SK hynix: Fiscal 1Q23 Financial Results

SK hynix: Fiscal 1Q23 Financial Results

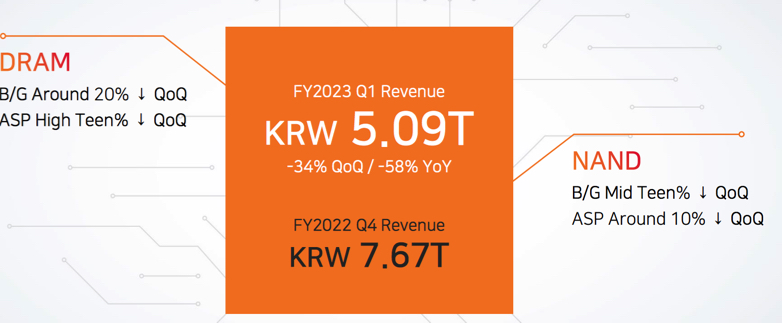

Sales down as much as 34% Q/Q and 58% Y/Y, and not profitable, but revenue expected to improve in 2FQ23

This is a Press Release edited by StorageNewsletter.com on April 27, 2023 at 2:02 pm| (in billion KRW) | 1Q22 | 1Q23 | Growth |

| Revenue |

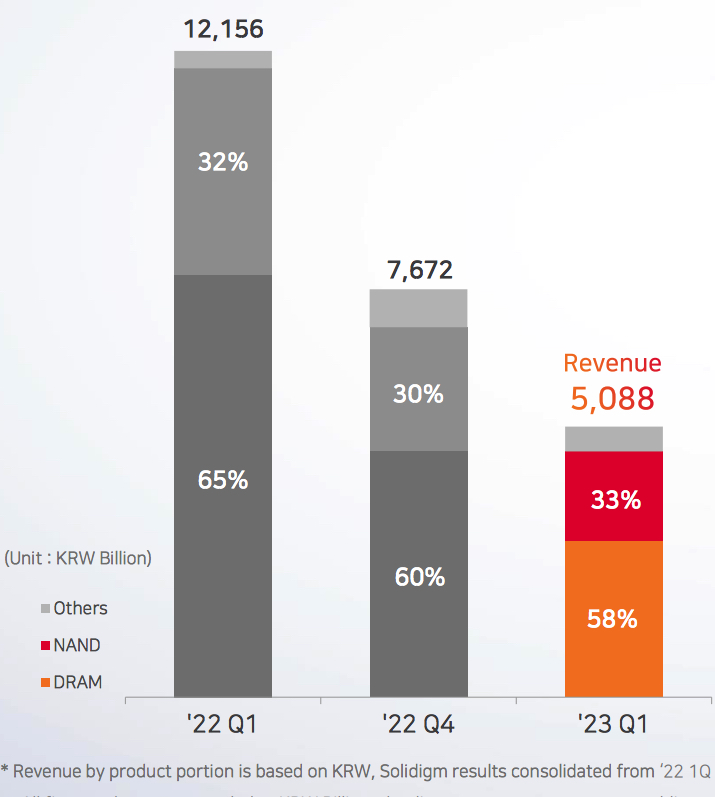

12,156 | 5,088 | -58% |

| Net income (loss) | 1,987 | (2,586) |

• Revenues at 5.088 trillion won, operating loss at 3.402 trillion won, net loss at 2.586 trillion won

• Operating loss continues due to weak demand and price fall of memory chips; revenue expected to improve in 2FQ23

• “Company to lead premium memory market with products including DDR5, LPDDR5, HBM3“

SK hynix Inc. reported financial results for the first quarter ended March 31, 2023.

The company recorded revenues of 5.088 trillion won, operating loss of 3.402 trillion won (with operating margin of negative 67%), and net loss of 2.586 trillion won (with net profit margin of negative 51%) in 1FQ23.

“As the memory chip downturn continued through the first quarter, the company posted a sequential drop in revenues and widened operating loss on sluggish demand and falling products prices,” company said. “But we expect revenues to rebound in the second quarter after bottoming out in the first, driven by a gradual increase in sales volume.”

The company forecasts an improvement in market conditions from 2H23, as memory inventory levels at customers declined throughout 1FQ23, while inventory across the memory industry is expected to improve from 2FQ23 with production cut by suppliers taking into effect.

The company also expects the growing high-performance server market for AI including ChatGPT and a wider adoption of high-capacity memory products by customers to have positive impact on the market.

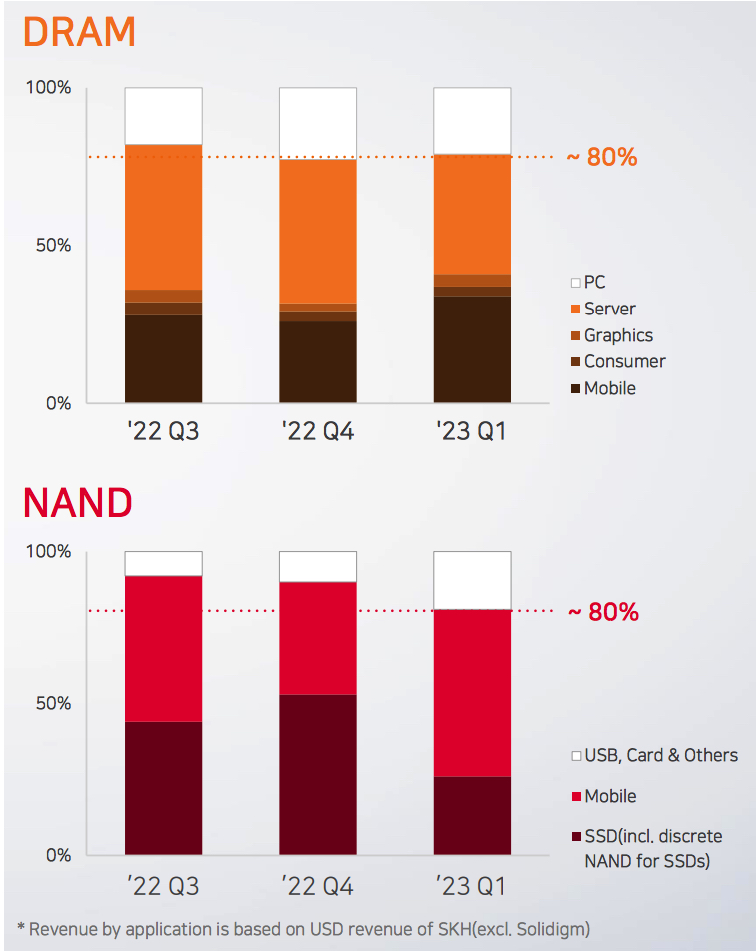

The company, accordingly, plans to focus on the sales of high-performance DRAM products including server DDR5 and HBM, as well as 176-layer SSD and uMCP products in NAND, and plans to maintain investments in high-end memory products that are believed to change the landscape of the memory market, such as chips for AI, even as the company cuts capital expenditure.

Moreover, the company will invest for mass production readiness of 1b nanometer DRAM (the 5th gen of 10nm technology) and 238-layer NAND to support a quick business turnaround once the market conditions improve.

“With SK hynix having secured a top-notch competitiveness for the lineup of products, of which growth in demand is materializing from this year, such as DDR5/LPDDR5 and HBM3, the company will solidify its leadership in the premium market by increasing the sales volume of such products,” said Kim Woohyun, CFO. “The memory market, which is still under tough conditions, seems to be bottoming out. We will make all efforts to restore the corporate value by focusing on improving profitability and technology development as we believe that the market will soon find a balance.”

Comments

One of the biggest WW storage company in front of Micron, WD and Dell, SK hynix records a poor quarter with sales at KRW 5,088 billion ($3.448 billion) down as much as 34% Q/Q and 58% Y/Y, being also not profitable, but expects revenue to improve in 2FQ23.

For the former quarter (4FQ22), no more brilliant, sales were down 38% Y/Y and the firm registered its first net loss in 3 years.

Revenue analysis

Revenue by product

Revenue by application

Company plan

DRAM

B/G

- Flexible response to customers' demand by actively shifting product mix

- Double digit percentage increase Q/Q in 2FQ23

Tech

- Proactively support DDR5/LPDDR5 demand

- Yield of all 1anm products reached stable levels

NAND

B/G

- Flexible response to customers' demand by actively shifting product mix

- Double digit percentage increase Q/Q in 2FQ23

(Solidigm included)

Tech

- Expand sales of 176L SSD/uMCP products

- Yield of all 176L products reached stable levels

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter