Commvault: Fiscal 4Q21 Financial Results

Commvault: Fiscal 4Q21 Financial Results

Record quarterly and annual revenue, FY not profitable

This is a Press Release edited by StorageNewsletter.com on May 5, 2021 at 2:33 pm| (in $ million) | 4Q20 | 4Q21 | FY20 | FY21 |

| Revenue | 164.7 | 191.3 | 670.9 | 723.5 |

| Growth | 16% | 8% | ||

| Net income (loss) | 8.9 | (6.3) | (5.6) | (31.0) |

Commvault Systems, Inc. announced its financial results for the fourth quarter and fiscal year ended March 31, 2021.

“We are proud to report Commvault delivered record quarter and full fiscal year revenue coupled with material operating margin expansion,” said Sanjay Mirchandani, President and CEO. “Our portfolio and roadmap are strong, our team is focused on execution, and our vision is resonating in the marketplace. While our work is never done, our transformation efforts thus far have been successful and we expect will fuel our continued growth in the new fiscal year.“

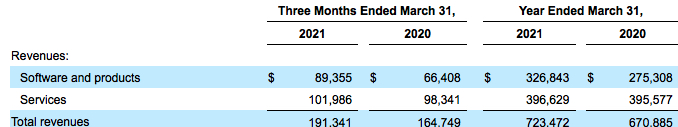

Total revenues for 4FQ21 were $191.3 million, an increase of 16% Y/Y. Total recurring revenue was $145.6 million, an increase of 24% Y/Y. For FY21, total revenues were $723.5 million, an increase of 8% from FY20.

Annualized recurring revenue (ARR), which is the annualized value of all active recurring revenue streams at the end of the reporting period, was $517.9 million as of March 31, 2021, up 15% from March 31, 2020.

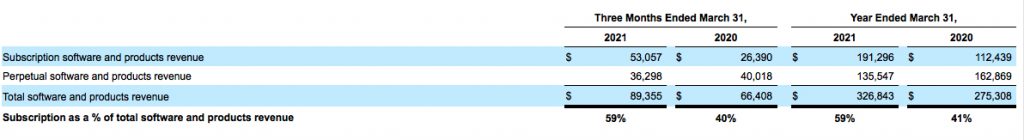

Software and products revenue in 4FQ21 was $89.4 million, an increase of 35% Y/Yr. The yearly increase in software and products revenue was driven by a 39% increase in revenue from larger deals (deals greater than $0.1 million in software and products revenue).

Larger deal revenue represented 69% of software and products revenue in 4FQ21. The number of larger deal revenue transactions increased 30% Y/Y to 198 deals for 4FQ21. The average dollar amount of larger deal revenue transactions was approximately $313,000, representing a 7% increase from 3FGQ21.

Software and products revenue for FY21 was $326.8 million, an increase of 19% from FY20. The yearly increase in software and products revenue was driven by a 26% increase in revenue from larger deals. Larger deal revenue represented 69% of software and products revenue in FY21. The number of larger deal revenue transactions increased 12% from FY020 to 673 deals. The average dollar amount of larger deal revenue transactions was approximately $335,000, representing a 13% increase from the prior year.

Services revenue in 4FQ21 was $102.0 million, up 4% Y/Y. For FY21, services revenue was $396.6 million, flat from FY20.

On a GAAP basis, income from operations (EBIT) was $10.3 million for 4FQ21 compared to loss of $2.2 million in 4FQ20. Non-GAAP EBIT was $38.8 million in the quarter compared to $18.3 million in the prior year.

On a GAAP basis, loss from operations (EBIT) for the FY21 was $22.3 million compared to loss of $17.5 million in FY20. Non-GAAP income from operations (EBIT) was $137.5 million in FY21 compared to $87.5 million in FY20.

For 4FQ21, Commvault reported net income of $6.3 million. Non-GAAP net income for the quarter was $28.5 million, or $0.59 per diluted share.

For FY21, it reported net loss of $31.0 million. Non-GAAP net income for FY21 was $101.1 million, or $2.11 per diluted share.

Operating cash flow totaled $64.7 million for 4FQ21 compared to $32.5 million in 3FQ21. For FY21, operating cash flow was $124.0 million, compared to $88.5 million for FY20. Total cash and short-term investments were $397.2 million as of March 31, 2021 compared to $339.7 million as of March 31, 2020.

During 4FQ21, the storage software firm repurchased approximately 943,000 shares of its common stock totaling $62.1 million at an average price of approximately $65.91 per share. During FY21, it repurchased approximately 1.6 million shares of its common stock totaling $95.3 million at an average price of approximately $57.97 per share.

Comments

The company continues to recover vs. hard competitors, especially Veeam now bigger than Commvault.

The former quarter, at $188 million in sales, was the best quarter ever in revenue.

For current one, it's also a record at $191.4 million (+16% Y/Y, much more than 6% to 7% expected), and also for fiscal year reaching $723.5 million up 8% Y/Y.

Former record for the year was $711.1 million in FY19.

But, for the full year, services revenue was flat.

The company added 200 subscription customers in the quarter. For the full year, subscription revenue increased 70% Y/Y, and also represented 59% of total software revenue. The subscription net dollar retention rate exceeded 110% for both the quarter and the year.

These results were led by largest regions with the Americas posting record software revenue.

In Q4, HyperScale X saw increased momentum and new customer wins. Additionally, firm's stand-alone distributed storage offering formerly known as Hedvig is also gaining traction in SDS and container-based environments.

For next quarter, Commvault expects software and products revenue of approximately $81 million and total revenue of approximately $181 million, down 5% Q/Q and Y/Y.

Revenue and net income (loss) for Commvault in $million

| Fiscal period | Revenue | Y/Y growth |

Net income (loss) |

| FY15 | 607.5 | 4% | 25.7 |

| FY16 | 595.1 | -2% | 0.1 |

| FY17 | 650.5 | 9% | 0.5 |

| 1Q18 | 166.0 | 9% | (0.3) |

| 2Q18 | 168.1 | 5% | (1.0) |

| 3Q18 | 180.4 | 8% | (59.0) |

| 4Q18 | 184.9 | 11% | (1.7) |

| FY18 | 699.4 | 8% | (61.9) |

| 1Q19 | 176.2 | 6% |

(8.6) |

| 2Q19 | 169.1 | 1% |

0.9 |

| 3Q19 | 184.3 | 2% |

13.4 |

| 4Q19 |

181.4 | -2% |

(2.2) |

| FY19 | 711.1 | 2% |

3.6 |

| 1Q20 | 162.2 | -8% | (6.8) |

| 2Q20 | 167.6 | -1% |

(7.1) |

| 3Q20 | 176.4 | -4% | (0.7) |

| 4Q20 | 164.7 | -9% | (5.6) |

| FY20 |

670.9 |

-6% |

(5.6) |

| 1Q21 | 173.0 | 7% |

2.3 |

| 2Q21 | 171.1 | 2% | (41.2) |

| 3FQ21 | 188.0 | 7% | 1.7 |

| 4FQ21 | 191.3 | 16% | 6.3 |

| FY21 | 723.5 | 8% | (31.0) |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter