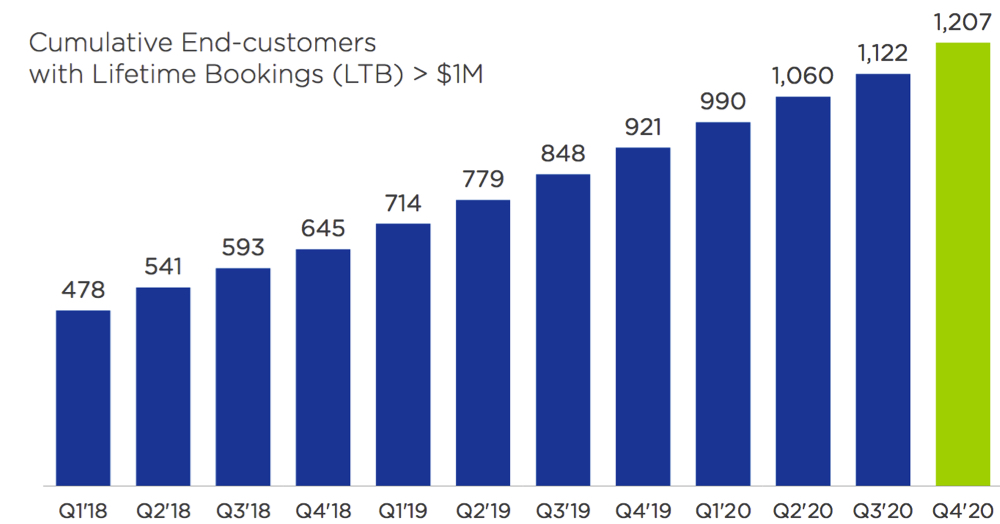

Customer growth

No financial outlook were revealed, like at the end of the previous quarter.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter