Nutanix: Fiscal 2Q21 Financial Results

Nutanix: Fiscal 2Q21 Financial Results

Stable sales at $346 million, with as much as $287 million net loss, and increasing

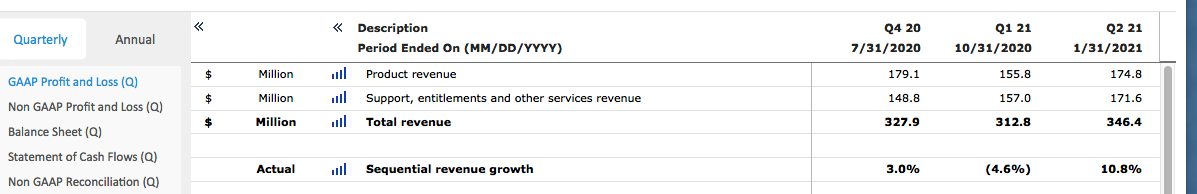

This is a Press Release edited by StorageNewsletter.com on March 2, 2021 at 2:17 pm| (in $ million) | 2Q20 | 2Q21 | 6 mo. 20 | 6 mo. 21 |

| Revenue | 346.8 | 346.4 | 661.5 | 659.1 |

| Growth | -0% | -0% | ||

| Net income (loss) | (217.6) | (287.4) | (446.9) | (552.4) |

Nutanix, Inc. announced financial results for its second quarter ended January 31, 2021.

“We delivered a strong quarter across the board, exceeding guidance on all metrics and continuing our momentum with key customer wins and solid execution,” said Rajiv Ramaswami, president and CEO. “In my first two months as CEO of Nutanix, my conviction that we have a talented employee base, loyal customers who love the simplicity of our software, and a strong market opportunity ahead of us has only been reinforced.”

“We delivered record ACV billings with growth of 14% Y/Y, bolstered by the strength of our emerging products,” said Duston Williams. “We continued to make progress on our transition to subscription and maintained our disciplined approach to managing operating expenses, which were lower than expected this quarter. We look forward to continuing to execute on our transformation and are confident Nutanix is well positioned for long-term value creation.”

3FQ21 outlook:

- ACV billings: $150-$155 million

- Non-GAAP gross margin: Approximately 81%

- Non-GAAP operating expenses: $365-$370 million

- Weighted average shares outstanding: Approximately 207 million

Comments

Revenue at $346 million is essentially flat from 2FQ20, driven by a 0.5 year decrease in average term length vs. 2FQ20.

The company exceeded guidance across about all metrics despite stable sales and huge losses at $287 million for the quarter and more than half billion dollar for the first 6-month period.

Opex was less than expected.

Shares climb 3% after this announcement with a narrower than expected $0.37 loss per share.

Click to enlarge

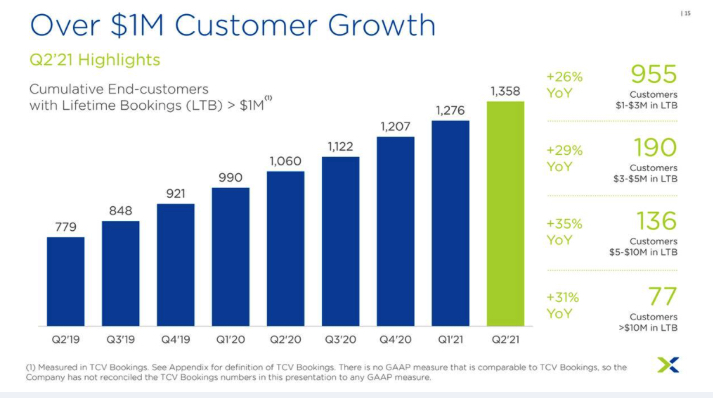

77 customers spend more than $10 million up to now, 136 between $5 and $10 million, and 190 between $3 and $5 million. 1,358 of them are in excess of $1 million (+26% Y/Y).

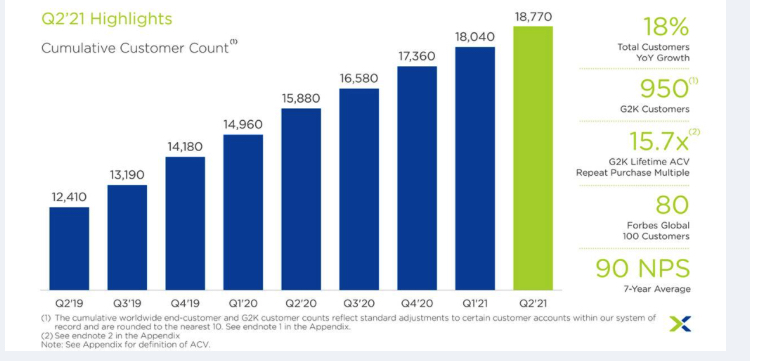

In 3FQ21, the firm had record new, renewal and total ACV (Annual Contract Value). The billings were $159 million reflecting 14% growth Y/Y significantly above guidance range of $145 million to $148 million. Run rate ACV as of the end of 1FQ21 was $1.38 billion growing 28% Y/Y compared to guidance of approximately 25% growth.

Emerging products, particularly database management solution Era and file storage solution Files had a strong quarter. Emerging product ACV was up over a 100% Y/Y and the firm had a 37% attach rate to deals on a rolling 4-quarter basis.

As communicated last quarter in similar to the seasonality, Nutanix has experienced over the last 2 years its 3FQ21 guidance, anticipating a slight seasonal decrease in ACV billings in 3FQ21 vs. 2FQ21 while at the same time reflecting Y/Y growth of 11% to 15% and a raise of 5% to 8% from current estimates.

Based on the 3FQ21, ACV billings guidance, the company expects run rate ACV to continue its strong growth trend and grow in the mid 20% range Y/Y. It believes to be now to the point in its transition that we will not see dramatic Q/Q change in term lengths with terms fluctuating by 0.1 or so per quarter going forward. As term length begins to stabilize It expects reported Y/Y revenue growth to move closer to ACV billings growth over time.

No revenue guidance was revealed and profitability is far to be realized after years of continuing losses.

Nutanix employs 6,210 people.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter