Micron: Fiscal 1Q24 Financial Results

Micron: Fiscal 1Q24 Financial Results

Revenue up 16% Q/Q with huge loss, excellent outlook

This is a Press Release edited by StorageNewsletter.com on December 22, 2023 at 2:03 pm| (in $ million) | 1Q23 | 1Q24 | Growth |

| Revenue |

4,085 | 4,726 | 16% |

| Net income (loss) | (195) | (1,234) |

Micron Technology, Inc. announced results for its first quarter of fiscal 2024, which ended November 30, 2023.

Fiscal 1FQ24 highlights

- Revenue of $4.73 billion vs. $4.01 billion for 4FQ23 and $4.09 billion for 1FQ23

- GAAP net loss of $1.23 billion, or $1.12 per diluted share

- Non-GAAP net loss of $1.05 billion, or $0.95 per diluted share

- Operating cash flow of $1.40 billion versus $249 million for 4FQ23 and $943 million for 1FQ23

“Micron’s strong execution and pricing drove better-than-anticipated first quarter financial results,” said president and CEO Sanjay Mehrotra. “We expect our business fundamentals to improve throughout 2024, with record industry TAM projected for calendar 2025. Our industry leading High Bandwidth Memory for data center AI applications illustrates the strength of our technology and product roadmaps, and we are well positioned to capitalize on the immense opportunities artificial intelligence is fueling across end markets. ”

Outlook for 2FQ24: Revenue $5.30 billion ± $200 million or between 8% and 16% Q/Q.

Comments

Micron delivered in 1FQ24 revenue, gross margin, and EPS higher than the upper end of the guidance range provided in its last earnings call.

Total 1FQ24 sales were approximately $4.7 billion, up 18% Q/Q and 16% Y/Y, as guidance was $4.4 billion ± $200 million.

During the quarter, an improving supply-demand environment and team's strong execution resulted in higher prices across DRAM and NAND.

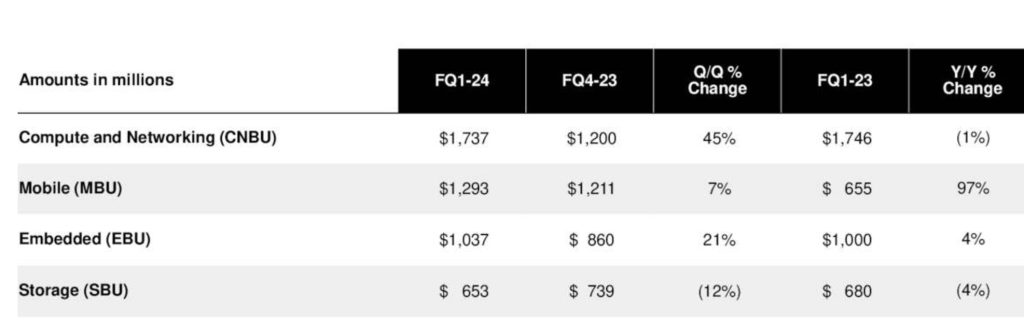

Revenue by business unit

Revenue for the storage business unit was $653 million, down 12% Q/Q due to sharply lower consumer component sales, partially offset by strong growth in SSD revenue.

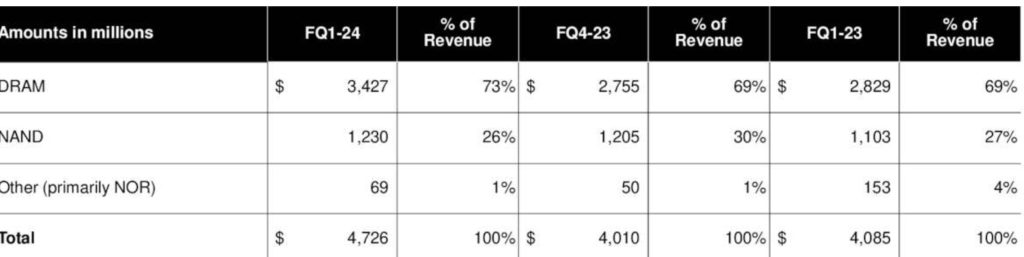

Revenue by technology

DRAM

1FQ24 DRAM revenue was $3.4 billion, representing 73% of total revenue. It increased 24% Q/Q, with bit shipments increasing in the low-20s percentage range and prices increasing in the low-single-digit percentage range.

NAND

1FQ24 NAND revenue was $1.2 billion, representing 26% of total revenue. It increased 2% Q/Q with pricing more than offsetting an expected and communicated decline in volumes. Bit shipments declined in the mid-teens percentage range after record shipments in 4FQ23, and prices increased by approximately 20%. Portfolio mix improvements in NAND contributed to the increase.

In 1FQ24, the firm achieved record bit shipments in both client and consumer SSDs, as customers adopted company's solutions. Building upon QLC leadership, client SSD QLC bit shipments also reached a new record. QLC now comprises the majority of bit shipment mix for both client and consumer SSD.

The manufacturer also began sampling its next-gen 232-layer NAND UFS 3.1 and its 1-beta DRAM 24Gb LP5x to support the memory needs of emerging AI foundational models.

Outlook for 2FQ24:

While the firm remains mindful of macroeconomic risks, the memory and storage market environment is improving. Both DRAM and NAND bit shipments are expected to decline somewhat.

Outlook for FY24 and calendar year 2024:

The firm expects supply-demand balance to tighten in both DRAM and NAND throughout 2024.

Its DRAM and NAND nodes are oversubscribed for the full year. Consequently, the company expects prices to increase through calendar 2024, driving improvements in its financial performance.

It expects pricing to continue to strengthen through the course of calendar 2024, and improved margins and financial performance throughout 2024 and record industry TAM in calendar 2025.

It expects FY24 front-end cost reductions to track in line with its long-term expectations of mid- to high-single-digits in DRAM and low-teens in NAND. It is on track for volume production in 1-gamma DRAM using EUV in calendar 2025.

In data center, total server unit shipments are expected to increase by a mid-single-digit percentage in calendar 2024, following a year of low-double-digit percentage decline in calendar 2023.

Micron's bit supply growth in FY24 is planned to be well below demand growth for both DRAM and NAND, and the company expects to decrease its days of inventory. It expects calendar 2024 industry supply to be below demand for both DRAM and NAND, which will result in a contraction of industry inventory levels.

NAND revenue only

| Period | Revenue in $ million |

Q/Q or Y/Y change for FY |

% of global revenue |

| FY19 | 5,335 | NA | 23% |

| FY20 | 6,131 | 14% | 29% |

| FY21 | 7,007 | 14% | 25% |

| 1FQ22 | 1,878 | -5% | 24% |

| 2FQ22 | 1,957 | 4% | 25% |

| 3FQ22 | 2,300 | 18% | 26% |

| 4FQ22 | 1,688 | -26% | 25% |

| FY22 | 7,811 | 11% | 25% |

| 1FQ23 |

1,103 |

-35% | 27% |

| 2FQ23 | 885 | -20% |

24% |

| 3FQ23 | 1,013 | 14% |

27% |

| 4FQ23 | 1,205 | 19% |

30% |

| FY23 | 4,206 | -46% |

27% |

| 1FQ24 | 1,230 | 2% | 26% |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter