SK hynix: Fiscal 1Q24 Financial Results

SK hynix: Fiscal 1Q24 Financial Results

Revenue marking all-time high for first quarter, up 144% Y/Y, back to profit

This is a Press Release edited by StorageNewsletter.com on April 26, 2024 at 2:02 pm

| (in KRW billion) | 1Q23 | 1Q24 | Growth |

| Revenue |

5,088 | 12,430 | 144% |

| Net income (loss) | (2,586) | 1,917 |

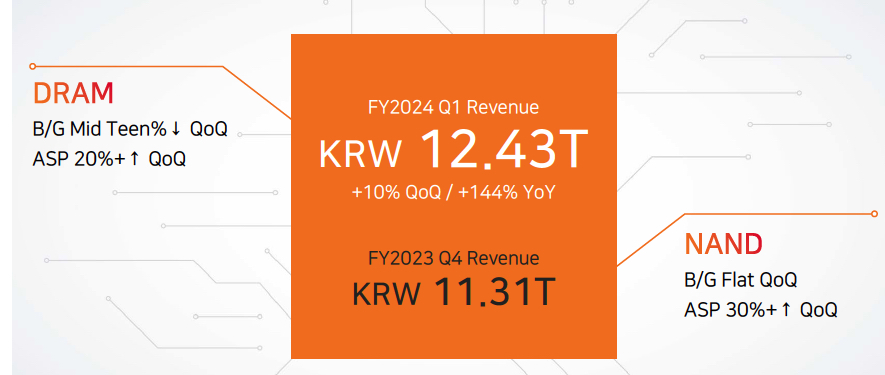

- Revenue at 12.43 trillion won, operating profit at 2.886 trillion won, net profit at 1.917 trillion won

- 1FQ24 revenue all-time high, operating profit 2nd highest for 1FQ24 result

- NAND turns around on rise in eSSD sales, product prices

- To continue to work towards improving earnings with leadership in AI memory

SK hynix Inc. recorded 12.43 trillion won in revenues, 2.886 trillion won in operating profit (with an operating margin of 23%), and 1.917 trillion won in net profit (with a net margin of 15%) in 1FQ24.

With revenue marking an all-time high for a first quarter and the operating profit a 2nd-highest following the records of 1FQ18, it believes that it has entered the phase of a clear rebound following a prolonged downturn.

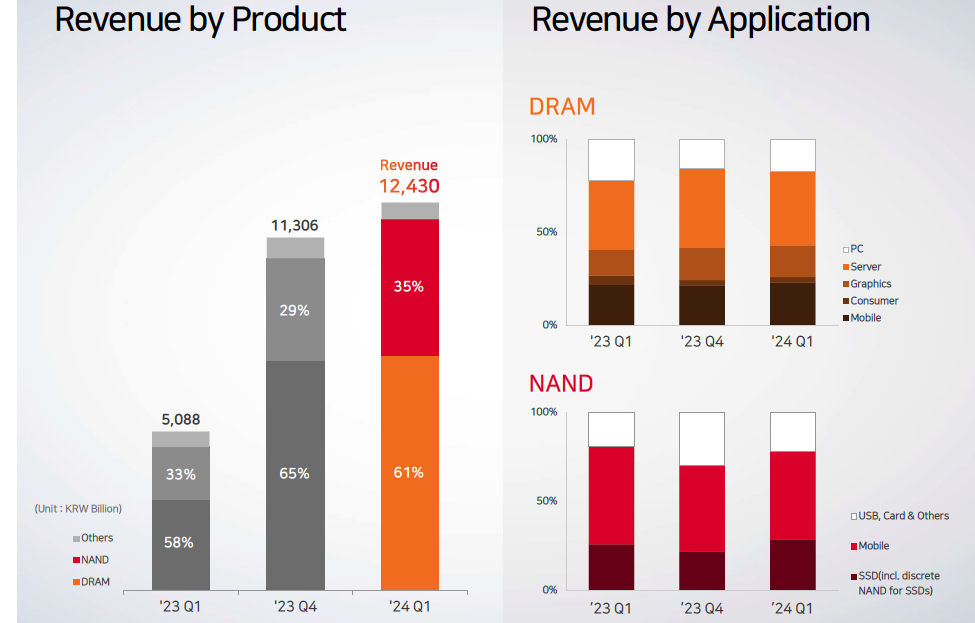

It said that an increase in the sales of AI server products backed by its leadership in AI memory technology including HBM and continued efforts to prioritize profitability led to a 734% on-quarter jump in the operating profit. With the sales ratio of eSSD, a premium product, on the rise and the ASPs rising, the NAND business has also achieved a meaningful turnaround in the same period.

The company forecasts the overall memory market to be on a steady growth path in coming months as demand for AI memory continues to rise, while the market for the conventional DRAM also starts to recover from the second half. Industry experts believe that inventories both at suppliers and customers will decrease as an increase in production of premium products such as HBM requires higher production capacities than conventional DRAM, resulting in a relative reduction in conventional DRAM supply.

In the DRAM space, the company plans to increase supply volume of HBM3E, of which mass production has started in March for the first time in the industry, while expanding the customer base. It will also introduce 32Gb DDR5 products based on the 1bnm process, the 5th generation of the 10nm technology, within this year to strengthen its leadership in the high-capacity server DRAM market.

For the NAND business, the firm will seek product optimization to sustain the trend of earnings recovery. It will aggressively increase the sales of both high-performance 16-channel eSSD, an area where the company has a technological edge, and QLC-based high-capacity eSSD by its U.S. subsidiary Solidigm. It will also launch the 5th generation of the PCIe cSSD for AI PCs at an early time in order to respond to market demands with an optimized product lineup.

Separately, it announced earlier that it will accelerate the process to build the M15X fab in Cheongju, North Chungcheong Province, to expand DRAM production capacities.

Aside from the M15X fab, it will also carry out investments in advanced packaging facilities in Indiana and the Yongin Semiconductor Cluster as planned over the longer term.

With sizeable investments planned, the overall capital expenditure for this year is expected to be larger than initially planned at the beginning of 2024. In addition to the plan to increase investment to meet rising customer demand, SK hynix will also boost supply of conventional DRAM in line with market trend, which it expects to lead to a steady growth of the global memory market and an improved investment efficiency and financial soundness of the company.

“With the industry’s best technology in the AI memory space led by HBM, we have entered a clear recovery phase,” CFO Kim Woohyun said. “We will continue to work towards improving our financial results by providing the industry’s best performing products at a right time and maintaining the profitability-first commitment.”

Comments

Revenue analysis

Production

- Memory industry is gradually recovering utilization on back of healthy AI memory demand

- Upgrade investments essential to increase level of wafer production, as demand is centered on advanced node products

- Expect limited DRAM/NAND production growth in ‘24, as a result of conservative investments in ‘23, and more capacity allocated to produce HBM which has larger die size

HBM3E/HBM4

- In March, began mass production/supply of 1bnm HBM3E

- Increase HBM3E supply in-line with customers’ demand

- Expand customer base using increased production capability

- Signed MOU with TSMC for development of HBM4 and collaboration on next gen packaging technology

DDR5

- Represent 45%+ of PC, 60%+ of SV bit sales

- Strong sales of 128GB+ modules contributed to DDR5 sales

- 1bnm 32Gb DDR5 product to be launched to support high-density SV DRAM demand

NAND

- Sales of high-performance 16ch eSSD increased in 1FQ24

- Solidigm's QLC-based high density eSSD will increase in demand due to growing needs for high performance, high density and power efficient storage solution for AI use

- Plan to launch PCIe Gen5 cSSD within ‘24 for adoption in AI PCs

In trillion won

| Period | Revenue | Net income (loss) |

| 1FQ22 | 12,156 | 1,987 |

| 2FQ22 | 12,811 | (2,881) |

| 3FQ22 | 10,983 | (2,185) |

| 4FQ22 | 7,699 | (3,524) |

| FY22 | 44,622 | 2,242 |

| 1FQ23 | 5,088 | (2,586) |

| 2FQ23 | 7,306 | (2,988) |

| 3FQ23 | 9,066 | 1,108 |

| 4FQ23 | 11,306 | (1,380) |

| FY23 | 32,766 | (9,138) |

| 1FQ24 | 12,430 | 1,917 |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter