Nutanix: Fiscal 1Q24 Financial Results

Nutanix: Fiscal 1Q24 Financial Results

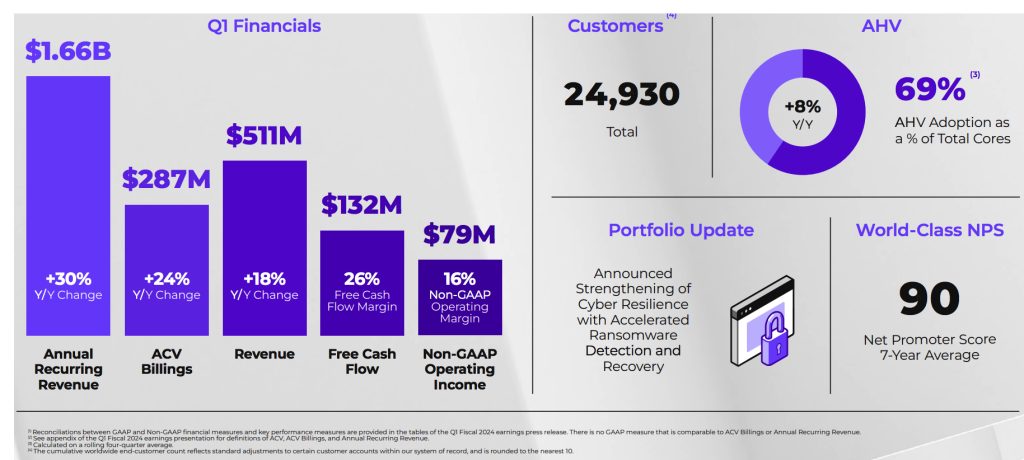

Not far to be profitable for first time since inception in 2012, to surpass $2 billion sales in FY24, good outlook

This is a Press Release edited by StorageNewsletter.com on December 4, 2023 at 2:02 pm| (in $ million) | 1Q23 | 1Q24 | Growth |

| Revenue |

433.6 | 511.1 | 18% |

| Net income (loss) | (99.5) | (15.9) |

Nutanix, Inc. announced financial results for its first quarter ended October 31, 2023.

“We delivered a solid first quarter financial performance vs. an uncertain macro backdrop reflecting the value our customers see in the Nutanix Cloud Platform and the strength of our subscription business model,” said Rajiv Ramaswami, president and CEO. “I’m excited about our future as we look to capitalize on our large and growing market opportunity, favorable industry competitive dynamics, and our ramping partnerships.”

“Our first quarter marked a good start to our fiscal year with 24% Y/Y ACV billings growth along with strong free cash flow generation,” said Rukmini Sivaraman, CFO. “We continue to see good execution and remain focused on driving towards the targets we shared at our recent Investor Day and delivering durable growth and increasing profitability.”

2FQ4 outlook

- ACV billings $295-$305 million

- Revenue $545-$555 million

- Non-GAAP gross margin 85-86%

- Non-GAAP operating margin 14% to 16%

- Weighted average shares outstanding (diluted) approximately 297 million

FY24 Outlook

- ACV billings $1.08-$1.10 billion

- Revenue $2.095-$2.125 billion

- Non-GAAP gross margin ~85%

- Non-GAAP operating margin 11.5% to 12.5%

- Free cash flow $340-$360 million

Comments

Ramaswami commented: "We delivered a solid first quarter with results that came in ahead of our guidance. The uncertain macro backdrop that we saw in our first quarter was largely unchanged compared with the prior quarter. However, we saw a steady demand for our solutions driven by businesses prioritizing their digital transformation and infrastructure modernization initiatives and looking to optimize their TCO."

Revenue in 1FQ24 was a record of $511 million, higher than the guided range of $495 million to $505 million, and growth rate of 18% Y/Y and 3% Q/Q, well ahead of analysts’ estimates of $500.8 million.

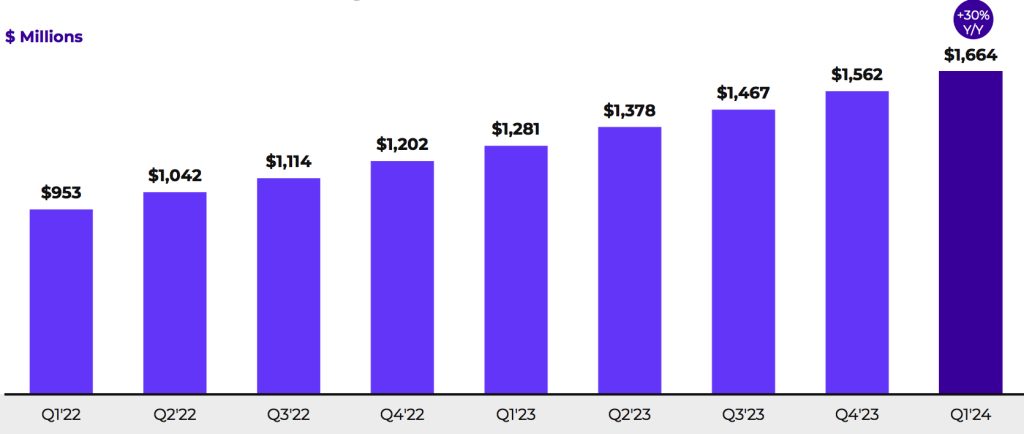

The company exceeds $2 billion ARR for the first time, and grew ARR 30% Y/Y to $1.7 billion.

ARR

It ended 1FQ24 with cash, cash equivalents and short-term investments of $1.571 billion, up from $1.437 billion in 2023.

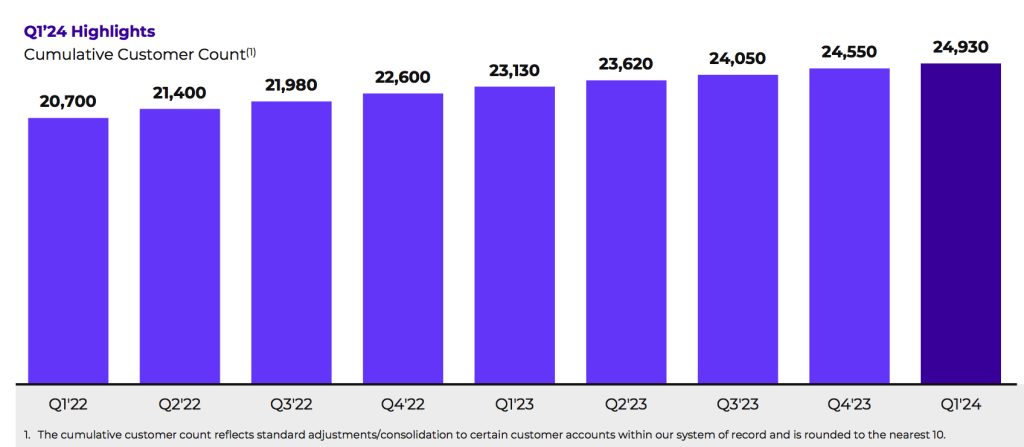

Customer growth

The updated FY24 guidance is higher than the previously provided FY24 guidance across all metrics.

Long-term vision is an ARR CAGR of approximately 20% through FY27 and generation of $700 million to $900 million of free cash flow in FY27.

Revenue and net income (loss)

(in $ million)

| FY ended in July |

Revenue | Net income (loss) |

| 2012 | 6.6 | (14.0) |

| 2013 | 30.5 | (44.7) |

| 2014 | 127.1 | (84.0) |

| 2015 | 241.4 | (126.1) |

| 2016 | 444.9 | (168.5) |

| 2017 | 845.9 | (379.6) |

| 2018 | 1155 | (297.2) |

| 2019 | 1136 | (621.2) |

| 2020 | 1308 | (872.9) |

| 2021 |

1,394 | (1,034) |

| 1FQ22 | 378.5 | (419.9) |

| 2FQ22 | 413.1 | (115.1) |

| 3FQ22 | 403.7 | (111.6) |

| 4FQ22 | 385.5 | (151.0) |

| FY22 |

1,581 | (797.5) |

| 1FQ23 | 443.6 | (99.5) |

| 2FQ23 | 486.5 | NA |

| 3FQ23 | 448.6 | (71.0) |

| 4FQ23 | 494.2 | (13.3) |

| FY23 |

1,863 | (254.6) |

| 1FQ24 |

511.1 | (15.9) |

| 2FQ24 (estim.) |

545-555 | NA |

| FY24 (estim.) |

2,095-2,125 | NA |

($238 million IPO in 2016)

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter