Nutanix: Fiscal 4Q23 Financial Results

Nutanix: Fiscal 4Q23 Financial Results

Booming with revenue up 28% Y/Y and 10% Q/Q, historical lowest loss

This is a Press Release edited by StorageNewsletter.com on September 4, 2023 at 2:02 pm| (in $ million) | 4Q22 | 4Q23 | FY22 | FY23 |

| Revenue | 385.5 | 494.2 | 1,581 | 1,863 |

| Growth | 28% | 18% | ||

| Net income (loss) | (151.3) | (13.3) | (798.9) | (245.6) |

Nutanix, Inc. announced financial results for its fourth quarter and fiscal year ended July 31, 2023.

“Our 4FQ23 capped off a fiscal year that showed healthy Y/Y top line growth and sharp Y/Y improvements in profitability and free cash flow,” said Rajiv Ramaswami, president and CEO. “Our consistent execution over the course of the year vs. an uncertain macro backdrop is a testament to the benefits of our subscription model, as well as the value our customers see in the Nutanix Cloud Platform as they look to modernize their IT footprints and implement hybrid multicloud operating models.”

“Our FY23 results demonstrated a good balance of growth and profitability and further strengthened our balance sheet,” said Rukmini Sivaraman, CFO. “In conjunction with our earnings release, we’re pleased to announce that our board of directors has authorized the repurchase of up to $350 million of our stock, which we see as a reflection of confidence in the Company’s long-term market opportunity and financial outlook.”

Comments

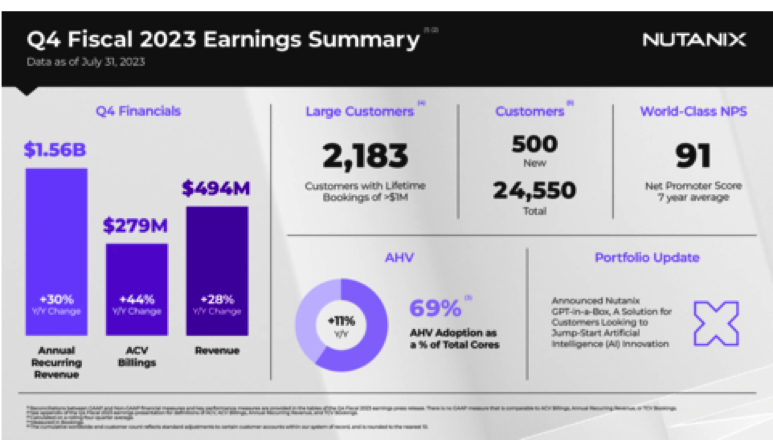

Nutanix delivered an excellent 4FQ23 with results that came in ahead of guidance.

Revenue reached $494.2 million in this period, up 28% Y/Y and 10% Q/Q. Remember that expectation was $470 million to $480 million.

Revenue in FY23 was $1.863 billion, higher than guidance of $1.84 billion to $1.85 billion and representing a Y/Y growth of 18%.

Company's shares surged 19% after these results.

ACV billings in 4FQ23 was $279 million, higher than guidance of $240 million to $250 million.

In FY23 they were $957 million, higher than guidance of $915 million to $925 million and representing a Y/Y growth of 27%, led by outperformance of its renewals business.

ARR at the end of 4FQ23 was $1.562 billion, a yearly growth of 30%.

The firm also delivered its first year of non-GAAP profitability in the company's history with a non-GAAP operating margin of 9%.

Similar to 3FQ23, the company saw a modest elongation of sales cycles likely due to increased deal inspection. New logo additions were about 500 in 4FQ23, average contract duration in FY23 being 3 years, lower than the 3.2 years in FY22 as expected.

Nutanix generated in 4FQ23 free cash flow in excess of $200 million, a roughly tenfold increase compared to prior fiscal year.

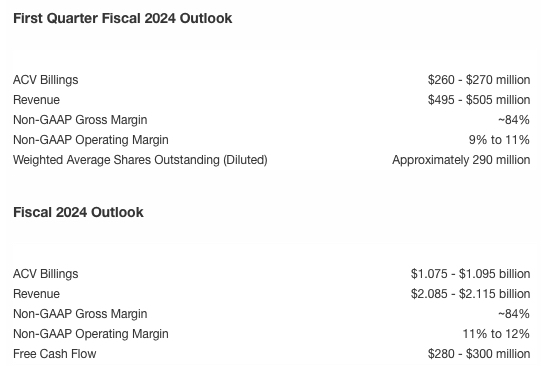

Next quarter, revenue are expected to be between $495-505 million, or up 12% to 14% Y/Y.

The firm also expects to surpass $2 billion revenue for the first time in FY24, up yearly between 12% and 14%.

The is a good chance for Nutanix, recording net losses since inception more than 10 years ago, to be profitable in the next future.

Revenue and loss of Nutanix

(in $ million)

| FY ended in July |

Revenue | Loss |

| 2012 | 6.6 | 14.0 |

| 2013 | 30.5 | 44.7 |

| 2014 | 127.1 | 84.0 |

| 2015 | 241.4 | 126.1 |

| 2016 | 444.9 | 168.5 |

| 2017 | 845.9 | 379.6 |

| 2018 | 1155 | 297.2 |

| 2019 | 1136 | 621.2 |

| 2020 | 1308 | 872.9 |

| 2021 |

1,394 | 1,034 |

| 1FQ22 | 378.5 | 419.9 |

| 2FQ22 | 413.1 | 115.1 |

| 3FQ22 | 403.7 | 111.6 |

| 4FQ22 | 385.5 | 151.0 |

| FY22 |

1,581 | 797.5 |

| 1FQ23 | 443.6 | 99.1 |

| 2FQ23 | 486.5 | NA |

| 3FQ23 | 448.6 | (71.0) |

| 4FQ23 | 494.2 | (13.3) |

| FY23 |

1,863 | (254.6) |

| 1FQ24 (estim.) | 495-505 | NA |

| FY24 (estim.) |

2,085-2,115 | NA |

($238 million IPO in 2016)

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter