Pure Storage: Fiscal 2Q24 Financial Results

Pure Storage: Fiscal 2Q24 Financial Results

Sales at $689 million up 6% Y/Y and 17% Q/Q with much smaller net loss and good outlook

This is a Press Release edited by StorageNewsletter.com on August 31, 2023 at 2:02 pm| (in $ million) | 2Q23 | 2Q24 | 6 mo. 23 | 6 mo. 24 |

| Revenue | 646.8 | 688.7 | 1,267 | 1,278 |

| Growth | 6% | 1% | ||

| Net income (loss) | 10.9 | (7.1) | (0.6) | (74.5) |

Pure Storage, Inc. announced financial results for its second quarter fiscal 2024 ended August 6, 2023.

“Customers have responded enthusiastically to Pure’s new ability to satisfy all of their data storage needs on a single, consistent, flash data storage and management platform,” said Charles Giancarlo, chairman and CEO. “With the introduction of Pure’s //E family of products, customers can now store cost sensitive bulk data with the benefits of all flash.”

2FQ24 highlights

• Revenue $688.7 million, an increase of 6.5% Y/Y

• Subscription services revenue $288.9 million, up 24% Y/Y

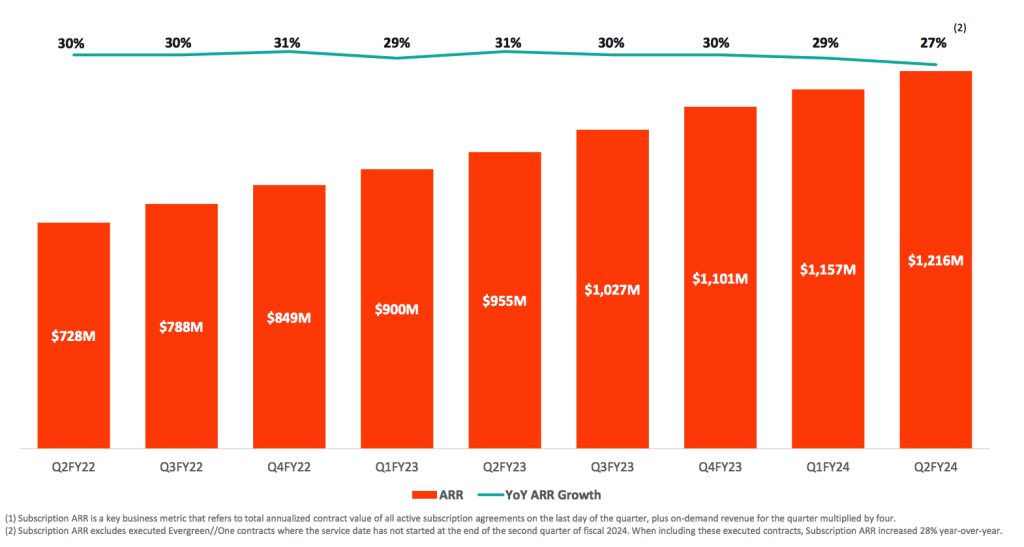

• Subscription annual recurring revenue (ARR) $1.2 billion, up 27% Y/Y

• Remaining performance obligations (RPO) $1.9 billion, up 26% Y/Y

• GAAP gross margin 70.7%; non-GAAP gross margin 72.8%

• GAAP operating loss $(6.2) million; non-GAAP operating income $111.8 million

• GAAP operating margin (0.9)%; non-GAAP operating margin 16.2%

• Operating cash flow $101.6 million; free cash flow $46.5 million

• Total cash, cash equivalents, and marketable securities $1.2 billion

• Returned approximately $22.0 million in Y/Y to stockholders through share repurchases of 0.6 million shares

“We were very pleased with record sales across our FlashBlade portfolio, and doubling sales of our Evergreen//One subscription offering this quarter,” said Kevan Krysler, CFO. “With our Purity software working directly with raw flash, we have established substantial differentiated advantages and business value for our customers, while at the same time expanding our margins.”

Comments

Revenue of $689 million in 2FQ24, grew 6.5% Y/Y and 17%, and exceeded guidance ($680 million).

The company achieved record sales of its entire FlashBlade portfolio, including

FlashBlade//E and saw continued high demand for its Evergreen//One subscription services as sales more than doubled Y/Y.

Subscription services revenue of $289 million comprised 42%,of total revenue, which is 6 points higher than 2FQ23.

In 2FQ24, subscriptions services annual recurring revenue grew 27% Y/Y to $1.2 billion, and included strong growth from its Evergreen//One storage-as-a-service offering.

US revenue for 2FQ24 was $495 million and international revenue was $194 million.

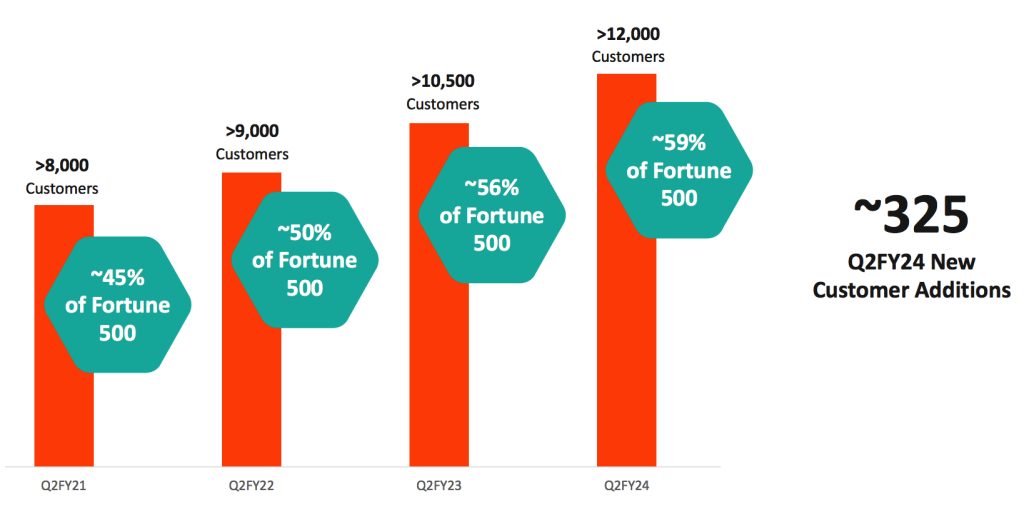

Pure acquired 325 new customers during the quarter and our total customer count now exceeds 12,000.

Customers

The company has been shipping 48TB DFMs for the last 3 years, and will introduce 75TB DFM, later this year. Today, itss DFMs are 2x to 4x denser than the largest HDDss and SSDs in competitive use, and its advantage in density is accelerating. Roadmap calls for a

150TB DFM next year, and a 300TB DFM by 2026.

Subscription Annual Recurring Revenue

Headcount increased slightly to 5,400 employees at the end of the quarter.

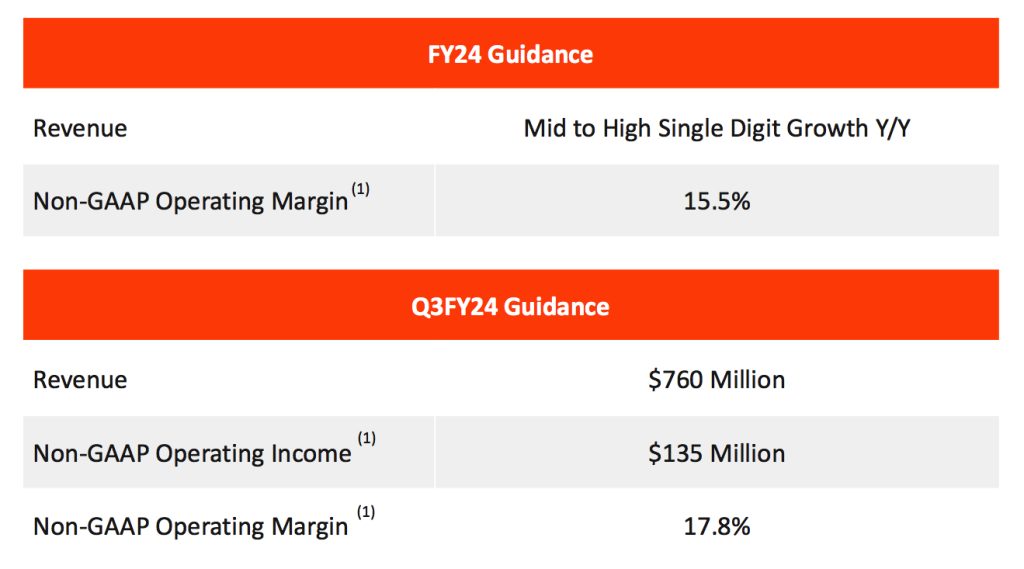

Annual revenue guidance previously communicated remains unchanged and assumes revenue growth in the mid-to-high single digits as the firm expects significantly stronger Y/Y revenue growth for 2FH24.

Revenue in $ million

(FY ended in January)

| Period | Revenue | Y/Y growth | Net income (loss) |

| FY13 | 6.1 | NA | (23.4) |

| FY14 | 42.7 | 603% | (78.6) |

| FY15 | 174.5 | 308% | (183.2) |

| FY16 | 440.3 | 152% | (213.8) |

| FY17 | 728.0 | 65% | (245.1) |

| FY18 |

1,023 | 41% |

(159.9) |

| FY19 |

1,360 | 33% |

(178.4) |

| FY20 |

1,643 | 21% | (201.0) |

| FY21 |

1,684 | 2% |

(282.1) |

| 1F22 |

412.7 | 12% |

(84.2) |

| 2F22 |

496.8 | 23% |

(45.3) |

| 3F22 |

562.7 | 29% |

(28.7) |

| 4F22 |

708.6 | 41% |

14.9 |

| FY22 |

2,181 |

30% |

(143.3) |

| 1F23 | 620.4 | 50% |

(11.5) |

| 2F23 |

646.8 | 30% |

10.9 |

| 3F23 |

676.1 | 20% | (0.8) |

| 4F23 |

810.2 | 14% | 74.5 |

| FY23 |

2,753 |

26% |

73.1 |

| 1Q24 |

589.3 |

-5% |

(67.4) |

| 2Q24 | 688.7 |

6% |

(7.1) |

| 3Q14 (estim.) | 750 | 11% | NA |

| FY24 (estim.) |

Mid to high single digit growth Y/Y | NA |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter