Western Digital: Fiscal 1Q26 Financial Results

Revenue of $2.8 billion, up 27% YoY and up 8% QoQ

This is a Press Release edited by StorageNewsletter.com on October 31, 2025 at 2:02 pmFiscal Q1 2026 Highlights:

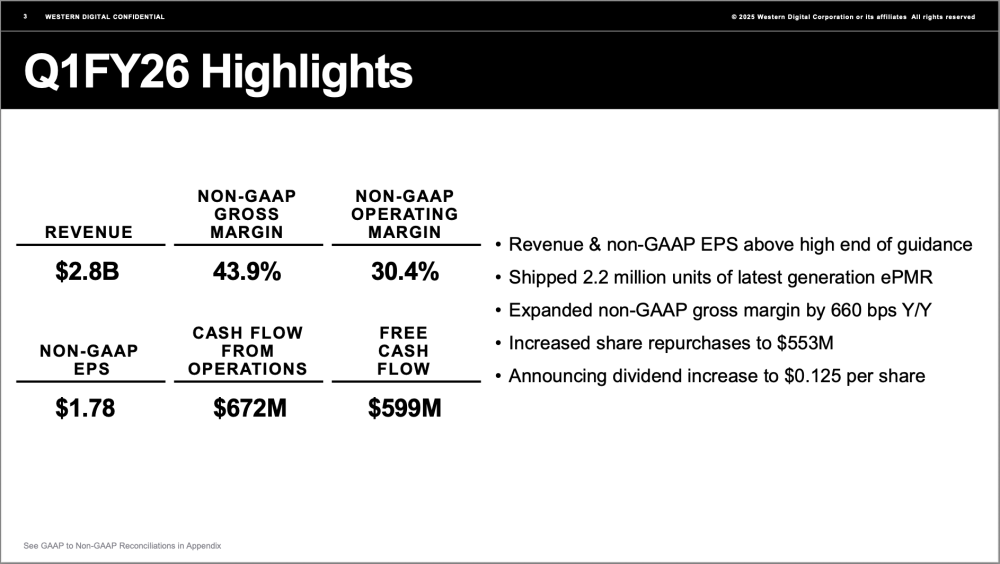

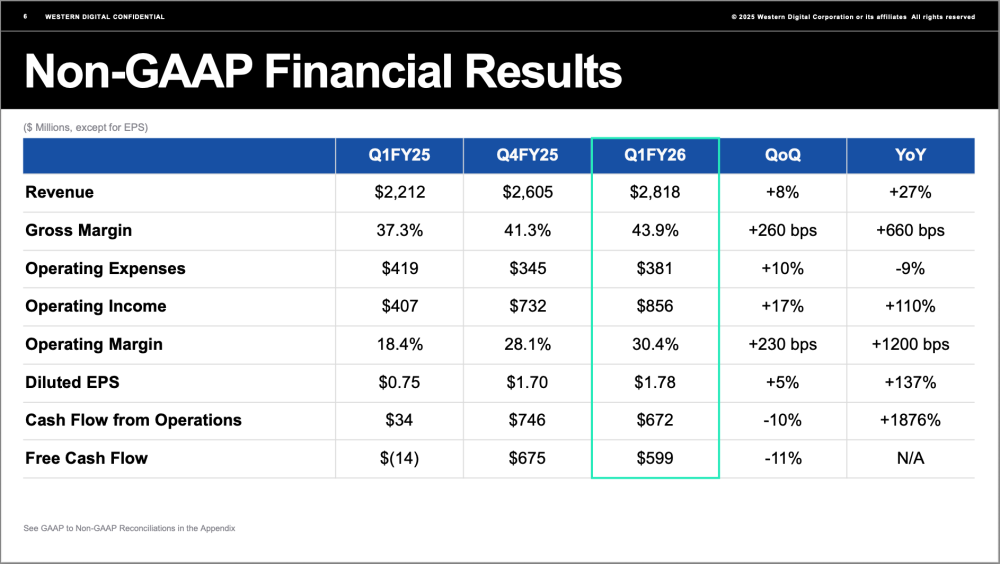

- Revenue of $2.82 billion, up 27% YoY

- GAAP diluted EPS of $3.07 and non-GAAP diluted EPS of $1.78

- Cash flow from operations of $672 million; free cash flow of $599 million

- Q2FY26 revenue expected to be up 20% YoY at mid-point

Western Digital Corp. reported fiscal first quarter 2026 financial results for the period ended October 3, 2025.

Click to enlarge

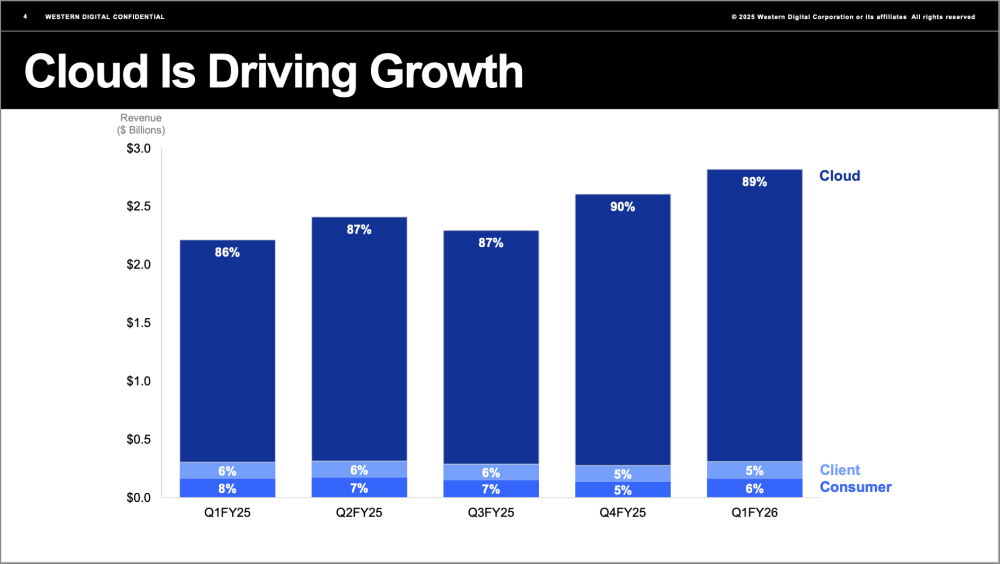

“Western Digital continues to execute well in a strong demand environment driven by growth of data storage in the cloud. In our fiscal first quarter, we achieved revenue and gross margin above the high end of our guidance range, while delivering strong free cash flow,” said Irving Tan, CEO, Western Digital. “As AI accelerates data creation, Western Digital’s continued innovation and operational discipline position us well to capture new opportunities and drive sustained shareholder value. Reflecting confidence in the company’s strong business momentum, the Board of Directors has increased the quarterly cash dividend on the company’s common stock by 25% to $0.125 per share.”

Click to enlarge

Click to enlarge

Dividend

Western Digital’s Board of Directors declared a cash dividend of $0.125 per share of the company’s common stock, which will be paid on December 18, 2025 to stockholders of record as of the close of business on December 4, 2025.

Business Outlook for Fiscal Second Quarter of 2026

“We expect continued revenue growth driven by data center demand, and improved profitability led by the adoption of our high-capacity drives. For our fiscal second quarter of 2026, at the mid-point of the ranges provided in the table below, we expect revenues of $2.9 billion, non-GAAP gross margin of 44.5%, with non-GAAP EPS of $1.88,” said Kris Sennesael, CFO, Western Digital.

Comments

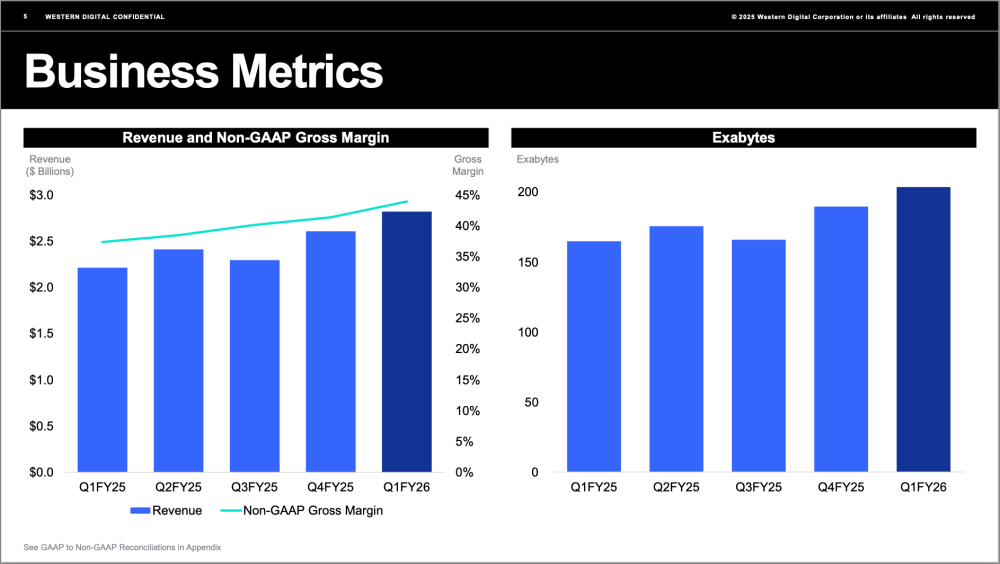

The two HDD giants - Seagate with financial results published yesterday in our article and Western Digital today - offer a pretty similar trajectory with these figures, WDC presents a sequential growth of 8% and 27% YoY and the revenue is almost the same as well. The nearline activity generated $2.51 billion for 183EB shipped.

The revenue approaches the $3 billion mark per quarter which approximately means an annual revenue in the range of $11-12 billion this year confirming a solid growth from $9.52B for FY24. Last 6 months delivers $5.42 billion. Next quarter will be interesting to see as it will give a full HDD view following the split with Sandisk earlier this year.

It reflects the solid demand for HDD products by cloud providers and hyperscalers in particular wishing to select dense drives, more capacity on the same footprint, with an attractive $/TB. Again the revenue profile is really unbalanced as client and consumer business appear to be anecdotic even if they grew marginally.

Click to enlarge

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter