Commvault: Fiscal 4Q20 Financial Results

Impacted by Covid-19, company shrinking with sales down 9% Y/Y and 7% Q/Q, bad outlook for 1FQ21

This is a Press Release edited by StorageNewsletter.com on May 13, 2020 at 2:22 pm| (in $ million) | 4Q19 | 4Q20 | FY19 | FY20 |

| Revenue | 181.4 | 164.7 | 711.0 | 670.9 |

| Growth | -9% | -6% | ||

| Net income (loss) | (2.2) | 8.9 | 3.6 | (5.6) |

Commvault Systems, Inc. announced its financial results for the fourth quarter and fiscal year ended March 31, 2020.

“We remain focused on keeping our employees safe while supporting customers during these challenging times,” Commvault president and CEO Sanjay Mirchandani. “Like most, our quarterly results were impacted by the pandemic. However, we are confident in the long-term opportunities for the company, our strategy, and our return to profitable growth. Our products are mission critical; our large enterprise customer base remains strong; and our employees are resilient. All of this, when combined with our financial stability, will enable us to weather these challenges and continue to deliver industry-leading solutions to our customers.”

Total revenues for 4FQ20 were $164.7 million, a decrease of 9% Y/Y and 7% Q/Q.

Software and products revenue in 4FQ20 was $66.4 million, a decrease of 18% Y/Y and 13% Q/Q. Software and products revenue excludes approximately $10.0 million of completed subscription renewals that will be recognized in 4FQ21, when the current subscriptions are due to expire. Services revenue in 4FQ20 was $98.3 million, a decrease of 2% Y/Y and 1% Q/Q.

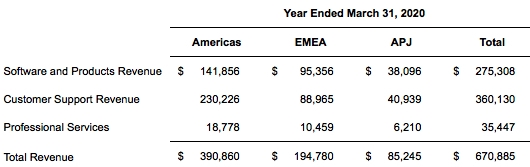

For FY20, total revenues were $670.9 million, a decrease of 6% from FY19.

Software and products revenue for FY20 was $275.3 million, a decrease of 11% from fiscal 2019. Services revenue for FY20 was $395.6 million, a decrease of 1% from FY19.

On a GAAP basis, loss from operations (EBIT) was $2.2 million for 4FQ20 compared to income of $0.3 million in 4FQ19. Non-GAAP income from operations (EBIT) was $18.3 million in 4FQ20 compared to $30.9 million in 4FQ19.

On a GAAP basis, loss from operations (EBIT) for FY20 was $17.5 million. Non-GAAP income from operations (EBIT) was $87.5 million in FY20 compared to $111.9 million in FY19.

For 4FQ20, the company reported net income of $8.9 million, which includes the recognition of approximately $10.0 million of tax benefits related to net operating losses it can carry back as a result of the CARES Act. Non-GAAP net income for 4FQ20 was $13.8 million, or $0.30 per diluted share.

For FY20, the firm reported a net loss of $5.6 million, Non-GAAP net income of $67.5 million, or $1.45 per diluted share.

Operating cash flow totaled $32.5 million for 4FQ20 compared to $36.6 million in 4FQ19. For FY20, operating cash flow was $88.5 million, compared to $110.2 million for FY19.

Total cash, restricted cash and short-term investments were $339.7 million as of March 31, 2020.

During 4FQ20, Commvault repurchased $37.2 million of common stock (872,000 shares), bringing the FY20 total repurchases to $77.2 million (1,700,000 shares).

Comments

Global fiscal year revenue is decreasing continously since FY18.

For FY20, subscription revenue exceeded 40% of software and products revenue compared to less than 10% in FY17. Remember the company began its transition to a more subscription-based recurring revenue model in FY18.

For FY20, services revenue was $396 million, down 1% Y/Y, and expenses declined 3% Y/Y to $459 million.

In 4FQ20, Commvault added 150 subscription customers and revenues now represent over 40% of software product revenue.

President and CEO Sanjay Mirchandani commented: "We expected a carry that momentum into 4FQ20 but Covid impacted APJ and EMEA throughout the quarter then extended to the Americas in March. (...) During the quarter, we made some prudent short-term adjustments to our expense structure to align with the current revenue environment, most notably a temporary reduction of salaries."

The average tenure of customers is 9 years and historical maintenance rates are approximately 90% across customer base, it's even 97% among our Top 100 customers.

Outlook for 1FQ21

Brian Carolan, CFO, stated: "Given the uncertainty and limited visibility associated with Covid-19, we are being measured with our outlook. At this time, it's simply not possible to predict when we might return to a more normal business environment. Having said this, we have several factors that provide underlying support for existing revenue base. For example, over 70% of our revenue is recurring in nature. Approximately two-thirds of new software sales are to existing customers and subscription renewals represent a growing and more predictable part of our sales motion."

For 1FQ21, the company expects total revenue of $150 million to $155 million including $58 million to $62 million of software and products revenue. Revenue outlook is underpinned by the renewal of two of firm's largest subscription customers. These renewals were signed in 4FQ20 before their contract expiration and will represent combined software revenue of approximately $10 million in 1FQ21.

Revenue and net income (loss) for Commvault in $million

| Fiscal period | Revenue | Y/Y growth |

Net income (loss) |

| FY15 | 607.5 | 4% | 25.7 |

| FY16 | 595.1 | -2% | 0.1 |

| FY17 | 650.5 | 9% | 0.5 |

| 1Q18 | 166.0 | 9% | (0.3) |

| 2Q18 | 168.1 | 5% | (1.0) |

| 3Q18 | 180.4 | 8% | (59.0) |

| 4Q18 | 184.9 | 11% | (1.7) |

| FY18 | 699.4 | 8% | (61.9) |

| 1Q19 | 176.2 | 6% |

(8.6) |

| 2Q19 | 169.1 | 1% |

0.9 |

| 3Q19 | 184.3 | 2% |

13.4 |

| 4Q19 |

181.4 | -2% |

(2.2) |

| FY19 | 711.1 | 2% |

3.6 |

| 1Q20 | 162.2 | -8% | (6.8) |

| 2Q20 | 167.6 | -1% |

(7.1) |

| 3Q20 | 176.4 | -4% | (0.7) |

| 4Q20 | 164.7 | -9% | (5.6) |

| FY20 |

670.9 |

-6% |

(5.6) |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter