SK hynix: Fiscal 4Q23 Financial Results

SK hynix: Fiscal 4Q23 Financial Results

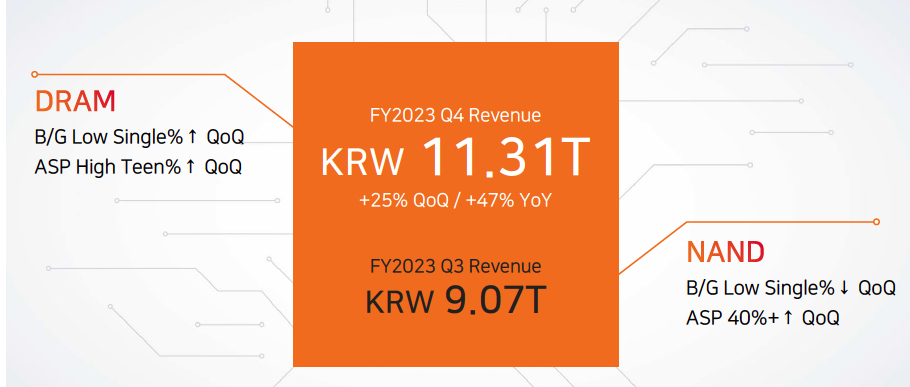

Sales up 25% Q/Q and 47% Y/Y for ≠1 WW storage company, but not profitable

This is a Press Release edited by StorageNewsletter.com on January 29, 2024 at 2:02 pm| (in KRW billion) | 4Q22 | 4Q23 | FY22 | FY23 |

| Revenue | 9,066 | 11,306 | 44,622 | 32,766 |

| Growth | 25% | -27% | ||

| Net income (loss) | (3,735) | (1,380) | 2,242 | (9,138) |

- Reports first quarterly profit in a year, backed by demand recovery, industry rebound

- Revenue for 2023 at 32.77 trillion won, operating loss at 7.73 trillion won

- Aims to grow into ‘total AI memory provider’ of optimal memory solutions

SK hynix Inc. recorded an operating profit of 346 billion won in 4FQ23 amid a recovery of the memory chip market, marking the first quarter of profit following 4 straight quarters of losses.

The company posted revenues of 11.31 trillion won, operating profit of 346 billion won (operating profit margin at 3%), and net loss of 1.38 trillion won (net profit margin at negative 12%) for the 3 months ended December 31, 2023. (Based on K-IFRS)

It said that the overall memory market conditions improved in 4FQ23 with demand for AI server and mobile applications increasing and ASP rising.

“We recorded the first quarterly profit in a year following efforts to focus on profitability,” it said.

The financial results of the last quarter helped narrow the operating loss for the entire year to 7.73 trillion won (operating profit margin at negative 24%) and net loss to 9.14 trillion won (with net profit margin at negative 28%). The revenue was 32.77 trillion won.

The company said that sales of its main products, DDR5 and HBM3, increased by more than 4x and 5x, respectively, compared with a year earlier, as it took advantage of its market-leading technology in the DRAM space to actively respond to customer demand. In the NAND space, where a recovery is relatively slow, it prioritized streamlining investments and costs.

It will now proceed with mass production of HBM3E, a main AI memory product, and ongoing development of HBM4 smoothly, while supplying high-performance, high-capacity products such as DDR5 and LPDDR5T to server and mobile markets in a timely manner, to meet increasing demand for high-performance DRAM.

It also plans to make its technological leadership stronger by preparing high-capacity server module MCRDIMM1 and mobile module LPCAMM22 to respond to ever-increasing demand for AI server and on-device AI adoption.

- 1MCR DIMM (Multiplexer Combined Ranks Dual In-line Memory Module): A module product with multiple DRAMs bonded to a motherboard, in which 2 ranks, basic information processing units, operate simultaneously, resulting in improved speed

- 2LPCAMM2 (Low Power Compression Attached Memory Module 2): LPDDR5X-based module solution that provides power efficiency and high performance as well as space savings. It has the performance effect of replacing two existing DDR5 SODIMMs with one LPCAMM2

For NAND, the company aims to continue to improve profitability and stabilize the business by expanding sales of products such as eSSD.

For FY24, it will focus on improving profitability and efficiency through sales of value-added products, while minimizing an increase in capital expenditure for a stable operation of the business.

“We achieved a remarkable turnaround, marking the first operating profit in 4FQ23 following a protracted downturn, thanks to our technological leadership in the AI memory space,” said Kim Woohyun, VP and CFO. “We are now ready to grow into a total AI memory provider by leading changes and presenting customized solutions as we enter an era for a new leap forward.“

Comments

Even if revenue decreased 37% for FY23, SK hynix, in DRAM and flash chips, remains the biggest WW storage company with sales equivalent to $24,507 million for the year, followed by Micron, WD and Dell.

Revenue analysis

In 4FQ23, there was a notable growth in demand for HBM and high-density DDR5 for AI servers as well as mobile memory from our customers in the Greater China region. As a result, not only DRAM but NAND prices also turned positive, further improving the memory market environment.

Driven by the increased pricing of memory products, 4FQ23 revenue reached KRW11.31 trillion, up 25% Q/Q and 47% Y/Y. For DRAM, firm's focus was on enhancing profitability rather than increasing shipment volume by expanding sales of high value-added products such as HBM and high-density DDR5. The company saw a low single-digit increase in DRAM shipments compared to the previous quarter, albeit lower than the initial guidance. Meanwhile, the ASP rose by high-teen percent sequentially surpassing the growth rate in the previous quarter. For NAND, it reduced sales of low-margin products, while expanding sales of mobile and eSSD products. As a result, bit shipment decreased by low single-digits sequentially, outperforming our earlier guidance.

The ASP rose by over 40%, driven by price increases across all application products and a higher contribution from higher-priced solution products. With stronger pricing, SK hynix saw profitability improve and previously recognized inventory valuation losses were further reversed. As a result, 4FQ23 operating profit was KRW 0.35 trillion with an operating profit margin of 3%, marking a turnaround after a full year of losses.

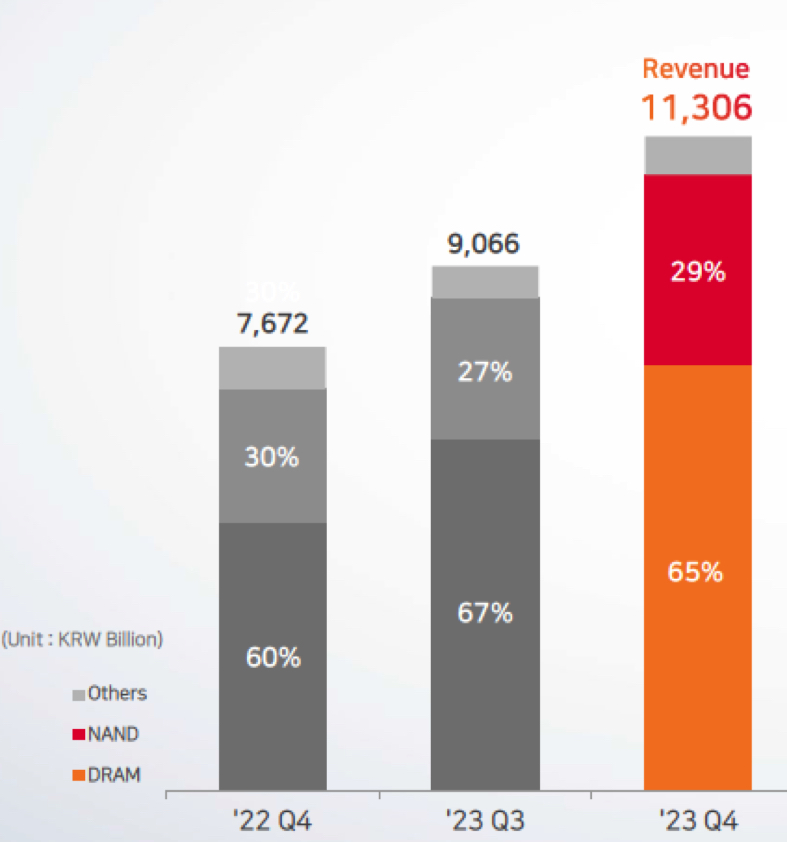

Revenue by product

* Revenue by product portion is based on KRW, Solidigm results consolidated from 1FQ22

All figures above are rounded to KRW billions, leading to some statements not adding up completely

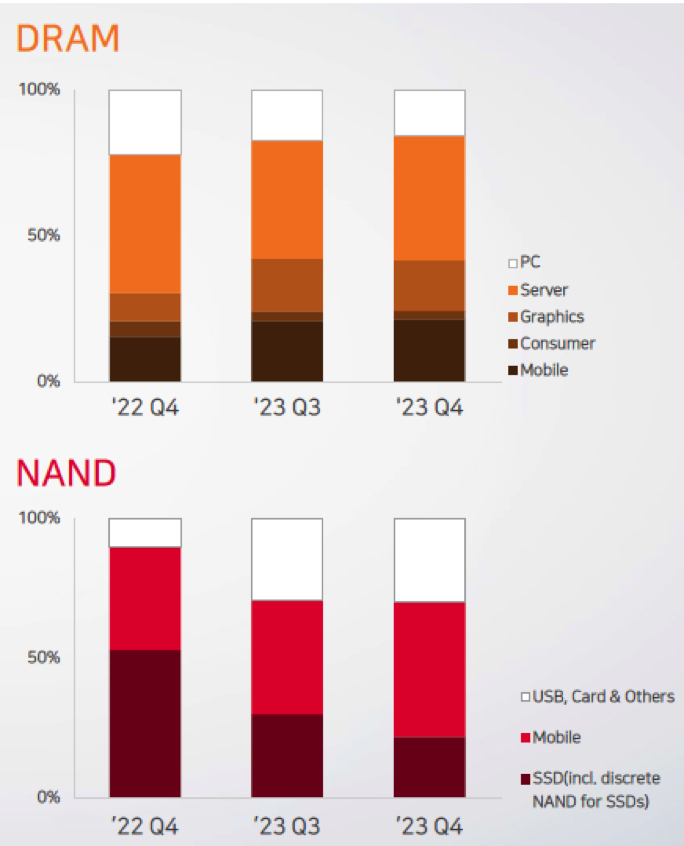

Revenue by application

* Revenue by application is based on US$ revenue of SKH (excluding Solidigm)

Company plan for 1FQ24

DRAM

- Bit sales growth: decrease by single percentage Q/Q

- Continuous improvement in price environment

NAND

- Bit sales growth: Increase by mid-teen percentage Q/Q (included Solidigm)

- Continuous improvement in price environment

This year's demand growth for DRAM and NAND is expected to be in the mid- to high-teen percent, respectively. And the company plans to respond flexibly to grow in line with market growth level. Despite seasonality in demand, it anticipates continued price improvement in 1FQ24 and intend to maintain a focus on profitability in its operations. Consequently, it expect a mid-teen percent decrease in DRAM shipments Q/Q with the potential for further profit expansion driven by favorable pricing. For NAND, it anticipates a mid-single-digit increase in bit Q/Q, as NAND pricing improvement is also expected to continue.

In trillion won

| Period | Revenue | Net income (loss) |

| 1FQ22 | 12,156 | 1,987 |

| 2FQ22 | 12,811 | (2,881) |

| 3FQ22 | 10,983 | (2,185) |

| 4FQ22 | 7,699 | (3,524) |

| FY22 | 44,622 | 2,242 |

| 1FQ23 | 5,088 | (2,586) |

| 2FQ23 | 7,306 | (2,988) |

| 3FQ23 | 9,066 | 1,108 |

| 4FQ23 | 11,306 | (1,380) |

| FY23 | 32,766 | (9,138) |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter