Marvell: Fiscal 2Q22 Financial Results

Marvell: Fiscal 2Q22 Financial Results

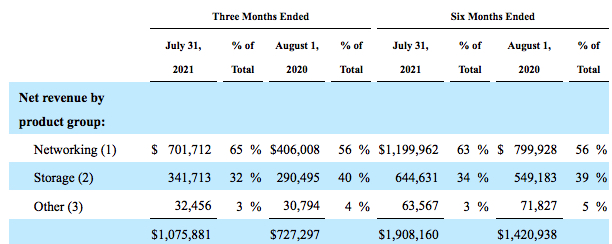

Sales of storage controllers and FC adapters at $341 million, up 13% Q/Q and 18% Y/Y, representing 32% of global revenue

This is a Press Release edited by StorageNewsletter.com on September 1, 2021 at 2:03 pm| (in $ million) | 2Q21 | 2Q22 | 6 mo. 21 | 6 mo. 22 |

| Revenue | 727.3 | 1,076 | 1,421 | 1,908 |

| Growth | 48% | 34% | ||

| Net income (loss) | (157.9) | (276.4) | (270.9) | (364.7) |

Marvell Technology, Inc. reported financial results for the second quarter of fiscal year 2022.

Net revenue for 2FQ22 was $1.076 billion, which exceeded the midpoint of the guidance provided on June 7, 2021.

GAAP net loss for 2FQ22 was $(276) million, or $(0.34) per diluted share. Non-GAAP net income for 2FQ22 was $284 million, or $0.34 per diluted share. Cash flow from operations for the quarter was $222 million.

“Marvell delivered record revenue of $1.076 billion, above the midpoint of guidance, growing 29% sequentially and 48% Y/Y. Growth was driven by the data center, which now represents Marvell’s largest end market at 40% of total revenue, benefiting from our growing momentum in the fast-growing cloud infrastructure market,” said Matt Murphy, president and CEO. “I am pleased that stand-alone Marvell and the acquired Inphi businesses both contributed to our strong Y/Y revenue growth. We expect Y/Y revenue growth will accelerate in the third quarter, led by substantial contributions from the cloud data center market. In addition, we expect our 5G business to continue to grow with strong sequential revenue growth in the third quarter, and a significant step up projected in the fourth quarter.“

Historically, the company reported revenue from three product groups: networking, storage and other. Beginning with the second quarter of fiscal 2022, the company is changing its reporting to present revenue from 5 end markets: data center, carrier infrastructure, enterprise networking, consumer, and automotive/industrial. For transition purposes, in this press release, the company is reporting revenue from both product groups and end markets, including providing historical revenue data from end markets for prior periods. Starting with the 3FQ22, it expects to no longer report revenue by product group.

It categorizes revenue from its 5 end markets by using a number of data points, including the type of customer purchasing the product, the function of our product being sold, and its knowledge of the end customer product or application into which our product will be incorporated. The categorization of products by end market is inherently subjective and can vary over time, both as a result of continued improvements in our ability to understand the final usage of our products, as well as changes in how our customers utilize our products.

Subsequent to quarter end, on August 3, 2021, the company announced the execution of a definitive agreement to acquire Innovium, Inc. in an all-stock transaction. The transaction is expected to close by the end of calendar 2021, subject to the satisfaction of customary closing conditions, including approval by Innovium’s stockholders and applicable regulatory approvals.

The financial outlook for 3FQ22 includes expected results of Inphi for the full quarter.

3FQ22 Outlook

• Net revenue to be $1.145 billion +/- 3%.

• GAAP gross margin to be 46.3% to 48.3%.

• Non-GAAP gross margin to be 64% to 65%.

• GAAP operating expenses to be $584 million to $594 million.

• Non-GAAP operating expenses to be $365 million to $370 million.

• Basic weighted average shares outstanding to be 824 million.

• Diluted weighted average shares outstanding to be 841 million.

• GAAP diluted loss per share to be $(0.10) +/- $0.04 per share.

• Non-GAAP diluted income per share be $0.38 +/- $0.03 per share.

Comments

(1) Networking products are comprised primarily of Ethernet solutions, embedded processors, custom ASICs, and electro-optics solutions.

(2) Storage products are comprised primarily of storage controllers and FC adapters.

(3) Other products are comprised primarily of printer solutions.

Storage revenue was $342 million above the midpoint of expectations and grew 13% sequentially and 18% Y/Y, contributing to 32% of total sales. But is was $406.8 million in 3FQ19 ... (see below)

Storage business, which does not include any contributions from Inphi, is now running at an annualized revenue run rate of $1.4 billion.

This business has been growing double digits yearly in recent quarters, reflecting its transformation from significant PC exposure to now being focused largely on the data center.

Based on the significant improvement in the mix of end markets combined with design wins secured for SSD controllers, HDD controllers and preamps, the company expects its storage business to continue "to grow strongly" over the next several years.

Revenue of storage products in $ million

| Period | Revenue | Y/Y growth |

| 3FQ18 | 315.3 | -4% |

| 4FQ18 | 323.7 | 4% |

| 1FQ19 | 278.7 | -8% |

| 2FQ19 | 335.8 | 8% |

| 3FQ19 | 406.8 | 29% |

| 4FQ19 | 317.0 | -2% |

| 1FQ20 | 278.7 | 0% |

| 2FQ20 | 274.9 | -18% |

| 3FQ20 | 287.7 | -29% |

| 4FQ20 | 296.5 | -6% |

| 1FQ21 | 258.7 | 6% |

| 2FQ21 | 290.5 | 6% |

| 3FQ21 | 276.3 | -4% |

| 4FQ21 | 326.4 | 27% |

| 1FQ22 | 302.9 | 17% |

| 2FQ22 | 341.7 | 18% |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter