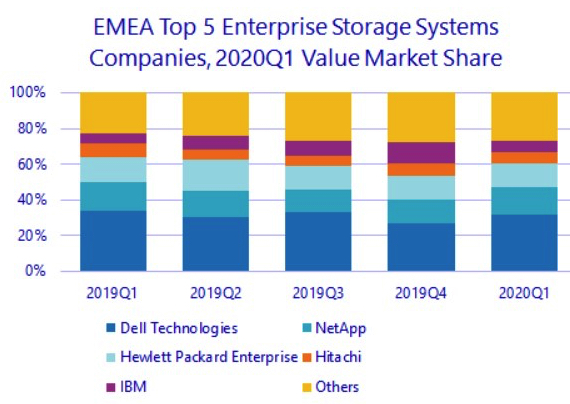

EMEA External Enterprise Storage Market Down 10.7% Y/Y in 1Q20, AFA Up 4%

Top vendors: Dell, NetApp, HPE, Hitachi, IBM

This is a Press Release edited by StorageNewsletter.com on July 2, 2020 at 2:26 pmEMEA external storage systems market value in 1Q201 was down 10.7% Y/Yr in dollars and 8.1% in euros, according to International Data Corporation‘s EMEA Quarterly Disk Storage Systems Tracker.

Once again, the quarter saw marked differences across subregions, with Western Europe down 16.5% year on year and CEMA up 9% (both in dollars).

On a bright note, AFA segment retained its steady path to growth at 4% Y/Y, further increasing its share of the external storage market value to 47%. The increase happened at the expense of both hybrid flash arrays (HFAs), down by almost 25% Y/Y and covering 36% of value shipments, and HDD-only arrays, down by roughly 11% and representing only 17% of shipment value.

“Although IDC expects the market decline to persist for the remaining of the year, the COVID-19 pandemic will also be remembered as a watershed moment for the datacenter sector, accelerating the transition to public cloud and pay-per-use consumption models for on-premises equipment, while also driving more investment in digital transformation,” said Silvia Cosso, associate research director, storage systems, IDC Western Europe.

Western Europe

The Western European External Storage market value was down again by 16.5% in dollars (-14.1% in euros).

AFAs jumped to 49% of total value, recording a small 1.6% decrease Y/Y and therefore proving to be considerably more resilient than HFA and HDD-only arrays.

The German market returned to positive territory, but it was not enough to compensate for the heavy declines in the other major countries such as the UK.

“Despite the decline, expenditure in AFA and HCI (hyperconverged) systems has proven more resilient, and, while in major markets some unbudgeted investments have understandably been put on hold, the general consensus is that expenditure in certain areas such as VDI deployments, collaborative tools and business continuity has been an important driver for the quarter,” said Cosso. (see also IDC’s How will COVID-19 Affect IT Infrastructure Spending in 2020?)

The outlook for the full year is still negative, with the stringent lockdown measures which have brought recession in many European markets expected to take a toll during the second quarter of 2020, before seeing a rebound in 2021.

Central and Eastern Europe, the Middle East, and Africa (CEMA)

Despite the start of Covid-19 pandemic, the storage market value in CEMA grew by 9% Y/Y to reach $514.1 million in 1Q20. This development was more optimistic than expected fueled mostly by large telco investments in Russia and data centre projects in the Middle East that were executed prior to implementing rigid restrictions across the region.

AFA and HDD-only systems recorded growth at the expense of hybrid storage systems. All-flash HCI continued to be the fastest growing segment of the market, recording a solid double-digit increase albeit from a small basis. On the other hand, purpose-built backup solutions sustained HDD growth as backup and recovery became crucial in remote working and collaboration environments.

“While storage-related projects were still in the pipeline in 2Q20, a negative repercussion is expected till the end of the year, with worsening GDPs and business sentiment and limited budgets,” said Marina Kostova, research manager, storage systems, IDC CEMA. “Only cost-optimized solutions supporting mission-critical primary workloads as well as backup, DR, VDI, and collaboration will witness accelerating growth compared to the declining overall storage systems market. The continuing expansion of hyperscalers in CEMA underlines the fast move towards a cloud consumption model which will further restrain spending on infrastructure in the long-term no matter the expected recovery after 2020.“

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter