Pure Storage: 1FQ22 Financial Results

Pure Storage: 1FQ22 Financial Results

Uninterrupted losses since 2013, sales up 12% Y/Y and down 18% Q/Q

This is a Press Release edited by StorageNewsletter.com on May 27, 2021 at 2:32 pm| (in $ million) | 1Q21 | 1Q22 | Growth |

| Revenue |

367.1 | 412.7 | 12% |

| Net income (loss) | (90.6) | (84.2) |

Pure Storage, Inc. announced financial results for its fiscal first quarter ended May 2, 2021.

“Pure Storage expanded our strong growth trend from last quarter with balanced contributions across all aspects of our business,” said Charles Giancarlo, chairman and CEO. “Our growing customer base loves our Modern Data Experience consisting of the industry’s most advanced platforms, unique Evergreen and Pure as-a-Service models, with leading reliability and TCO.”

1FQ22 Highlights

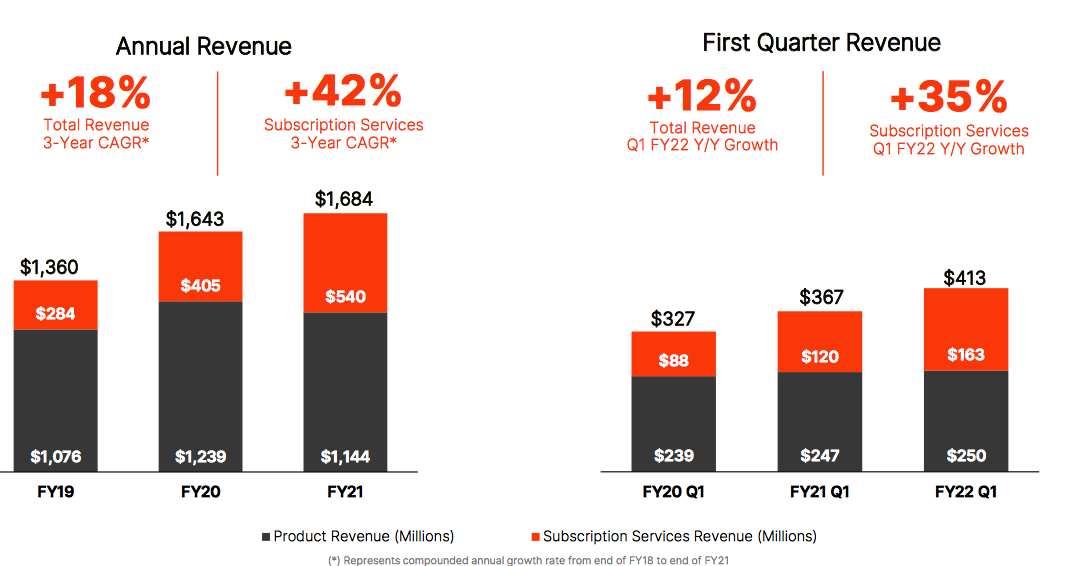

• Revenue $412.7 million, up 12% Y/Y

• Subscription services revenue $162.8 million, up 35% Y/Y

• GAAP gross margin 68.3%; non-GAAP gross margin 70.5%

• GAAP operating loss $(76.2) million; non-GAAP operating income $0.3 million

• Operating cash flow $21.4 million; free cash flow $(6.4) million

• Total cash and investments $1.2 billion

• Deferred revenue $866.2 million, up 23% Y/Y

• Remaining performance obligations (RPO) exceeding $1.1 billion, up 24% Y/Y

“We are very pleased with the strong start to the year returning to double digit revenue growth,” said Kevan Krysler, CFO. “Broad-based performance in the quarter included early signs of strength in our commercial business and continuing accelerated momentum of FlashArray//C.”

2FQ22 expectations:

- Revenue: $470 million

- Non-GAAP Operating Income: $15 million

Comments

Revenue for the quarter was $412.7 million, as $405 million was expected at the end of former quarter. Pure in late trading is up 0.8%, to $19.35.

1FQ22 Highlights

• Return to double-digit revenue growth of 12% Y/Y driven by broad-based strength

• International revenue grew 14% while revenue in the United States grew 12% compared to last year

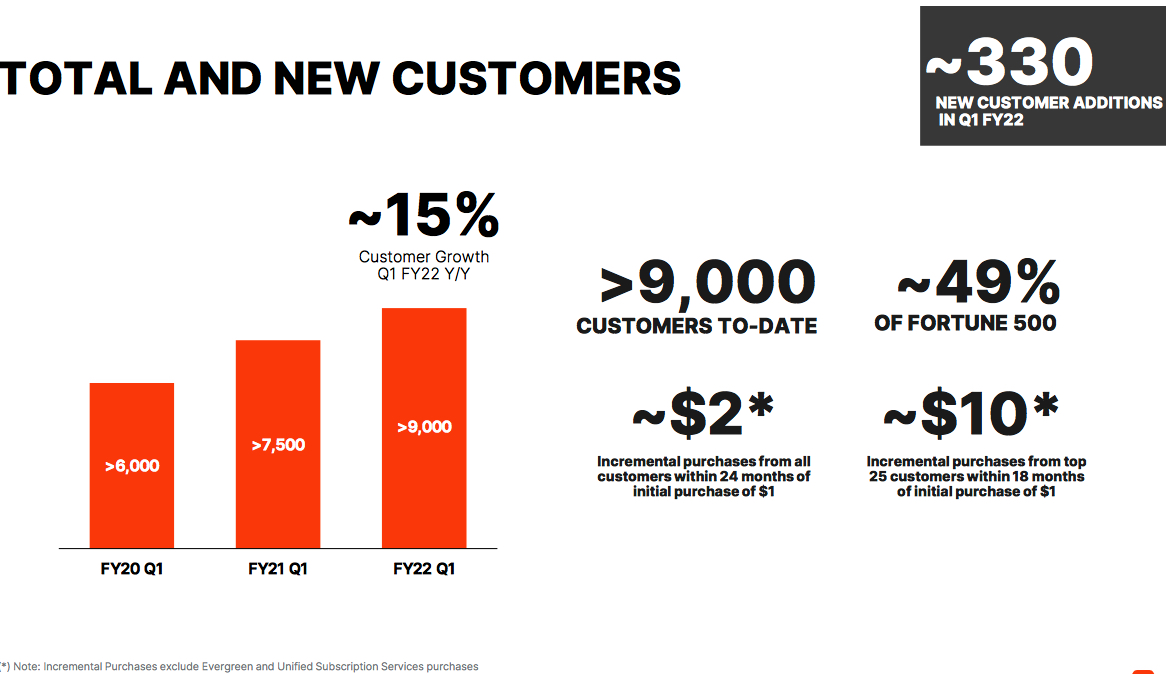

• New customer additions of approximately 330 this quarter, up 15% Y/Y driven in part by our commercial business

• Continued strength and momentum in subscription services revenue, up 35% Y/Y with growth from existing and new customers, and represents 39% of total revenue.

• FlashArray//C, a QLC flash array, grew double-digits Y/Y and continues to be company's fastest growing new product ever

• Sales growth, excluding cancelable orders, was 13% compared to last year

Pure ended the quarter with over $1.23 billion in cash and 3,800 employees.

2FQ22 revenue is expected to be approximately $470 million, or a growth of 16%.

Revenue in $ million

(FY ended in January)

| Period | Revenue | Y/Y growth | Loss |

| FY13 | 6.1 | NA | (23.4) |

| FY14 | 42.7 | 603% | (78.6) |

| FY15 | 174.5 | 308% | (183.2) |

| FY16 | 440.3 | 152% | (213.8) |

| FY17 | 728.0 | 65% | (245.1) |

| FY18 |

1,023 | 41% |

(159.9) |

| FY19 |

1,360 | 33% |

(178.4) |

| 1Q20 |

326.7 | 28% |

(100.3) |

| 2Q20 |

396.3 | 28% |

(66.2) |

| 3Q20 |

428.4 | 15% | (28.2) |

| 4Q20 |

492.0 | 17% |

(4.7) |

| FY20 |

1,643 | 21% | (201.0) |

| 1F21 |

367.1 | 12% |

(90.6) |

| 2F21 |

403.7 | 2% |

(65.0) |

| 3F21 |

410,.6 | -4% |

(74.2) |

| 4F21 |

502.7 | 2% |

(52.2) |

| FY21 |

1,684 | 2% |

(282.1) |

| 1F22 |

412.7 | 12% |

(84.2) |

| 2F22* |

470 | 14% |

NA |

| FY22* |

1,920-1,937 |

14%-15% |

NA |

* Estimations

Earnings call transcript

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter