FalconStor: Fiscal 4Q21 Financial Results

FalconStor: Fiscal 4Q21 Financial Results

Flat revenue and small loss

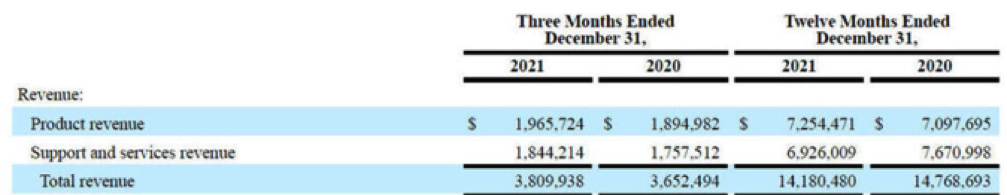

This is a Press Release edited by StorageNewsletter.com on March 14, 2022 at 2:02 pm| (in $ million) | 4Q20 | 4Q21 | FY20 | FY21 |

| Revenue | 3.7 | 3.8 | 14.8 | 14.2 |

| Growth | 4% | -4% | ||

| Net income (loss) | (0.1) | (0.2) | 1.1 | 0.2 |

FalconStor Software, Inc. announced financial results for its fourth quarter and full year 2021, which ended on December 31, 2021, delivering a 40% Y/Y increase in subscription revenue for the full year of 2021, fueled by the growth in MSP business and market adoption of hybrid cloud data protection solutions.

“We are making good progress vs. our strategic plans to reinvent FalconStor and enable secure hybrid cloud backup and data protection,” said Todd Brooks, CEO. “Driven by encouraging adoption of the FalconStor StorSafe and StorGuard solutions, we continue to focus on building recurring revenue and expanding new and existing and commercial channels to market. As part of this focus, we signed additional MSPs, and continued migrating our installed based to a subscription revenue model. As a result, total subscription revenue increased 20% compared to Q4 of 2020, and 40% for the full year of 2021 compared to 2020.“

“While we are encouraged by our subscription revenue growth and expanding partnerships, we are continuing to work toward our goal of consistent total revenue growth. Despite total revenue increasing by 4% Y/Y during the quarter, total revenue for the year of 2021 decreased by 4% compared to 2020. Consistent with our commitment to deliver profitable operating results, we delivered positive GAAP net income for FY21, but are focused on increasing our level of profitability in 2022. Migration to the cloud, data center rationalization, and increased leverage of outsourced managed services are top priorities for enterprise CIOs and are fundamental macro shifts to which FalconStor technology and market experience are well aligned,” he added. “We are excited by our hybrid cloud focus, strategic progress, and trust our shareholders have placed in our team to deliver customer and shareholder value.“

4FQ21 Results

• Subscription Revenue: 20% increase to $1.4 million, compared to $1.1 million in 4FQ20

• Subscription % of Total Revenue: 37%, compared to 31% in 4FQ20

• Total Revenue: $3.8 million, compared to $3.7 million in 4FQ20

• Total Cost of Revenue: $0.4 million, compared to $0.5 million in 4FQ20

• Total Operating Expenses: $3.0 million, compared to $3.2 million in 4FQ20

• GAAP Net Income (Loss): $(0.2) million, compared to a loss of $(0.1) million in 4FQ20

• Ending Cash: $3.2 million, compared to $1.9 million in 4FQ20

FY Results

• Subscription Revenue: 40% increase to $4.0 million, compared to $2.8 million during FY20

• Subscription Revenue % of Total Revenue: 28%, compared to 19% during FY20

• Total Revenue: $14.2 million, compared to $14.8 million during FY20

• Total Cost of Revenue: $2.0 million, compared to $1.8 million during FY20

• Total Operating Expenses: $11.6 million, compared to $11.1 million during FY20

• GAAP Net Income: $0.2 million, compared to $1.1 million during FY20

• Ending Cash: $3.2 million, compared to $1.9 million at FY20

FY22 guidance (in $ millions)

- Revenue: 14.2 to 15.5

- Adjusted EBITDA*: 3.2 to 3.9, 23% to 25%

- Net Income: 1.9 to 2.3, 13% to 15%

- Rule of 40 (Revenue Growth % + Adjusted EBITDA %): 23 to 34

*Adjusted EBITDA adds back non-operating and other expenses and income

Comments

$14.2 million is the lowest fiscal year revenue since as far as FY04, down 4% Y/Y, and outlook for FY22 being just a little better.

For 4FQ21, sales were $3.8 million, compared to $3.7 million for 4FQ20, an increase of 4%. If you look over the last 4 quarters prior to 4FQ21, in 3FQ21, it is down (-25%) like in 2FQ21 (-7%); in 1FQ21, there was 20% increase Y/Y; but 4FQ20, it was down.

For FY21, the company closed total revenues of $14.2 million, compared to $14.8 million for FY20, a decrease of 4%.

FalconStor expanded recently its long-time reseller relationship with Hitachi and then Hitachi Vantara to provide this tme advanced DR and cloud-enabled protection for Hitachi AFAs through its StorGuard solution

It has currently over 1,000 end user customers, and 1EB of data under management.

In 2017, net customer revenue retention was 65%. That's grown in 2021 to 99%. Gross margin in 2017 was 78%. That has grown to 86% in 2021. Adjusted EBITDA was 7% in 2017, that has grown to 25%.

The company has been tracking each quarter its percentage of sales from non-core markets, as an example, China. Back in 2017, sales from those markets were about 23%, just a little over 23% of total sales. In 2021, that has shrunk to 4%. Going forward, it is expected sales from those markets will continue to be in that 4% range, maybe a bit less as the firm moves forward.

Concerning the ongoing crisis in Ukraine, the firm stated: "So our thoughts and our prayers, of all FalconStor employees, are with those that have been so tragically - continue to be tragically impacted. And all this crisis has the potential to cause disruption across the globe and negatively impact our business. We don't have any employees, any contractors or any customers in either Ukraine or Russia. But regardless, we'll continue to closely monitor the situation for any potential impacts to our business. And most importantly, continue to diligently help our customers protect their incredibly valuable data."

| FY | Revenue in $ million |

Growth |

| 2004 | 28.7 | NA |

| 2005 | 41.0 | 43% |

| 2006 | 55.1 | 34% |

| 2007 | 77.4 | 41% |

| 2008 | 87.0 | 12% |

| 2009 | 89.5 | 3% |

| 2010 | 82.8 | -7% |

| 2011 | 82.9 | 0% |

| 2012 | 75.4 | -9% |

| 2013 | 58.6 | -32% |

| 2014 | 46.3 | -21% |

| 2015 | 48.6 | 5% |

| 2016 | 30.3 | -38% |

| 2017 | 25.2 | -17% |

| 2018 | 17.8 | -29% |

| 2019 | 16.5 | -7% |

| 2020 | 14.8 | -10% |

| 1FQ21 | 3.8 | 20% |

| 2FQ21 | 3.3 | -7% |

| 3FQ21 | 3.3 | -25% |

| 4FQ21 | 3.8 | 4% |

| FY21 | 14.2 | -4% |

| FY22 (estim.) | 14.2 - 15.5 | 0% - 9% |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter