Pure Storage: Fiscal 4Q23 Financial Results

Pure Storage: Fiscal 4Q23 Financial Results

All figures up but bad outlook

This is a Press Release edited by StorageNewsletter.com on March 2, 2023 at 2:01 pm| (in $ million) | 4Q22 | 4Q23 | FY22 | FY23 |

| Revenue | 708.6 | 810.2 | 2,181 | 2,753 |

| Growth | 14% | 26% | ||

| Net income (loss) | 14.9 | 74.5 | (143.3) | 73.1 |

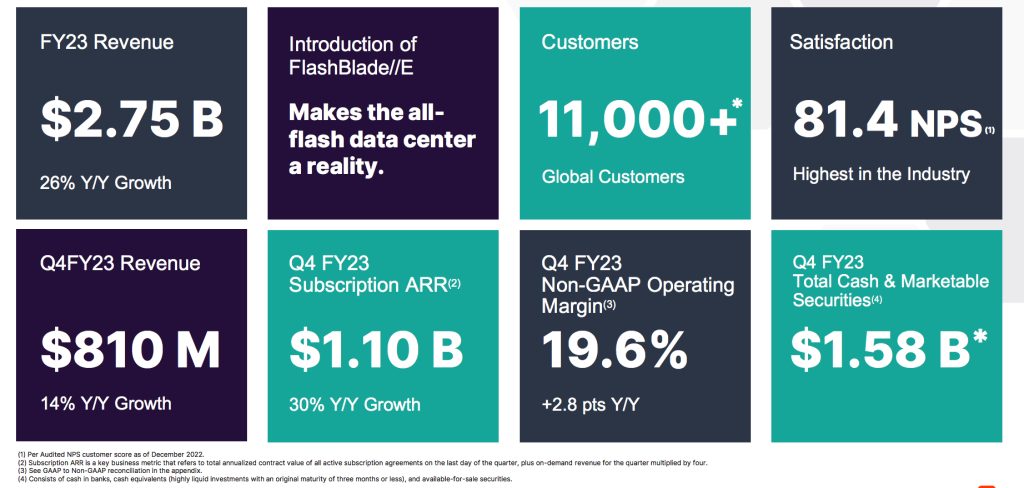

Pure Storage, Inc. announced financial results for its fiscal fourth quarter and full year 2023 ended February 5, 2023.

“Pure continued to grow faster than the market this year with the industry’s most advanced, reliable, and energy-efficient products and services,” said Charles Giancarlo, chairman and CEO. “Despite current macro conditions, we remain confident in our ability to execute, manage costs, and maintain a strong innovation cycle, highlighted by today’s introduction of FlashBlade//E.“

4FQ23 and FY highlights

- 4FQ23 revenue $810.2 million, up 14% Y/Y

- Full-year revenue $2.8 billion, up 26% Y/Y

- 4FQ23 subscription services revenue $265.1 million, up 23% Y/Y

Full-year subscription services revenue $961.3 million, up 30% Y/Y - 4FQ23 subscription annual recurring revenue (ARR) $1.1 billion, up 30% Y/Y

- Remaining performance obligations (RPO) $1.8 billion, up 24% Y/Y

- 4FQ23 GAAP gross margin 69.3%; non-GAAP gross margin 70.8%

- FY23 GAAP gross margin 68.9%; non-GAAP gross margin 70.7%

- 4FQ23 GAAP operating income $64.6 million; non-GAAP operating income $158.6 million

- Full-year GAAP operating income $83.5 million; non-GAAP operating income $457.2 million

- 4FQ23 GAAP operating margin 8.0%; non-GAAP operating margin 19.6%

- Full-year GAAP operating margin 3.0%; non-GAAP operating margin 16.6%

- 4FQ23 operating cash flow $233.0 million; free cash flow $172.8 million

- Full-year operating cash flow $767.2 million; free cash flow $609.1 million

- Total cash, cash equivalents, and marketable securities $1.6 billion

- Returned approximately $67.5 million and $219.0 million in 4FQ23 and FY23, respectively, to stockholders through share repurchases of 2.4 million shares and 7.8 million shares, respectively

- Authorized incremental share repurchases of up to an additional $250 million under its stock repurchase program

“Pure delivered strong 4FQ23 results growing revenue 14% and achieving record operating profit and margin,” said Kevan Krysler, CFO. “We are confident that we will navigate the current macro backdrop, while focusing on our commitment to deliver long-term, profitable growth.“

FY24 outlook

- Revenue: mid to high single digit Y/Y growth

- Non-GAAP operating margin: 15%

Share repurchase authorization

The board of directors has authorized, and its audit committee has approved, incremental share repurchases of up to an additional $250 million under its stock repurchase program. The authorization allows Pure to repurchase shares of its Class A common stock opportunistically and will be funded from available working capital. Repurchases may be made at management’s discretion from time to time on the open market through privately negotiated transactions, transactions structured through investment banking institutions, block purchase techniques, 10b5-1 trading plans, or a combination of the foregoing. The repurchase program does not have an expiration date, does not obligate the company to acquire any of its common stock, and may be suspended or discontinued by the company at any time without prior notice.

Comments

Revenue was $810 million in 4FQ23, up 14% Y/Y and 20% Q/Q, exactly what was expected at the end of former quarter.

Subscription annual recurring revenue ARR continues to be exceeds $1.1 billion, up 30% Y/Y. Evergreen//One, once again represented a key driver of this subscription ARR growth in 4FQ23, and resonates strongly with customers as they navigate tighter IT budgets without having to compromise performance and value. Also, consistent with last year, subscription net dollar retention or NDR at the end of the year, exceeded 120% compared to firm's long-term target of 115% as a result of expansion from existing customers.

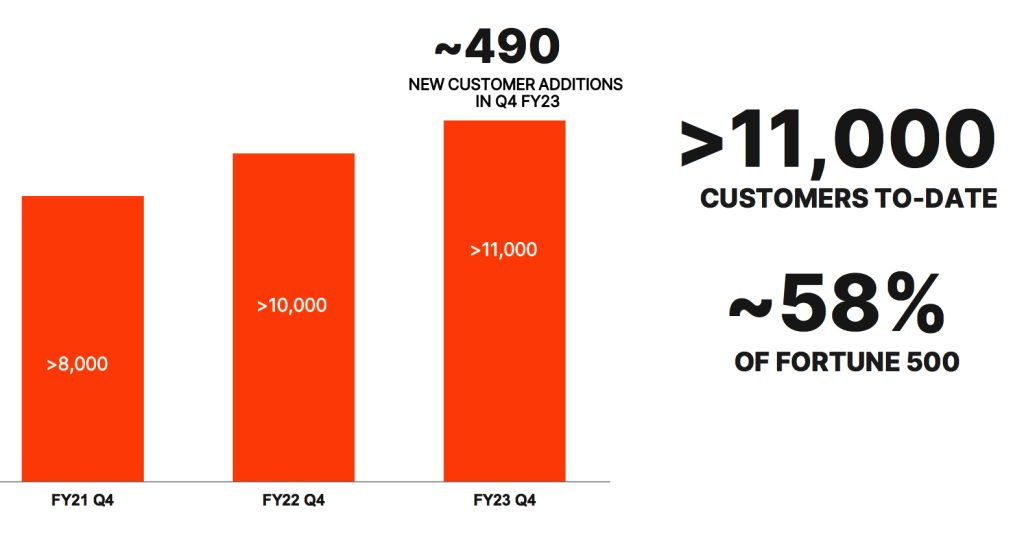

Total and new customers

4FQ23 product revenue grew 11%, and subscription services revenue increased 23% Y/Y and comprised approximately one third of total revenue for the quarter. Adjusting for the extra week in 4FQ22, it would have grown 31% Y/Y. The strength of subscription services gross margins of 74% for the quarter and nearly 73% for the year, driven by increasing efficiencies as we grow and scale our Evergreen subscription offerings.

International revenue in 4FQ23 grew 39% to $258 million, and US revenue of $552 million grew 6% Y/Y. US revenue growth reflects caution in IT spending that customers are exercising, most notably in the enterprise segment.

Headcount increased to 5,100 employees.

Revenue in $ million

(FY ended in January)

| Period | Revenue | Y/Y growth | Loss |

| FY13 | 6.1 | NA | (23.4) |

| FY14 | 42.7 | 603% | (78.6) |

| FY15 | 174.5 | 308% | (183.2) |

| FY16 | 440.3 | 152% | (213.8) |

| FY17 | 728.0 | 65% | (245.1) |

| FY18 |

1,023 | 41% |

(159.9) |

| FY19 |

1,360 | 33% |

(178.4) |

| FY20 |

1,643 | 21% | (201.0) |

| FY21 |

1,684 | 2% |

(282.1) |

| 1F22 |

412.7 | 12% |

(84.2) |

| 2F22 |

496.8 | 23% |

(45.3) |

| 3F22 |

562.7 | 29% |

(28.7) |

| 4F22 |

708.6 | 41% |

14.9 |

| FY22 |

2,181 |

30% |

(143.3) |

| 1F23 | 620.4 | 50% |

(11.5) |

| 2F23 |

646.8 | 30% |

10.9 |

| 3F23 |

676.1 | 20% | (0.8) |

| 4F23 |

810.2 | 14% | 74.5 |

| FY23 |

2,753 |

26% |

73.1 |

| 1Q24* |

560 |

-10% |

NA |

| FY24* |

Mid to high single digit growth | NA |

* Estimations

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter