Commvault: Fiscal 2Q21 Financial Results

Stable revenue and back to loss

This is a Press Release edited by StorageNewsletter.com on October 28, 2020 at 2:06 pm| (in $ million) | 2Q20 | 2Q21 | 6 mo. 20 | 6 mo. 21 |

| Revenue | 167.6 | 171.1 | 132.3 | 148.9 |

| Growth | 2% | 13% | ||

| Net income (loss) | (7.1) | (41.2) | (13.9) | (38.9) |

Commvault Systems, Inc. announced its financial results for the second quarter ended September 30, 2020.

“We are pleased by this quarter’s solid financial performance and are on track to deliver continued growth and operating margin expansion,” said Sanjay Mirchandani, president and CEO. “The Commvault portfolio has never been stronger. New product announcements including Commvault HyperScale X, Commvault DR, and Metallic Cloud Storage Service represent a series of first-mover advantages, addressing critical needs like cloud transformation and ransomware.”

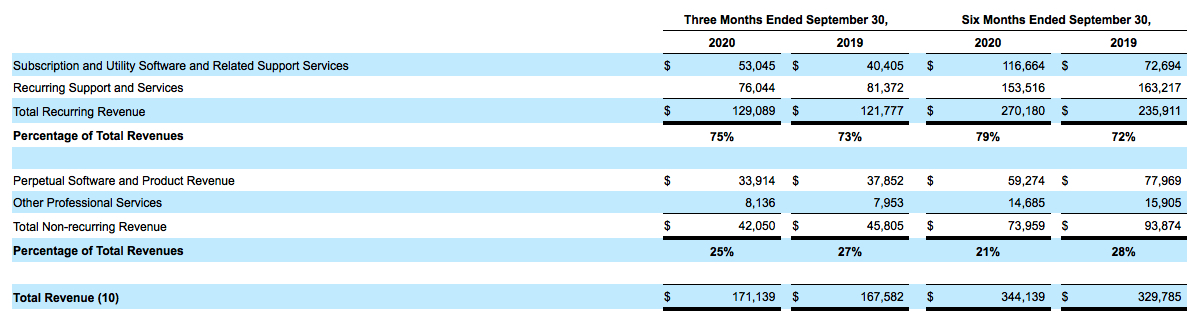

Total revenues for the second quarter of fiscal 2021 were $171.1 million, an increase of 2% Y/Y and a decrease of 1% Q/Q. Total recurring revenue was $129.1 million, an increase of 6% Y/Y.

Annualized recurring revenue (ARR), which is the annualized value of all active recurring revenue streams at the end of the reporting period, was $483.5 million as of September 30, 2020, up 9% from September 30, 2019.

Software and products revenue was $72.3 million, an increase of 5% Y/Y and a decrease of 6% Q/Q. The Y/Y increase in software and products revenue was driven by an 8% increase in larger deals (deals greater than $0.1 million in software and products revenue).

Services revenue in the quarter was $98.8 million, flat Y/Y and an increase of 2% Q/Q.

On a GAAP basis, loss from operations was $42.0 million for 2FQ21 compared to a loss of $8.2 million in 2FQ20. The current quarter loss was driven by $40.7 million of non-cash impairment charges of intangible assets recognized in the acquisition of Hedvig, Inc. The impairments are primarily due to a moderated view of the acquisition assumptions. The Hedvig technology has now been integrated into Hyperscale X software and appliances. The integration of this technology will lessen reliance on third party vendors, begin driving meaningful gross margin expansion on Hyperscale technology, and improve the customer experience. Non-GAAP EBIT, which excludes the non-cash impairment charges, was $28.9 million in 2FQ21 compared to $24.8 million in 2FQ20.

Operating cash flow totaled $27.0 million for 2FQ21 compared to $24.0 million in 1FQ21. Total cash and short-term investments were $394.0 million as of September 30, 2020 compared to $339.7 million as of March 31, 2020.

Comments

Commvault shares were up up 5% after these fiscal results beating top and bottom line estimates.

Company's expectations at the end of 1FQ21 for revenue was approximately $164 million or -5% Q/Q, and finally 171.1 million up 2% Y/Y and down 1% Q/Q

Click to enlarge

FY21 marks the first significant year of firm's new strategy of subscription renewal cycle.

In 2FQ21 subscription revenue represented 53% of total software revenue. The firm added 200 subscription customers and its subscription net dollar retention rate exceeded 100% for the second consecutive quarter. Total recurring revenue increased 6% Y/Y to $129 million and represented 75% of total revenue in 2FQ21. Last quarter, Commvault introduced annual recurring revenue or ARR, defined as the annualized value of recurring revenue streams at a point in time. As of September 30, ARR increased 9% Y/Y to $483 million.

Large deals represented 66% of software revenue in the quarter, compared to 64% a year ago. Revenue from software transactions over $100,000 increased 8% Y/Y to $48 million. The volume of these transactions increased 11% Y/Y. Average deal size was $319,000. Revenue from these large deals grew across all three regions.

The vendor also saw a rebound in deals under $100,000, revenue from these transactions grew both Q/Q and Y/Y with improvements in Americas and EMEA.

For 3FQ21, Commvault expects global sales of $174 million to $176 million - up 2% to 3% quarterly, respectively -, and software and products revenue of $77 million to $79 million - up 7% to 9% quarterly, respectively.

Revenue and net income (loss) for Commvault in $million

| Fiscal period | Revenue | Y/Y growth |

Net income (loss) |

| FY15 | 607.5 | 4% | 25.7 |

| FY16 | 595.1 | -2% | 0.1 |

| FY17 | 650.5 | 9% | 0.5 |

| 1Q18 | 166.0 | 9% | (0.3) |

| 2Q18 | 168.1 | 5% | (1.0) |

| 3Q18 | 180.4 | 8% | (59.0) |

| 4Q18 | 184.9 | 11% | (1.7) |

| FY18 | 699.4 | 8% | (61.9) |

| 1Q19 | 176.2 | 6% |

(8.6) |

| 2Q19 | 169.1 | 1% |

0.9 |

| 3Q19 | 184.3 | 2% |

13.4 |

| 4Q19 |

181.4 | -2% |

(2.2) |

| FY19 | 711.1 | 2% |

3.6 |

| 1Q20 | 162.2 | -8% | (6.8) |

| 2Q20 | 167.6 | -1% |

(7.1) |

| 3Q20 | 176.4 | -4% | (0.7) |

| 4Q20 | 164.7 | -9% | (5.6) |

| FY20 |

670.9 |

-6% |

(5.6) |

| 1Q21 |

173.0 | 7% |

2.3 |

| 2Q21 |

171.1 | 2% |

(41.2) |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter