Pure Storage: Fiscal 2Q22 Financial Results

Pure Storage: Fiscal 2Q22 Financial Results

Revenue growing 23% Y/Y, lower loss, FY22 outlook raised to $2 billion

This is a Press Release edited by StorageNewsletter.com on August 31, 2021 at 1:32 pm| (in $ million) | 2Q21 | 2Q22 | 6 mo. 21 | 6 mo. 22 |

| Revenue | 403.7 | 496.8 | 770.8 | 909.5 |

| Growth | 23% | 18% | ||

| Net income (loss) | (65.0) | (45.3) | (155.6) | (129.5) |

Pure Storage, Inc. announced financial results for its fiscal second quarter ended August 1, 2021.

“With revenue growth exceeding 23%, and the highest 2Q operating profit in our history, it’s clear that our long-term strategy to provide customers with modern data services is working,” said Charles Giancarlo, chairman and CEO. “We are in a great innovation cycle with our portfolio and our sales momentum and execution have never been stronger.”

2Q22 Financial Highlights

- Revenue $496.8 million, up 23% Y/Y

- Subscription services revenue $171.9 million, up 31% Y/Y

- GAAP gross margin 68.4%; non-GAAP gross margin 70.5%

- GAAP operating loss $(33.9) million; non-GAAP operating income $46.6 million

- GAAP operating margin (6.8)%; non-GAAP operating margin 9.4%

- Operating cash flow $123.4 million; free cash flow $95.7 million

- Total cash and investments $1.3 billion

- Deferred revenue $909.8 million, up 26% Y/Y

- Remaining performance obligations $1.2 billion, up 25% Y/Y

“Our outstanding financial performance this quarter reflected strong sales execution and our long standing practice of providing leading edge solutions and best-in-class services to our customers,” said Kevan Krysler, CFO. “We saw strength from both our enterprise and commercial customers across our entire solutions portfolio.”

2FQ22 Company Highlights and Achievements

- Industry Accolades: FlashArray was named a Gartner Peer Insights Customers’ Choice for Primary Storage Arrays. Pure was named a Kubernetes storage leader in 2 GigaOm Radar Reports and recognized as leader in enterprise flash array storage and object storage categories by TrustRadius for the second consecutive year.

- It achieved the highest total sales for any second quarter in the history of the company, growing more than 30% Y/Y.

- It saw continued strength and momentum in subscription services revenue, up 31% Y/Y with strong growth in Pure as-a-Service, which almost doubled revenues compared to the prior year.

- Success in the large enterprise segment continues to grow, comprising over 50% of sales, with the top 10 customers spending more than $100 million in total.

3FQ22 guidance: revenue of $530 million

FY22 guidance: $2.04 billion

Comments

As usual, the company, now with 3,900 employees, is always growing quarterly (but in 3FQ21) but also always with losses (but diminishing) since inception. (see below)

Sales, revenue and profitability were above expectations with highest operating profit in company's history.

Revenue growth was 23% this quarter (up 32% excluding cancelable orders) at $497 million vs. $470 million expected, and product revenue had its highest Y/Y growth rate compared to the previous 7 quarters.

As a result, share was up 9.9% after these financial announcements to $23.

Concerning Covid-19, CEO said: "We believe that the Delta variant has slowed a return to the office environment only temporarily, and that large-scale global vaccinations will do much to enable a full 'return to normal' by spring of next year."

Subscription services revenue grew 31% Y/Y and represents 35% of total revenue, with strong growth in Pure as-a-Service which nearly doubled revenues compared to prior year. Pure as-a-Service and Portworx were approximately tripling Y/Y. All subscription sales taken together, including Portworx, Pure as-a-Service and Evergreen, increased almost 50% during the most recent quarter, and is approaching half of total sales.

FlashBlade sales established a new record high.

FlashArray//C sales more than tripled Y/Y remaining the fastest growing new product in company's history.

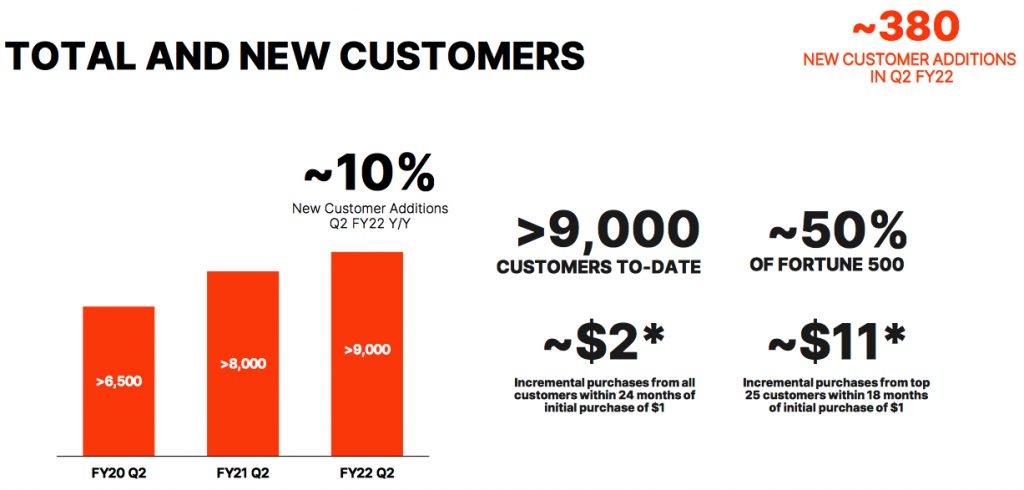

Pure, now with 9,000 global customers, acquired 380 new ones during 2FQ22 representing 10% Y/Y growth, and it saw particular strength with new enterprise customers this quarter.

Revenue in $ million

(FY ended in January)

| Period | Revenue | Y/Y growth | Loss |

| FY13 | 6.1 | NA | (23.4) |

| FY14 | 42.7 | 603% | (78.6) |

| FY15 | 174.5 | 308% | (183.2) |

| FY16 | 440.3 | 152% | (213.8) |

| FY17 | 728.0 | 65% | (245.1) |

| FY18 |

1,023 | 41% |

(159.9) |

| FY19 |

1,360 | 33% |

(178.4) |

| 1Q20 |

326.7 | 28% |

(100.3) |

| 2Q20 |

396.3 | 28% |

(66.2) |

| 3Q20 |

428.4 | 15% | (28.2) |

| 4Q20 |

492.0 | 17% |

(4.7) |

| FY20 |

1,643 | 21% | (201.0) |

| 1F21 |

367.1 | 12% |

(90.6) |

| 2F21 |

403.7 | 2% |

(65.0) |

| 3F21 |

410,.6 | -4% |

(74.2) |

| 4F21 |

502.7 | 2% |

(52.2) |

| FY21 |

1,684 | 2% |

(282.1) |

| 1F22 |

412.7 | 12% |

(84.2) |

| 2F22 |

496.8 | 23% |

(45.3) |

| 3F22* |

530 | 29% |

NA |

| FY22* |

2,040 |

21% |

NA |

* Estimations

Earnings call transcript

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter