Silicon Motion: Fiscal 3Q25 Financial Results

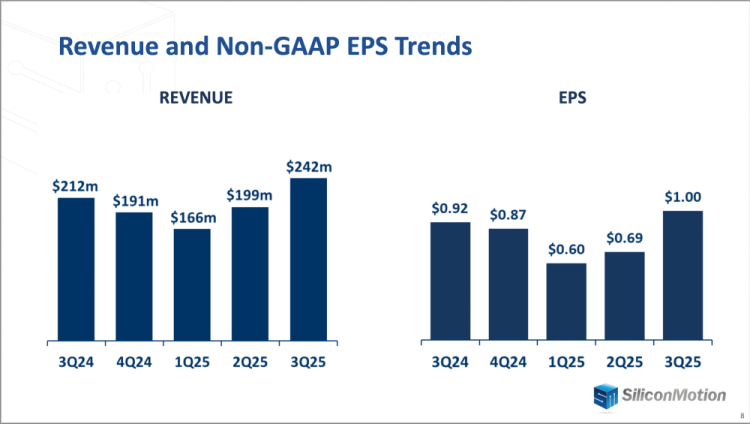

Revenue of $242 million, up 22% QoQ and up 14% YoY

This is a Press Release edited by StorageNewsletter.com on November 13, 2025 at 2:05 pmBusiness Highlights

- Third quarter of 2025 sales increased 22% QoQ and increased 14% YoY

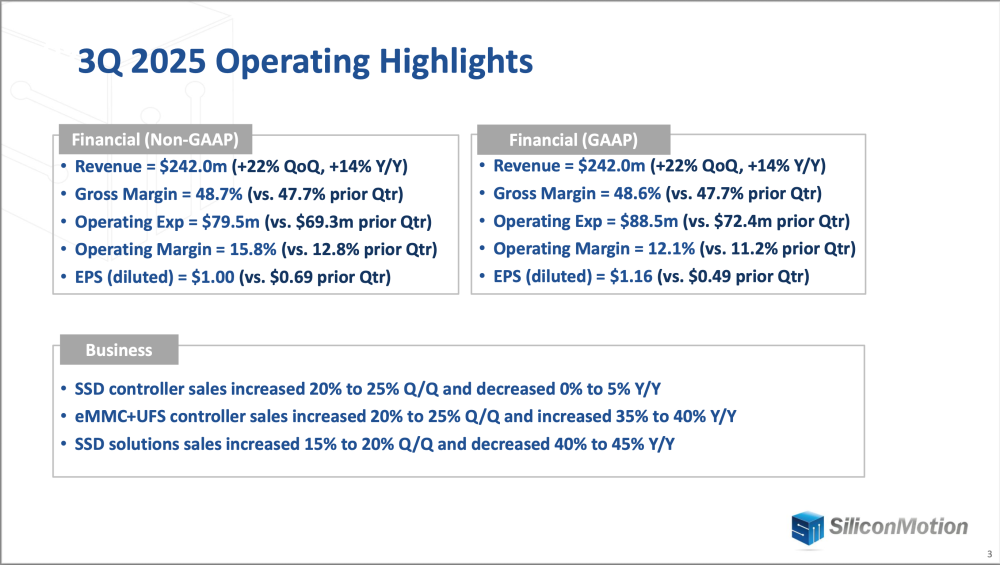

- SSD controller sales: 3Q of 2025 increased 20% to 25% QoQ and decreased 0% to 5% YoY

- eMMC+UFS controller sales: 3Q of 2025 increased 20% to 25% QoQ and increased 35% to 40% YoY

- SSD solutions sales: 3Q of 2025 increased 15% to 20% QoQ and decreased 40% to 45% YoY

Silicon Motion Technology Corporation announced its financial results for the quarter ended September 30, 2025.

For the third quarter of 2025, net sales (GAAP) increased sequentially to $242.0 million from $198.7 million in the second quarter of 2025. Net income (GAAP) also increased sequentially to $39.1 million, or $1.16 per diluted American depositary share (“ADS”) (GAAP), from net income (GAAP) of $16.3 million, or $0.49 per diluted ADS (GAAP), in the second quarter of 2025.

For the third quarter of 2025, net income (non-GAAP) increased sequentially to $33.8 million, or $1.00 per diluted ADS (non-GAAP), from net income (non-GAAP) of $23.0 million, or $0.69 per diluted ADS (non-GAAP), in the second quarter of 2025.

Third Quarter of 2025 Review

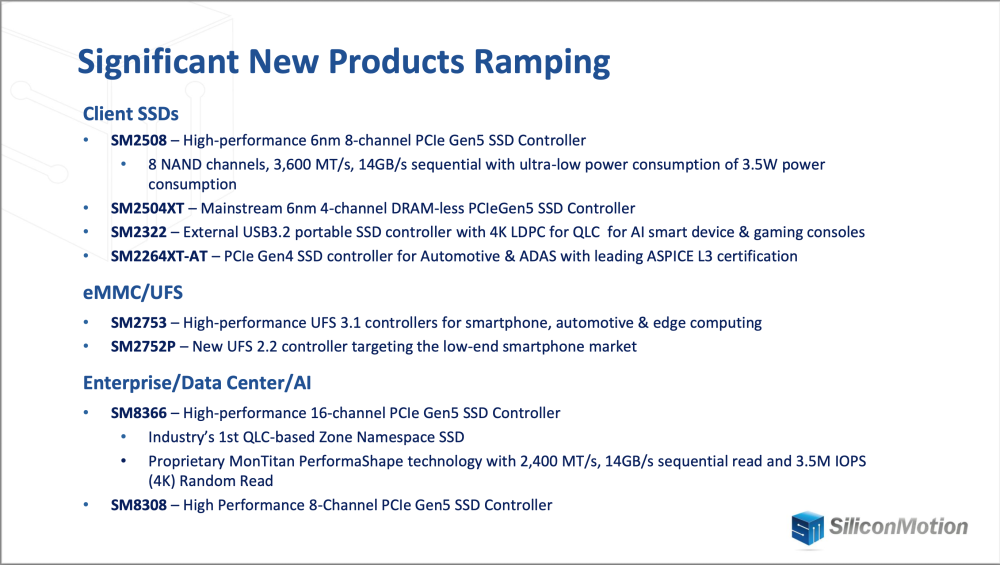

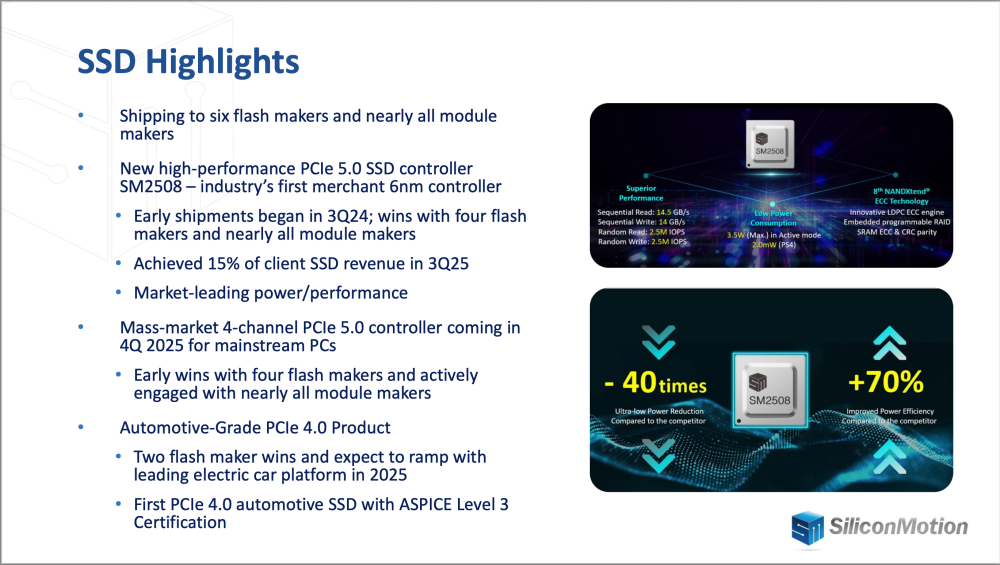

“We experienced better than projected strength across each of our markets in the third quarter of 2025 and delivered revenue well above our previously provided range,” stated Wallace Kou, president and CEO, Silicon Motion. “Our eMMC and UFS products experienced strong growth during the third quarter, primarily driven by a rebounding smartphone market coupled with market share gains. We also experienced continued growth in our automotive segment primarily driven by increased product diversification and new customer ramps. Our leading PCIe5 client SSD controller sales grew 45% quarter-over-quarter as AI-at-the-edge PCs are gaining traction and as white box AI server makers continue to leverage mainstream hardware components. The investments we have made over the past few years are taking root as we are starting to benefit from increased product and market diversification. We believe we are well positioned to achieve long-term, sustainable growth given our expanding product portfolio of leading consumer, enterprise, automotive and industrial storage solutions.”

Business Outlook

“Our efforts in product and market diversification are yielding results on both the top and bottom lines. We introduced several new products in 2025 in client SSDs, portable SSDs, eMMC/UFS, enterprise, automotive and expandable cards that will ramp and scale in 2026, driving higher share across our markets and benefiting from higher ASPs and strong margins. We expect continued top and bottom line growth in the current quarter, exceeding our previously announced full-year revenue run rate target of $1 billion exiting the quarter, and look forward to capitalizing on these new products and further expanding our product portfolio and target markets next year,” stated Mr. Kou.

Comments

The first 9 months of FY2025 delivered $607 million that anticipates a FY above previous year but these 9 months are down 1% in comparison to FY24. The company should continue to see quarter revenue above a key threshold of $200 million in order to sustain the trajectory to $1 billion in 1 or 2 years now. The ARR reaches almost $800 million.

Click to enlarge

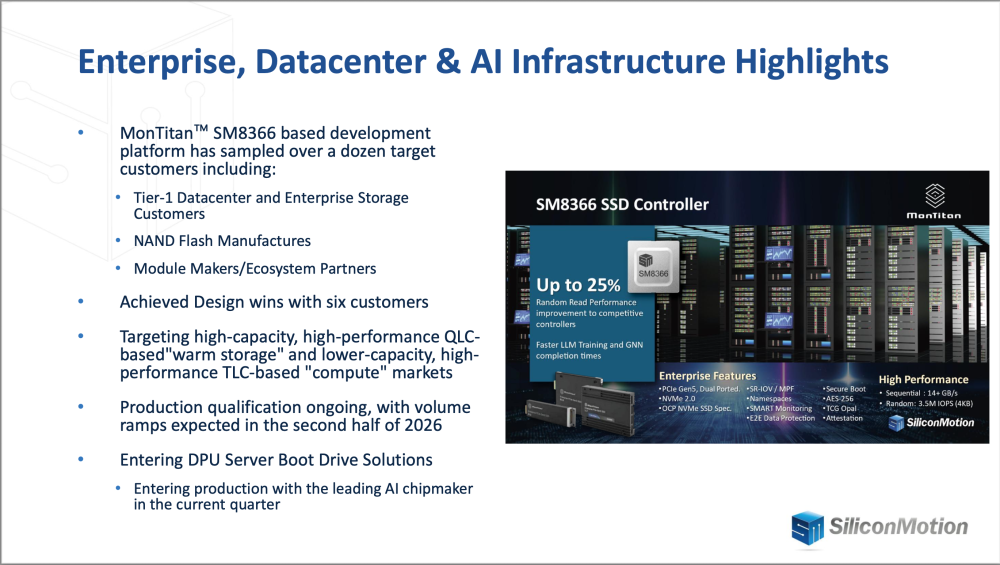

These quarter's figures are solid and demonstrate a strong SSD controllers business, same for the client SSD business and other activities. PCIe Gen 5 products were very well received by the industry and several partners adopted them, it is the case for both 8 and 16 channel products. MonTitan SM8366 confirms its innovative model with several wins and others in the pipe. At the same time, the company initiated several new products directions that require some time to reach the market. And as AI really shook the market for several quarters now, all companies, especially in this area, have to adapt very rapidly and accelerate product development and releases.

Click to enlarge

Click to enlarge

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter