Seagate: Fiscal 4Q23 Financial Results

4Q23 sales down 39% Y/Y, -37% for FY23, net loss continuing, worst to come

This is a Press Release edited by StorageNewsletter.com on July 27, 2023 at 2:02 pm| (in $ million) | 4Q22 | 4Q23 | FY22 | FY23 |

| Revenue | 2,628 | 1,602 | 11,661 | 7,384 |

| Growth | -39% | -37% | ||

| Net income (loss) | 276 | (92) | 1,649 | (529) |

4FQ23 Highlights

• Revenue of $1.60 billion

• GAAP (loss) per share of $(0.44); non-GAAP (loss) per share of $(0.18)

• Cash flow from operations of $218 million and free cash flow of $168 million

• Declared cash dividend of $0.70 per share

FY23 Highlights

• Revenue of $7.38 billion

• GAAP (loss) per share of $(2.56); non-GAAP diluted earnings per share (EPS) of $0.19

• Cash flow from operations of $942 million and free cash flow of $626 million

• Returned $990 million to shareholders through dividends and share repurchases

Seagate Technology Holdings plc reported financial results for its fiscal fourth quarter and fiscal year ended June 30, 2023.

“Our 4FQ23 performance reflected the uneven pace of economic recovery in China, cloud inventory digestion, and cautious enterprise spending amid the uncertain macroeconomic environment. The proactive actions we’ve taken to lower costs, manage production output, reduce debt and drive operational leverage have underpinned resilient performance and solid cash gen, while continuing to advance our revolutionary HAMR technology,” said Dave Mosley, CEO. “Through our actions, Seagate is now leaner, our balance sheet healthier, and our product roadmap even stronger, positioning the company to weather the near-term business environment, deliver financial leverage, and capture attractive long-term opportunities for mass capacity storage.”

The company generated $218 million in cash flow from operations and $168 million in free cash flow during 4FQ23. For FY23, it generated $942 million in cash flow from operations and $626 million in free cash flow. During 4FQ23, it paid cash dividends of $145 million. For FY23, it returned $990 million of capital to shareholders, through the payment of cash dividends of $582 million and in 1FQ23 used $408 million to repurchase 5.4 million ordinary shares. In light of the macroeconomic environment, it paused stock repurchases for the reminder of the fiscal year. Additionally, it strengthened its balance sheet position by reducing its overall debt by approximately $800 million through debt exchange, retirement and restructuring since 1FQ23. As of the end of FY23 cash and cash equivalents totaled $786 million, and there were 207 million ordinary shares issued and outstanding.

Quarterly Cash Dividend

The board of directors declared a quarterly cash dividend of $0.70 per share, which will be payable on October 10, 2023 to shareholders of record as of the close of business on September 26, 2023. The payment of any future quarterly dividends will be at the discretion of the board and will be dependent upon firm’s financial position, results of operations, available cash, cash flow, capital requirements and other factors deemed relevant by the Board.

Business Outlook for 1FQ24

• Revenue of $1.55 billion, ±$150 million

• Non-GAAP (loss) per share of $(0.16), plus or min$0.20

Guidance regarding non-GAAP (loss) per share excludes known pre-tax charges related to estimated share-based compensation expenses of $0.15 per share.

BIS settlement penalty

The company accrued a settlement penalty of $300 million for 3FQ23 related to the alleged violations of the US Export Administration Regulations between August 17, 2020 and September 29, 2021 by the US Department of Commerce’s Bureau of Industry and Security (BIS), which were subsequently resolved by a settlement agreement on April 18, 2023. This settlement penalty is excluded from the non-GAAP measures to facilitate a more meaningful evaluation of the company’s current operating performance and comparison to its past periods’ operating performance.

Comments

It's probably historically the worst financial quarter for the manufacturer of HDDs, a market currently in big trouble and where Seagate is the leader. And next quarter could be worst for the company.

Revenue in 4FQ23 at $1,602 million is down 39% Y/Y and in the lower half of the guidance range. It's 37% at 7,384 million for FY23 (between $7,332 and $7,632 expected), the lowest figure since many years.

This small revenue reflects the uneven pace of economic recovery in China, cloud inventory digestion, and cautious enterprise spending.

The company reduced production output to drive better supply/demand dynamics, managing manufacturing capacity through "build-to-order” approach and adjusting pricing strategy in certain markets to support a healthy supply chain for its customers over the long-term.

HDD product trends

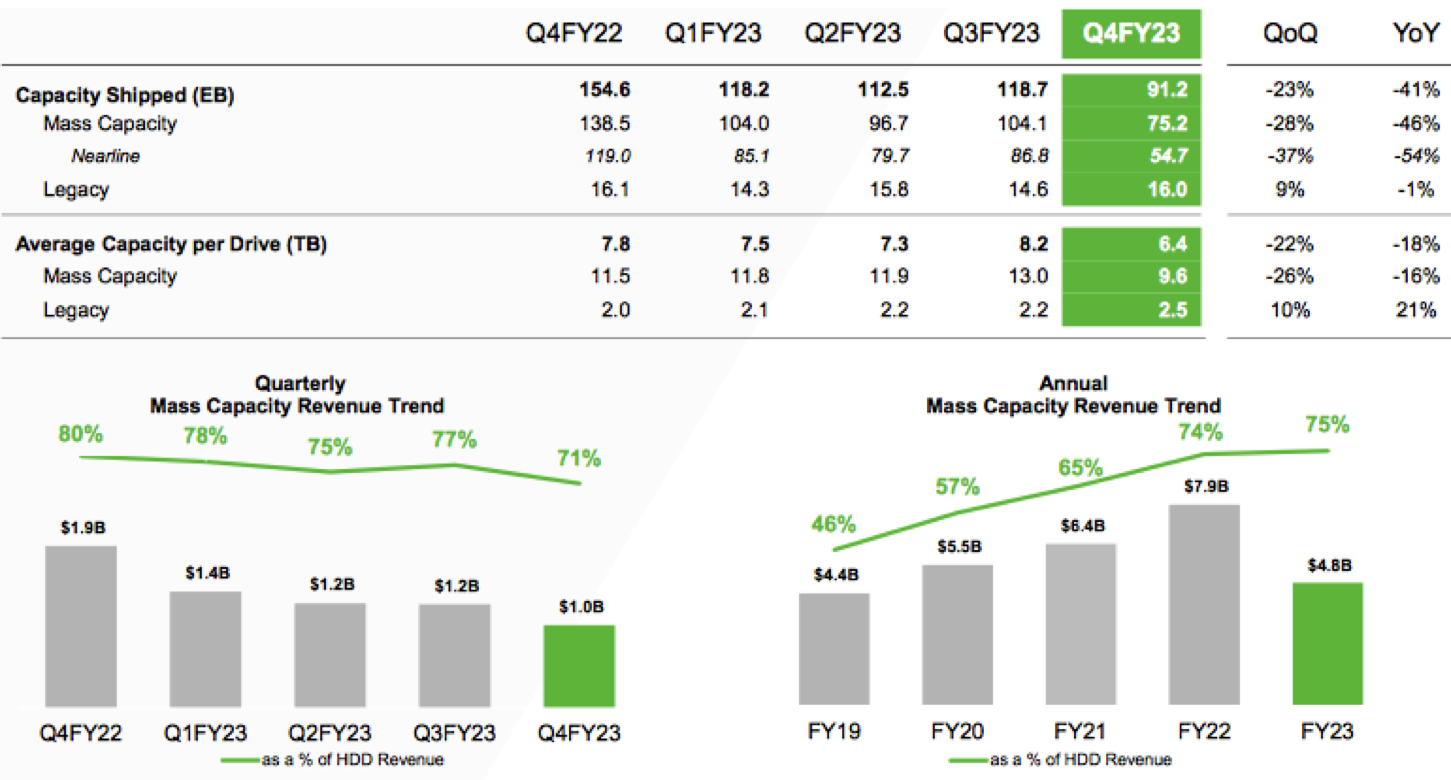

Total HDD revenue in 4FQ23 declined 14% Q/Q to $1.4 billion, with shipment of 91.2EB down 23% Q/Q and 39% Y/Y.

Mass capacity revenue declined 20% Q/Q to $1 billion, reflecting softer demand in the cloud nearline market, partially offset by an improvement in the VIA business.

Shipment into the mass capacity markets totaled 75EB compared with 104EB in 3FQ23. Mass capacity shipments as a percentage of total HDD exabyte was roughly 82% compared to the March quarter 88%. The expected slowdown in cloud business led to nearline shipments of 55EB, down 37% sequentially.

Roadmap

• Extending PMR platform into the mid-to-upper 20TB capacities

• HAMR 30TB+ on track to begin volume ramp in early CY24, preparing qualification with broader number of customers

• Mass capacity data storage remaining both an enabler and beneficiary of long-term demand trends including emerging AI applications

Legacy

• Legacy revenue up 8% sequentially at $401 million reflecting higher demand for mission critical products

• Client and consumer markets were down slightly Q/Q, typical for a June quarter.

• Finally, revenue for non-HDD business decreased 15% Q/Q to $218 million on lower enterprise systems volume.

The firm shipped first HAMR-based Corvault systemn for revenue as planned during the June

quarter, expecting broader availability end of CY23.

For now, forecasting sales into China remain relatively stable for the balance of the calendar year. Outside of China, nearline demand from enterprise OEM customers has remained soft. CIOs continue to operate under tighter budgets in response to near-term macroeconomic uncertainties.

Seagate expects even a worst 1FQ24 compared to 4FQ23 with sales of $1,550±150 million or between -16% and -31%.

HDDs from 1FQ19 to 4FQ23

| Fiscal period | HDD ASP | Exabytes shipped |

Average GB/drive |

| 1Q19 | $70 | 98.8 | 2,500 |

| 2Q19 |

$68 | 87.4 | 2,400 |

| 3Q19 |

$72 | 76.7 | 2,400 |

| 4Q19 | $79.7 | 84.5 | 2,700 |

| 1Q20 |

$81 | 98.3 | 2,900 |

| 2Q20 |

$77 | 106.9 | 3,300 |

| 3Q20 | $86 | 120.2 | 4,100 |

| 4Q20 |

$89 | 117.0 | 4,500 |

| 1Q21 |

$82 | 114.0 | 4,400 |

| 2Q21 |

$81 | 129.2 | 4,300 |

| 3Q21 | $91 | 139.6 | 5,100 |

| 4Q21 | $97 | 152.3 | 5,400 |

| 1Q22 |

$103 | 159.1 | 5,700 |

| 2Q22 |

$106 | 163.2 | 6,100 |

| 3Q22 |

NA | 154.2 | 6,700 |

| 4Q22 |

NA | 154.6 | 7,800 |

| 1Q23 |

$104 | 118.2 | 7,500 |

| 2Q23 |

$108 | 112.5 | 7,300 |

| 3Q23 |

$111 |

118.7 |

8,200 |

| 4Q23 |

$97 | 91.2 |

6,400 |

FY ending in June

* in $million

| Period | Revenue* | Y/Y growth | Net income* |

| FY18 | 11,184 | 4% | 772 |

| FY19 | 10,390 | -7% | 2,012 |

| FY20 | 10,509 | 1% | 1,004 |

| FY21 | 10,681 | 2% | 1,314 |

| 1FQ22 | 3,115 | 35% | 526 |

| 2FQ22 | 3,116 | 19% | 501 |

| 3FQ22 | 2,802 | 3% | 346 |

| 4FQ22 | 2,628 | -13% | 276 |

| FY22 | 11,661 | 9% | 1,649 |

| 1FQ23 |

2,035 |

-35% |

29 |

| 2FQ23 | 1,887 | -49% | (33) |

| 3FQ23 | 1,860 | -34% | (433) |

| 4FQ23 | 1,602 | -39% | (92) |

| FY23 |

7,384 | -37% | (529) |

| 1FQ24 (estim.) | 1,550±150 |

-16%-31% |

NA |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter