NetApp: Fiscal 1Q21 Financial Results

Net revenue up 5% Y/Y and -7% Q/Q, better than expected, AFA up 34% Y/Y

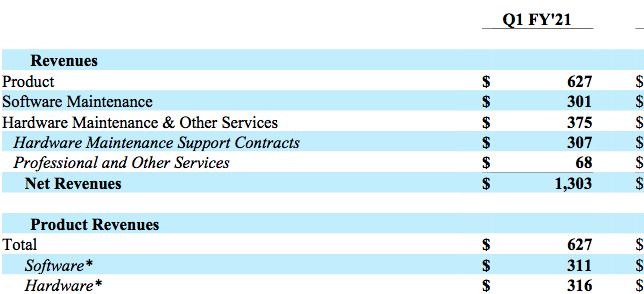

This is a Press Release edited by StorageNewsletter.com on August 28, 2020 at 2:16 pm| (in $ million) | 1Q20 | 1Q21 | Growth |

| Revenue |

1,236 | 1,303 | 5% |

| Net income (loss) | 103 | 77 |

NetApp, Inc. reported financial results for the first quarter of fiscal year 2021, which ended on July 31, 2020.

“We executed well in the first quarter. Revenue, operating margin and EPS all exceeded our guidance, despite a challenging environment. Enterprises are increasingly prioritizing transformational and hybrid cloud projects, which drove our momentum as customers turn to NetApp to help them achieve these goals,” said George Kurian, CEO. “We are building on a strong foundation of industry-leading data-centric software innovation, trusted customer relationships and an open-ecosystem approach that is strengthened by partnerships with the leading public cloud companies who endorse our Data Fabric Strategy. NetApp is uniquely positioned to help our customers unlock the best of cloud.”

1FQ21 Financial Results

- Net Revenue: $1.30 billion, compared to $1.24 billion in 1FQ20

- Net Income: GAAP net income of $77 million, compared to GAAP net income of $103 million in 1FQ20; non-GAAP net income of $163 million, compared to non-GAAP net income of $157 million in 1FQ20

- Earnings per Share: GAAP net income per share of $0.35 compared to GAAP net income per share of $0.42 in 1FQ20; non-GAAP net income per share of $0.73, compared to non-GAAP net income per share of $0.65 in 1FQ20

- Cash, Cash Equivalents and Investments: $3.77 billion at the end of 1FQ21

- Cash Provided by Operations: $240 million, compared to $310 million in 1FQ20

- Dividend: Returned $107 million to shareholders through cash dividend

2FQ21 Financial Outlook

Net revenues are expected to be in the range of $1.225 billion to $1.375 billion

Dividend

Next cash dividend of $0.48 per share to be paid on October 28, 2020, to shareholders of record as of the close of business on October 9, 2020.

1FQ21 Business Highlights: Product Innovations

- Announced the latest release of Active IQ, which uses AI for IT operations to automate the proactive care and optimization of firm’s environments. It adds new interface features, new workloads, and a new customer experience.

- Announced that HCI now offers a 2-node storage cluster, providing a scalable entry point for customer workloads with the latest release of NetApp Element 12.0 and NetApp HCI 1.8.

Acquisitions and Partnerships

- Acquired Spot to establish leadership in application-driven infrastructure (ADI), offering a portfolio of compute and storage services that monitor and analyze the needs of applications and automatically optimize cloud resources

- Acquired VDI player CloudJumper and launched the new NetApp Virtual Desktop Service, giving customers a simple and secure path to manage current environments alongside their new remote desktop.

- NetApp and Cleondris expanded their partnership to bring to market a simple, seamless DR experience for NetApp HCI with Cleondris HCI Control Center.

- NetApp and Commvault partnered to create a solution for backing up data with NetApp AFF and NetApp StorageGRID using Commvault software.

- Announced support for HashiCorp Vault Enterprise 1.3, a key manager that complies with Key Management Interoperability Protocol (KMIP) and is secure, scalable, and easy to implement for ONTAP software-based and hardware-based data-at-rest encryption.

- Announced a partnership with cnvrg.io, using the cnvrg.io dataset caching tool and NetApp ONTAP AI to deliver an AI and ML data science pipeline solution that is streamlined and improves productivity and efficiency.

- The US Department of Veterans Affairs expanded its FlexPod converged infrastructure for remote access environments, enabling additional users and services.

- Is offering 25TB of NetApp Cloud Volumes Service for Google Cloud free of charge for 90 days for IT teams that are addressing the digital fallout of the Covid-19 pandemic.

Growth and Leadership

- Is expanding its partner-first approach with updates to the Unified Partner Program to complement and align with its partners’ business capabilities and models.

- Appointed Cesar Cernuda as president, reporting to George Kurian and leading global go-to-market operations.

Comments

Former quarter records the lowest revenue since FY16, -12% Y/Y and Q/Q, and expectations for current 3-month period was between $1,090 and $1,240 million. Finally the company realized better sales: 1,303 million, up 5% Y/Y and -7% Q/Q, with operating margin and EPS also exceeding guidance despite of Covid-19.

"Our customers are also adapting to the new normal," said CEO George Kurian, adding. "As I stated on the 4QF20 call, we have 2 clear priorities in FY21: returning to growth in our storage business powered by share gains from our industry-leading file, block and object software and scaling our highly differentiated cloud services business."

* Revenue recognition policy under GAAP defines a configured storage system, inclusive of the OS software essential to its functionality, as a single performance obligation. Company provided a breakdown of GAAP product revenue into the software and hardware components to display the significance of software included in total product revenues.

More recent quarter's billings was $1.15 billion, up 6% Y/Y.

In 1FQ21, half of new customers came in through firm's cloud business. Cloud ARR reaches $178 million, up 192% Y/Y. Public cloud services delivered $178 million in ARR, growing 192% Y/Y and 60% Q/Q.

Total product revenue of $627 million decreased yearly 3%, the firm seeing growth in its largest global enterprise accounts as customers initiated digital transformation and hybrid cloud projects.

AFA revenue was $567 million, up 34% Y/Y. At the end of 1FQ21, 25% of installed systems were all-flash.

Hardware product revenue of $316 million decreased 7% Y/Y, as spinning disk solutions continued to decline.

Software product revenue of $311 million increased yearly 2%, driven by an increase in software all-flash FAS.

Software maintenance and hardware maintenance revenue of $608 million was up 14% Y/Y up 6% Y/Y when adjusted for the approximately $40 million, related to the extra week in the quarter. These two recurring revenue lines comprised 47% of global revenue.

When combined, software revenue and recurring maintenance revenue totaled $919 million in the more recent quarter, representing 71% of total revenue. The firm ended 1FQ21 with $3.6 billion in deferred revenue, an increase of 3% Y/Y, as it continued to grow its installed-base.

NetApp expects 2FQ21 revenues between $1.225 billion and $1.375 billion which, at the midpoint, implies a 5% decline Y/Y.

According to Blocks & Files UK publication, NetApp is laying off up to 700 people, with Solidfire engineers taking a big hit. More than 100 staff at Solidfire facility in Colorado lost their jobs, according to sources.

NetApp's financial results since FY16

| Fiscal Period | Revenue | Y/Y Growth | Net income (loss) |

| FY16 | 5,546 | -9% | 229 |

| FY17 | 5,519 | -0% | 509 |

| 1Q18 | 1,325 | -11% | 136 |

| 2Q18 | 1,422 | 7% | 175 |

| 3Q18 | 1,523 | 7% | (506) |

| 4Q18 | 1,641 | 8% | 271 |

| FY18 | 5,911 | 7% | 75 |

| 1Q19 |

1,474 | 12% |

283 |

| 2Q19 |

1,517 | 7% |

241 |

| 3Q19 |

1,563 | 2% |

319 |

| 4Q19 |

1,592 | -3% |

296 |

| FY19 |

6,146 | 4% |

1,169 |

| 1Q20 |

1,236 | -16% | 103 |

| 2Q20 |

1,371 | -10% | 243 |

| 3Q20 |

1,404 | -10% | 277 |

| 4Q20 |

1,401 | -12% | 196 |

| FY20 |

5,412 | -12% |

819 |

| 1Q21 |

1,303 |

5% |

77 |

| 2Q21* |

1,225-1,375 |

-6%/+6% |

NA |

Revenue and net income (loss) in $ million

* Outlook

To read the earnings call transcript

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter