Pure Storage: Fiscal 3Q24 Financial Results

Pure Storage: Fiscal 3Q24 Financial Results

Sales up 13% Y/Y and 11% Q/Q, back to profit

This is a Press Release edited by StorageNewsletter.com on December 1, 2023 at 2:02 pm| (in $ million) | 3Q23 | 3Q24 | 9 mo. 23 | 9 mo. 24 |

| Revenue | 676.1 | 762.8 | 1,943 | 2,041 |

| Growth | 13% | 5% | ||

| Net income (loss) | (0.8) | 70.4 | (1,4) | (4,1) |

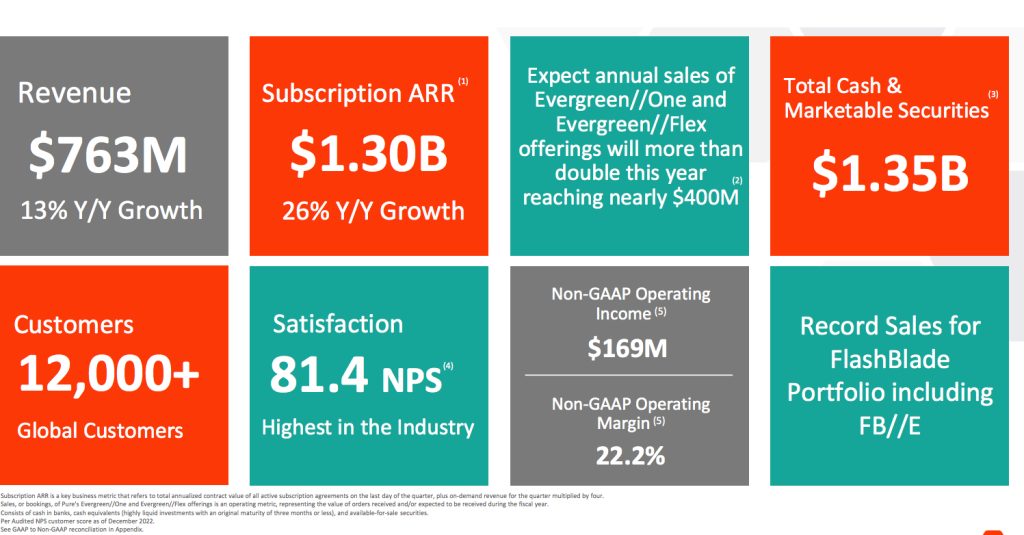

- Record sales for FlashBlade portfolio including FB//E

- Expect nearly $400 million of combined annual Evergreen//One and Evergreen//Flex Sales

- Increased operating margin annual guidance

Pure Storage, Inc. announced financial results for its third quarter fiscal 2024 ended November 5, 2023.

“Pure continues to see extraordinary growth in our Evergreen Storage-as-a-Service consumption services providing customers with a Cloud Operating Model for their multi-cloud infrastructure,” said Charles Giancarlo, chairman and CEO. “And we have raised the bar for data storage management with strong SLAs that guarantee no change management downtime or disruption, and no future data migrations for hardware changes or replacements – all while simplifying data storage operations, optimizing cloud storage, and reducing costs.”

3FQ24 Financial Highlights

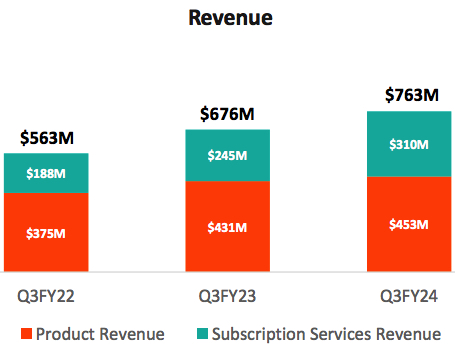

- Revenue $762.8 million, an increase of 13% Y/Y

- Subscription services revenue $309.6 million, up 26% Y/Y

- Subscription annual recurring revenue (ARR) $1.3 billion, up 26% Y/Y

- Remaining performance obligations (RPO) $2.0 billion, up 30% Y/Y

- GAAP gross margin 72.5%; non-GAAP gross margin 74.0%

- GAAP operating income $74.2 million; non-GAAP operating income $169.1 million

- GAAP operating margin 9.7%; non-GAAP operating margin 22.2%

- Operating cash flow $158.4 million; free cash flow $113.4 million

- Total cash, cash equivalents, and marketable securities $1.35 billion

- Returned approximately $22.4 million in Q3 to stockholders through share repurchases of 0.6 million shares

“We are pleased to see strengthening demand across our data storage platform, including the growth of our Evergreen//One Storage-as-a-Service offering, while also expanding our operating margin,” said Kevan Krysler, CFO. “Our business strategy continues to focus on continually increasing the value we provide to our customers including our consumption and subscription based offerings.”

Guidance

- 4FQ24 and FY24 revenue and revenue growth rates are reflective of continuing outperformance and increased momentum in Evergreen//One Storage-as-a-Service.

- Revenue of $782 million in 4FQ24, $2.82 billion in FY24

Comments

For 3FQ24, revenue was $763 million, up 13% Y/Y and 11% Q/Q, above guidance being $750 million as announced in 2FQ24, and operating profit was $169 million.

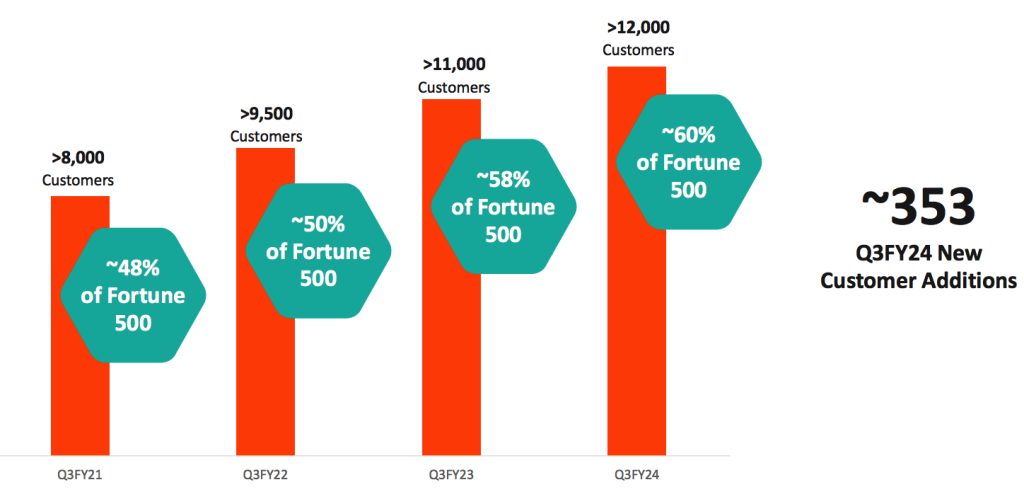

Customers

Subscription services sales were $310 million dollars or 41% of total revenue for the quarter. Subscription services ARR grew 26% Y/Y to nearly $1.3 billion, highlighting the strong traction for firm's consumption and subscription-based service offerings.

US revenue for 3FQ24 was $536 million and international revenue $227 million.

Headcount increased slightly to approximately 5,500 employees.

Weak forecast

Although the company expects demand to increase for the 2nd half of the year, there are 2 important factors that are impacting annual revenue expectation this year which is now expected to be $2.82 billion, growing 2.5%, and 4FQ24 revenue is expected to be $782 million, declining 3.5%, well below consensus estimates of $2.96 billion and $919 million: 1st is the impact of Evergreen//One, storage-as-service momentum, 2nd is the impact of a $41 million non-cancelable product order with a telco customer that is not expected to be fulfilled until next year. Both factors, on a combined basis, represent approximately 4.5 points of incremental headwind when compared to the annual revenue guide provided at the beginning of the year.

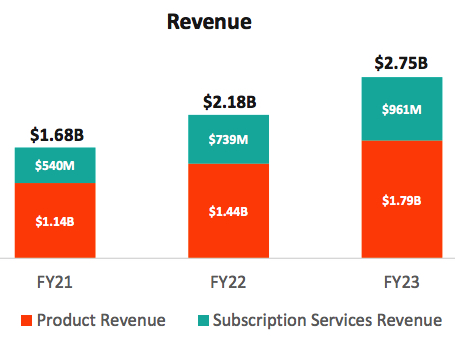

Revenue in $ million

(FY ended in January)

| Period | Revenue | Y/Y growth | Net income (loss) |

| FY13 | 6.1 | NA | (23.4) |

| FY14 | 42.7 | 603% | (78.6) |

| FY15 | 174.5 | 308% | (183.2) |

| FY16 | 440.3 | 152% | (213.8) |

| FY17 | 728.0 | 65% | (245.1) |

| FY18 |

1,023 | 41% |

(159.9) |

| FY19 |

1,360 | 33% |

(178.4) |

| FY20 |

1,643 | 21% | (201.0) |

| FY21 |

1,684 | 2% |

(282.1) |

| 1F22 | 412.7 | 12% |

(84.2) |

| 2F22 | 496.8 | 23% |

(45.3) |

| 3F22 | 562.7 | 29% |

(28.7) |

| 4F22 | 708.6 | 41% |

14.9 |

| FY22 |

2,181 |

30% |

(143.3) |

| 1F23 | 620.4 | 50% |

(11.5) |

| 2F23 | 646.8 | 30% |

10.9 |

| 3F23 | 676.1 | 20% | (0.8) |

| 4F23 | 810.2 | 14% | 74.5 |

| FY23 |

2,753 |

26% |

73.1 |

| 1Q24 |

589.3 |

-5% |

(67.4) |

| 2Q24 | 688.7 |

6% |

(7.1) |

| 3Q24 | 762.8 | 13% | 70.4 |

| 4F24 (estim.) | 782 | -3% | NA |

| FY24 (estim.) |

2,820 | 2% |

NA |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter