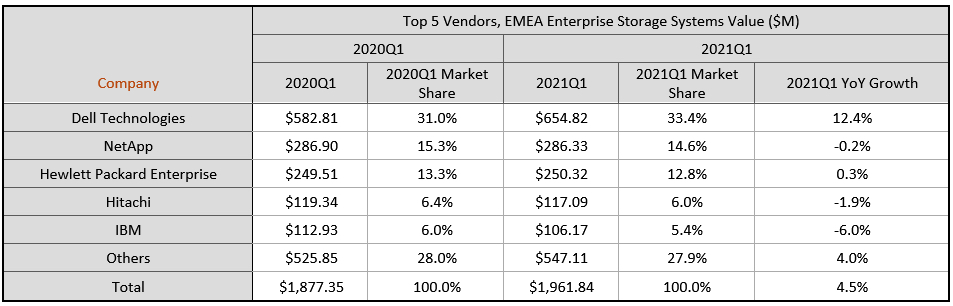

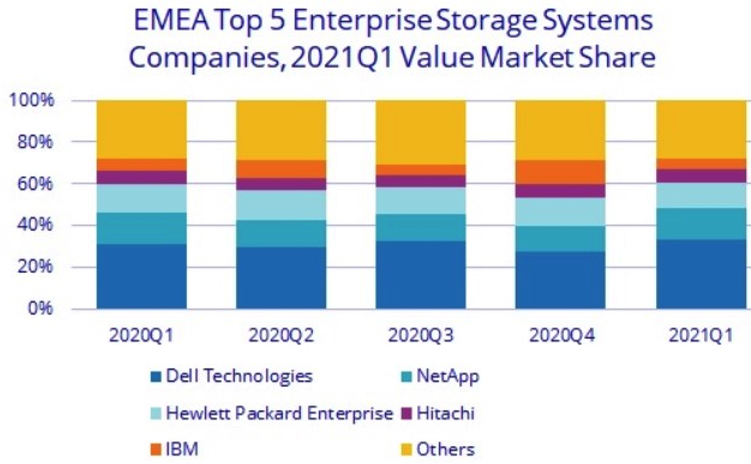

EMEA External Enterprise Storage Market in 1Q21 Up 4.5% Y/Y in Dollar But Down 4.3% in Euros

In dollar, +0.4% for AFA, +8.2% for hybrid flash array and +7.8% for HDD-only

This is a Press Release edited by StorageNewsletter.com on June 21, 2021 at 11:32 amThe EMEA external storage systems market value was up 4.5% year on year in dollars but down 4.3% in euros in 1Q21, according to International Data Corporation‘s EMEA Quarterly Disk Storage Systems Tracker.

Once again, the exchange rate played a key role in making the Y/Y comparison more favorable when looking at it in dollar rather than euro.

On the other hand, 1Q21 was more positive for Western Europe, whose value was up in dollar terms (6.6%). CEMA, however, was down 0.9% (also in dollar).

The AFA segment recorded slight growth of 0.4% Y/Y, while the hybrid flash array segment recorded the highest growth (+8.2%), followed by HDD-only (+7.8%).

While AFA systems are increasingly being adopted in EMEA datacenters, covering 45% of total new shipments for the quarter, many enterprises and institutions still opt for HFA, whose price-to-performance combination hits the sweetspot for less-mission-critical data. On the other hand, sales of HDD-only arrays have been pushed by a particularly buoyant PBBA market.

“As restrictions are being lifted in several major economies, IT investments have resumed following growing confidence in the future among both consumers and enterprises. Alongside refreshment cycles returning to normal, some strategic investments in more innovative areas such as AI, 5G, and edge are back on the priority list of enterprises that view them as fundamental to competing in a post-pandemic economy. Opex-based consumption models are also being adopted or at least evaluated by enterprises,” said Silvia Cosso, associate research director, storage systems, Western Europe.

Western Europe

The Western European external storage market value was up by 6.6% in dollar and down 2.4% in euro.

“From a geo perspective, growth resumed in major economies such as Germany and the UK, thanks to improved macroeconomics and a resumed appetite to invest in innovation. From a system type perspective, on the other hand, HCI were the single greatest force for growth in Western Europe, thanks to their ease of use, automation, and versatility for private cloud deployments,” said Cosso.

Although the signs of recovery are lining up for the subregion, the outlook remains cautious and heavily dependent on a number of developments such as the lifting of restrictions in some major economies, which will be a key factor in boosting the recovery.

Central and Eastern Europe, the Middle East, and Africa

The CEMA external storage market remained flat (0.9% Y/Y or $519.5 million in value) in 1Q21, which was better than forecast. Large deals in Israel, Russia, and Turkey managed to negate the impact of the slowdown in economies and the component shortage on the run-rate business.

HCI in the MEA region and PBBA in CEE recorded double-digit growth rates and stabilized overall storage spending, but traditional storage systems declined.

AFAs decreased marginally in value (by 0.3% Y/Y) but improved over the previous quarter to reclaim their dominance on the CEMA market, with AFA investments shifting to HCI and lower price bands. Hybrid arrays were the only segment to record growth, while all-HDD arrays continued their downturn, despite the good PBBA performance.

“Despite the resilience in the market in the first quarter, the slowdown in public spending, the prevailing capex-based expenditures, and the ongoing shipment delays caused by component shortages will push the CEMA storage market recovery into 2H21. Investments will gradually move to more emerging workloads and outside the core datacenter, but the market structure and demand will not undergo dramatic change over the next year,” said Marina Kostova, research manager, storage systems, CEMA.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter