FalconStor: Fiscal 1Q21 Financial Results

20% revenue growth at only $3.8 million

This is a Press Release edited by StorageNewsletter.com on May 7, 2021 at 2:33 pm| (in $ million) | 1Q20 | 1Q21 | Growth |

| Revenue |

3.2 | 3.8 | 20% |

| Net income (loss) | (0.07) | 0.04 |

FalconStor Software, Inc. announced financial results for its first quarter of fiscal year 2021, which ended on March 31, 2021, recording solid product revenue growth, customer expansions and continuing profitability of $425,248.

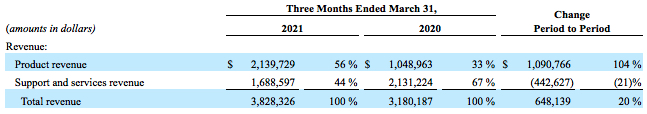

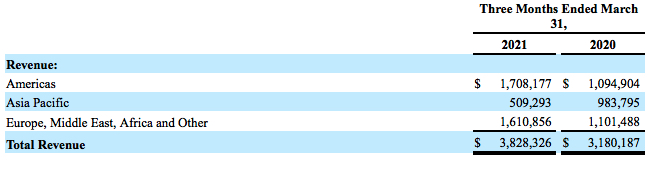

“We continue to make good progress vs. our strategic plans to reinvent FalconStor, enhance the value we deliver to our customers, and innovate within the cloud-based data protection market,” said Todd Brooksr. “During the first quarter, we continued to stabilize growth as we delivered a 20% Y/Y increase in total revenue. Our growth was driven by a 104% Y/Y increase in product revenue, which continues to reflect our shift to a subscription model and growth in new customer wins. Over the next year, we expect our Y/Y revenue growth to continue to stabilize as our sales pipeline becomes more predictable, and we expand our markets.“

“Migration to the cloud, data center rationalization and infrastructure optimization are top priorities for enterprise CIOs in the post-pandemic world, and FalconStor plays a vital role in each,” he added. “As the economy continues to recover, we will continue to work with enterprises and MSPs to modernize backup and archival solutions software for the cloud era, reducing the cost and complexity of leveraging the cloud while improving essential data portability and security, including protection vs. ransomware attacks.”

1FQ21 Financial Results

• Product Revenue: 104% product revenue growth to $2.1 million, compared to $1.05 million in 1FQ20

• New Customer Billings: $3.2 million, compared to $1.1 million in 1FQ20

• Total Revenue: $3.8 million, compared to $3.2 million in 1FQ20

• Total Cost of Revenue: $0.6 million, compared to $0.5 million in 1FQ20

• Total Operating Expenses: $3.2 million, compared to $3.0 million in 1FQ20

• GAAP Net Income (Loss): $0.4 million, compared to $(0.7) million in 1FQ20

• Ending Cash: $2.0 million, compared to $1.0 million in 1FQ20

1FQ21 Business Highlights

• Delivered updates to our next-gen long-term data retention and recovery technology in StorSafe, built with a bridge to all industry-leading public clouds for long-term archival optimization, including AWS, Microsoft Azure, IBM Cloud, and Wasabi

• Continued to demonstrate enterprise scalability of our product, including expansion to 3PB of data across 8 nodes and multiple data centers for a large government institution

• Continued win trajectory in IBM environments, specifically IBM I and AS/400 system implementations

• Continued to deliver additional multi-tenant capabilities to enable MSPs to better serve clients

Comments

One more the company continues to have the lowest annual revenue of any storage public companies in the world.

Revenue was of $3.8 million, compared to $3.2 million in 1FQ20 and $3.7 million in 4FQ20 with tiny net income.

No guidance and earnings call transcript were published.

During next 5 years, company's goal is to acquire 1 to 2 companies per year.

| FY | Revenue in $ million |

Growth |

| 2004 | 28.7 | NA |

| 2005 | 41.0 | 43% |

| 2006 | 55.1 | 34% |

| 2007 | 77.4 | 41% |

| 2008 | 87.0 | 12% |

| 2009 | 89.5 | 3% |

| 2010 | 82.8 | -7% |

| 2011 | 82.9 | 0% |

| 2012 | 75.4 | -9% |

| 2013 | 58.6 | -32% |

| 2014 | 46.3 | -21% |

| 2015 | 48.6 | 5% |

| 2016 | 30.3 | -38% |

| 2017 | 25.2 | -17% |

| 2018 | 17.8 | -29% |

| 2019 | 16.5 | -7% |

| 2020 | 14.8 | -10% |

| 1FQ21 |

3.8 |

20% |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter