Marvell: Fiscal 4Q21 Financial Results

Marvell: Fiscal 4Q21 Financial Results

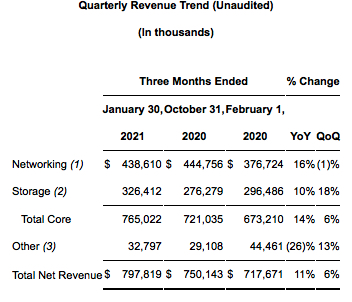

Storage controllers growing 18% Q/Q to $326 million, representing 41% of global sales

This is a Press Release edited by StorageNewsletter.com on March 5, 2021 at 2:17 pm| (in $ million) | 4Q20 | 4Q21 | FY20 | FY21 |

| Revenue | 717.7 | 797.8 | 2,969 | 2,969 |

| Growth | 11% | -0% | ||

| Net income (loss) | 1,773 | 16.5 | 1,584 | (277.3) |

Marvell Technology Group Ltd. reported financial results for the fourth fiscal quarter and the full fiscal year, ended January 30, 2021.

Net revenue for 4FQ21 was $798 million, which exceeded the midpoint of the company’s guidance provided on December 3, 2020. GAAP net income for FY21 was $17 million, or $0.02 per diluted share. Non-GAAP net income for 4FQ21 was $201 million, or $0.29 per diluted share. Cash flow from operations for 4FQ21 was $158 million.

Net revenue for FY21 was $3.0 billion. GAAP net loss for FY21 was $(277) million, or $(0.41) per diluted share. Non-GAAP net income for FY21 was $627 million, or $0.92 per diluted share.

“Marvell ended FY21 on a strong note with 4FQ21 revenue exceeding the mid-point of guidance. We delivered outstanding FY21 performance, with robust revenue growth of 10%, led by our networking business which grew 22% driven by strong 5G and cloud product ramps,” said Matt Murphy, president and CEO. “The Marvell team has done an excellent job driving revenue growth, innovating to deliver new products, and positioning the company to emerge even stronger from the pandemic. We are excited about the numerous opportunities ahead in FY22. We anticipate strong growth in 1FQ22, projecting revenue to grow approximately 15% year on year at the mid-point of guidance.”

Marvell’s first quarter guidance takes into account the US Government’s export restrictions on certain Chinese customers. Given the ongoing uncertainty associated with Covid-19 and related public health measures, we also have temporarily widened the guidance range on net revenue.

1FQ22 Outlook

• Net revenue is expected to be $800 million +/- 5%.

• GAAP gross margin is expected to be approximately 52.5%.

• Non-GAAP gross margin is expected to be approximately 63.5%.

• GAAP operating expenses are expected to be approximately $391 million.

• Non-GAAP operating expenses are expected to be approximately $300 million.

• Basic weighted-average shares outstanding are expected to be 677 million.

• Diluted weighted-average shares outstanding are expense to be 690 million.

• GAAP diluted income (loss) per share is expected to be $(0.05) to $0.05 per share.

• Non-GAAP diluted income per share is expected to be $0.23 to $0.31 per share.

Comments

Revenue in 4FQ21 was $798 million, $13 million above the midpoint of guidance.

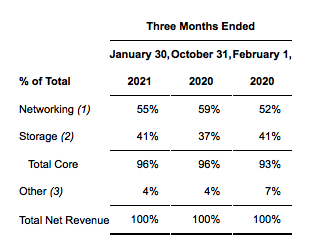

Networking represented 55% of revenue and storage contributing 41%.

Shares decreased 3.9% in after-market trading after the company reported these results.

For fiscal year, storage increases 1% from $1,138 in 2020 to $1,152 in 2021.

For storage only (in $ million)

| 4Q20 | 3Q21 | 4Q21 | |

| Revenue | 296.5 | 276.3 | 326.4 |

| Q/Q growth | 3% | -7% | 18% |

| % of total revenue | 41% | 37% | 41% |

(1) Networking products are comprised primarily of Ethernet solutions, embedded processors and custom ASICs.

(2) Storage products are comprised primarily of storage controllers and FC adapters.

(3) Other products are comprised primarily of printer solutions.

For 4FQ21, it was better than expected across all storage product lines growing 18% sequentially to $326 million, with 10% Y/Y growth driven by custom SSD controller and cloud HDD products progressing in high capacity nearline HDDs.

The company extended its long-standing relationship with Toshiba, and recently announced that its controllers and preamps are powering new 18TB HDDs utilizing MAMR technology and signal processing developed in partnership.

In 4FQ21, custom SSD controller revenue benefited from the ongoing ramp at a tier-1 OEM as well as the initial ramp at a major cloud customer. In HDDs, demand was strong across multiple end markets including enterprise, smart video, retail and client and business benefited from aggregate HDD unit TAM growth of about 10% sequentially.

In FC business demand recovered from the Covid-19 impacts earlier in the year.

Looking to 2FQ22, Marvell projects a seasonal decline in storage controller demand. In addition after last quarter's inventory replenishment by customers, it expects a more than seasonal decline in FC demand.

As a result, after a strong 4FQ21, the manufacturer expects storage revenue declining in the low teens sequentially on a percentage basis. However, it sees continued Y/Y growth of over 10% in 1FQ22 and strong Y/Y growth from both networking and storage businesses next quarter.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter