Nutanix: Fiscal 1Q21 Financial Results

HCI star not in sky: revenue down Y/Y and loss never stopping

This is a Press Release edited by StorageNewsletter.com on November 24, 2020 at 1:36 pm| (in $ million) | 1Q20 | 1Q21 | Growth |

| Revenue |

314.8 | 312.8 | -1% |

| Net income (loss) | (229.3) | (265.0) |

Nutanix, Inc. announced financial results for its first quarter ended October 31, 2020.

“We are pleased with our financial performance in the first quarter, which marked a strong start to fiscal 2021 including increased adoption of new products as well as continued growth in our core HCI software,” said Dheeraj Pandey, chairman, co-founder and CEO. “After launching our solutions on AWS in August, we announced a major partnership with Microsoft to develop our portfolio on Azure, placing the Nutanix HCI (Hybrid Cloud Infrastructure) at a significant competitive advantage to help our customers build out their hybrid and multicloud environments.”

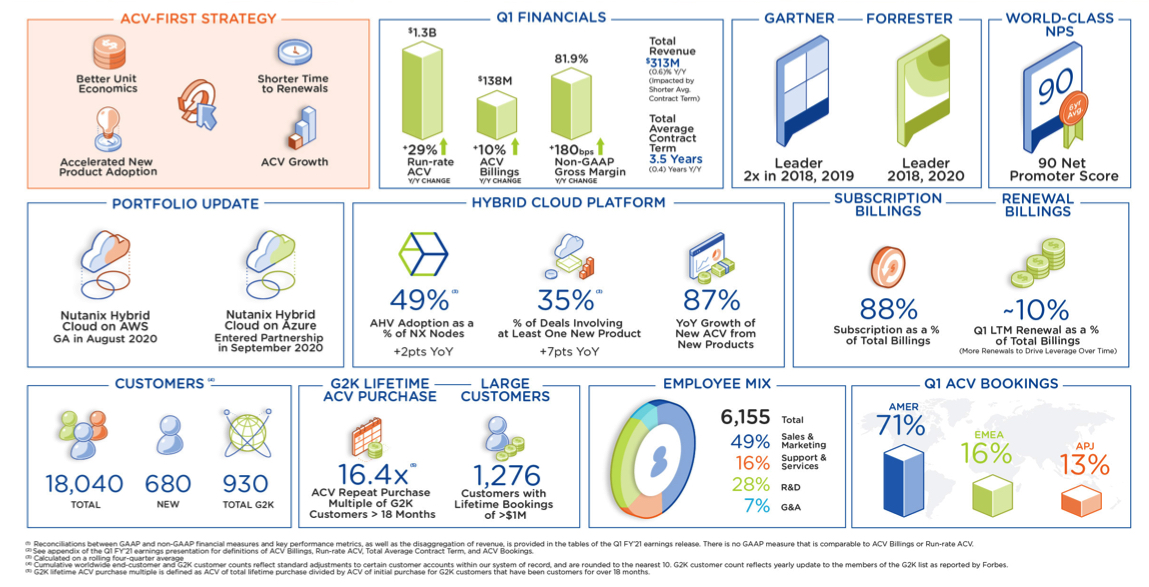

“Our ACV-first strategy and solid go-to-market execution drove outperformance across all key financial metrics including ACV billings growth of 10% Y/Y and run-rate ACV growth of 29% Y/Y,” said Duston Williams, CFO. “Looking ahead, we remain focused on thoughtfully managing operating expenses as we continue to execute on our business model transformation and are confident in Nutanix’s ability to drive long-term growth for the benefit of all stakeholders.“

Recent company Highlights

• Entered into a Partnership with Microsoft Azure: The firm announced a new partnership with Microsoft that will enable both companies to deliver a hybrid cloud solution with seamless application, data, and license mobility as well as unified management across on-premises and Azure environments, using its HCI on Azure.

• Reset the Bar for Innovation in HCI Market: The company introduced new capabilities in its HCI software, delivering innovation to datacenter and cloud customers, which will result in up to 50% faster performance, easier cloud deployments with native virtual networking, simplified Zero-Trust security, and expanded automation and budgeting capabilities for cloud resources.

• Expanded Innovation Including Launch of Karbon Container Technology: Additional innovation during the quarter continued in the core platform and new products with announcements about new capabilities added to the HCI software platform, significant updates to the database-as-a-service solution (Era), as well as the launch of a new Kubernetes-based PaaS solution (Karbon Platform Services) to democratize containers beyond DevOps for IT operators, building on the AHV revolution to revolutionize hypervisors.

• Introduced New Cloud Partner Program: The firm announced Elevate, a global partner program, to simplify engagement for its entire partner ecosystem using a set of tools, resources, and marketing platforms to take advantage of cloud business models. Under one integrated architecture, Elevate enables VARs, VADs, service providers and telcos, hyperscalers, independent software, hardware, and platform vendors, global system integrators, and services delivery partners to grow their business with hybrid and multicloud solutions.

• Launched the Third Annual Enterprise Cloud Index, Showing Importance of Hybrid Cloud: For the third year, the company partnered with a third-party research firm to analyze key trends and priorities in the industry. This year, the survey also provided a window into companies’ responses to Covid-19 and how it affected spending priorities. The research showed that IT leaders overwhelmingly (86%) continue to see hybrid cloud as the ideal deployment model, and that companies are taking important steps in their digital transformation journey including deploying hyperconverged infrastructure.

• Expanded New Customer Base and New Business with Existing Customers: Despite the ongoing pandemic, Nutanix continued to add new customers, ending the first quarter of fiscal 2021 with a total of 18,040 end-customers. Further, Nutanix saw increased demand from new and existing customers for both new products and new workloads. First quarter customer wins included the following Global 2000 companies: Allianz (China) Insurance Holding Co., Ltd, CaixaBank, HCL Technologies Limited, Nomura Research Institute, Ltd., Royal Vopak, Teleperformance Colombia.

• Transformed .NEXT to Digital Experience: The firm held its largest ever .NEXT user conference this year, 100% virtually, with record attendance of over 40,000 prospects, customers and partners across multiple time zones and languages, resulting in a record weekly number of Test Drives and product trials. In addition, .NEXT is on track to deliver strong pipeline gen at a lower cost than in-person events.

Definitions and Total Revenue Impact

1 Annual Contract Value, or ACV, is defined as the total annualized value of a contract, excluding amounts related to professional services and hardware. The total annualized value for a contract is calculated by dividing the total value of the contract by the number of years in the term of such contract, using, where applicable, an assumed term of five years for contracts that do not have a specified term. ACV billings for any given period is defined as the sum of the ACV for all contracts billed during the given period.

2 Run-rate ACV at the end of any period, is the sum of ACV for all contracts that are in effect as of the end of that period. For the purposes of this calculation, the company assumes that the contract term begins on the date a contract is booked, irrespective of the periods in which we would recognize revenue for such contract.

3 Total Average Contract Term represents the dollar-weighted term, calculated on a billings basis, across all subscription and life-of-device contracts, using an assumed term of five years for life-of-device licenses, executed in the quarter.

4 Total Revenue was negatively impacted by Y/Y decline in average contract term associated with the ongoing transition to a subscription-based business model.

Comments

HCI is currently considered as one of the most successful storage business. For example, Gartner predicts that by 2025, 80% of organizations will be using hyperconverged solutions, doubling from 40% in 2020. But more recent financial quarter of Nutanix is far to be great.

The company recognizes a 5% decrease in revenue compared to previous quarter, and -1% Y/Y.

More than that, up to now, it was unable to be profitable, totaling huge losses, $2.9 billion, since the beginning of its business.

Click to enlarge

Quarterly revenue was impacted by Y/Y decline in average contract term associated with the ongoing transition to a subscription-based business model, by decreased average term length.

Nevertheless co-founder, chairman and CEO Dheeraj Pandey, commented: "Q1 was a very good quarter, positioning us well for the rest of fiscal."

He added: "On a rolling 4-quarter basis, our new product attach rate during Q1 was 35%, up 7% points from a year ago. In fact, new ACV for new products grew 87% Y/Y and 27% Q/Q. Within our newer products, we saw particularly good momentum with our data center solutions, Files and Flow, as well as DevOps and database-as-a-service solutions, our Calm and Era."

During the quarter, firm's core product continued to perform well with new customer ACV bookings, representing 23% of total ACV bookings. Nutanix also added 680 new customers in the quarter.

In 1FQ21, average contract term decreased to 3.5 years compared to 3.8 years in 4FQ20, lower than expectations.

Partnerships with HPE, Dell, Lenovo and others continue to be an important part of firm's strategy. Nutanix had its best quarter-to-date with HPE in new ACV as well as meaningful new customer acquisition.

It closed the quarter with cash and short-term investments of $1.32 billion versus $720 million in 4FQ20.

For next quarter, guidance for ACV billings could be between $145 million and $148 million, representing Y/Y growth of 4% to 6%. Expectation for 3FQ21 is to exhibit sequential seasonality, which suggests a slight decrease in ACV billings in 3FQ21 vs. 2FQ21. And based on 2FQ21 ACV billings guidance, Nutanix expects run rate ACV to continue its growth trend and grow approximately 25% Y/Y. It is projecting a slight decrease in term length in 2FQ21 compared to 3.5 years in 1FQ21.

No financial outlook for revenue was revealed, like at the end of the two previous quarters.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter