Micron: Fiscal 2Q23 Financial Results

Micron: Fiscal 2Q23 Financial Results

Revenue down 53% Y/Y and huge loss

This is a Press Release edited by StorageNewsletter.com on March 30, 2023 at 2:02 pm| (in $ million) | 2Q22 | 2Q23 | 6 mo. 22 | 6 mo. 23 |

| Revenue | 7,786 | 3,693 | 15,473 | 7,778 |

| Growth | -53% | -50% | ||

| Net income (loss) | 2,263 | (2,312) | 4,569 | (2,507) |

Micron Technology, Inc. announced results for its second quarter of fiscal 2023, which ended March 2, 2023.

2FQ23 highlights

- Revenue of $3.69 billion vs. $4.09 billion for 1FQ23 and $7.79 billion for 2FQ22

- GAAP net loss of $2.31 billion, or $2.12 per diluted share

- Non-GAAP net loss of $2.08 billion, or $1.91 per diluted share

- Inventory write-downs of $1.43 billion, impact of $1.34 per diluted share

- Operating cash flow of $343 million vs. $943 million for 1FQ23 and $3.63 billion for 2FQ22

“Micron delivered fiscal second quarter revenue within our guidance range in a challenging market environment,” said president and CEO Sanjay Mehrotra. “Customer inventories are getting better, and we expect gradual improvements to the industry’s supply-demand balance. We remain confident in long-term demand and are investing prudently to preserve our technology and product portfolio competitiveness.”

Investments in capital expenditures, net were $2.16 billion for 2FQ23, which resulted in adjusted free cash flows of negative $1.81 billion. The company ended 2FQ23 with cash, marketable investments, and restricted cash of $12.12 billion. Board of directors has declared a quarterly dividend of $0.115 per share, payable in cash on April 25, 2023, to shareholders of record as of the close of business on April 10, 2023.

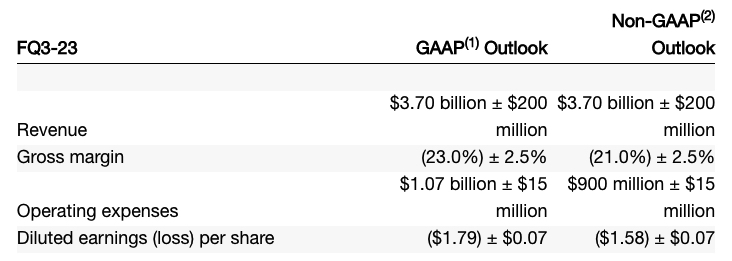

Business Outlook

The table below presents guidance for 3FQ23. This guidance assumes a write down of approximately $500 million associated with inventory produced during the third quarter, impacting both GAAP and non-GAAP diluted earnings (loss) per share by approximately $0.45.

Comments

2FQ23 revenue were $3.7 billion, down 53% Y/Y an 10% Q/Q at low end of guidance ($3.6 and $4.0 billion) and remember that sales decreased already in 1FQ23 as much as 47% Y/Y.

Mehrotra commented: "The semiconductor memory and storage industry is facing its worst downturn in the last 13 years, with an exceptionally weak pricing environment that is significantly impacting our financial performance. We have taken substantial supply reduction and austerity measures, including executing a company wide reduction in force."

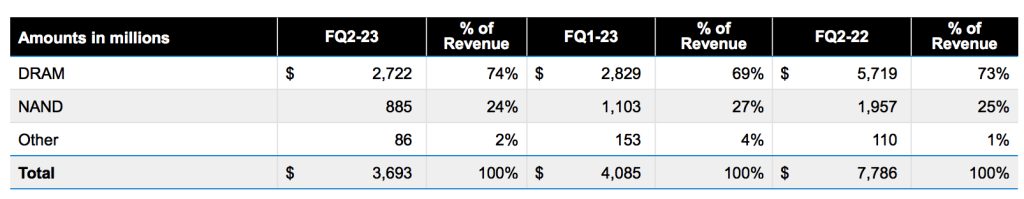

Revenue by technology

DRAM

- 74% of total revenue in 2FQ23

- Revenue down 4% Q/Q

- Bit shipments increased in the mid-teens percent range Q/Q

- ASPs declined approximately 20% Q/Q

NAND

- 24% of total revenue in 2FQ23

- Revenue down 20% Q/Q

- Bit shipments increased in the mid-to-high single-digit percent range Q/Q

- ASPs declined in the mid-20s percent range Q/Q

- 176-layer and 232-layer now represent more than 90% of NAND bit production. QLC accounted for over 20% of NAND bit production and shipments in 2FQ23.

- Qualified Micron 2400 SSD, the only 176-layer QLC SSD qualified at OEMs

- Began volume production and shipments of the fast PCIe Gen4x4 NVMe SSD, for AI and high performance computing workloads

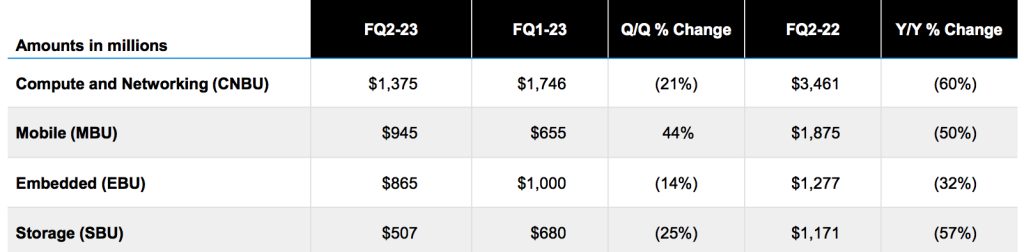

Revenue by business unit

- Compute and networking business unit revenue was $1.4 billion, down 21% Q/Q. On a sequential basis, cloud revenue was down while client revenue was stable.

- Revenue for the mobile business unit was $945 million, up 44% Q/Q. It benefited from the timing of some shipments between 1FQ23 and 2FQ23.

- Embedded business unit revenue was $865 million, down 14% Q/Q. On a sequential basis, automotive markets were relatively stable while industrial and consumer end markets experienced weakness.

- Revenue for the storage business unit was $507 million, down 25% Q/Q, impacted by challenging conditions in the NAND market

Industry outlook

- Expectations for calendar 2023 industry bit demand growth have moderated to approximately 5% in DRAM and low-teens percentage range in NAND, which are well below the expected long-term CAGR of mid-teens percentage range in DRAM and low 20s percentage range in NAND.

- The reduction in calendar 2023 demand from prior forecast is driven by an assessment of customer inventories as well as some degradation in end market demand.

- Micron expects that improving customer inventories will support sequential bit demand growth for DRAM and NAND through the calendar year. China's reopening is also a positive factor for calendar 2023 bit demand.

- Now expects that industry bit supply growth for DRAM and NAND in calendar 2023 will be below demand growth, which will help improve supplier inventories. While the supply demand balance is expected to gradually improve, due to the high levels of inventories, industry profitability and free cash flow are likely to remain extremely challenged in the near term.

- Market recovery can accelerate if there is a Y/Y reduction in production, or in other words, negative DRAM and NAND industry bit supply growth in 2023

Micron's actions and outlook

1. Reducing supply: Made additional reductions to FY23 Capex plan and now expect to invest ~$7 billion, down >40% from last year, with WFE down >50%. In FY24, expects WFE to fall further, as we ramp 1-beta and 232-layer nodes in a capital efficient manner. Has further reduced DRAM and NAND wafer starts, which are now down by ~25%.

2. Furthering cuts to Opex: Now expect overall headcount reduction to approach 15%. This will occur through a combination of workforce reductions - which are now largely complete - as well as anticipated attrition through the remainder of the calendar year.

3. Executing to firm's flat bit share strategy: While have had to reduce price to remain competitive in the market, have not done so in an attempt to gain share, as such share changes at customers are generally transitory.

4. Ensuring liquidity: Strongest balance sheet among the pure play memory and storage companies. Strong liquidity will enable to weather this downturn while ensuring product and technology competitiveness.

Resulting Outlook:

Expect Micron's CY23 Y/Y bit supply growth to be meaningfully negative for DRAM. Firm also expects to produce fewer NAND bits in CY23 than in CY22. Excluding the impact of inventory write-downs, expect Micron's DIO to decline sequentially going forward, from its peak in the second quarter.

Micron expects revenue to be $3.7 billion, plus or minus $200 million; gross margin to be in the range of negative 21.0%, plus or minus 250 basis points; and operating expenses to be approximately $900 million, plus or minus $15 million.

NAND revenue only

| Period | Revenue in $ million |

Q/Q or Y/Y change for FY |

% of global revenue |

| FY19 | 5,335 | NA | 23% |

| FY20 | 6,131 | 14% | 29% |

| 1FQ21 | 1,574 | 3% | 27% |

| 2FQ21 | 1,650 | 5% | 26% |

| 3FQ21 | 1,812 | 10% | 24% |

| 4FQ21 | 1,971 | 9% | 21% |

| FY21 | 7,007 | 14% | 25% |

| 1FQ22 | 1,878 | -5% | 24% |

| 2FQ22 | 1,957 | 4% | 25% |

| 3FQ22 | 2,300 | 18% | 26% |

| 4FQ22 | 1,688 | -26% | 25% |

| FY22 | 7,811 | 11% | 25% |

| 1FQ23 |

1,103 |

-35% | 27% |

| 2FQ23 | 885 | -20% |

24% |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter