Pure Storage: Fiscal 4Q22 Financial Results

Pure Storage: Fiscal 4Q22 Financial Results

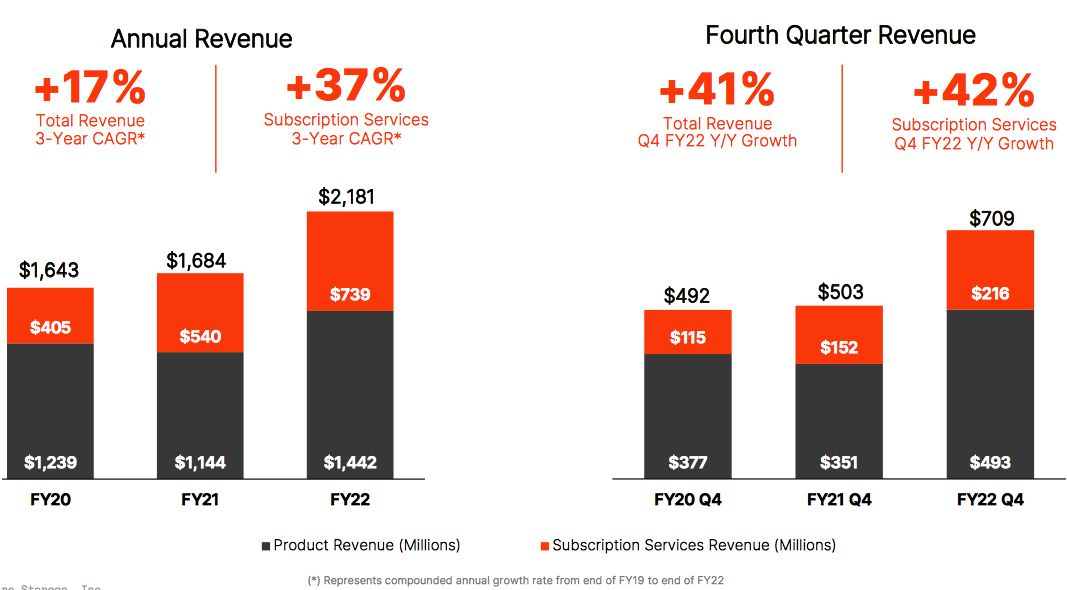

Sales up 41% in 4FQ22, historically first quarter of profitability, more than $2 billion revenue in FY22

This is a Press Release edited by StorageNewsletter.com on March 3, 2022 at 2:02 pm| (in $ million) | 4Q20 | 4Q22 | FY21 | FY22 |

| Revenue | 502.7 | 708.6 | 1,684 | 2,181 |

| Growth | 41% | 30% | ||

| Net income (loss) | (52.3) | 14.9 | (282.1) | (143.3) |

Pure Storage, Inc. announced financial results for its fiscal fourth quarter and full year ended February 6, 2022.

“By every measure, Pure had an outstanding quarter and fiscal year,” said Charles Giancarlo, chairman and CEO. “As evidenced by the 41% growth in 4FQ22, our strategy to deliver an innovative portfolio of storage and services, with industry-leading customer experiences and flexible, efficient operations continues to position Pure as the trusted provider for all organizations.”

4FQ22 and FY22 Highlights

• 4FQ22 revenue $708.6 million, up 41% Y/Y

• FY22 $2.18 billion, up 29% Y/Y

• 4FQ22 subscription services revenue $216.0 million, up 42% Y/Y

• FY22 subscription services revenue $738.5 million, up 37% Y/Y

• 4FQ22 subscription annual recurring revenue (ARR) $848.8 million, up 31% Y/Y

• Remaining performance obligations (RPO) $1.4 billion, up 29% Y/Y

• 4FQ22 GAAP gross margin 67.2%; non-GAAP gross margin 68.8%

• FY22 GAAP gross margin 67.5%; non-GAAP gross margin 69.4%

• 4FQ22 GAAP operating income $29.8 million; non-GAAP operating income $118.7 million

• 4FQ22 GAAP operating margin 4.2%; non-GAAP operating margin 16.8%

• FY22 GAAP operating loss $(98.4) million; non-GAAP operating income $235.0 million

• FY22 GAAP operating margin (4.5)%; non-GAAP operating margin 10.8%

• 4FQ22 operating cash flow $138.2 million; free cash flow $117.2 million

• FY22 operating cash flow $410.1 million; free cash flow $307.8 million

• Total cash, cash equivalents, and investments of $1.41 billion

• Returned approximately $69 million and $200 million in 4FQ22 and FY22, respectively, to stockholders through share repurchases and completed our board authorized amount of $200 million

“We are thrilled to be capping off the year in a position of leadership and strength,” said Kevan Krysler, CFO. “The momentum we are experiencing is the year’s culmination of relentless focus on innovating for our customers.”

4FQ22 and FY22 Company Highlights

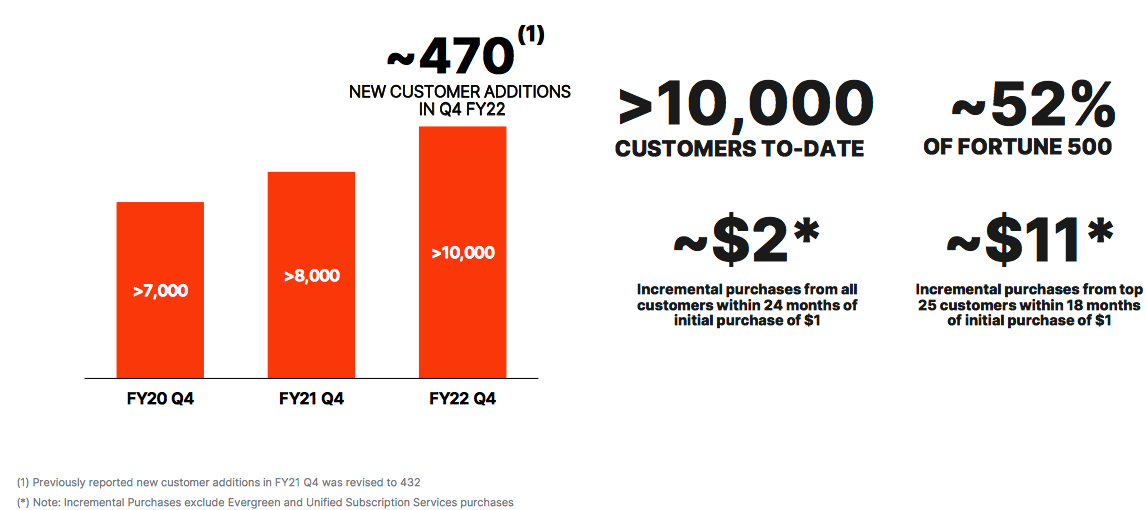

• Surpassed the 10,000 Customer Mark: Customer base further expanded across a wide and balanced range of use cases, industries, and geographies. In 4FQ22, Meta announced Pure as the storage partner to deliver scalable storage capabilities to power its AI Research SuperCluster (RSC).

• Subscription Services Momentum: Subscription services revenue grew 37% Y/Y in FY22 and Pure unveiled 2 new service offerings to be available in 1FQ23, Pure Fusion and Portworx Data Services.

• Portfolio Innovation: The firm introduced the FlashArray//XL to provide unmatched performance and scale to platinum tier applications and expanded features and functionality across the FlashArray and FlashBlade platforms with new Purity software, all available through Pure as-a-Service. It also delivered new releases of Portworx Enterprise and PX-Backup.

• Industry and Customer Recognition: The company sets a high-bar with an 85.2 third-party certified Net Promoter Score (NPS). It was named a leader in the Gartner Magic Quadrants for both Primary Storage and Distributed File Systems & Object Storage, marking its 8th consecutive year as a leader.

• Expansion of R&D Centers: The vendor opened a new R&D site in Bangalore, India, joining global R&D centers in Mountain View, CA, Bellevue, WA, and Vancouver, Canada in North America; and Prague, Czech Republic in EMEA.

1FQ23 guidance:

- Revenue: around $520 million

- Non-GAAP Operating Income: $16 million

- Non-GAAP Operating Margin: around 3%

FY23 guidance

- Revenue: around $2.6 billion, 19%-20% Y/Y growth

- Non-GAAP Operating Income: $300 million

- Non-GAAP Operating Margin: around 11.5%

Comments

For the quarter, revenue reached $708.6 million, up 41% Y/Y and 26% Q/Q, largely above guidance of $630 million, and, for FY22 $2.181 billion, up 30% Y/Y, compared to former quarter's guidance of $2.1 billion.

Stock jumped 9.4% to $29, during after-hours action on the stock market.

Total revenue

Click to enlarge

4FQ22 revenue as the result of robust demand especially in the US and Canada. It benefited from a substantial sale of FlashArray//C to Meta, and includes an extra week in FY22.

Total and news customers

Click to enlarge

The company acquired 470 new customers in 4FQ22 and total customer count now exceeds 10,000 which also includes 50% of the US Fortune 500 companies.

As highlighted in previous quarters, the Covid environment was a tailwind to operating profits, contributing approximately 2 to 3 points of benefit to FY22 operating margin. Slower than planned hiring, significantly reduced travel, and the reduction of physical marketing events were the largest drivers.

Pure is carefully monitoring the situation in Ukraine and ceased all shipments and support services in Russia and Belarus, which represents a small amount of business.

Revenues in $ million

(FY ended in January)

| Period | Revenue | Y/Y growth | Loss |

| FY13 | 6.1 | NA | (23.4) |

| FY14 | 42.7 | 603% | (78.6) |

| FY15 | 174.5 | 308% | (183.2) |

| FY16 | 440.3 | 152% | (213.8) |

| FY17 | 728.0 | 65% | (245.1) |

| FY18 |

1,023 | 41% |

(159.9) |

| FY19 |

1,360 | 33% |

(178.4) |

| 1Q20 |

326.7 | 28% |

(100.3) |

| 2Q20 |

396.3 | 28% |

(66.2) |

| 3Q20 |

428.4 | 15% | (28.2) |

| 4Q20 |

492.0 | 17% |

(4.7) |

| FY20 |

1,643 | 21% | (201.0) |

| 1F21 |

367.1 | 12% |

(90.6) |

| 2F21 |

403.7 | 2% |

(65.0) |

| 3F21 |

410,.6 | -4% |

(74.2) |

| 4F21 |

502.7 | 2% |

(52.2) |

| FY21 |

1,684 | 2% |

(282.1) |

| 1F22 |

412.7 | 12% |

(84.2) |

| 2F22 |

496.8 | 23% |

(45.3) |

| 3F22 |

562.7 | 29% |

(28.7) |

| 4F22 |

708.6 | 41% |

14.9 |

| FY22 |

2,181 |

30% |

(143.3) |

| 1F23* | 520 | 26% |

NA |

| FY23* |

around 2,600 |

19%-20% |

NA |

* Estimations

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter